## Forex and Global News

Market sentiment remains cautious as the U.S. government faces a potential shutdown, which could impact key economic data and Federal Reserve decisions. Political tensions are heightened, with Democrats linking funding to enhanced Obamacare subsidies, while the Fed’s path may be clouded if a shutdown occurs.

In Europe, inflation data from France indicates rising prices, aligning with trends in Spain and Belgium, which may influence the European Central Bank’s stance on interest rates. Meanwhile, the UK Prime Minister prepares for a pivotal address amidst ongoing political developments.

Gold prices are surging, nearing record highs of approximately $3,850, as investors seek safe-haven assets amid uncertainty. Additionally, China’s manufacturing sector shows signs of contraction despite a slight uptick in activity, further complicating global economic dynamics.

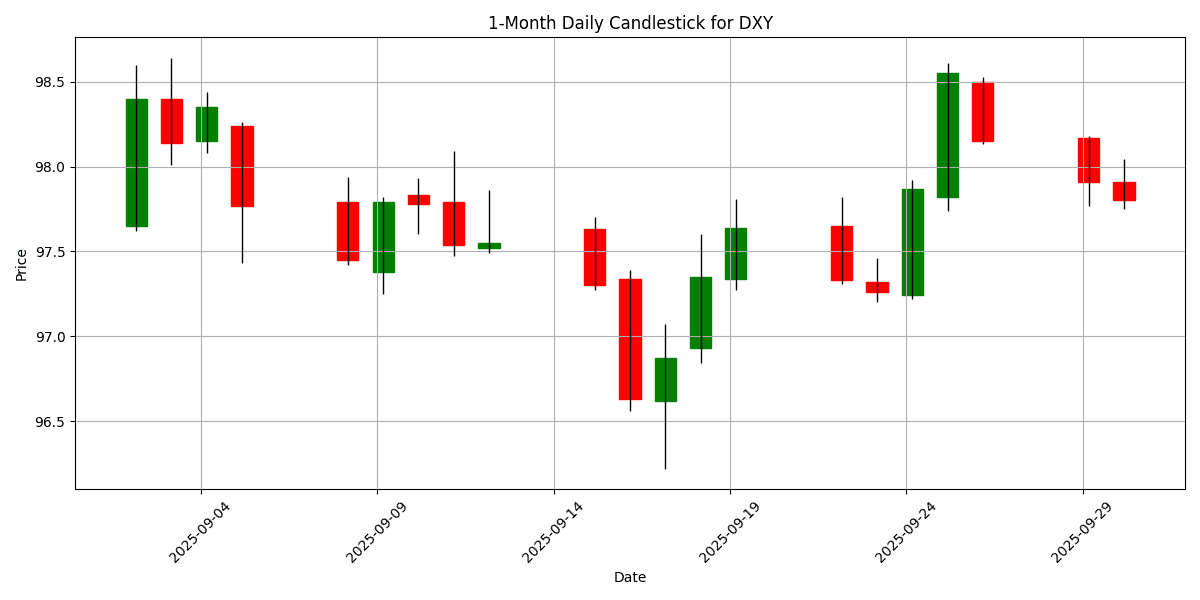

The U.S. Dollar Index (DXY) is currently at 97.80, reflecting a daily change of -0.1460%, as traders navigate through geopolitical tensions and economic signals that could shape currency movements in the near term.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-09-30 | 00:30 | 🇦🇺 | High | RBA Interest Rate Decision (Oct) | 3.60% | 3.60% |

| 2025-09-30 | 00:30 | 🇦🇺 | Medium | RBA Rate Statement | ||

| 2025-09-30 | 02:00 | 🇬🇧 | Medium | Business Investment (QoQ) (Q2) | -1.1% | -4.0% |

| 2025-09-30 | 02:00 | 🇬🇧 | Medium | Current Account (Q2) | -28.9B | -24.8B |

| 2025-09-30 | 02:00 | 🇬🇧 | High | GDP (YoY) (Q2) | 1.4% | 1.2% |

| 2025-09-30 | 02:00 | 🇬🇧 | High | GDP (QoQ) (Q2) | 0.3% | 0.3% |

| 2025-09-30 | 02:00 | 🇪🇺 | Medium | German Retail Sales (MoM) (Aug) | -0.2% | 0.6% |

| 2025-09-30 | 02:45 | 🇪🇺 | Medium | French Consumer Spending (MoM) (Aug) | 0.1% | 0.3% |

| 2025-09-30 | 02:45 | 🇪🇺 | Medium | French CPI (MoM) (Sep) | -1.0% | -0.9% |

| 2025-09-30 | 02:45 | 🇪🇺 | Medium | French HICP (MoM) (Sep) | -1.1% | -0.9% |

| 2025-09-30 | 03:00 | 🇨🇭 | Medium | KOF Leading Indicators (Sep) | 98.0 | 97.1 |

| 2025-09-30 | 03:55 | 🇪🇺 | Medium | German Unemployment Change (Sep) | 14K | 8K |

| 2025-09-30 | 03:55 | 🇪🇺 | Medium | German Unemployment Rate (Sep) | 6.3% | 6.3% |

| 2025-09-30 | 05:30 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-09-30 | 07:30 | 🇧🇷 | Medium | Gross Debt-to-GDP ratio (MoM) (Aug) | ||

| 2025-09-30 | 08:00 | 🇬🇧 | Medium | MPC Member Ramsden Speaks | ||

| 2025-09-30 | 08:00 | 🇪🇺 | Medium | German CPI (YoY) (Sep) | 2.3% | |

| 2025-09-30 | 08:00 | 🇪🇺 | High | German CPI (MoM) (Sep) | 0.2% | |

| 2025-09-30 | 08:00 | 🇧🇷 | Medium | Unemployment Rate (Aug) | 5.6% | |

| 2025-09-30 | 08:50 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-09-30 | 09:00 | 🇺🇸 | Medium | S&P/CS HPI Composite – 20 n.s.a. (MoM) (Jul) | ||

| 2025-09-30 | 09:00 | 🇺🇸 | Medium | S&P/CS HPI Composite – 20 n.s.a. (YoY) (Jul) | 1.7% | |

| 2025-09-30 | 09:00 | 🇪🇺 | Medium | ECB’s Elderson Speaks | ||

| 2025-09-30 | 09:25 | 🇬🇧 | Medium | BoE MPC Member Mann Speaks | ||

| 2025-09-30 | 09:45 | 🇺🇸 | High | Chicago PMI (Sep) | 43.4 | |

| 2025-09-30 | 10:00 | 🇺🇸 | High | CB Consumer Confidence (Sep) | 96.0 | |

| 2025-09-30 | 10:00 | 🇺🇸 | High | JOLTS Job Openings (Aug) | 7.190M | |

| 2025-09-30 | 11:00 | 🇺🇸 | High | U.S. President Trump Speaks | ||

| 2025-09-30 | 13:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-09-30 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | ||

| 2025-09-30 | 19:50 | 🇯🇵 | Medium | Tankan All Big Industry CAPEX (Q3) | ||

| 2025-09-30 | 19:50 | 🇯🇵 | Medium | Tankan Big Manufacturing Outlook Index (Q3) | 13 | |

| 2025-09-30 | 19:50 | 🇯🇵 | Medium | Tankan Large Manufacturers Index (Q3) | 14 | |

| 2025-09-30 | 19:50 | 🇯🇵 | Medium | Tankan Large Non-Manufacturers Index (Q3) | 33 |

Today, several key economic events are poised to influence FX markets, particularly concerning the Australian Dollar (AUD), British Pound (GBP), and Euro (EUR).

The Reserve Bank of Australia (RBA) is expected to maintain its interest rate at 3.60%, aligning with forecasts. The accompanying RBA Rate Statement will be closely scrutinized for any hints regarding future monetary policy shifts, which could impact the AUD.

In the UK, Q2 GDP data indicates a better-than-expected growth of 1.4%, surpassing the forecast of 1.2%. However, business investment contracted by 1.1%, significantly better than the anticipated -4.0%, while the current account deficit widened to £28.9 billion against a forecast of £24.8 billion. This mixed data could lead to volatility in the GBP as traders reassess their outlook on the Bank of England’s rate decisions.

For the Eurozone, disappointing German retail sales at -0.2% versus a forecast of 0.6% signal potential economic weakness. Meanwhile, the German unemployment change of 14K, higher than the expected 8K, may further pressure the EUR. The upcoming ECB speeches will be critical for market sentiment, particularly in light of these mixed economic indicators.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

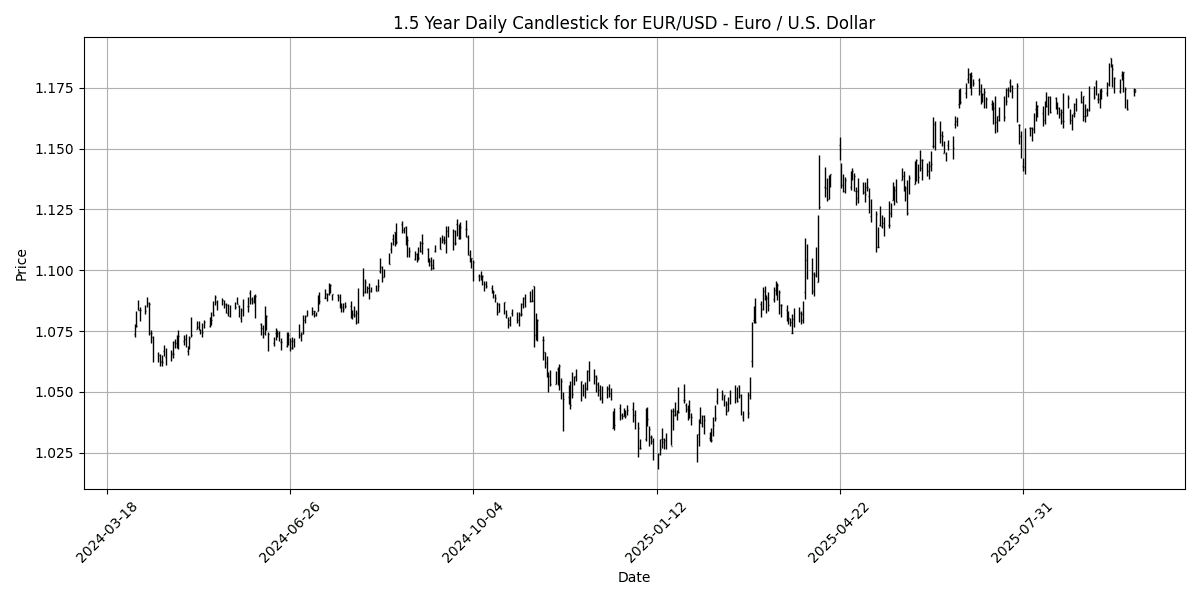

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1745 | 0.1108 | 0.0028 | -0.4752 | 0.5431 | -0.5128 | 7.6664 | 12.87 | 5.1495 | 1.1683 | 1.1594 | 1.1149 | 48.30 | 0.0021 |

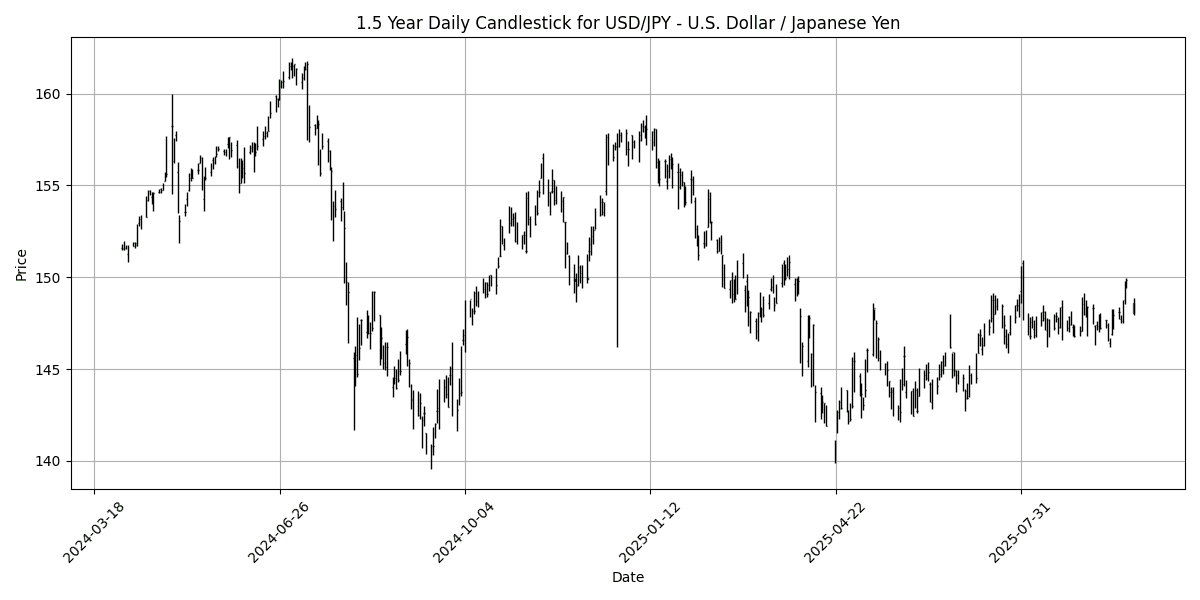

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 148.08 | -0.3452 | -0.4518 | 0.2396 | 0.8781 | 3.2615 | 0.1400 | -5.6792 | 3.7091 | 147.70 | 146.41 | 148.58 | 54.43 | 0.2649 |

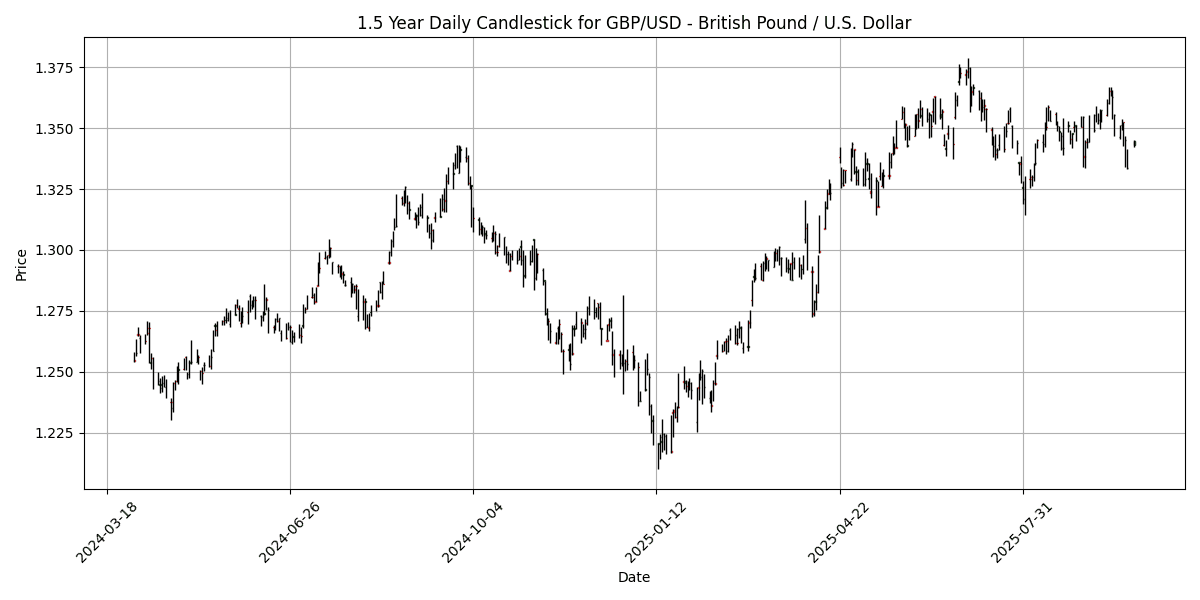

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3448 | 0.1042 | -0.0327 | -0.4956 | -0.4673 | -2.1766 | 3.0789 | 7.1631 | 0.4835 | 1.3471 | 1.3491 | 1.3121 | 43.08 | -0.0009 |

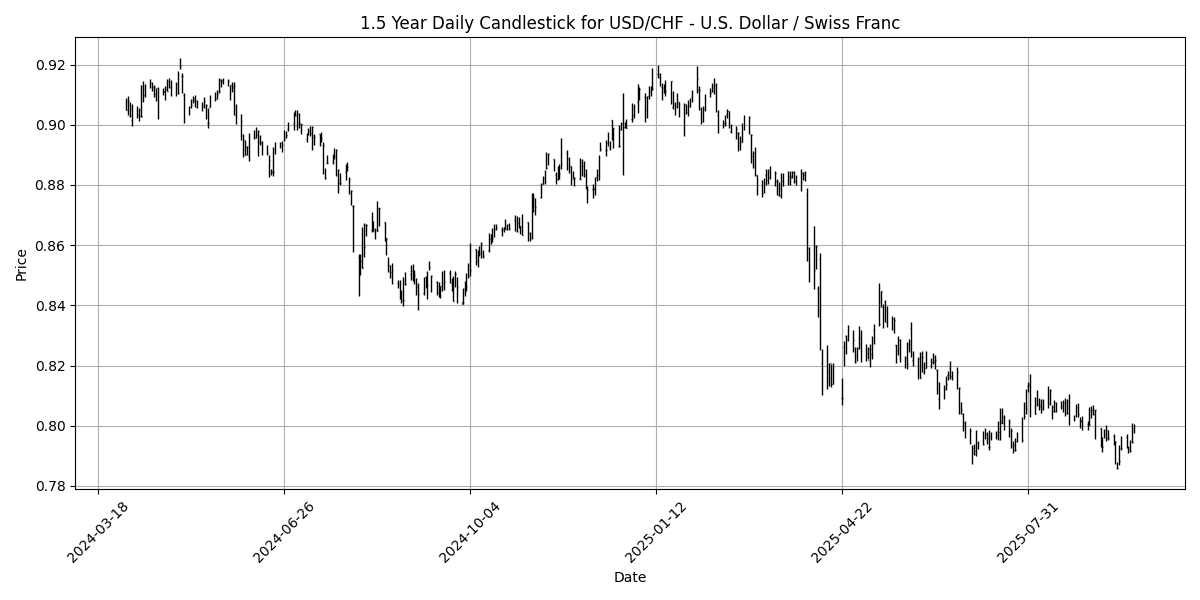

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7960 | -0.1881 | 0.1686 | 0.4556 | -0.6974 | 0.6716 | -9.2143 | -11.8728 | -5.2945 | 0.8012 | 0.8078 | 0.8449 | 50.86 | -0.0023 |

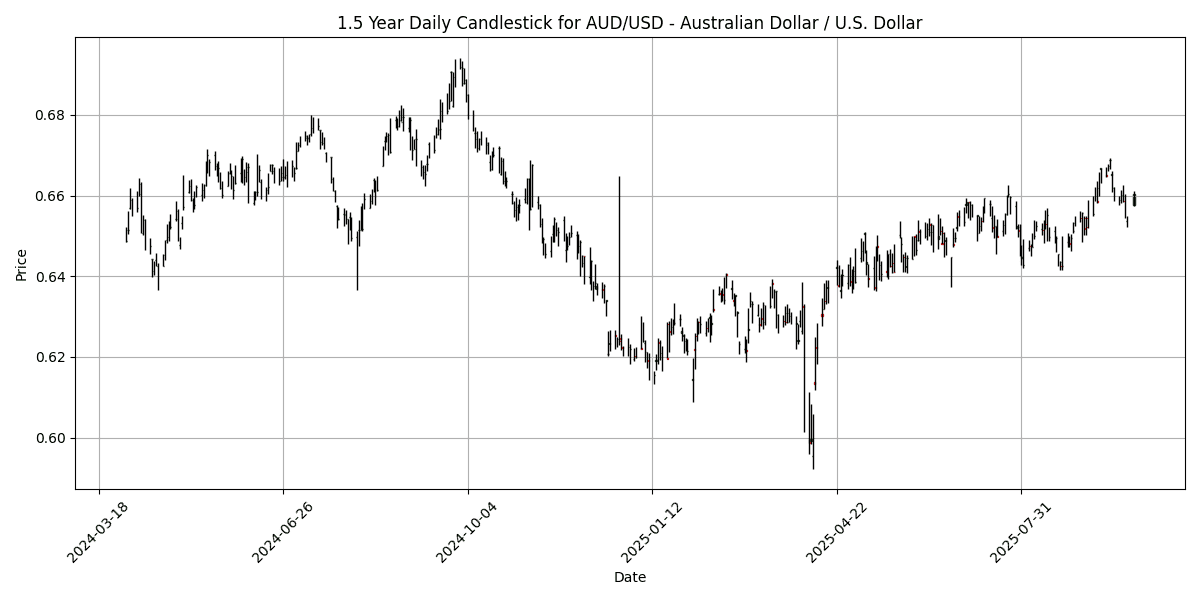

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6605 | 0.3799 | 0.2745 | 0.0455 | 1.1114 | 0.3326 | 5.4320 | 6.1897 | -4.5353 | 0.6543 | 0.6520 | 0.6402 | 50.81 | 0.0016 |

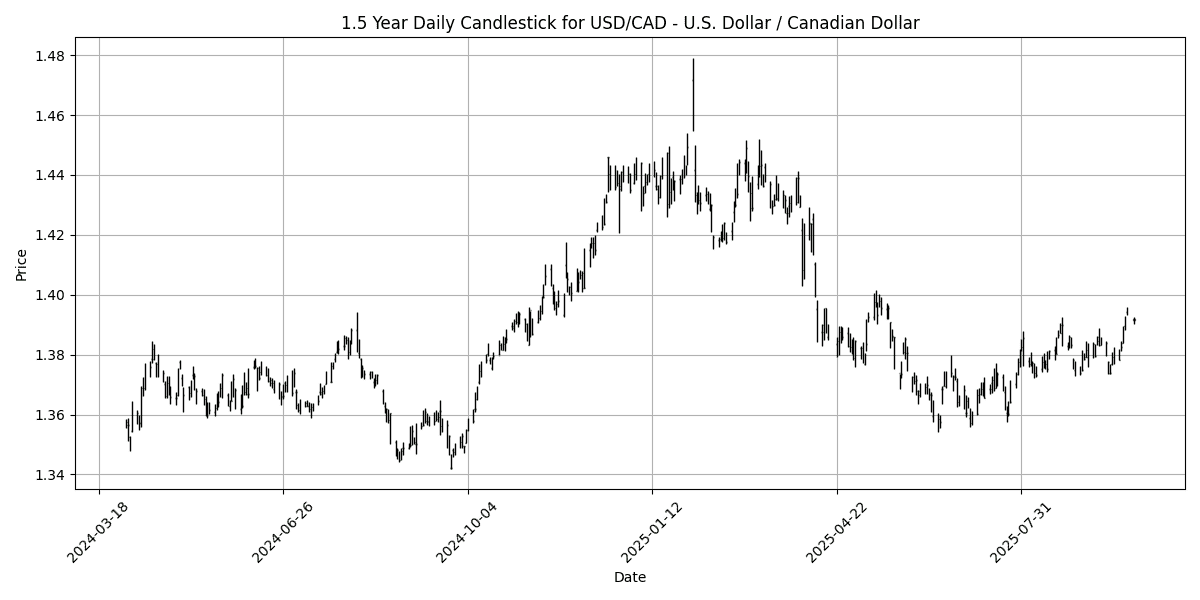

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3915 | 0.0216 | 0.1367 | 0.6517 | 1.2015 | 1.9840 | -2.1208 | -3.0300 | 3.0069 | 1.3791 | 1.3761 | 1.4003 | 63.45 | 0.0026 |

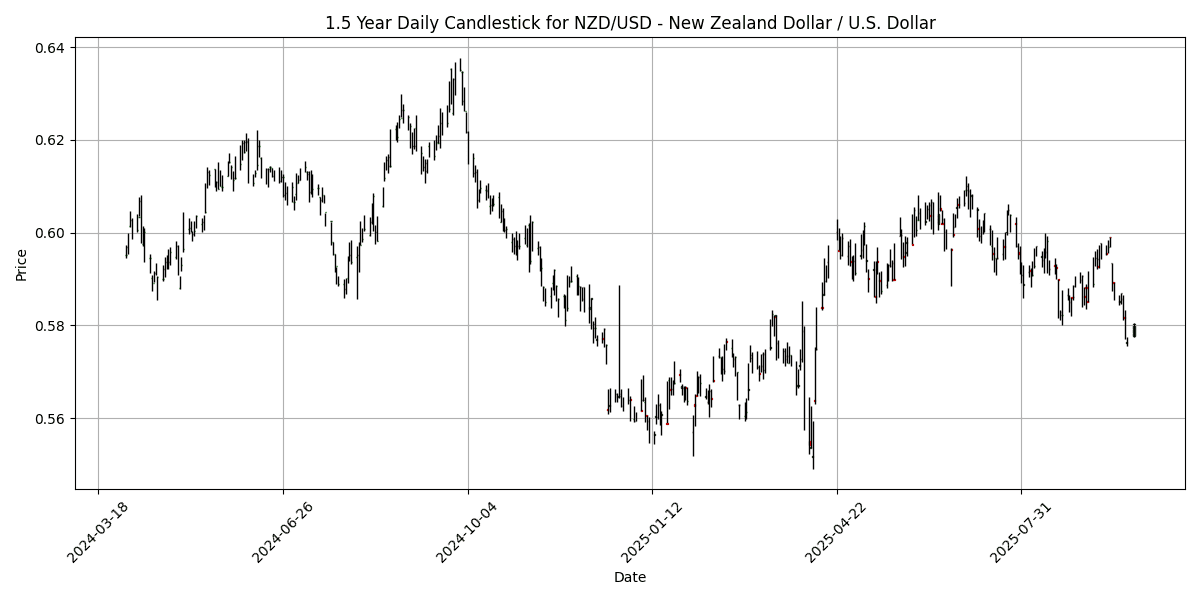

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5802 | 0.3806 | -0.2510 | -1.1382 | -1.4118 | -4.8977 | 1.2989 | 2.8776 | -8.6272 | 0.5914 | 0.5955 | 0.5839 | 33.43 | -0.0027 |

Analyzing the current market conditions for key FX pairs reveals notable insights into potential overbought and oversold scenarios. The EUR/USD pair exhibits a neutral RSI of 48.30, indicating no immediate overbought or oversold conditions, while the MACD remains slightly positive, suggesting a potential for upward momentum.

In contrast, GBP/USD shows an RSI of 43.08, approaching oversold territory, compounded by a negative MACD, indicating bearish sentiment. The NZD/USD pair is significantly oversold with an RSI of 33.43 and a negative MACD, suggesting continued weakness.

For USD/JPY, the RSI of 54.43 reflects a stable condition, while the positive MACD supports a bullish outlook. USD/CAD, with an RSI of 63.45, is nearing overbought territory, though not yet extreme. Overall, GBP/USD and NZD/USD warrant close attention for potential corrections, while USD/JPY and USD/CAD may experience further bullish

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8733 | 0.0458 | 0.0344 | 0.0229 | 1.0133 | 1.6908 | 4.4867 | 5.3196 | 4.6420 | 0.8672 | 0.8593 | 0.8493 | 62.06 | 0.0022 |

| EUR/JPY | EURJPY | 173.88 | -0.2198 | -0.4694 | -0.2599 | 1.4020 | 2.7059 | 7.8354 | 6.4204 | 9.0268 | 172.54 | 169.75 | 165.47 | 53.99 | 0.6213 |

| EUR/CHF | EURCHF | 0.9348 | -0.0535 | 0.1650 | -0.0267 | -0.1613 | 0.1489 | -2.2268 | -0.5426 | -0.5077 | 0.9358 | 0.9358 | 0.9390 | 57.48 | -0.0007 |

| EUR/AUD | EURAUD | 1.7786 | -0.2356 | -0.2423 | -0.5090 | -0.5307 | -0.8579 | 2.1884 | 6.2993 | 10.18 | 1.7857 | 1.7778 | 1.7399 | 47.84 | -0.0009 |

| GBP/JPY | GBPJPY | 199.08 | -0.2670 | -0.5087 | -0.2790 | 0.3822 | 1.0005 | 3.2032 | 1.0574 | 4.1861 | 198.94 | 197.52 | 194.78 | 44.62 | 0.2145 |

| GBP/CHF | GBPCHF | 1.0703 | -0.0933 | 0.1244 | -0.0374 | -1.1681 | -1.5173 | -6.4260 | -5.5632 | -4.9239 | 1.0790 | 1.0892 | 1.1059 | 42.97 | -0.0035 |

| AUD/JPY | AUDJPY | 97.74 | 0.0061 | -0.2307 | 0.2420 | 1.9398 | 3.5940 | 5.5311 | 0.1239 | -1.0508 | 96.60 | 95.41 | 95.07 | 60.45 | 0.4277 |

| AUD/NZD | AUDNZD | 1.1382 | -0.0088 | 0.5264 | 1.2039 | 2.5444 | 5.5335 | 4.0754 | 3.2198 | 4.4642 | 1.1055 | 1.0942 | 1.0964 | 82.19 | 0.0072 |

| CHF/JPY | CHFJPY | 185.99 | -0.1616 | -0.6246 | -0.2275 | 1.5823 | 2.5638 | 10.30 | 7.0151 | 9.5878 | 184.35 | 181.36 | 176.21 | 50.94 | 0.7997 |

| NZD/JPY | NZDJPY | 85.87 | 0.0338 | -0.7421 | -0.9128 | -0.5789 | -1.8337 | 1.4125 | -2.9992 | -5.2773 | 87.32 | 87.16 | 86.69 | 24.62 | -0.2450 |

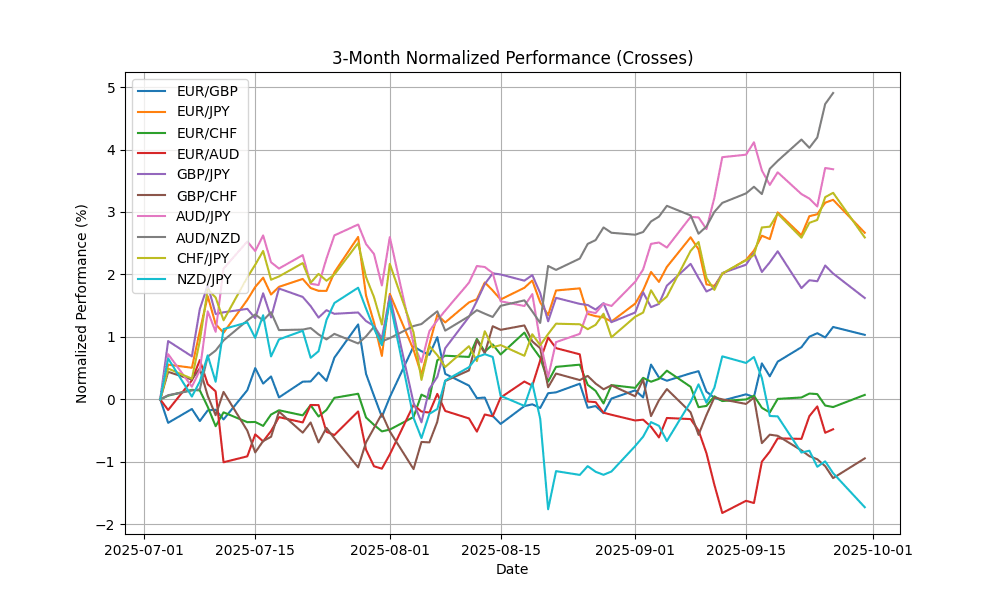

Currently, the AUD/NZD pair is exhibiting overbought conditions with an RSI of 82.19, indicating potential for a price correction. The MACD remains positive, suggesting bullish momentum, but traders should exercise caution. In contrast, NZD/JPY is significantly oversold at an RSI of 24.62, coupled with a negative MACD, indicating bearish pressure and potential buying opportunities. Other pairs, such as GBP/JPY and GBP/CHF, show continued bearish sentiment with RSIs below 50 and negative MACDs, while EUR pairs remain neutral, with RSIs between 42 and 62. Monitoring these indicators will be crucial for informed trading decisions.

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.58 | 0.0284 | 0.2754 | 0.4636 | 1.0775 | 4.3802 | 9.5908 | 17.78 | 21.77 | 40.99 | 40.24 | 38.48 | 80.12 | 0.1584 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.26 | 0.0075 | -0.4056 | -0.4264 | -2.3973 | -1.9069 | -8.9057 | -8.0357 | 0.9914 | 17.60 | 17.73 | 18.12 | 38.18 | -0.0917 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.30 | 0.3417 | 0.6544 | 1.7323 | 0.1240 | -0.4224 | -5.9406 | -5.3868 | -0.1546 | 32.22 | 32.44 | 33.16 | 73.48 | -0.0514 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4122 | -0.0987 | 0.1303 | 0.5863 | -0.6979 | -0.6340 | -4.5542 | -14.6195 | -6.6494 | 9.4950 | 9.5407 | 10.00 | 54.48 | -0.0282 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9849 | -0.0080 | 0.4914 | 0.7467 | -0.7860 | -0.7825 | -3.8119 | -11.8535 | -4.7660 | 10.09 | 10.11 | 10.53 | 50.87 | -0.0478 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3537 | -0.1446 | -0.0205 | 0.4514 | -0.5609 | 0.5324 | -7.1373 | -11.3454 | -4.8192 | 6.3902 | 6.4406 | 6.7117 | 53.69 | -0.0127 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.35 | -0.0800 | -0.3786 | -0.0473 | -1.6152 | -2.0755 | -9.4248 | -11.0662 | -6.5281 | 18.61 | 18.82 | 19.55 | 32.08 | -0.0799 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6368 | -0.0440 | 0.1860 | 0.8704 | -0.2804 | 1.1076 | -5.0320 | -11.4503 | -4.8887 | 3.6434 | 3.6705 | 3.8089 | 55.60 | -0.0042 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 332.96 | -0.1023 | -0.0744 | 1.0139 | -1.8735 | -1.3522 | -9.4444 | -15.7075 | -6.2290 | 337.94 | 343.68 | 361.61 | 51.81 | -1.8712 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.69 | -0.0739 | 0.0740 | 0.7824 | -1.3674 | -0.9798 | -9.4566 | -14.3606 | -7.9601 | 20.93 | 21.24 | 22.34 | 51.78 | -0.0906 |

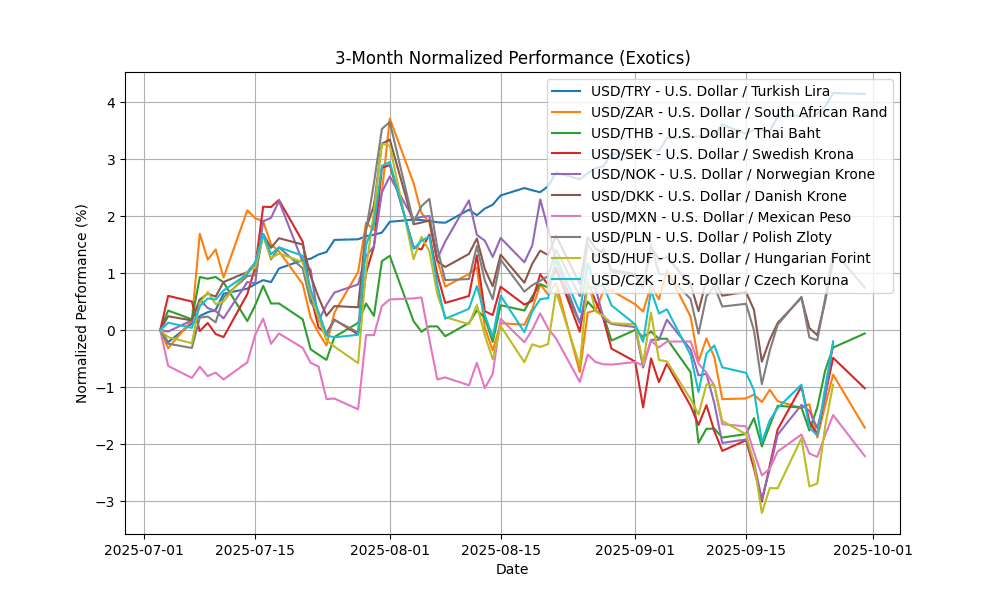

In the current analysis of selected FX pairs, USD/TRY is significantly overbought with an RSI of 80.12, indicating potential for a price correction. The positive MACD of 0.1584 supports bullish momentum, yet the extreme RSI suggests caution. Conversely, USD/ZAR exhibits oversold conditions with an RSI of 38.18 and a negative MACD, hinting at possible upward retracement. USD/THB, with an RSI of 73.48, also shows overbought signals, while USD/MXN is oversold at an RSI of 32.08, indicating potential buying opportunities. Monitoring MA crossovers will be essential for identifying trend reversals in these pairs.