In the current trading session European equities have seen a timid rebound of risk appetite with a modest recovery, largely influenced by optimistic expectations surrounding the upcoming financial results from Taiwan Semiconductor Manufacturing Co. (TSMC). This optimism helped mitigate some of the negative sentiment generated by the underwhelming new bookings reported by ASML, a Dutch semiconductor equipment manufacturer. Meanwhile, in the United States, the stock market endured its most prolonged downturn since January, attributed primarily to significant sell-offs among major technology firms. This led to the S&P 500 declining for four consecutive days, marking a more than 4% fall from its recent peak.

- The DAX is showing a slight increase, currently at 17,793.95, up by 6.96 points or 0.04%. It has been moving between a high of 17,840.25 and a low of 17,789.45.

- The FTSE 100 is trading notably higher, at 7,887.97, which is 39.98 points or 0.51% above its opening. The index has hit a high of 7,897.25 and a low of 7,877.25.

- The CAC 40 has gained 32.92 points or 0.41%, trading at 8,014.43. Its range for the session is between 8,004.98 and 8,032.18.

- The Euro Stoxx 50 has increased by 16.12 points or 0.33%, currently at 4,930.25. It is fluctuating with a low of 4,930.15 and a high of 4,939.95.

- The AEX has a slight rise of 0.34 points or 0.04%, trading at 865.69 with a session high of 868.84 and a low of 864.11.

- The IBEX 35 is trading at 10,692.50, up by 58.6 points or 0.55%. The index has reached a high of 10,730.54 and a low of 10,684.50.

- The FTSE MIB is experiencing a marginal gain, currently at 33,664.00, up by 31.29 points or 0.09%. It is trading steadily with the day’s high and low recorded at 33,800.00 and 33,664.00 respectively.

The European markets are mostly on the uptrend in the ongoing session, with most indices registering modest gains. The IBEX 35 leads the gainers with a 0.55% rise, while the DAX and AEX are witnessing the smallest increases, both by 0.04%.

Yesterday performance of US indices was quite negative

- The Dow Jones Industrial Average closed at 37,753.31, down by 45.66 points or 0.12% from the previous session. Throughout the day, it reached a high of 38,036.70 and a low of 37,611.56.

- The S&P 500 ended the session at 5,022.21, which represents a decrease of 29.2 points or 0.58%. Its peak for the day was 5,077.96, while the lowest point was 5,007.25.

- The Nasdaq Composite finished at 15,683.37, dropping 181.88 points or 1.15%. The high of the day was 15,957.03, and the low was 15,654.51.

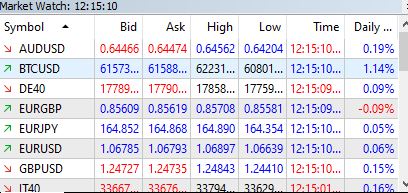

In the Forex market today the US dollar is showing a moderate weakness against GBP and EUR.

- EUR/USD is trading with a slight increase, quoted at 1.0675 bid and 1.0677 ask, with a session high of 1.069 and low of 1.0664, marking a change of 0.0005 or 0.05%.

- USD/JPY has seen a minor decrease, currently at 154.33 bid and 154.34 ask, reaching a high of 154.41 and a low of 153.96, with a change of -0.04 or -0.03%.

- GBP/USD is experiencing growth, standing at 1.247 bid and 1.2471 ask. It has touched a high of 1.2485 and a low of 1.2447, with an increase of 0.0025 or 0.20%.

- USD/CHF is on a downtrend, with the bid at 0.9088 and the ask at 0.909. The high for the session is 0.9113, and the low is 0.9084, decreasing by -0.0017 or -0.19%.

- USD/CAD shows a small decline, quoted at 1.3755 bid and 1.3756 ask, with a high of 1.378 and a low of 1.3742, down by -0.0014 or -0.10%.

In today’s ongoing financial market session, precious metals and energy commodities are experiencing a mixed set of movements. Gold currently stands at $2,379.43 per ounce, reflecting a modest rise of 0.77%. Silver, too, sees an uptick, trading at $28.4845 per ounce, which translates to a 0.92% increase.

On the platinum front, the commodity is trading at $956.05 per ounce, representing a slight increase of 0.19%. In contrast, the energy sector is not faring as well, with Crude Oil WTI and Brent Oil witnessing declines. Crude Oil WTI is trading lower by 0.42%, at $82.34 per barrel, while Brent Oil has decreased by 0.39%, currently trading at $86.95 per barrel.

Natural Gas is the standout in today’s session, currently up by 2.86%, trading at $1.761 per mmBtu.

Bitcoin (BTC) with a price of $61,356.6 has experienced a decrease of 3.62% over the past 24 hours. Ethereum (ETH) at $2,986.22, has seen a 3.55% decrease on the same time period.