Educational Development Corporation (EDUC) Post Earning Analysis

Educational Development Corporation specializes in providing educational children’s books through its two main segments: PaperPie and Publishing. Founded in 1965 and based in Tulsa, Oklahoma, the company distributes its products via independent Brand Partners, internet and direct sales, as well as through retail channels including bookstores, toy stores, and museums. The company utilizes a variety of sales strategies including home shows, book fairs, and a dedicated sales force.

Educational Development Corporation (EDC) recently announced significant updates that could impact its stock performance. On October 9, 2025, EDC released its fiscal 2026 second quarter and year-to-date results. Although the specific details of these financial results were not provided in the summary, such announcements typically influence investor sentiment and stock prices based on the company’s performance relative to market expectations.

Additionally, on October 6, 2025, EDC disclosed an important development regarding its real estate assets. The company announced the first amendment to a real estate contract and confirmed the buyer’s intent to proceed with the purchase. This news could potentially affect the company’s financial health positively, depending on the terms of the sale and the intended use of the proceeds, such as debt reduction or reinvestment into the business.

Both of these announcements are crucial as they provide insights into the company’s operational and financial strategies, which are key factors for investors assessing the company’s current value and future prospects.

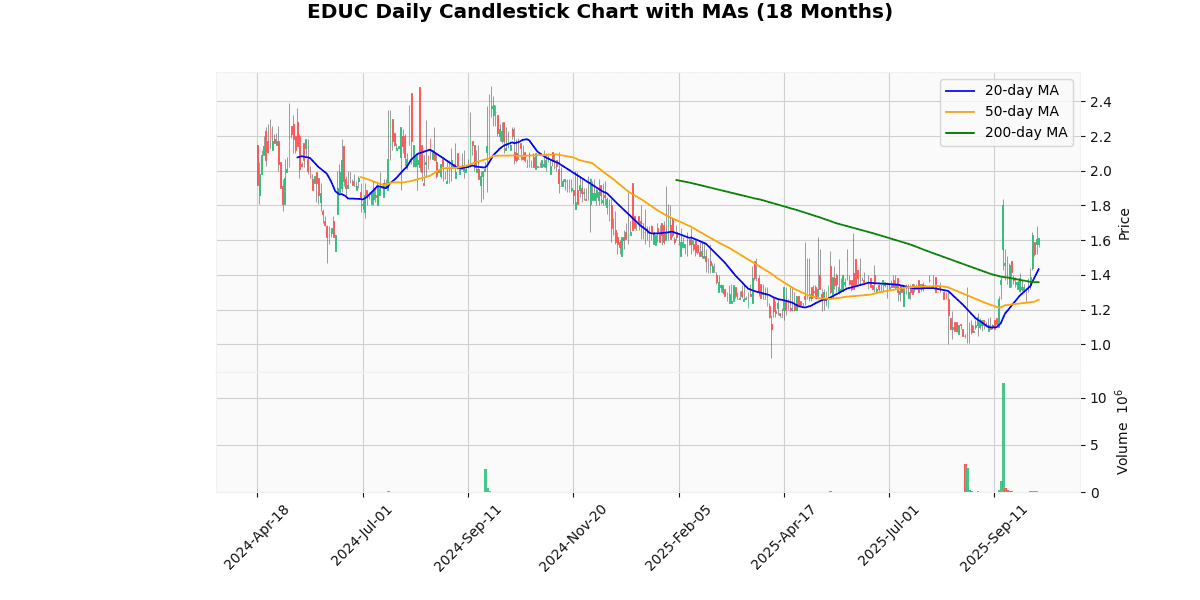

The current price of the asset is $1.6155, showing no change from the previous day. The asset is trading below its 52-week high of $2.25 by approximately 28.2%, but significantly above its 52-week and year-to-date low of $0.92 by 75.6%. This indicates a strong recovery from the lowest price points of the year, although it still lags behind the highest recorded values.

The asset’s proximity to its week high ($1.68) and surpassing the week low ($1.32) by 22.39% suggests short-term bullish behavior. The moving averages further support this, with the asset currently trading above the 20-day, 50-day, and 200-day moving averages by 12.71%, 28.51%, and 18.94% respectively, indicating a positive trend across multiple time frames.

The RSI of 63.08 points towards a somewhat overbought condition but not excessively so, suggesting there is still potential for upward movement without immediate reversal risks. The MACD of 0.08, although modest, aligns with a bullish crossover signal, supporting the potential for continued upward momentum. Overall, the asset’s price trends and technical indicators suggest a bullish outlook in both short and medium terms, with caution warranted as it approaches overbought territory.

Price Chart

Educational Development Corporation (EDC) reported its financial results for the fiscal second quarter ended August 31, 2025. The company experienced a significant decline in net revenues, which fell by 29% year-over-year to $4.6 million, down from $6.5 million in the same quarter the previous year. This decline was echoed in the first six months of the fiscal year, with revenues decreasing to $11.7 million from $16.5 million. The number of average active PaperPie Brand Partners also saw a substantial reduction, dropping by 58% in the quarter and 50% over the six-month period.

EDC reported a net loss of $1.3 million for the quarter, improving from a net loss of $1.8 million year-over-year, and a loss per share of $(0.15), which is better compared to $(0.22) in Q2 2024. Over the first half of the fiscal year, the net loss amounted to $2.4 million, with a loss per share of $(0.28).

CEO Craig White announced the sale of the Hilti Complex, expected to close by mid-November 2025, which will enable the company to pay off its outstanding bank debt. He emphasized the company’s commitment to reducing operational costs and returning to revenue growth through strategic initiatives aimed at expanding the Brand Partner network and enhancing sales. The report did not mention any dividends or share repurchases.

Earnings Trend Table

| Earnings Date | Date | Estimate EPS | Reported EPS | Surprise % |

|---|---|---|---|---|

| 2022-10-06 17:25:00-04:00 | 2022-10-06 | 0.04 | -0.10 | -350.00 |

Over the last eight quarters, EPS (Earnings Per Share) trends have demonstrated significant variability and a notable instance of underperformance relative to market expectations. The data from the most recent quarter, specifically on October 6, 2022, highlights a critical deviation where the company reported an EPS of -0.10, starkly contrasting with the estimated EPS of 0.04. This resulted in a surprise percentage of -350.00%, indicating a substantial shortfall in earnings compared to what analysts had anticipated.

This dramatic underperformance could be indicative of operational challenges, unexpected costs, or a downturn in revenue, which are critical areas of concern for stakeholders. Such a negative surprise could potentially impact investor confidence and reflect broader issues within the company or industry. It’s essential for investors to monitor subsequent quarters closely to determine if this is an isolated incident or part of a more extended negative trend in the company’s financial health.

Dividend Payments Table

| Date | Dividend |

|---|---|

| 2022-02-18 | 0.1 |

| 2021-11-17 | 0.1 |

| 2021-08-23 | 0.1 |

| 2021-06-01 | 0.1 |

| 2021-02-22 | 0.1 |

| 2020-11-18 | 0.1 |

| 2020-08-19 | 0.06 |

| 2020-06-01 | 0.06 |

The dividend data spanning from June 2020 to February 2022 indicates a notable trend in the distribution patterns of the company. Initially, dividends were set at $0.06, as observed in the payouts for June and August 2020. This rate represents a possible adjustment period, potentially reflecting the company’s strategic financial decisions during a volatile economic climate.

Subsequently, there was a discernible increase in the dividend to $0.1 starting from November 2020, which has been consistently maintained through to the latest recorded dividend in February 2022. This increment suggests a positive adjustment in the company’s dividend policy, likely indicative of improved financial health or a confident outlook by the company’s management regarding future earnings stability.

The consistency of the $0.1 dividend over the last six distributions demonstrates a stable dividend policy, which could be appealing to income-focused investors seeking regular and predictable returns. This trend might also reflect a robust operational performance and a strong financial position during the period under review.

As of the latest data, the stock is currently priced at $1.62. This pricing is crucial to consider, especially when juxtaposed against the average target price projected by market analysts.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.