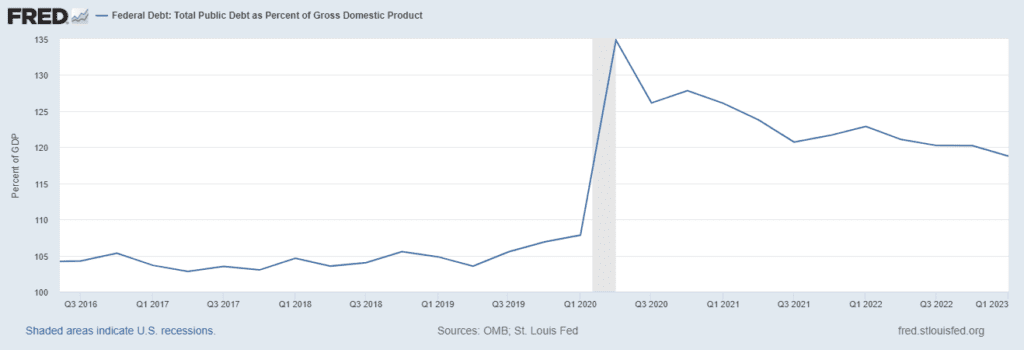

US avoided default with a bipartisan debt ceiling deal, with borrowing limits suspended until 2025. The $31.46 trillion in federal debt thus is likely to increase despite a number of cuts on federal spendings. While an imminent crisis was averted, the Total Public Debt as Percent of Gross Domestic Product at 118.77% keeps open the possibility for an US debt rating downgrade. This would probably have a larger impact on longer maturities , instead of a pure parallel shift of the whole term structure. Currently the yield curve is still inverted and the time gap between yield curve inversion and recession between the years 1978 and 2022 ranges from 6-22 months, with 12 months being the average time elapsed between the initial yield curve inversion and the beginning of a recession. If timing a rate cut does it seem difficult, timing a recession is even more complicated given the interrelations between different agents (policy makers, private sector) , the Keynesian “Animal spirits”, and many internal end external variables.

Having said that, when in 2007-2008 the financial system risked a meltdown ,the US entered in recession when the S&P had already fallen more than 40%. Waiting a recession validation in that case before to reduce long positions or open bearish trades could had a serious impact on traders book and investors portfolios. Traders and Investors, despite their style , must be price sensitive regardless their perception of fair value, and start building their positions in a cautious way, ready to adapt to new information and accept losses that will not trigger the ruin risk factor. Timing the entry or the exit from just from economic data had been the main source of severe drawdown among Global Macro Hedge Funds Managers. Admitting uncertainty is an healthy and essential pre requisite for people aspiring to manage their assets or other people money as it considers different scenarios and possible probabilities , where risk appetite should be modulated on scenarios, not on desires.

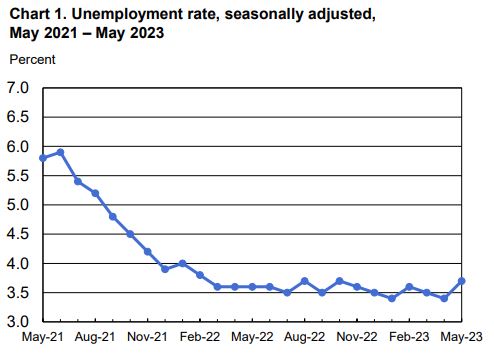

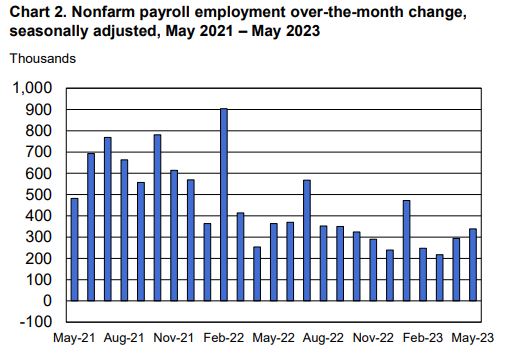

The U.S. labour market is strong. Payrolls rose 339,000 in May, beating expectations of 180,000 and the unemployment rate rose by 0.3 percentage point to 3.7 percent, the U.S. Bureau of Labor Statistics reported on Friday.

The resiliency of the US economy , despite a decrease of the wealth effect due to a weakened real estate market, is delaying technical recession possibilities, and create more disagreement among Federal Reserve voters for the appropriate Fed Funds rate. The CME Group FedWatch Tool provided markets probabilities at 74.7% for current rates for the 14 June FED meeting on the 2nd of June. The previous week the most likely scenario assessed by market participants was for a rate hike of 25bp , with a 64.2% probability.

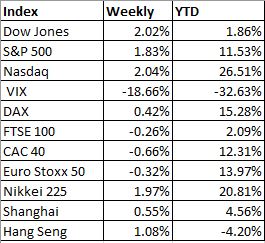

Among stock indices, Nasdaq continued to outperform, thanks also to the AI effect, where high expectations are driving higher multiples. The Nikkei225 closed at 32- year high, thanks most to foreign buyers and a BoJ policy to keep weaken the Yen. The VIX index , as a consequence of positive market sentiment lost ground, closing near April low at 17.05.

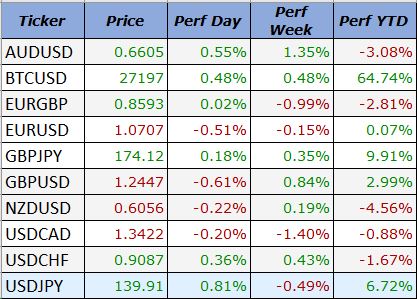

In the FX market the Loonie and the Aussie dollar were the best performer vs. the greenback. Australia is the second largest exporter of beef in the world after Brazil. Lean Hogs(+12.97% weekly), Live (+4.81%) and Feeder Cattle (+3.35%) were the best performers in the whole commodities group. USDCAD retraced as expectation for rates differential narrowing has increased while energy commodities seems that have bottomed.

USCAD on the weekly chart is showing the development of a symmetrical triangle. The uptrend started 2 years ago from 1.20 that lifted the pair to almost 1.4 got a break. More likely trading range opportunities for the short term unless a breakout of either side would materialize.

XAUUSD weekly candlestick chart is showing the validity of the triple resistance in area 2,070 $/oz. A breakout of this level would lift the shiny metal on unchartered territory as it will be trading on a record high. Swing traders are likely positioned short as there is a 450$ trading range on the shiny metal but if geopolitical and inflation pressure as well will increase gold is likely to make another bullish leg. XAUUSD advanced 1.03% in 5 trading sessions but closed much below its intraweek high, a sign of weakness with bearish traders temporary in control.

USDJPY weekly chart seems ready for another bullish leg after it made the retracement of 50% of the March 2020-October 2022 uptrend. As long that higher highs and lows are made the target remain area 151.5. Below 137.6 selling pressure may increase to 132.6.