European Markets Rising as FTSE 100 Leads with 0.67% Gain

European Trading Session Report | October 24, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: Modest Gains Amid Political Uncertainty and Banking Resilience

European equities opened the trading session with cautious optimism, building on positive momentum from overnight US and Asian markets. The S&P 500’s 0.58% advance, driven by tech-heavy Nasdaq gains of 0.88%, provided a supportive backdrop, while Asian indices showed mixed resilience amid ongoing China trade tensions. This spillover helped European benchmarks post modest gains, though political headlines and currency volatility tempered enthusiasm.

The Euro Stoxx 50 led regional indices with a 0.52% rise, buoyed by strength in financials and industrials. Banking stocks were a standout, with UK lender NatWest’s upbeat profit outlook lifting sentiment across the sector, while Swiss giant UBS’s leadership reshuffle signaled progress in Credit Suisse integration, potentially unlocking value for investors. The FTSE 100 outperformed peers at 0.67%, reflecting domestic banking resilience and commodity exposure, though UK political turbulence—a seismic by-election loss for the ruling Labour party to regional rivals—introduced uncertainty around fiscal policy. In contrast, Germany’s DAX (+0.23%) and France’s CAC 40 (+0.23%) lagged, weighed by mixed Eurozone data and lingering ECB policy debates. Upcoming ECB rate decisions remain in focus, with markets pricing in a dovish tilt amid softening inflation signals, though persistent services sector strength could delay easing.

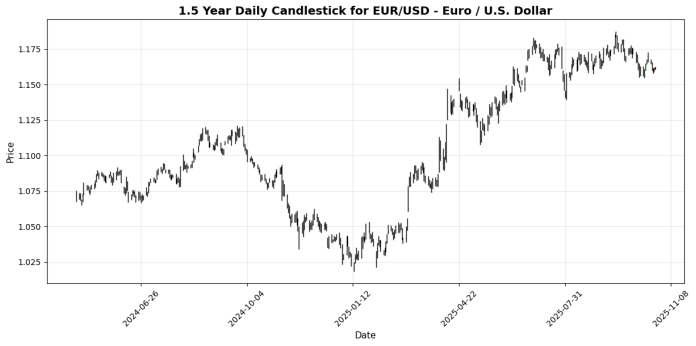

Currency markets reflected a broadly stronger US dollar, pressuring the euro. EUR/USD dipped 0.07%, as Eurozone political risks, including Turkish court developments on opposition parties, added to regional instability. GBP/USD edged up 0.02%, supported by NatWest’s results, but EUR/GBP weakened 0.08%, highlighting sterling’s relative outperformance amid UK election jitters. The Swiss franc saw USD/CHF rise modestly by 0.03%, underscoring CHF’s safe-haven appeal amid global trade frictions, including elusive US-China deal prospects under a potential second Trump administration.

Investor sentiment remains positioned defensively, with flows favoring quality banks and tech amid AI-driven longevity debates and private credit rating concerns. Oil sanctions rhetoric, however, kept energy volatile, capping broader upside. Overall, European markets eye US-China dynamics and ECB cues for direction, with positioning skewed toward selective opportunities in a fragmented landscape.

🇪🇺 European Indices Performance

Performance: (Today Last – Yesterday Close) / Yesterday Close × 100

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5668.33 | +0.52 |

| DAX | 24207.79 | +0.23 |

| CAC 40 | 8225.78 | +0.23 |

| FTSE 100 | 9578.57 | +0.67 |

🇺🇸 US Markets (Previous Close)

Performance: (Yesterday – 2 Days Ago) / 2 Days Ago × 100

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6738.44 | +0.58 |

| Dow Jones | 46734.61 | +0.31 |

| Nasdaq 100 | 25097.41 | +0.88 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | -0.07 |

| GBP/USD | 1.33 | +0.02 |

| USD/JPY | 152.87 | +0.19 |

| EUR/GBP | 0.87 | -0.08 |

| USD/CHF | 0.80 | +0.03 |

| AUD/USD | 0.65 | -0.15 |

| USD/CAD | 1.40 | +0.16 |

🛢️ Commodities Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Commodity | Price | Daily (%) |

|---|---|---|

| Gold | 4107.60 | -0.43 |

| Silver | 48.05 | -0.89 |

| Crude Oil (WTI) | 61.45 | -0.55 |

| Brent Oil | 64.29 | -2.58 |

| Natural Gas | 3.33 | -0.30 |

₿ Cryptocurrency Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Crypto | Price | Daily (%) |

|---|---|---|

| Bitcoin | 111439.05 | +1.24 |

| Ethereum | 3981.53 | +3.25 |

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (YoY) (Sep) | 2.3% | 0.7% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (MoM) (Sep) | 0.6% | |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (YoY) (Sep) | 1.5% | 0.6% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (MoM) (Sep) | 0.5% | -0.2% |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Manufacturing PMI (Oct) | 48.2 | |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Services PMI (Oct) | 48.7 | |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Manufacturing PMI (Oct) | 49.5 | |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Services PMI (Oct) | 51.1 | |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Manufacturing PMI (Oct) | 49.8 | |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Composite PMI (Oct) | 51.0 | |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Services PMI (Oct) | 51.2 | |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Composite PMI (Oct) | 50.6 | |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Manufacturing PMI (Oct) | 46.6 | |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Services PMI (Oct) | 51.0 | |

| 2025-10-24 | 05:15 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-24 | 06:30 | 🇷🇺 | Medium | Interest Rate Decision (Oct) | 17.00% | |

| 2025-10-24 | 08:00 | 🇷🇺 | Medium | CBR Press Conference | ||

| 2025-10-24 | 08:30 | 🇺🇸 | Medium | Building Permits (Sep) | ||

| 2025-10-24 | 08:30 | 🇺🇸 | Medium | Core CPI (YoY) (Sep) | 3.1% | |

| 2025-10-24 | 08:30 | 🇺🇸 | High | Core CPI (MoM) (Sep) | 0.3% | |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (YoY) (Sep) | 3.1% | |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (MoM) (Sep) | 0.4% | |

| 2025-10-24 | 08:30 | 🇨🇦 | Medium | New Housing Price Index (MoM) (Sep) | 0.2% | |

| 2025-10-24 | 08:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Manufacturing PMI (Oct) | 51.9 | |

| 2025-10-24 | 09:45 | 🇺🇸 | Medium | S&P Global Composite PMI (Oct) | ||

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Services PMI (Oct) | 53.5 | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 1-Year Inflation Expectations (Oct) | 4.6% | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 5-Year Inflation Expectations (Oct) | 3.7% | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Expectations (Oct) | 51.2 | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Sentiment (Oct) | 55.0 | |

| 2025-10-24 | 10:00 | 🇺🇸 | High | New Home Sales (Sep) | 710K | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | New Home Sales (MoM) (Sep) | ||

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | ||

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.