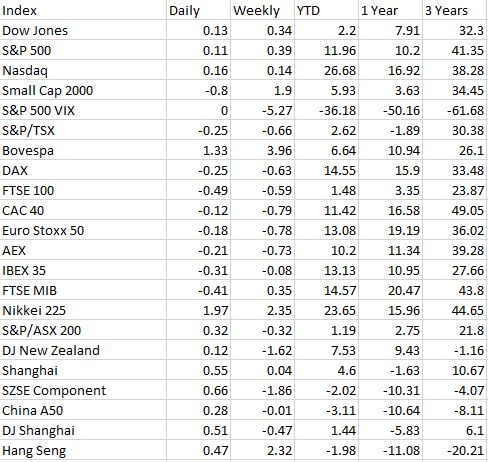

The S&P 500 officially entered in a bull market, up 0.39% in 5 trading session and closed on Friday at 4,298.96. The index is more than 20% above the October 6th low but is still 10% below the intraday high on January 4th 2022.

In China, In China, producer prices declined 4.6% y/y, the biggest decline since 2016 while the the Bank of Canada and the The Reserve Bank of Australia hiked their rates, giving a positive momentum to commodities currencies.

Was a difficult week for the crypto industry as Gary Gensler went not only on a crusade against Binance and Coinbase, 2 businesses with a completely different settings, but his opinion that the majority of digital tokens are securities will likely pave a way of conservative attitude from broker dealers offering multi assets on their platform (e.g. Robin Hood already started)

Next week the US Federal Reserve, the ECB and the BoJ will meet for rate decision.

On Wednesday is likely to see the FED keep rates at current level, while on Thursday the ECB is likely to increase by 25 bp to 4%. On Friday the Bank of Japan probably will not increase the curve control band, a move that is considered monetary tightening. Governor Kazuo Ueda is pragmatic but looks more oriented to continue ultra loose policy of his predecessor Kuroda. The Bank of Japan , according to an ETFGI report, held last summer 63% of the Assets in the ETFs Industry in Japan. If BoJ ETFs portfolio has remained similar is very unlikely to trigger a colossal proprietary trading self inflicted loss.

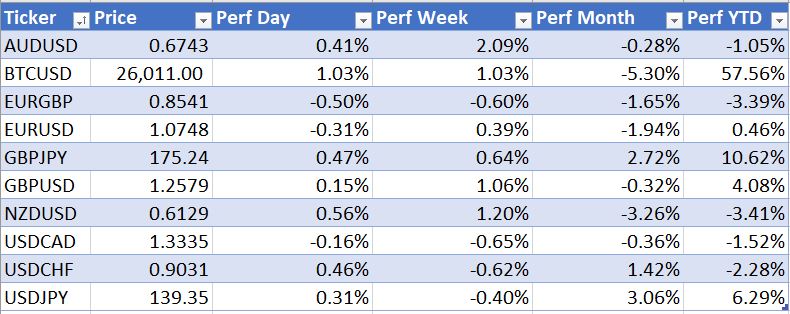

In the FX market the Australian dollar was the best performer against the greenback, up 2.09%, and closed AUDUSD last Friday at 0.6743. Bitcoin showed resiliency in a week rich of headwinds for the asset class, and rose 1.03% in 5 sessions to 26,011 $.

Does it look that in the AI bandwagon small caps are going to be quite speculative: while the technology and its consequences on many sectors and businesses are not in question there is the risk that several CEOs will try to sell the Blockchain 2.0 stuff. Due diligence is needed instead of irrational exhuberance.