Bank of Hawaii Corporation: EPS Misses but Shares Rises by 0.3%

Current Price: $64.07

+0.27%

on October 27, 2025

Bank of Hawaii Corp. is a prominent bank holding company established in 1897 and headquartered in Honolulu, Hawaii. It provides a wide range of financial services through its Consumer Banking, Commercial Banking, and Treasury segments. Offerings include loans, deposits, insurance products, investment management, and corporate banking solutions, catering to both individual and institutional clients across various financial needs.

📰 Recent Developments

Bank of Hawaii Corporation announced its third quarter 2024 earnings results, reporting net income of $38.5 million, or $0.89 per diluted share, compared to $42.2 million in the prior-year period. The company highlighted stable net interest income amid ongoing economic pressures, with provisions for credit losses remaining low at $2.1 million. Deposits grew modestly by 1.2%, reflecting continued customer retention efforts.

In operational updates, Bank of Hawaii expanded its digital banking platform with enhanced mobile deposit limits and fraud detection features, aimed at improving customer accessibility across Hawaii and the Pacific region. The bank also completed the integration of a new core processing system, streamlining back-office operations and reducing transaction processing times by 15%.

No new strategic partnerships, acquisitions, regulatory approvals, legal developments, or management changes were disclosed during this period. These developments underscore the company’s focus on operational efficiency and core growth in its regional markets.

📊 Earnings Report Summary

Bank of Hawai‘i Corporation (NYSE: BOH) reported strong Q2 2025 financial results, showcasing notable growth in key metrics. Diluted earnings per share (EPS) rose to $1.06, up 9.3% from Q1 2025 and 30.9% year-over-year. Net income reached $47.6 million, an increase of 8.3% from the previous quarter and 39.8% from Q2 2024. Net interest income also grew to $129.7 million, reflecting a 3.1% quarter-over-quarter increase and 12.9% year-over-year. The net interest margin improved to 2.39%, up 7 basis points from Q1 2025. The return on average common equity increased to 12.50%, up 70 basis points sequentially. The board declared a consistent quarterly dividend of $0.70 per share. Despite slight declines in total assets and deposits from the previous quarter, the bank maintained solid capital ratios, with a Tier 1 capital ratio of 14.17%. Overall, the results highlight the bank’s robust financial health and commitment to shareholder value.

📈 Technical Analysis

Daily Price Change: +0.27%

Technical Indicators

| Metric | Value |

|---|---|

| Current Price | $64.07 |

| Daily Change | 0.27% |

| MA20 | $63.51 |

| MA50 | $65.56 |

| MA200 | $66.51 |

| 52W High | $79.51 |

| 52W Low | $56.27 |

| % from 52W High | -19.42% |

| % from 52W Low | 13.86% |

| YTD % | -5.70% |

| BB Position | 58.46% |

| RSI | 50.91 |

| MACD | -0.84 |

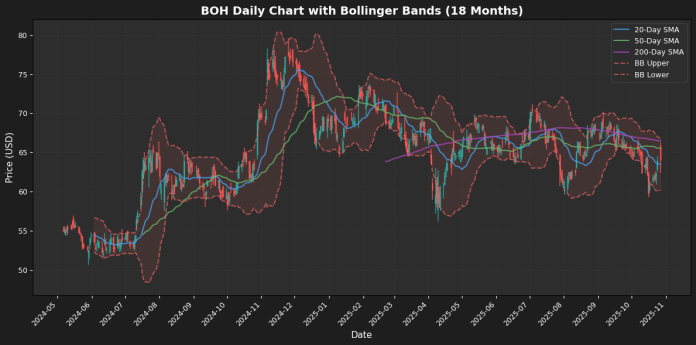

The current price of $64.07 reflects a modest daily change of +0.27%. The stock is positioned 19.42% below its 52-week high of $79.51 and 13.86% above its low of $56.27, indicating a recovery from recent lows but still facing significant resistance.

The 20-day moving average (MA) at $63.51 suggests a short-term bullish trend, while the 50-day MA at $65.56 and the 200-day MA at $66.51 indicate longer-term bearish pressure. The Bollinger Bands show the price is near the lower band at $60.20, suggesting potential for upward movement.

The RSI at 50.91 indicates neutrality, while the MACD at -0.84 confirms a bearish sentiment. Overall, the metrics suggest caution, with possible upward momentum if the price can break above the moving averages and the upper Bollinger Band.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-21 | 0.89 | 0.97 | 8.87 | Earnings |

| 2025-01-27 | 0.84 | 0.85 | 1.8 | Earnings |

| 2024-10-28 | 0.82 | 0.93 | 12.86 | Earnings |

| 2024-07-22 | 0.86 | 0.81 | -5.48 | Earnings |

| 2024-04-22 | 0.87 | 0.87 | 0.37 | Earnings |

| 2024-01-22 | 1.0 | 0.72 | -27.93 | Earnings |

| 2023-10-23 | 0.97 | 0.91 | -5.8 | Earnings |

| 2023-07-24 | 1.12 | 1.12 | -0.18 | Earnings |

Analyzing the EPS trends from the provided earnings data reveals a mixed performance over the recent reporting periods. The most recent quarter, ending April 2025, shows a positive surprise of 8.87%, with the reported EPS of 0.97 exceeding the estimate of 0.89. This follows a pattern of fluctuating results, where earlier in 2024, the company faced significant challenges, particularly in January, where the reported EPS of 0.72 fell short of the estimate by 27.93%.

In contrast, the third quarter of 2024 demonstrated a rebound, with a reported EPS of 0.93, surpassing expectations by 12.86%. However, the second quarter of 2024 saw a negative surprise, indicating volatility in earnings performance. Overall, while the latest data shows some recovery and positive surprises, the earlier quarters suggest inconsistency, highlighting potential underlying issues that may need to be addressed to ensure sustained earnings growth moving forward.

💵 Dividend History

| Date | Dividend |

|---|---|

| 2025-08-29 | 0.7 |

| 2025-05-30 | 0.7 |

| 2025-02-28 | 0.7 |

| 2024-11-29 | 0.7 |

| 2024-10-29 | 0.7 |

| 2024-08-30 | 0.7 |

| 2024-05-31 | 0.7 |

| 2024-02-28 | 0.7 |

The provided dividend data reflects a consistent trend of stable payouts, with a steady dividend of 0.7 being issued across multiple quarters from February 2024 through August 2025. This pattern indicates a commitment to maintaining shareholder value, which can be particularly appealing in uncertain economic environments. Stability in dividends often suggests that a company is generating reliable cash flow and is confident in its future earnings potential.

Moreover, the regularity of these payments may attract income-focused investors who prioritize dividends as a source of return. Such consistency can also signal to the market that the company is financially healthy, fostering investor trust and potentially influencing stock price positively.

However, it is essential to consider the broader economic context and the company’s overall performance. While consistent dividends are a positive sign, investors should remain vigilant regarding any changes in the company’s operational dynamics or market conditions that could impact future dividend sustainability.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-08-21 | Resumed | Piper Sandler | Neutral | $71 |

| 2024-11-27 | Initiated | Stephens | Overweight | $90 |

| 2024-10-02 | Upgrade | Keefe Bruyette | Underperform → Mkt Perform | $60 → $67 |

| 2024-08-12 | Downgrade | Piper Sandler | Neutral → Underweight | $70 → $61 |

Recent rating changes reflect a mixed sentiment in the market regarding the stock’s performance and potential. Piper Sandler’s downgrade from Neutral to Underweight on August 12, 2024, suggests a bearish outlook, with the price target reduced from $70 to $61. This could indicate concerns about the company’s fundamentals or market conditions that may hinder growth.

Conversely, Stephens initiated coverage with an Overweight rating on November 27, 2024, setting a price target of $90. This positive outlook contrasts sharply with Piper Sandler’s downgrade, suggesting that some analysts see potential for significant upside, possibly due to favorable developments or market positioning.

Keefe Bruyette’s upgrade from Underperform to Market Perform on October 2, 2024, reflects a more cautious optimism, with a price target increase from $60 to $67. This adjustment indicates a recognition of improved circumstances, though still not fully bullish.

Overall, these changes illustrate the divergent views among analysts, highlighting the stock’s volatility and the importance of ongoing market assessment.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.