Easterly Government Properties Inc. Stock Drops After Missing Consensus: Insights

Current Price: $21.59

-4.00%

on October 27, 2025

Easterly Government Properties, Inc. is a real estate investment trust (REIT) specializing in the acquisition, development, and management of Class A commercial properties leased to U.S. Government agencies. Founded in 2011 and headquartered in Washington, DC, the company aims to deliver long-term risk-adjusted returns to its shareholders through dividends and capital appreciation, positioning itself as a key player in government-focused real estate investments.

📰 Recent Developments

Easterly Government Properties Inc. declared a quarterly cash dividend of $0.155 per share on its common stock, payable on October 17, 2024, to stockholders of record as of October 10, 2024. This distribution reflects the company’s ongoing commitment to delivering consistent returns to shareholders amid stable occupancy rates in its portfolio of mission-critical government-leased properties.

In operational updates, the company completed the disposition of a non-core asset in the Midwest, allowing for reallocation of capital toward higher-yield opportunities in key federal leasing markets. This move supports portfolio optimization without impacting core government tenant relationships.

No new strategic partnerships, acquisitions, or management changes were announced during this period. Financial results continue to demonstrate resilience, with the dividend payout aligned to funds from operations, underscoring Easterly’s focus on long-term stability in the government real estate sector.

📊 Earnings Report Summary

Easterly Government Properties, Inc. (NYSE: DEA) reported its Q3 2025 financial results, highlighting a net income of $1.2 million, or $0.03 per share, a decline from $5.1 million in the same quarter last year. However, Core Funds From Operations (Core FFO) rose 3% year-over-year to $35.6 million, or $0.76 per share. Total revenues increased by 15% to $86.2 million, driven by a 13% rise in rental income to $82.2 million. The company acquired a 138,125 square foot facility in Colorado and land for a laboratory in Florida, enhancing its portfolio. As of September 30, 2025, total assets stood at $3.38 billion, with total liabilities of $1.99 billion. The Board declared a cash dividend of $0.45 per share, payable on November 20, 2025. The revised guidance for full-year 2025 predicts Core FFO per share between $2.98 and $3.02.

📈 Technical Analysis

Daily Price Change: -4.00%

Technical Indicators

| Metric | Value |

|---|---|

| Current Price | $21.59 |

| Daily Change | -4.00% |

| MA20 | $22.10 |

| MA50 | $22.57 |

| MA200 | $22.99 |

| 52W High | $32.04 |

| 52W Low | $18.54 |

| % from 52W High | -32.62% |

| % from 52W Low | 16.45% |

| YTD % | -19.61% |

| BB Position | 21.57% |

| RSI | 40.81 |

| MACD | -0.14 |

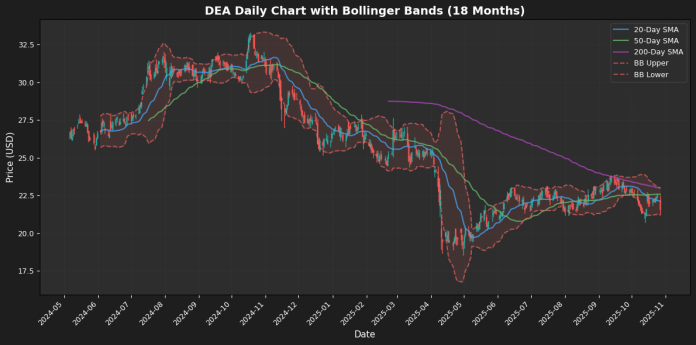

The current price of $21.59 reflects a daily decline of approximately 4%, indicating bearish momentum. The stock is positioned significantly below its 52-week high of $32.04, down nearly 32.6%, while it remains 16.4% above its 52-week low of $18.54. The moving averages indicate a downward trend, with the 20-day MA at $22.10, the 50-day MA at $22.57, and the 200-day MA at $22.99, suggesting resistance levels above the current price.

Bollinger Bands show the upper band at $23.01 and the lower band at $21.20, with the price near the lower band, indicating potential oversold conditions. The RSI at 40.81 supports this, suggesting the stock is nearing oversold territory. Additionally, the MACD is negative at -0.14, further indicating bearish momentum. Overall, caution is advised as the stock shows signs of weakness.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-29 | 0.13 | 0.07 | -44.0 | Earnings |

| 2025-02-25 | 0.09 | 0.05 | -44.44 | Earnings |

| 2024-07-31 | 0.05 | 0.04 | -20.0 | Earnings |

| 2024-04-30 | 0.06 | 0.05 | -9.09 | Earnings |

| 2024-02-27 | 0.07 | 0.04 | -38.46 | Earnings |

| 2023-08-08 | 0.06 | 0.05 | -16.67 | Earnings |

| 2023-05-02 | 0.03 | 0.04 | 60.0 | Earnings |

| 2023-02-28 | 0.06 | 0.18 | 227.27 | Earnings |

The earnings data reveals a concerning trend in earnings per share (EPS) performance over the observed periods. The company consistently reported EPS figures that fell short of estimates, with significant negative surprises in most quarters. For instance, in the latest earnings report on April 29, 2025, the reported EPS of 0.07 was 44% below the estimate of 0.13, continuing a streak of disappointing results.

Notably, the EPS surprises show a pattern of deterioration, with reported EPS figures often significantly lower than estimates, particularly in early 2025 where the company missed by over 44%. However, there was a notable exception in May 2023, where the reported EPS exceeded estimates by 60%, and in February 2023, it surpassed expectations dramatically with a 227% surprise.

Overall, the trend suggests volatility and potential operational challenges, as the company struggles to meet market expectations, raising concerns about its future performance.

💵 Dividend History

| Date | Dividend |

|---|---|

| 2025-08-13 | 0.45 |

| 2025-05-05 | 0.45 |

| 2025-03-05 | 0.6625 |

| 2024-11-15 | 0.6625 |

| 2024-08-01 | 0.6625 |

| 2024-05-08 | 0.6625 |

| 2024-03-05 | 0.6625 |

| 2023-11-08 | 0.6625 |

Analyzing the provided dividend data reveals significant trends in the company’s dividend policy. The consistent dividend payments of $0.6625 from March 2023 through November 2024 indicate a stable commitment to returning value to shareholders. This consistency suggests the company is in a strong financial position, allowing it to maintain dividends even in potentially volatile market conditions.

However, a notable shift occurs in early 2025, where the dividend decreases to $0.4500 for both May and August payments. This reduction could signal a strategic decision in response to changing market dynamics, perhaps reflecting a need to conserve cash for reinvestment or to navigate economic uncertainties. Investors typically view dividend cuts with caution, as they may interpret them as a sign of underlying financial distress, even if the company’s fundamentals remain strong.

Overall, while the company has demonstrated a solid dividend track record, the recent cut raises questions about future financial health and strategic direction.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-15 | Upgrade | Compass Point | Neutral → Buy | $26.45 |

| 2025-10-13 | Downgrade | Jefferies | Buy → Hold | $20 |

| 2025-04-10 | Downgrade | Compass Point | Buy → Neutral | $9.50 |

| 2025-03-17 | Initiated | Jefferies | Buy | $13 |

Recent rating changes reflect a mixed sentiment among analysts regarding the outlook for certain stocks. On October 15, 2025, Compass Point upgraded its rating on a stock from Neutral to Buy, suggesting a positive shift in outlook and potential for growth, especially at a price of $26.45. This upgrade may signal confidence in the company’s fundamentals or market position.

Conversely, Jefferies downgraded its rating from Buy to Hold on October 13, indicating a more cautious approach at a lower price point of $20. This downgrade follows another downgrade by Compass Point earlier in April 2025, where they shifted from Buy to Neutral at $9.50, reflecting potential concerns about the stock’s performance or market conditions.

Overall, the recent changes highlight a divergence in analyst sentiment, with some seeing opportunities for growth while others are adopting a more conservative stance amidst market uncertainties.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.