US Markets Closing Bell: Nvidia’s AI Chip News Boosts Sentiment, Nasdaq Rallies 0.7%

📊 Market Recap

**Market Recap – US Market Closing Session**

In today’s trading session, US markets opened with a cautiously optimistic sentiment, buoyed by expectations surrounding a potential interest rate cut from the Federal Reserve this week. The anticipation of a more accommodative monetary policy helped maintain investor confidence, leading to a steady performance throughout the session.

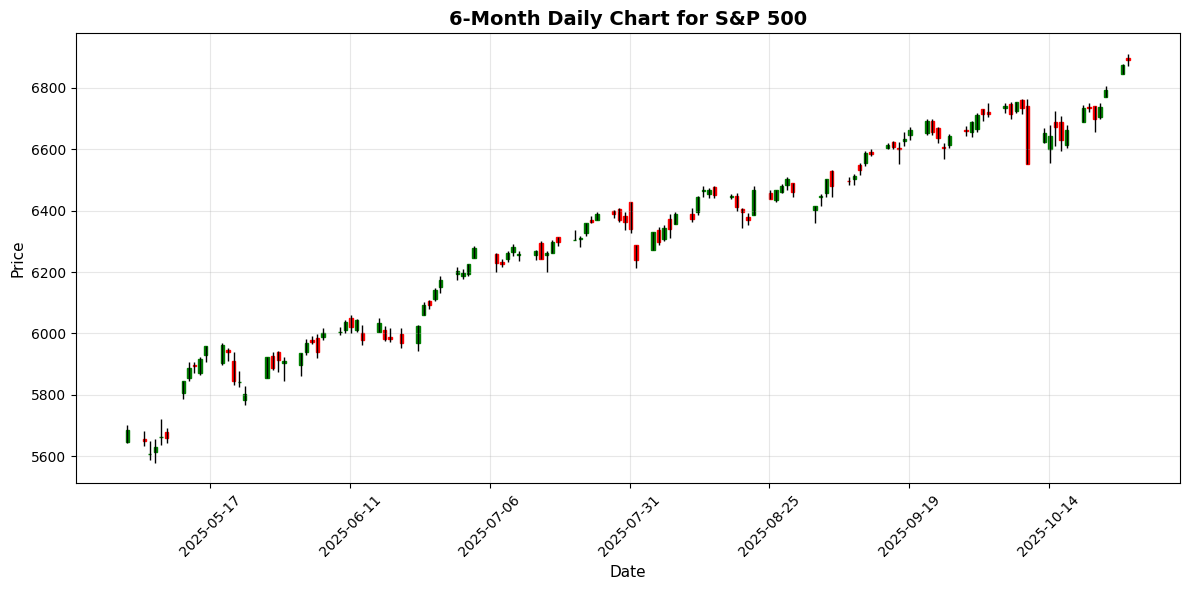

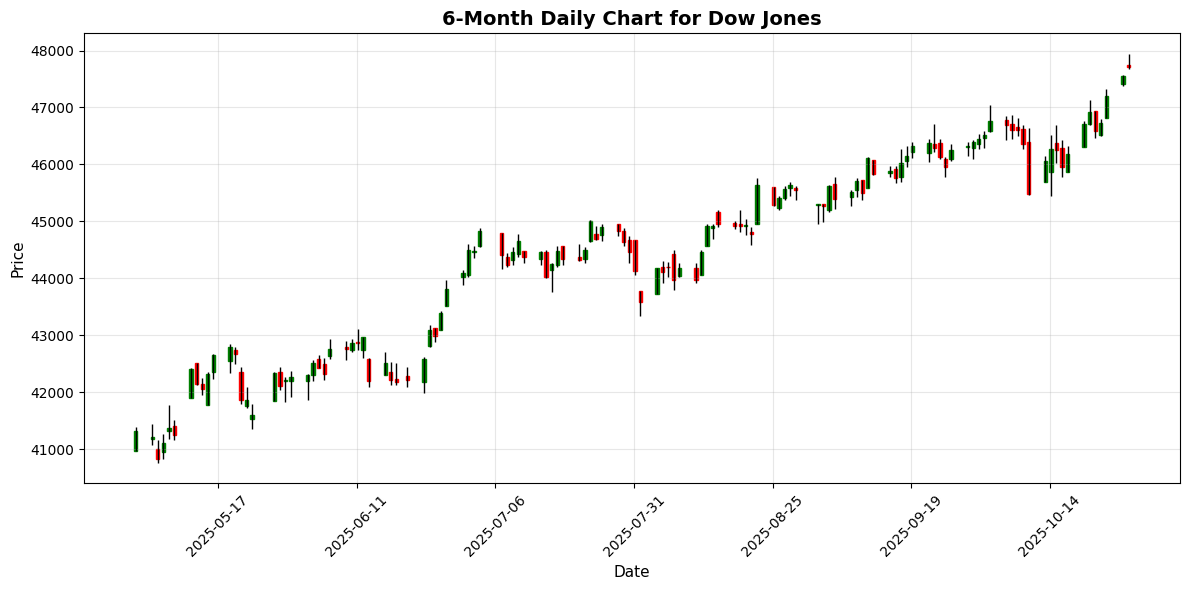

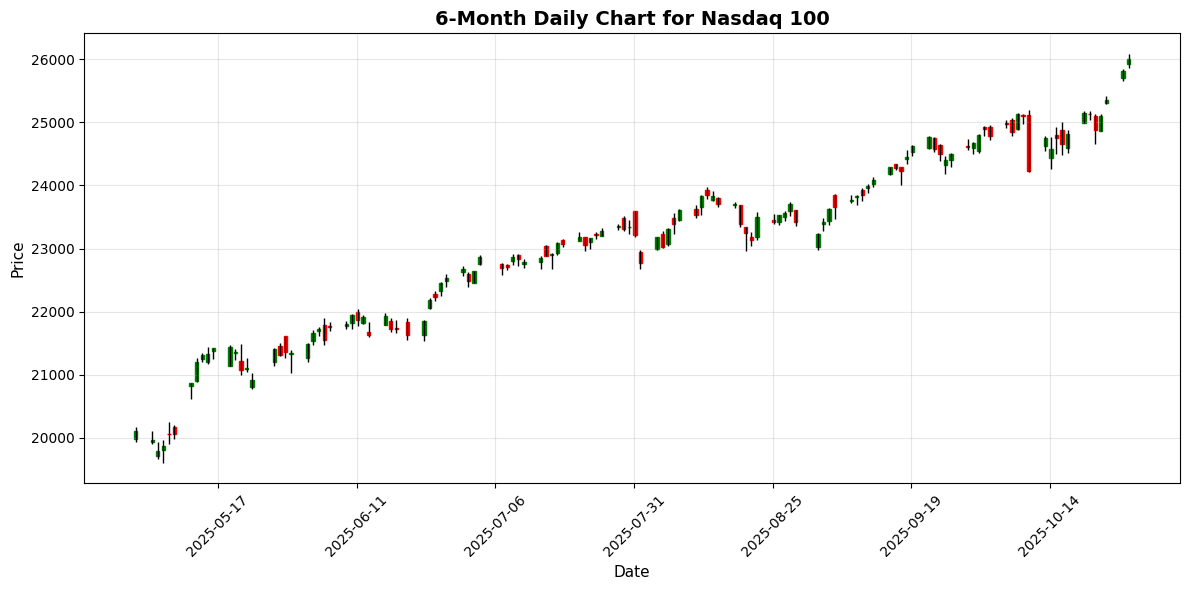

The major US indices closed positively, with the Nasdaq 100 leading the charge, up 0.74% to 26,012.16, driven by robust performances from technology giants such as Nvidia. The company announced that its AI chips are now being manufactured in Arizona, a strategic shift expected to bolster its production capabilities significantly. The S&P 500 gained 0.23% to finish at 6,890.89, while the Dow Jones rose 0.34% to close at 47,706.37, reflecting broad-based gains across various sectors.

Sector movements were notable, particularly in technology and materials. Nvidia’s supplier, SK Hynix, reported a remarkable 62% jump in third-quarter profits, further fueling optimism in the tech sector. Conversely, the energy sector faced headwinds, with crude oil prices declining by 1.65% to $60.30 per barrel, driven by ongoing concerns regarding Russian supply and mixed inventory data.

Market breadth indicators reflected a positive tone, with advancing issues outpacing decliners on major exchanges. Trading volume remained significant, suggesting active participation as investors positioned themselves ahead of the Fed’s decision.

In the currency markets, the euro held steady against the dollar at 1.1659, while the GBP/USD pair dipped slightly by 0.75% to 1.3277, reflecting ongoing uncertainties in the UK economy. The USD/JPY pair experienced a marginal increase, closing at 151.7480, as investors weighed the implications of US monetary policy on global currency flows.

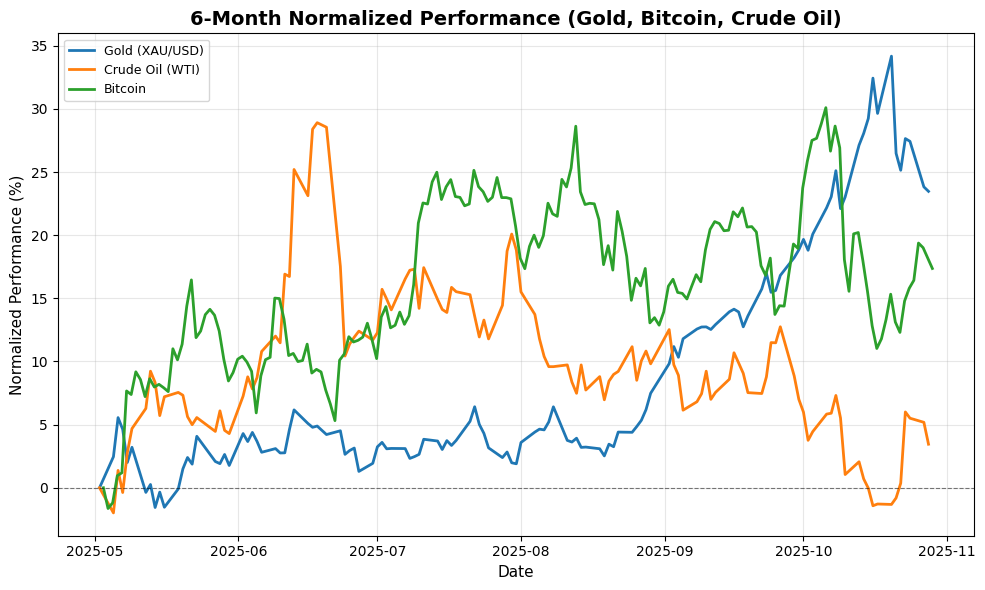

In commodities, gold prices slipped 0.29% to $3,990.40, as risk appetite grew amid hopes for a US-China trade breakthrough, which reduced the demand for safe-haven assets. Bitcoin also saw a decline, dropping 1.38% to $112,541.23, as market volatility continued to influence digital asset investments.

Globally, Asian markets opened higher, buoyed by Wall Street’s positive momentum, particularly in technology, while European markets reflected mixed performances, with the EuroStoxx 50 down slightly by 0.12%. Overall, today’s trading session highlighted a resilient US market, characterized by optimism surrounding tech advancements and forthcoming monetary policy adjustments. As investors await the Fed’s decision, market focus will likely remain on economic indicators and sector performance in the coming days.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6890.89 | +0.23 |

| Dow Jones | 47706.37 | +0.34 |

| Nasdaq 100 | 26012.16 | +0.74 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5704.35 | -0.12 |

| Nikkei 225 | 50900.92 | +0.77 |

| FTSE 100 | 9696.74 | +0.44 |

| Shanghai Composite | 3988.22 | -0.22 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.17 | 0.00 |

| USD/JPY | 151.75 | +0.01 |

| GBP/USD | 1.33 | -0.01 |

| Gold (XAU/USD) | 3990.40 | -0.29 |

| Crude Oil (WTI) | 60.30 | -1.65 |

| Bitcoin | 112541.23 | -1.38 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Current geopolitical developments are noticeably impacting market dynamics, particularly in the technology and energy sectors. Nvidia’s announcement regarding the manufacturing of its AI chips in Arizona signals a strategic shift aimed at reducing reliance on Taiwan, a region fraught with geopolitical tensions. This move could bolster investor confidence in domestic supply chains, particularly as demand for AI technologies surges, evidenced by SK Hynix’s record profits driven by AI memory demand. The intersection of technology and national security is increasingly relevant, positioning companies like Nvidia favorably amid concerns over global supply chain vulnerabilities.

Central bank activities are also pivotal this week, with the Federal Reserve expected to announce a rate cut, which may further stimulate market optimism. The anticipation of this decision has contributed to record highs in major stock indices, reflecting investor sentiment that leans towards growth and recovery. The recent consumer price index report indicating a lower-than-expected inflation rate of 3.0% for September is likely to reinforce the Fed’s accommodative stance.

On the trade front, the World Trade Organization’s remarks on the resilience of the global trade system amidst U.S. tariffs provide a backdrop of cautious optimism. However, ongoing geopolitical tensions, such as Russia’s military advancements and Israel’s intensified strikes in Gaza, may introduce volatility and uncertainty, impacting investor sentiment.

Overall, the confluence of positive economic indicators, central bank policy shifts, and strategic corporate maneuvers in technology are fostering a bullish market environment. Yet, investors must remain vigilant regarding geopolitical developments that could disrupt this trajectory, particularly in energy markets where sanctions against Russia continue to loom large.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-29 | 03:00 | 🇸🇪 | Medium | GDP (YoY) (Q3) | ||

| 2025-10-29 | 03:00 | 🇸🇪 | Medium | GDP (QoQ) (Q3) | 1.0% | |

| 2025-10-29 | 04:00 | 🇪🇺 | Medium | Spanish GDP (QoQ) (Q3) | 0.6% | |

| 2025-10-29 | 06:30 | 🇪🇺 | Medium | German 10-Year Bund Auction | ||

| 2025-10-29 | 08:30 | 🇺🇸 | Medium | Goods Trade Balance (Sep) | -90.00B | |

| 2025-10-29 | 08:30 | 🇺🇸 | Medium | Retail Inventories Ex Auto (Sep) | 0.3% | |

| 2025-10-29 | 09:45 | 🇨🇦 | Medium | BoC Monetary Policy Report | ||

| 2025-10-29 | 09:45 | 🇨🇦 | Medium | BoC Rate Statement | ||

| 2025-10-29 | 09:45 | 🇨🇦 | High | BoC Interest Rate Decision | 2.25% | |

| 2025-10-29 | 10:00 | 🇺🇸 | Medium | New Home Sales (MoM) (Sep) | ||

| 2025-10-29 | 10:00 | 🇺🇸 | High | New Home Sales (Sep) | 710K | |

| 2025-10-29 | 10:00 | 🇺🇸 | Medium | Pending Home Sales (MoM) (Sep) | 1.7% | |

| 2025-10-29 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | -0.400M | |

| 2025-10-29 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | ||

| 2025-10-29 | 10:30 | 🇨🇦 | Medium | BOC Press Conference | ||

| 2025-10-29 | 11:30 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q3) | 3.9% | |

| 2025-10-29 | 12:00 | 🇷🇺 | Medium | Retail Sales (YoY) (Sep) | 2.0% | |

| 2025-10-29 | 12:00 | 🇷🇺 | Medium | Unemployment Rate (Sep) | 2.3% | |

| 2025-10-29 | 14:00 | 🇺🇸 | High | FOMC Statement | ||

| 2025-10-29 | 14:00 | 🇺🇸 | High | Fed Interest Rate Decision | 4.00% | |

| 2025-10-29 | 14:30 | 🇺🇸 | High | FOMC Press Conference | ||

| 2025-10-29 | 22:30 | 🇯🇵 | Medium | BoJ Monetary Policy Statement | ||

| 2025-10-29 | 23:00 | 🇯🇵 | Medium | BoJ Outlook Report (YoY) | ||

| 2025-10-29 | 23:00 | 🇯🇵 | High | BoJ Interest Rate Decision | 0.50% |

Today’s economic calendar features several high-impact events that could significantly influence market sentiment and currency valuations. Notably, the focus is on the U.S. Federal Reserve’s interest rate decision and accompanying FOMC statement, scheduled for 14:00 ET, which is expected to maintain rates at 4.00%. This decision will be pivotal for the USD, impacting market expectations around future monetary policy.

Another key event is the Bank of Canada’s (BoC) interest rate decision at 09:45 ET, where the forecast is set at 2.25%. Any deviation from this could lead to volatility in the CAD. The BoC’s monetary policy report and subsequent press conference will provide further insights into the central bank’s outlook and could sway CAD traders.

Additionally, the release of the U.S. Goods Trade Balance and Retail Inventories at 08:30 ET could provide clues about economic health, with the trade balance expected at -90.00B. The market will closely monitor these figures for potential impacts on the USD.

Overall, today’s events are likely to create shifts in market sentiment, particularly for the USD and CAD, as traders react to central bank signals and economic indicators.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.