CVS Health Corporation Stock Flat After Missing Consensus: Insights

Ticker: CVS

Current Price: $82.20

+0.00%

on October 29, 2025

CVS Health Corp. is a comprehensive health solutions provider founded in 1963, headquartered in Woonsocket, RI. The company operates through four key segments: Health Care Benefits, Health Services, Pharmacy and Consumer Wellness, and Corporate and Other. CVS Health delivers a wide range of healthcare services, including pharmacy operations, health benefits, and personalized care solutions, addressing diverse health needs across the nation.

📰 Recent Developments

CVS Health Corporation announced its second-quarter 2024 financial results, reporting total revenues of $88.9 billion, a 6% increase from the prior year, driven by growth in the Health Care Benefits and Health Services segments. Adjusted operating income rose 7% to $3.2 billion, though GAAP net income declined due to higher medical costs.

The company expanded its MinuteClinic services by adding virtual care options for chronic condition management, including diabetes and hypertension, available at select locations nationwide.

CVS entered a strategic partnership with a leading telehealth provider to enhance digital health offerings for Aetna members, aiming to improve access to remote consultations.

Regulatory developments included the U.S. Food and Drug Administration’s approval for a new over-the-counter version of a branded allergy medication distributed through CVS pharmacies.

Operationally, CVS opened 20 new HealthHUB stores focused on wellness services in underserved communities, supporting broader expansion efforts.

No management changes were reported during this period.

📊 Earnings Report Summary

CVS Health Corporation reported its Q3 2025 financial results, showcasing total revenues of $102.9 billion, a 7.8% increase from the previous year. However, the company faced a GAAP diluted loss per share of $3.13, primarily due to a $5.7 billion goodwill impairment charge. In contrast, adjusted earnings per share rose significantly to $1.60, reflecting a 46.7% year-over-year increase. Operating income saw a substantial loss of $3.2 billion, compared to a profit of $832 million in Q3 2024. Notably, adjusted operating income improved by 35.8% to $3.5 billion. On the operational front, Aetna’s Medicare Advantage achieved high Star Ratings, and CVS secured nearly $6 billion in Caremark contracts. The company updated its full-year guidance, projecting adjusted EPS between $6.55 and $6.65. Despite the challenges, CVS paid $2.552 billion in dividends during the quarter, underscoring its commitment to returning value to shareholders.

📈 Technical Analysis

Daily Price Change: +0.00%

Technical Indicators

| Metric | Value |

|---|---|

| Current Price | $82.49 |

| Daily Change | 0.35% |

| MA20 | $79.56 |

| MA50 | $75.68 |

| MA200 | $65.77 |

| 52W High | $85.15 |

| 52W Low | $41.77 |

| % from 52W High | -3.12% |

| % from 52W Low | 97.47% |

| YTD % | 94.52% |

| BB Position | 79.79% |

| RSI | 72.89 |

| MACD | 2.17 |

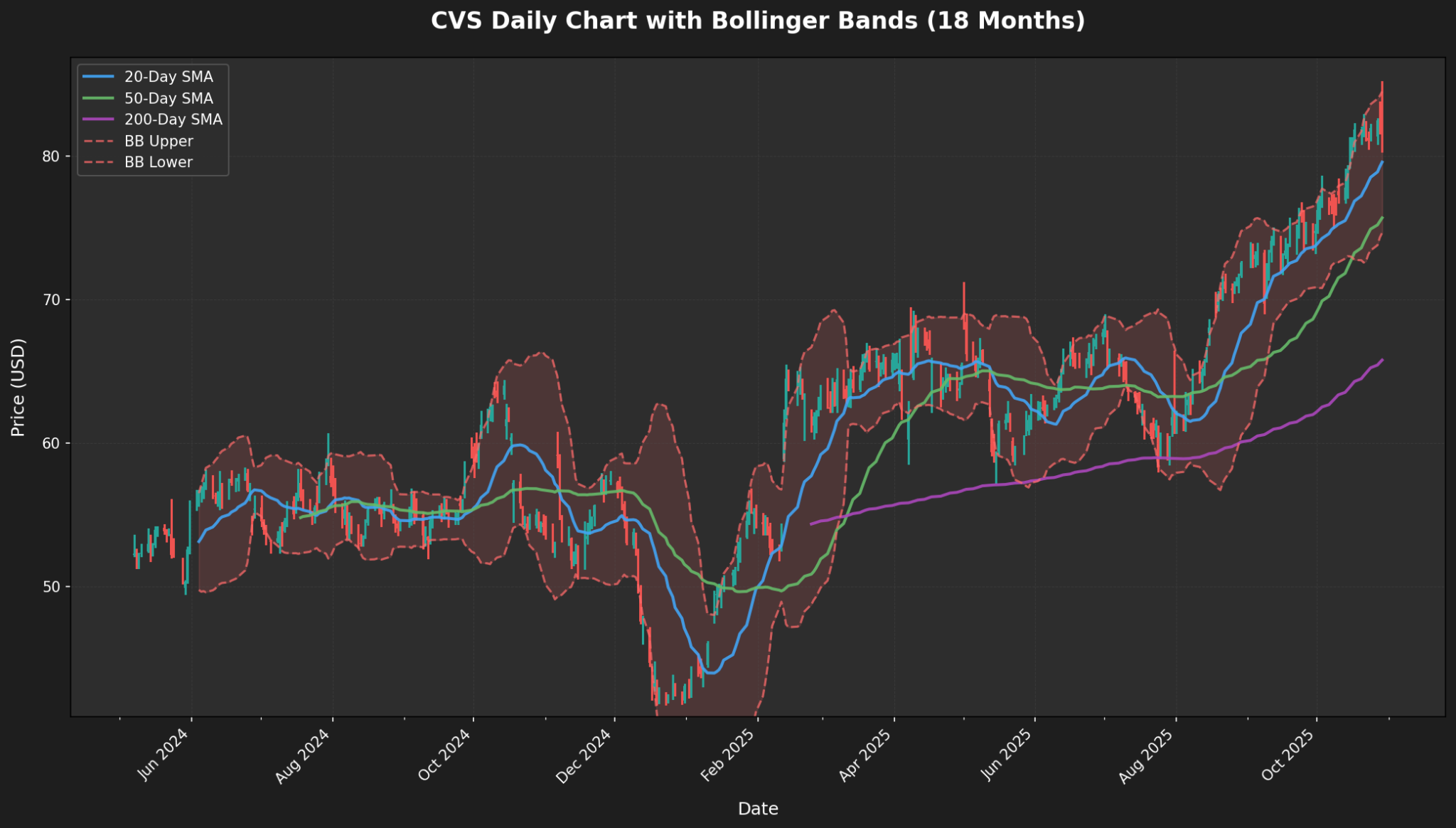

The current price of $82.49 reflects a modest daily increase of $0.35. Trading near its 52-week high of $85.15, the stock is just 3.12% below this peak, indicating strong upward momentum. The 52-week low of $41.77 highlights significant growth, with a remarkable 97.47% rise from this level.

Short-term moving averages reveal a bullish trend, with the 20-day MA at $79.56 and the 50-day MA at $75.68, both below the current price. The 200-day MA at $65.77 further supports this trend.

Bollinger Bands indicate the stock is nearing the upper band at $84.48, suggesting potential overbought conditions. The RSI of 72.89 confirms this, signaling that the stock may be overextended. Meanwhile, the MACD of 2.17 supports the bullish outlook but warrants caution for potential corrections.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-05-01 | 1.7 | 2.25 | 32.07 | Earnings |

| 2025-02-12 | 0.93 | 1.19 | 28.53 | Earnings |

| 2024-11-06 | 1.51 | 1.09 | -27.68 | Earnings |

| 2024-08-07 | 1.73 | 1.83 | 5.73 | Earnings |

| 2024-05-01 | 1.69 | 1.31 | -22.67 | Earnings |

| 2024-02-07 | 1.99 | 2.12 | 6.5 | Earnings |

| 2023-11-01 | 2.13 | 2.21 | 3.54 | Earnings |

| 2023-08-02 | 2.11 | 2.21 | 4.85 | Earnings |

The earnings data reveals notable trends in earnings per share (EPS) performance over recent quarters. The most recent report on May 1, 2025, highlighted a significant positive surprise, with reported EPS of 2.25 exceeding estimates by 32.07%. This follows a strong performance in February 2025, where EPS also surpassed expectations by 28.53%.

However, the preceding quarters show a mix of results, with two instances of negative surprises. Notably, in November 2024, the reported EPS of 1.09 fell short of the estimate by 27.68%, indicating potential challenges during that period. The fluctuations suggest volatility in earnings, with a general upward trend in the last two quarters of 2023 and early 2025, as evidenced by consistent outperformance against estimates.

Overall, while recent results indicate a rebound, the mixed performance in earlier quarters emphasizes the need for cautious optimism regarding future earnings stability and growth.

💵 Dividend History

| Date | Dividend |

|---|---|

| 2025-10-23 | 0.665 |

| 2025-07-22 | 0.665 |

| 2025-04-22 | 0.665 |

| 2025-01-23 | 0.665 |

| 2024-10-21 | 0.665 |

| 2024-07-22 | 0.665 |

| 2024-04-19 | 0.665 |

| 2024-01-19 | 0.665 |

The dividend data presented indicates a consistent trend in payouts, with the amount remaining steady at $0.665 per share across multiple quarters in 2024 and 2025. This stability suggests that the company is maintaining a solid financial position, allowing it to return value to shareholders consistently.

Such predictability in dividends can be appealing to investors, particularly those seeking income through dividend stocks. It reflects confidence in future earnings and cash flow stability. However, while consistent dividends can signal financial health, investors should also consider other factors such as overall market conditions, industry performance, and the company’s growth prospects.

The lack of growth in the dividend amount over this period may also indicate that the company is prioritizing maintaining its current payout rather than reinvesting profits for expansion. As the economic landscape evolves, it will be crucial for investors to monitor any potential shifts in dividend policies that could arise from changes in profitability or strategic direction.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-14 00:00:00 | Initiated | Goldman | Buy | $91 |

| 2025-08-18 00:00:00 | Upgrade | UBS | Neutral → Buy | $79 |

| 2025-08-14 00:00:00 | Upgrade | Robert W. Baird | Neutral → Outperform | $82 |

| 2025-02-13 00:00:00 | Upgrade | Leerink Partners | Market Perform → Outperform | $55 → $75 |

Recent rating changes reflect a positive shift in market sentiment for several stocks, indicating increased confidence among analysts. Goldman Sachs initiated coverage with a “Buy” rating at a price target of $91, suggesting strong potential for growth. This initiation often attracts investor interest, signaling that the stock is expected to perform well in the future.

Similarly, UBS upgraded its rating from “Neutral” to “Buy” with a price target of $79, while Robert W. Baird’s upgrade from “Neutral” to “Outperform” at a target of $82 further underscores a bullish outlook. These upgrades indicate that analysts believe the stocks have strong fundamentals or favorable market conditions that merit a higher rating.

Moreover, Leerink Partners’ upgrade from “Market Perform” to “Outperform,” along with a significant price target increase from $55 to $75, highlights a notable reassessment of the stock’s potential. Overall, these rating changes suggest a growing optimism among analysts, which could lead to increased investor activity and drive stock prices higher.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.