🌍 European Markets Steady as FTSE 100 Gains, US Markets Trade Amid Rate Speculation

European markets approaching close (still trading) • US markets actively trading • Analysis based on last 8 hours

📊 Market Overview

As European markets approach the close, the FTSE 100 is exhibiting resilience, up 0.61%. A primary driver behind this uptick is the strengthening of the British Pound (GBP) against the Euro, following the Bank of England’s (BoE) increased rate cut expectations. The potential for monetary easing has led to profit-taking in sectors sensitive to interest rates, while investors are cautiously optimistic about upcoming corporate earnings reports.

In contrast, the Canadian Dollar (CAD) has shown unexpected strength following the Bank of Canada’s (BoC) decision to implement a “hawkish cut,” which has led to a decline in the EUR/CAD pair by 0.40%. This development reflects broader concerns about trade tariffs and their potential impact on Canadian exports, thus influencing market sentiment.

Meanwhile, in the U.S. markets, the Dow Jones is up 0.52%, buoyed by investor anticipation regarding the Federal Reserve’s impending interest rate decision. Expectations are leaning towards another rate cut, as inflation remains subdued. This dovish outlook is contributing to a mixed sentiment across sectors, with financials performing well on hopes of a favorable economic environment, while utilities and consumer staples are facing pressure due to rising yields.

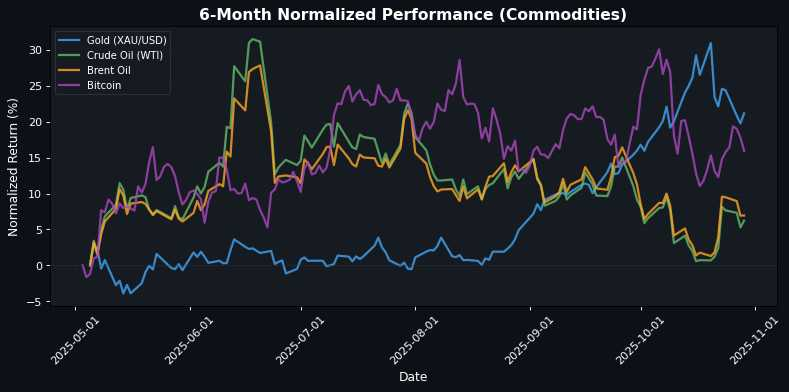

Cross-market dynamics reveal that the strengthening CAD has adversely affected the USD, with the USD/CAD pair falling to a one-month low. Moreover, commodities are experiencing volatility, as evidenced by copper reaching an all-time high, while gold and silver prices are declining due to liquidity-driven movements rather than demand fundamentals.

Overall, market sentiment remains cautiously optimistic, with a focus on central bank policies and their implications for economic growth and inflation. As the trading day progresses, investors are likely to remain attentive to developments from the Federal Reserve and the broader geopolitical landscape, including the upcoming Trump-Xi meeting.

🇪🇺 European Markets (Approaching Close)

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5705.81 | +0.03% |

| DAX | 24124.21 | -0.64% |

| FTSE 100 | 9756.14 | +0.61% |

| CAC 40 | 8200.88 | -0.19% |

🇺🇸 US Markets (Currently Active)

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6908.67 | +0.26% |

| Dow Jones | 47954.40 | +0.52% |

| Nasdaq 100 | 26115.81 | +0.40% |

🌏 Asian Markets

| Name | Price | Daily (%) |

|---|---|---|

| Nikkei 225 | 51307.65 | +2.17% |

| Shanghai Composite | 4016.33 | +0.70% |

| Hang Seng | 26346.14 | -0.33% |

💱 FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.17 | +0.03% |

| GBP/USD | 1.32 | -0.36% |

| USD/JPY | 152.15 | +0.03% |

| Gold (XAU/USD) | 4012.40 | +1.16% |

| Crude Oil (WTI) | 60.69 | +0.90% |

| Brent Oil | 64.41 | +0.02% |

| Bitcoin | 111172.68 | -1.58% |

🌍 Geopolitics and Market Drivers

Current geopolitical and macroeconomic dynamics are significantly influencing market behavior. Central banks are pivotal, with the Federal Reserve poised to cut interest rates further amid modest inflation gains, while the Bank of Canada (BoC) hinted at the cessation of rate cuts amid rising tariff concerns. This divergence has caused the Canadian dollar (CAD) to react strongly, with a “hawkish cut” from the BoC leading to a decline in the USD/CAD.

Geopolitically, the upcoming Trump-Xi meeting is creating volatility, particularly in the AUD/USD pair, as markets brace for potential trade implications. Meanwhile, the British pound (GBP) is under pressure due to weakened economic data and increased odds of a BoE rate cut, pushing GBP/USD below its 200-day SMA.

Commodity prices are also affected, with copper hitting an all-time high, while gold and silver are experiencing downward pressure driven more by liquidity than demand. Overall, market participants are closely monitoring central bank decisions and geopolitical developments to navigate the evolving landscape.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.