US Markets Closing Bell: Meta’s Tax Charge Weighs on Stocks, S&P 500 Flat Amid Mixed Sentiment

📊 Market Recap

**Market Recap: US Market Closing Session**

Today’s trading session opened with a cautious sentiment as investors digested the Federal Reserve’s recent interest rate cut and its implications for future monetary policy. The Fed announced a 25 basis point reduction, marking the second cut of the year, but Chair Jerome Powell’s comments raised concerns about the potential for further easing in the near term. As a result, the markets exhibited a mixed performance throughout the day.

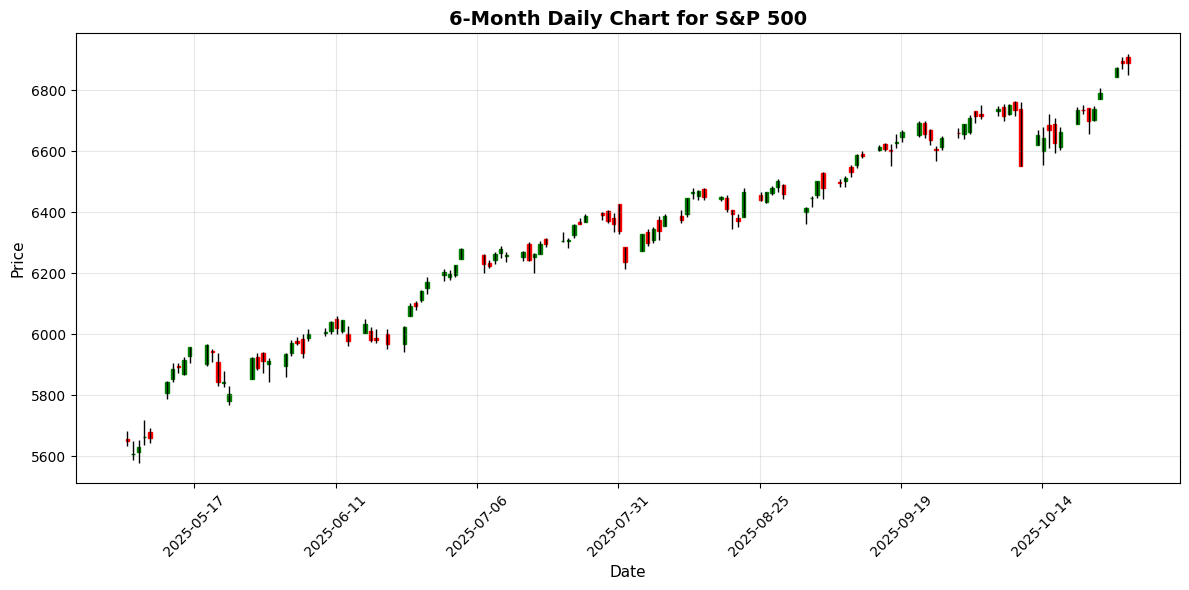

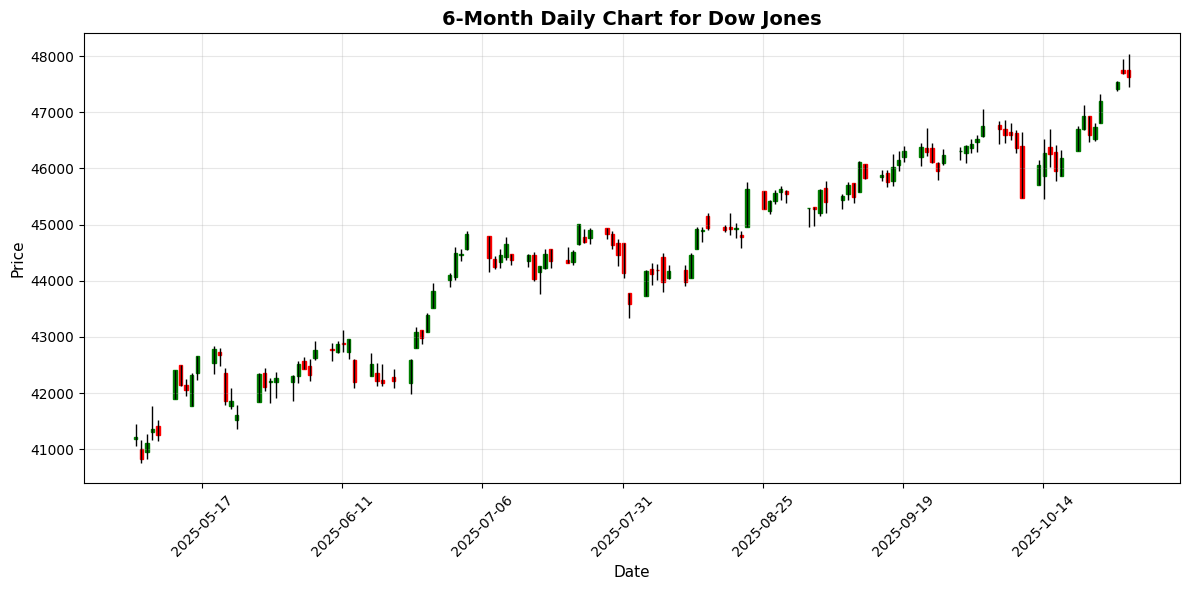

The major US indices reflected this ambivalence, with the S&P 500 closing slightly down by 0.004% at 6,890.59, while the Dow Jones Industrial Average fell 0.16% to 47,632.00. In contrast, the Nasdaq 100 managed to gain 0.41%, closing at 26,119.85, buoyed by strong performances from tech giants. Key drivers included Alphabet, which reported over $100 billion in quarterly revenue for the first time, and Microsoft, whose Azure cloud revenue surged by 40%, despite some concerns over rising capital expenditures.

Sector movements were notably varied. The technology sector saw gains driven by the positive earnings from Microsoft and Alphabet, while consumer discretionary stocks faced pressure following Meta’s disappointing performance. Meta’s shares plummeted 9% after the company announced a one-time tax charge, overshadowing its earnings beat. Other notable decliners included stocks in the financial sector, which reacted negatively to the Fed’s cautious outlook on future rate cuts.

In terms of market breadth, decliners outpaced advancers, indicating a cautious mood among investors. Trading volume was robust, reflecting heightened activity as market participants reacted to the Fed’s announcement and corporate earnings reports.

In the currency markets, the US dollar regained strength, particularly against the Euro and British Pound. The EUR/USD pair fell by 0.44% to 1.1608, while GBP/USD dropped 0.63% to 1.3195. The USD/JPY pair, however, rose 0.60% to 152.65, reflecting a stronger dollar sentiment amid the Fed’s actions.

Commodity markets displayed mixed results. Gold prices dipped 0.62% to $3,941.70, as investors continued to recalibrate following a recent rally. Meanwhile, crude oil prices edged up 0.35% to $60.36, supported by ongoing supply concerns. Bitcoin also saw a decline of 1.02%, trading at $111,806.60, as market volatility persisted.

Globally, markets were a mixed bag; the EuroStoxx 50 inched up 0.03%, while the Nikkei 225 surged 2.17%. The FTSE 100 gained 0.61%, and the Shanghai Composite rose 0.70%, reflecting a generally positive sentiment in international markets despite the caution observed in the US.

Overall, today’s market session encapsulated the complexities of investor sentiment in a transitioning monetary policy environment, with significant corporate

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6890.59 | -0.00 |

| Dow Jones | 47632.00 | -0.16 |

| Nasdaq 100 | 26119.85 | +0.41 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5705.81 | +0.03 |

| Nikkei 225 | 51307.65 | +2.17 |

| FTSE 100 | 9756.14 | +0.61 |

| Shanghai Composite | 4016.33 | +0.70 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | -0.44 |

| USD/JPY | 152.65 | +0.60 |

| GBP/USD | 1.32 | -0.63 |

| Gold (XAU/USD) | 3941.70 | -0.62 |

| Crude Oil (WTI) | 60.36 | +0.35 |

| Bitcoin | 111806.60 | -1.02 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Recent geopolitical developments and central bank activities have significantly influenced market dynamics. The Federal Reserve’s decision to cut interest rates by 25 basis points, while simultaneously signaling a cautious approach to further easing, has created uncertainty among investors. Fed Chair Jerome Powell’s remarks about the possibility of the latest cut being the last for a while contributed to a decline in the Dow Jones Industrial Average, which briefly hit an all-time high before retreating. This market reaction reflects heightened sensitivity to monetary policy shifts, particularly as two dissenting votes indicated divisions within the Fed regarding the appropriate course of action.

In the realm of international trade, former President Trump’s discussions with Chinese President Xi Jinping about potentially lowering tariffs on fentanyl-linked imports signal a thaw in U.S.-China relations, which could stabilize market sentiment. However, Trump’s push for rare-earth deals to counter China’s dominance highlights ongoing geopolitical tensions that could disrupt supply chains and impact related sectors.

On the corporate front, major tech firms reported mixed earnings. While Alphabet surpassed $100 billion in quarterly revenue and Microsoft showcased robust growth in its cloud division, Meta’s shares dropped 9% due to a one-time tax charge, underscoring the volatility in investor sentiment tied to earnings surprises. Additionally, the labor market remains resilient, with the ADP reporting nearly 15,000 new jobs created weekly, suggesting underlying economic strength that may support future consumer spending.

Amid these developments, geopolitical risks, including ongoing tensions in the Middle East and natural disasters like Hurricane Melissa, add layers of complexity to market forecasts. Investors should remain vigilant, as these factors could lead to increased volatility and shifts in market sentiment in the near term.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-29 | 03:00 | 🇸🇪 | Medium | GDP (QoQ) (Q3) | 1.1% | 0.8% |

| 2025-10-29 | 03:00 | 🇸🇪 | Medium | GDP (YoY) (Q3) | 2.4% | 1.6% |

| 2025-10-29 | 04:00 | 🇪🇺 | Medium | Spanish GDP (QoQ) (Q3) | 0.6% | 0.6% |

| 2025-10-29 | 06:30 | 🇪🇺 | Medium | German 10-Year Bund Auction | 2.620% | |

| 2025-10-29 | 09:45 | 🇨🇦 | Medium | BoC Monetary Policy Report | ||

| 2025-10-29 | 09:45 | 🇨🇦 | Medium | BoC Rate Statement | ||

| 2025-10-29 | 09:45 | 🇨🇦 | High | BoC Interest Rate Decision | 2.25% | 2.25% |

| 2025-10-29 | 10:00 | 🇺🇸 | Medium | Pending Home Sales (MoM) (Sep) | 0.0% | 1.6% |

| 2025-10-29 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | -6.858M | -0.900M |

| 2025-10-29 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | 1.334M | |

| 2025-10-29 | 10:30 | 🇨🇦 | Medium | BOC Press Conference | ||

| 2025-10-29 | 12:00 | 🇷🇺 | Medium | Retail Sales (YoY) (Sep) | 1.8% | 2.0% |

| 2025-10-29 | 12:00 | 🇷🇺 | Medium | Unemployment Rate (Sep) | 2.2% | 2.3% |

| 2025-10-29 | 12:01 | 🇷🇺 | Medium | GDP Monthly (YoY) (Sep) | 0.9% | |

| 2025-10-29 | 14:00 | 🇺🇸 | High | FOMC Statement | ||

| 2025-10-29 | 14:00 | 🇺🇸 | High | Fed Interest Rate Decision | 4.00% | 4.00% |

| 2025-10-29 | 14:30 | 🇺🇸 | High | FOMC Press Conference | ||

| 2025-10-29 | 15:30 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-29 | 22:30 | 🇯🇵 | Medium | BoJ Monetary Policy Statement | ||

| 2025-10-29 | 23:00 | 🇯🇵 | Medium | BoJ Outlook Report (YoY) | ||

| 2025-10-29 | 23:00 | 🇯🇵 | High | BoJ Interest Rate Decision | 0.50% |

**Overview:**

Today’s economic calendar features several high-impact releases, particularly from Sweden, Canada, and the U.S., alongside notable events from the Eurozone and Japan. The focus will be on GDP figures and central bank decisions, which can significantly influence market sentiment and currency valuations.

**Key Releases:**

1. **Sweden’s GDP (QoQ and YoY)**: Both metrics exceeded expectations, with QoQ growth at 1.1% (forecast: 0.8%) and YoY at 2.4% (forecast: 1.6%). This positive surprise is likely to strengthen the SEK.

2. **Pending Home Sales (U.S.)**: Reported at 0.0%, falling short of the 1.6% forecast, indicating potential weakness in the housing market, which may negatively impact the USD.

3. **Crude Oil Inventories (U.S.)**: A significant draw of -6.858M barrels against a forecast of -0.900M could support oil prices and the CAD, especially ahead of the Bank of Canada’s decisions.

**Market Impact:**

The stronger-than-expected GDP data from Sweden is likely to bolster the SEK, while disappointing U.S. housing data may weigh on the USD. The BoC’s interest rate decision is expected to maintain stability at 2.25%, which could lead to a cautious CAD response. Overall, market sentiment may shift towards risk-off, particularly in U.S. assets, as traders digest the mixed signals from today’s releases.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.