Nikkei 225 Soars 2.12% Best Performer in the Region

Note: This analysis covers the Asian trading session close for October 31, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3954.79 | -0.81 |

| Nikkei 225 | 52411.34 | +2.12 |

| Hang Seng Index | 25906.65 | -1.43 |

| Shenzhen Component | 13378.21 | -1.14 |

| KOSPI | 4107.50 | +0.50 |

| S&P/ASX 200 | 8881.90 | -0.04 |

| NIFTY 50 | 25722.10 | -0.60 |

| Straits Times Index | 4428.62 | -0.20 |

| S&P/NZX 50 | 13548.32 | +0.66 |

| Thailand SET Index | 1309.50 | -0.39 |

| FTSE Bursa Malaysia KLCI | 1609.15 | -0.31 |

| TAIEX | 28233.35 | -0.19 |

📰 Market Commentary

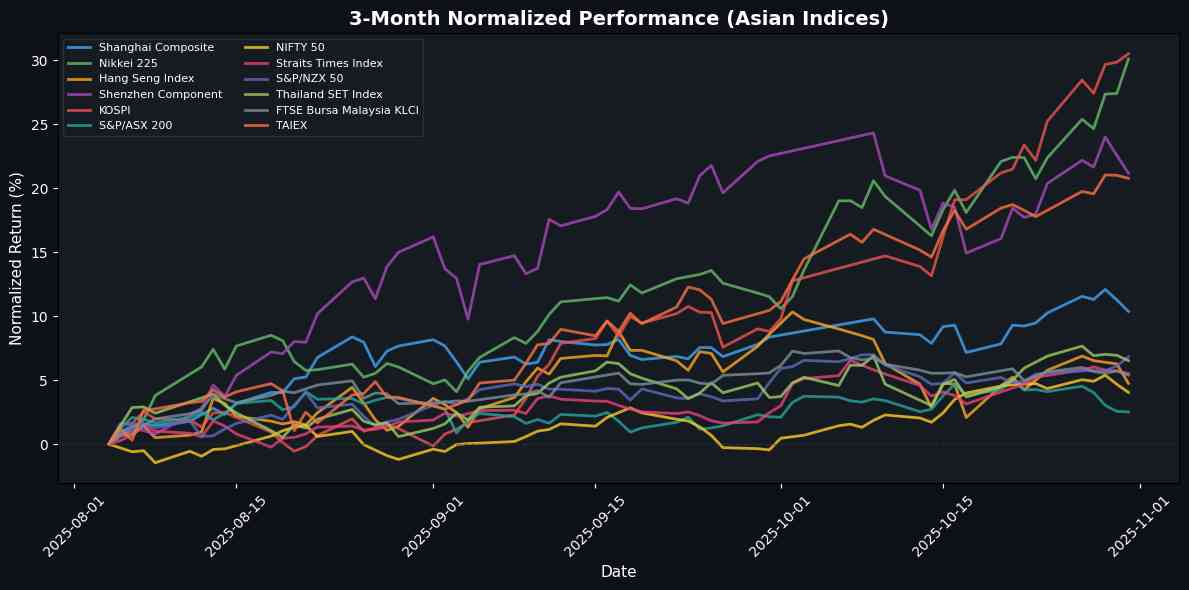

As of October 31, 2025, Asian markets exhibited a mixed performance, influenced by various regional economic developments and global market trends. Key drivers affecting the markets included significant corporate investments, shifts in consumer sentiment, and geopolitical factors.

Deloitte’s announcement of a US$64 million investment in Hong Kong, alongside plans to hire 1,000 staff, reflects a positive outlook for the region’s economic recovery and job market. This comes amid encouraging data from the Hong Kong Monetary Authority, which reported a 17% reduction in negative equity for Q3, suggesting improved financial stability for homeowners.

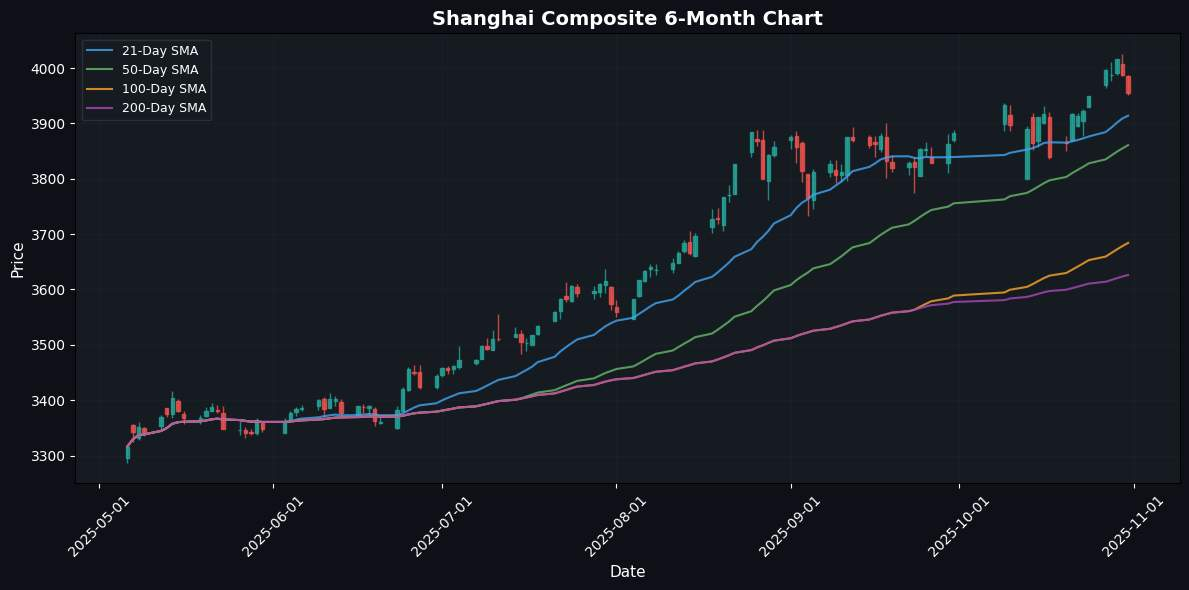

In terms of index movements, the Nikkei 225 outperformed its peers with a notable increase of 2.12%, driven by positive sentiment surrounding Japan’s economic resilience. Conversely, the Hang Seng Index fell by 1.43%, reflecting ongoing concerns about Hong Kong’s economic environment despite the positive news from Deloitte. The Shanghai Composite and Shenzhen Component also declined, by 0.81% and 1.14%, respectively, indicating a cautious approach among investors.

Regional trends highlighted a divergence in performance, with the KOSPI gaining 0.50%, supported by strong domestic demand, while the NIFTY 50 and Straits Times Index posted slight declines. The S&P/ASX 200 and FTSE Bursa Malaysia KLCI also experienced minor losses, reflecting broader market uncertainties.

Overall, while certain markets demonstrated resilience and growth potential, others faced headwinds influenced by local economic conditions and external market dynamics. The mixed performance underscores the complexity of the Asian economic landscape as it navigates recovery and growth challenges.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

No significant economic events during Asian session.

📈 Main Index Charts

Nikkei 225

Hang Seng Index

Shanghai Composite

Shenzhen Component

KOSPI

S&P/ASX 200

NIFTY 50

Straits Times Index

💱 FX, Commodities & Crypto

In recent trading, the foreign exchange market saw the USD/JPY pair slightly increase by 0.02%, while the USD/CNY and USD/SGD also exhibited modest gains of 0.07% and 0.07%, respectively. Conversely, the AUD/USD and NZD/USD pairs declined by 0.21% and 0.35%, driven by weaker economic data from Australia and New Zealand. The USD/INR rose by 0.13%, influenced by ongoing inflation concerns in India.

In commodities, gold prices edged up by 0.11% to $4,020, supported by safe-haven demand amid geopolitical tensions. However, crude oil prices fell by 0.35% to $60.32, reflecting concerns over global supply and demand dynamics.

In the cryptocurrency market, Bitcoin surged by 2.05% to $110,504, while Ethereum rose by 2.00% to $3,879, buoyed by increased institutional interest and positive market sentiment.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 154.12 | +0.02 |

| USD/CNY | 7.11 | +0.07 |

| USD/SGD | 1.30 | +0.07 |

| AUD/USD | 0.65 | -0.21 |

| NZD/USD | 0.57 | -0.35 |

| USD/INR | 88.70 | +0.13 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 4020.00 | +0.11 |

| Crude Oil | 60.32 | -0.35 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 110504.26 | +2.05 |

| Ethereum | 3879.14 | +2.00 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.