US Markets Closing Bell: Strong Earnings Boost Nasdaq 0.5% Amid Optimism in Tech Sector

📊 Market Recap

**Market Recap – US Market Closing Session**

The US stock market closed mixed on Friday, with a notable divergence between the major indices. The session opened with a cautiously optimistic sentiment, fueled by strong earnings reports from tech giants, particularly Amazon, which significantly boosted investor confidence. Throughout the day, the S&P 500 and Nasdaq 100 showed resilience, while the Dow Jones lagged behind, reflecting the ongoing challenges in certain sectors.

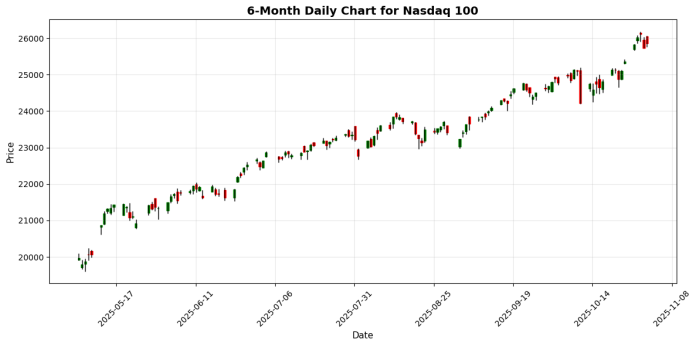

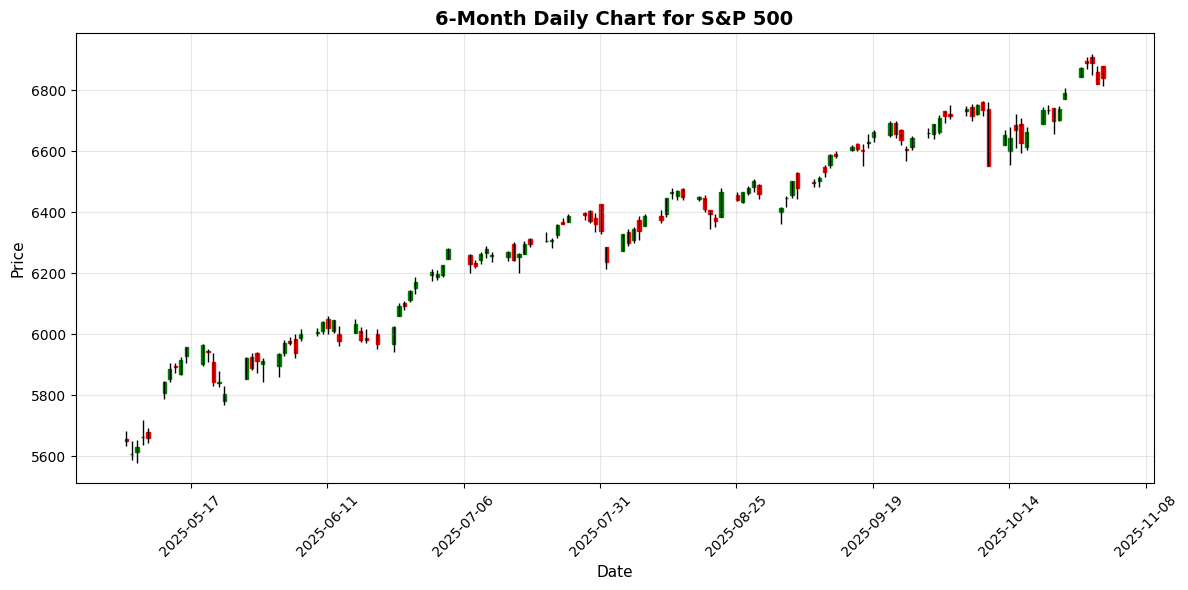

The S&P 500 closed at 6,840.20, up 0.26%, while the Nasdaq 100 finished at 25,858.13, gaining 0.48%. In contrast, the Dow Jones Industrial Average ended at 47,562.87, only slightly higher by 0.09%. The rally in tech stocks, especially Amazon’s impressive quarterly results, was a key driver for the Nasdaq and S&P 500, highlighting the sector’s continued strength despite macroeconomic uncertainties.

Sector performance was mixed, with technology stocks leading the charge. Notable gainers included Amazon, which surged to a record high, and other tech firms like Nvidia and Meta, which also posted strong results. Conversely, the energy sector faced headwinds as oil prices remained volatile, impacting stocks like Chevron and Exxon Mobil, which reported mixed earnings.

Market breadth indicators showed a slight edge in favor of advancing stocks, with approximately 56% of S&P 500 constituents closing higher. Trading volume was robust, indicating strong interest from investors as they positioned themselves ahead of the weekend.

In the currency markets, the US Dollar continued its rally, influenced by a hawkish tone from the Federal Reserve earlier in the week. The EUR/USD pair slid to a three-month low at 1.1543, down 0.28%, while GBP/USD fell to a seven-month low of 1.3154, reflecting ongoing fiscal concerns in the UK. The USD/JPY pair remained relatively stable, closing at 153.94, up marginally by 0.03%.

On the commodities front, gold prices slipped slightly, settling at $4,013.40, marking a second consecutive weekly loss as investors reassessed the Federal Reserve’s monetary policy outlook. Crude oil prices saw a modest gain, closing at $60.88, while Bitcoin rose by 1.23%, finishing the day at $109,640.54, as interest in cryptocurrencies remained resilient.

Globally, markets showed mixed performance. The EuroStoxx 50 declined by 0.65%, while the Nikkei 225 in Japan rose by 2.12%, reflecting regional divergences in economic sentiment. The FTSE 100 and Shanghai Composite also closed lower, indicating a cautious mood in European and Asian markets as investors weighed local economic data against global trends.

In summary, while the US markets displayed resilience, particularly in technology, concerns about inflation and fiscal policies continue to create a complex backdrop for investors as they navigate the final months of the year.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6840.20 | +0.26 |

| Dow Jones | 47562.87 | +0.09 |

| Nasdaq 100 | 25858.13 | +0.48 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5662.04 | -0.65 |

| Nikkei 225 | 52411.34 | +2.12 |

| FTSE 100 | 9717.25 | -0.44 |

| Shanghai Composite | 3954.79 | -0.81 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | -0.28 |

| USD/JPY | 153.94 | +0.03 |

| GBP/USD | 1.32 | -0.05 |

| Gold (XAU/USD) | 4013.40 | +0.30 |

| Crude Oil (WTI) | 60.88 | +0.51 |

| Bitcoin | 109640.54 | +1.23 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Current geopolitical developments are significantly influencing market dynamics. The ongoing U.S. government shutdown has raised concerns about the viability of essential programs like SNAP, which supports over 40 million Americans. This uncertainty could dampen consumer sentiment and spending, crucial for economic growth, particularly as the holiday shopping season approaches. Additionally, tariffs are anticipated to increasingly affect consumer prices, further complicating the economic landscape.

In the realm of central banking, the Federal Reserve’s recent hawkish stance has bolstered the U.S. dollar, leading to a decline in both the euro and pound against the greenback. The Fed’s decision to cut rates by 25 basis points has been interpreted as a signal of caution amid global economic pressures, which may lead to increased volatility in currency markets. Conversely, the European Central Bank’s decision to hold rates steady reflects a resilient Eurozone economy, although it may face headwinds from rising U.S. rates.

Trade relations are also evolving, with President Trump’s recent tariff reductions on Chinese fentanyl and the postponement of rare earths curbs signaling a potential thaw in U.S.-China relations. This conciliatory approach, coupled with Xi’s diplomatic overtures, could stabilize markets that have been jittery over trade tensions.

Political events, such as the NYC mayoral race, are influencing investor sentiment, particularly in sectors like real estate, which could experience pressure depending on election outcomes. Overall, the confluence of these factors—central bank policies, trade dynamics, and political developments—coupled with economic data releases, is shaping a complex market environment where investor caution is warranted amid signs of potential economic instability.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-31 | 03:00 | 🇬🇧 | Medium | Nationwide HPI (YoY) (Oct) | 2.4% | 2.3% |

| 2025-10-31 | 03:00 | 🇬🇧 | Medium | Nationwide HPI (MoM) (Oct) | 0.3% | 0.0% |

| 2025-10-31 | 03:00 | 🇪🇺 | Medium | German Retail Sales (MoM) (Sep) | 0.2% | 0.2% |

| 2025-10-31 | 03:45 | 🇪🇺 | Medium | French CPI (MoM) (Oct) | 0.1% | 0.1% |

| 2025-10-31 | 03:45 | 🇪🇺 | Medium | French HICP (MoM) (Oct) | 0.1% | 0.1% |

| 2025-10-31 | 06:00 | 🇪🇺 | Medium | Core CPI (YoY) (Oct) | 2.4% | 2.3% |

| 2025-10-31 | 06:00 | 🇪🇺 | High | CPI (YoY) (Oct) | 2.1% | 2.1% |

| 2025-10-31 | 06:00 | 🇪🇺 | Medium | CPI (MoM) (Oct) | 0.2% | |

| 2025-10-31 | 07:30 | 🇧🇷 | Medium | Gross Debt-to-GDP ratio (MoM) (Sep) | 78.1% | |

| 2025-10-31 | 08:00 | 🇧🇷 | Medium | Unemployment Rate (Sep) | 5.6% | 5.5% |

| 2025-10-31 | 08:30 | 🇨🇦 | Medium | GDP (MoM) (Aug) | -0.3% | 0.0% |

| 2025-10-31 | 08:31 | 🇨🇦 | Medium | GDP (MoM) (Sep) | 0.1% | |

| 2025-10-31 | 09:45 | 🇺🇸 | High | Chicago PMI (Oct) | 43.8 | 42.3 |

| 2025-10-31 | 12:00 | 🇺🇸 | Medium | FOMC Member Bostic Speaks | ||

| 2025-10-31 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | 414 | |

| 2025-10-31 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | 546 |

**Overview:**

Today, several key economic events are set to impact global markets, particularly focusing on the GBP, EUR, CAD, and USD. Notably, the releases include housing data from the UK, inflation metrics from the Eurozone, and GDP figures from Canada, all of which carry high importance for currency valuation and market sentiment.

**Key Releases:**

1. **GBP – Nationwide HPI (YoY & MoM):** The YoY figure came in at 2.4%, exceeding the forecast of 2.3%. The MoM data showed a stronger-than-expected growth of 0.3%, against a forecast of 0.0%. This positive surprise may bolster GBP strength as it indicates resilience in the housing market.

2. **EUR – Core CPI (YoY):** The core inflation rate was reported at 2.4%, slightly above the forecast of 2.3%. This could signal persistent inflationary pressures, potentially influencing ECB policy decisions.

3. **CAD – GDP (MoM):** August’s GDP showed a contraction of -0.3%, diverging from the expected 0.0% growth, while September’s data indicated a slight recovery at 0.1%. This mixed signal may weigh on CAD sentiment.

**Market Impact:**

The GBP strengthened following the housing data, while the EUR remained stable amid the inflation readings. The CAD’s mixed GDP results led to a cautious sentiment, potentially affecting its performance against the USD. Overall, today’s data releases fostered a sentiment of cautious optimism in the GBP, while the CAD faced headwinds from economic contraction concerns.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.