🌍 European Markets Rise as DAX Gains 0.73%; US Traders Eye AI Investment Trends

European markets approaching close (still trading) • US markets actively trading • Analysis based on last 8 hours

📊 Market Overview

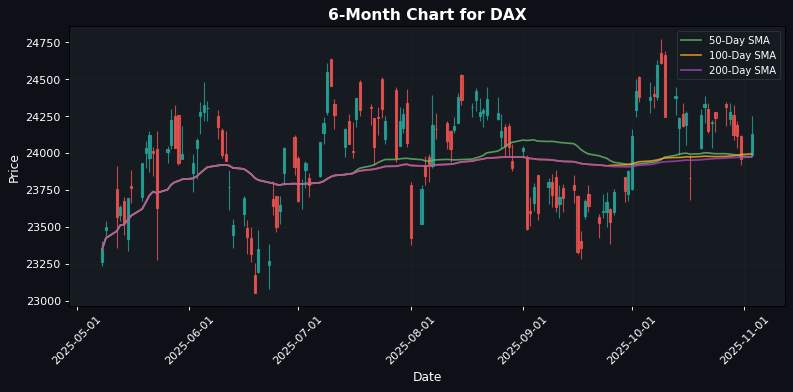

As European markets approach the close, the DAX is showing a notable gain of 0.73%, buoyed by positive sentiment surrounding corporate earnings and a resilient export sector, despite ongoing concerns about inflation and interest rates. Investors appear optimistic, driven by reports of strong earnings from key German companies, which have helped to offset broader economic uncertainties.

In the U.S., the Dow Jones Industrial Average (DJIA) is grappling with a decline of approximately 200 points, falling below the 47,250 mark for the first time recently. This downturn is largely attributed to concerns over missing out on the AI investment wave, as market participants weigh the implications of Federal Reserve statements on monetary policy. Federal Reserve Governor Lisa Cook’s remarks about the need to maintain policies that curb inflation have added to the cautious sentiment, alongside comments from San Francisco Fed President Mary Daly emphasizing the persistent inflationary pressures.

Meanwhile, the tech-heavy Nasdaq 100 has managed a modest gain of 0.37%, reflecting a divergence in sector performance. Technology stocks are benefiting from continued investor interest in AI, even as traditional sectors face headwinds. This divergence illustrates the market’s ongoing bifurcation, where growth-oriented sectors are favored amid uncertainty in value stocks.

Cross-market dynamics are evident, particularly in currency movements. The U.S. Dollar remains strong, with the EUR/USD pair holding near three-month lows, while the GBP/USD stabilizes ahead of the Bank of England’s policy announcement. Gold prices are range-bound, oscillating between $3,900 and $4,050, reflecting a cautious market sentiment as traders assess the evolving macroeconomic backdrop.

Overall, market sentiment is mixed, with European markets displaying resilience in the face of inflation concerns, while U.S. markets remain volatile as investors navigate the implications of monetary policy and sector-specific trends.

🇪🇺 European Markets (Approaching Close)

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5679.25 | +0.30% |

| DAX | 24132.41 | +0.73% |

| FTSE 100 | 9701.37 | -0.16% |

| CAC 40 | 8109.79 | -0.14% |

🇺🇸 US Markets (Currently Active)

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6850.31 | +0.15% |

| Dow Jones | 47342.67 | -0.46% |

| Nasdaq 100 | 25953.31 | +0.37% |

🌏 Asian Markets

| Name | Price | Daily (%) |

|---|---|---|

| Nikkei 225 | 52411.34 | +2.12% |

| Shanghai Composite | 3976.52 | +0.55% |

| Hang Seng | 26158.36 | +0.97% |

💱 FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | -0.28% |

| GBP/USD | 1.31 | -0.13% |

| USD/JPY | 154.20 | +0.17% |

| Gold (XAU/USD) | 4015.00 | +0.82% |

| Crude Oil (WTI) | 61.03 | +0.08% |

| Brent Oil | 64.39 | -1.05% |

| Bitcoin | 107322.15 | -3.00% |

🌍 Geopolitics and Market Drivers

Key geopolitical and macroeconomic factors currently influencing markets include central bank policies, economic data, and currency stability. The Federal Reserve remains focused on inflation, with officials indicating that monetary policy will continue to be restrictive, aiming to bring inflation down to target levels. This has led to mixed signals in U.S. markets, as the Dow Jones struggles with missed AI investment opportunities while the USD fluctuates against major currencies.

In Australia, the Reserve Bank is expected to maintain interest rates, which has implications for the AUD, while the GBP faces uncertainty ahead of the Bank of England’s rate decision. Recent U.S. manufacturing data showed a contraction, with the ISM Manufacturing PMI dropping to 48.7, raising concerns about economic growth.

Geopolitically, the U.S. dollar remains strong, impacting currency pairs like USD/JPY and USD/CHF, while the EUR and GBP experience pressure due to cautious market sentiment. Gold prices remain range-bound, reflecting uncertainty amid Fed caution and currency fluctuations. Overall, markets are navigating a complex landscape of policy decisions and economic indicators.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

No significant economic events scheduled.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.