Asian Markets Steady as S&P/NZX 50 Gains

Note: This analysis covers the Asian trading session close for November 04, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3960.19 | -0.41 |

| Nikkei 225 | 51497.20 | -1.74 |

| Hang Seng Index | 25952.40 | -0.79 |

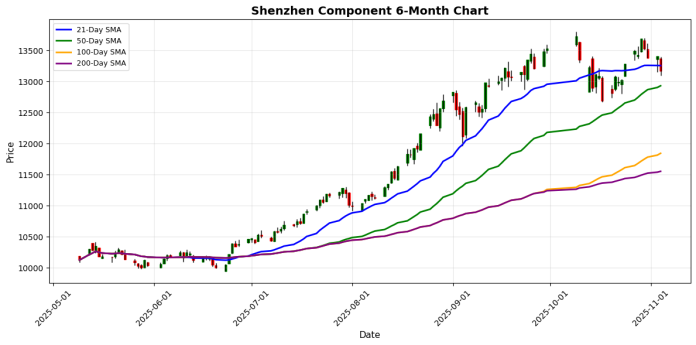

| Shenzhen Component | 13175.22 | -1.71 |

| KOSPI | 4121.74 | -2.37 |

| S&P/ASX 200 | 8813.70 | -0.91 |

| NIFTY 50 | 25597.65 | -0.64 |

| Straits Times Index | 4422.72 | -0.49 |

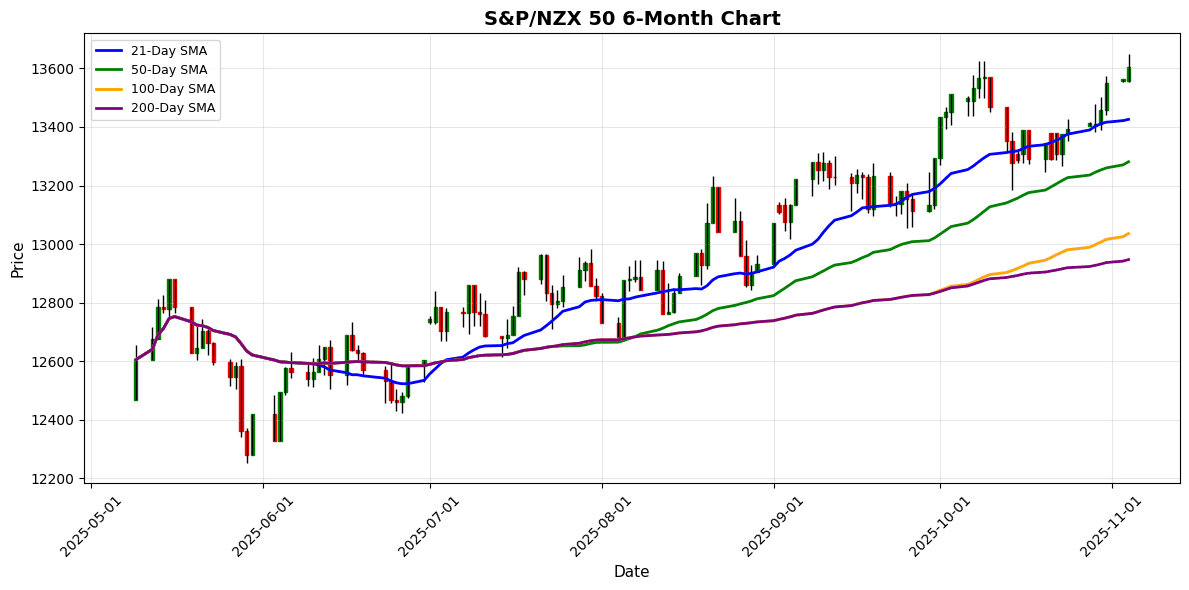

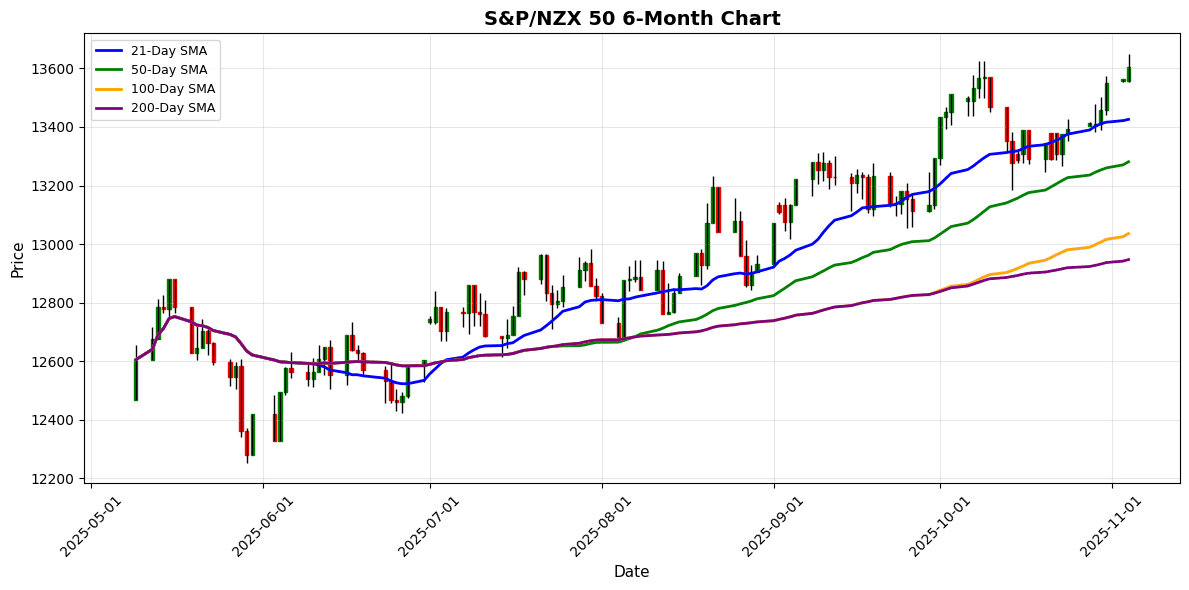

| S&P/NZX 50 | 13605.96 | +0.32 |

| Thailand SET Index | 1298.60 | -0.78 |

| FTSE Bursa Malaysia KLCI | 1623.50 | +0.07 |

| TAIEX | 28116.56 | -0.77 |

📰 Market Commentary

As of November 04, 2025, Asian markets experienced a notable decline, with most indices reflecting negative sentiment amid a backdrop of significant corporate developments and regulatory discussions.

The South Korean KOSPI led the downturn, falling by 2.37%, marking the end of a four-session winning streak. Other major indices, including Japan’s Nikkei 225 and Hong Kong’s Hang Seng Index, also saw declines of 1.74% and 0.79%, respectively. The Shanghai Composite dropped by 0.41%, while the Shenzhen Component fell by 1.71%. Market sentiment was largely influenced by a disconnect from Wall Street, which had enjoyed a tech-driven rally, suggesting a divergence in regional economic factors.

Key corporate news included Nintendo’s upward revision of its fiscal 2025 net profit forecast to 350 billion yen, reflecting strong performance in its gaming segment. This positive outlook, however, was overshadowed by Starbucks’ announcement of a joint venture with Boyu Capital to manage its China operations, following a significant drop in sales in the region. The $4 billion deal represents a strategic pivot for Starbucks, which has been grappling with challenges in the Chinese market.

In broader economic developments, a survey highlighted China’s rising digital competitiveness, positioning it 12th globally among 69 economies. This improvement comes amid concerns about trade fragmentation impacting digital capabilities worldwide. Additionally, Hong Kong’s Cathay Pacific announced new daily flights to Changsha, indicating a recovery in travel demand, which could support economic activity in the region.

On the regulatory front, UBS Chairman Colm Kelleher raised alarms about the current state of financial regulations, suggesting that overregulation in some areas has led to a loss of control, particularly concerning shadow banking. This commentary reflects broader concerns within the financial sector about regulatory balance and its implications for market stability.

Overall, the Asian markets on November 04, 2025, were characterized by a combination of corporate restructuring efforts, regulatory scrutiny, and shifting economic dynamics, leading to a cautious market environment as investors reassess their positions amid these developments.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-03 | 18:50 | 🇯🇵 | Medium | Monetary Policy Meeting Minutes | ||

| 2025-11-03 | 20:45 | 🇨🇳 | Medium | Caixin Services PMI (Oct) | 52.5 | |

| 2025-11-03 | 22:35 | 🇯🇵 | Medium | 10-Year JGB Auction |

On November 04, 2025, traders should note significant economic developments from Asia that may impact market sentiment and indices.

First, the Monetary Policy Meeting Minutes released for Japan at 18:50 ET did not provide actual figures against a forecast, leaving traders to interpret the implications for future monetary policy direction. The lack of concrete data may lead to cautious trading in Japanese equities as investors await clearer signals from the Bank of Japan.

Next, the Caixin Services PMI for China, released at 20:45 ET, came in at 52.5, matching forecasts. This indicates stable expansion in the services sector, which could bolster confidence in the Chinese economy. A stable services PMI may support Chinese indices, as it reflects resilience in domestic demand.

Lastly, the 10-Year JGB Auction results released at 22:35 ET did not provide actual figures against a forecast, leaving uncertainty regarding investor appetite for Japanese government bonds. This could lead to volatility in the JGB market, potentially affecting broader market sentiment in Japan.

Overall, while the PMI data supports a positive outlook for China, the lack of concrete figures from Japan’s monetary policy and bond auction may lead to cautious trading in Asian indices.

📈 Individual Index Charts

S&P/NZX 50

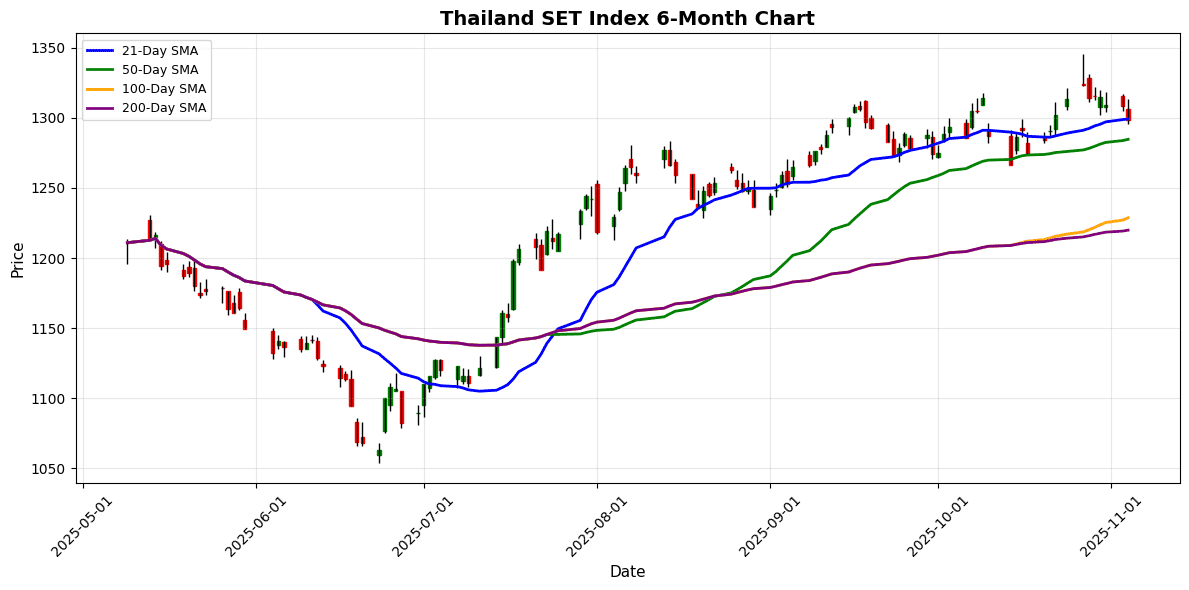

Thailand SET Index

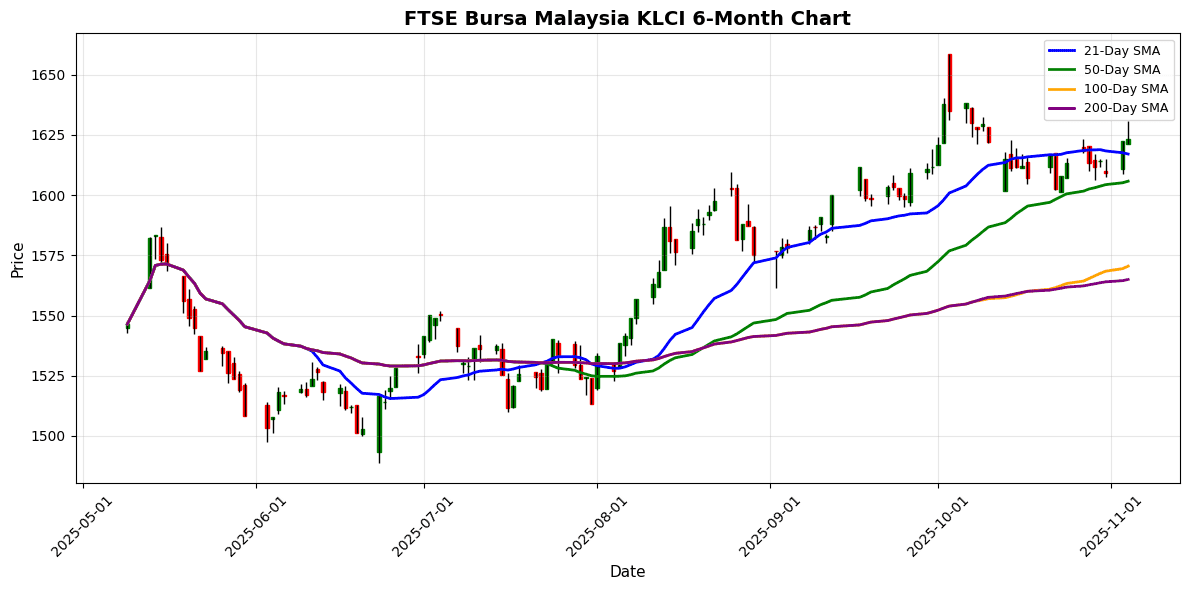

FTSE Bursa Malaysia KLCI

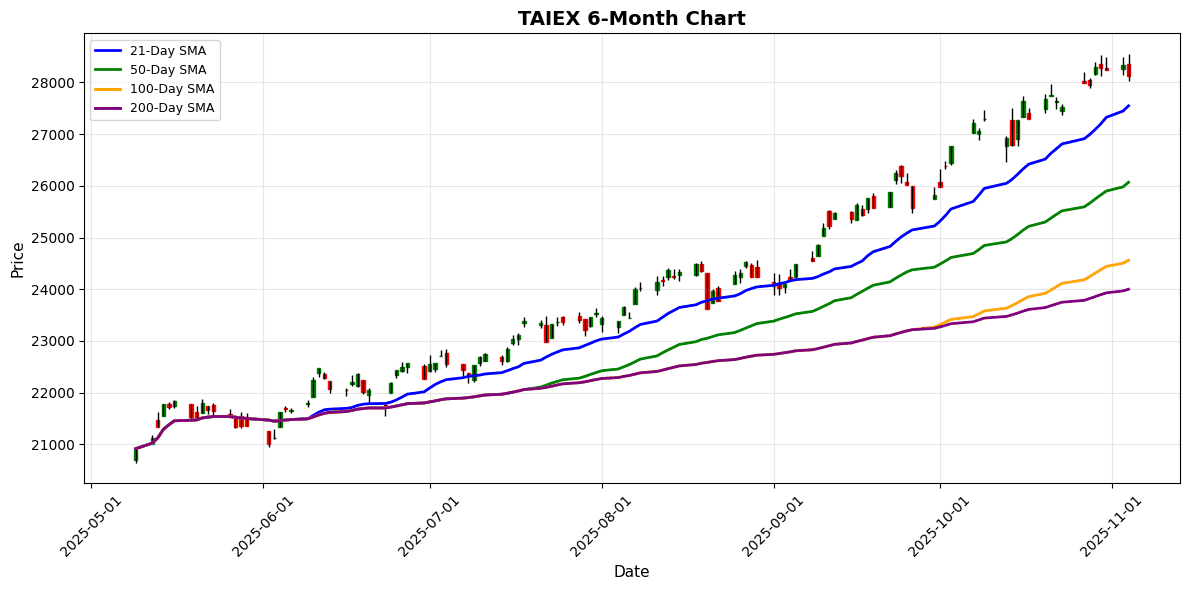

TAIEX

💱 FX, Commodities & Crypto

In recent trading sessions, the foreign exchange market saw notable movements, with the USD/JPY declining by 0.47% amid concerns over Japan’s economic outlook. The USD/CNY rose slightly by 0.06%, reflecting ongoing trade tensions and China’s economic recovery efforts. The AUD/USD and NZD/USD both fell, down 0.55% and 0.75%, respectively, driven by weaker commodity prices and risk-off sentiment.

In commodities, gold prices decreased by 0.23% as investors sought higher yields elsewhere, while crude oil experienced a significant drop of 1.56%, influenced by concerns over global demand amid economic slowdowns.

In the cryptocurrency market, Bitcoin and Ethereum fell by 2.27% and 2.56%, respectively, as regulatory uncertainty and market volatility continued to weigh on investor sentiment. Overall, market dynamics were shaped by economic indicators and geopolitical tensions, impacting risk appetite across asset classes.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 153.47 | -0.47 |

| USD/CNY | 7.12 | +0.06 |

| USD/SGD | 1.31 | +0.10 |

| AUD/USD | 0.65 | -0.55 |

| NZD/USD | 0.57 | -0.75 |

| USD/INR | 88.66 | -0.01 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 4004.90 | -0.23 |

| Crude Oil | 60.08 | -1.56 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 104135.50 | -2.27 |

| Ethereum | 3510.23 | -2.56 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.