Airbnb Inc. (ABNB) Post Earning Analysis

Airbnb, Inc. operates a global online marketplace that connects hosts with guests to book unique accommodations and experiences. Founded in 2007 by Brian Chesky, Nathan Blecharczyk, and Joseph Gebbia, Airbnb has revolutionized the way people travel, offering a platform for users to list and book spaces directly through their website or mobile app. The company is headquartered in San Francisco, CA.

Airbnb Inc. (ABNB) has recently reported its Q3 2025 earnings, revealing a mixed set of results that nonetheless indicate strong demand and strategic growth. Despite missing earnings estimates, Airbnb’s revenue exceeded expectations due to robust bookings growth, driven by travelers booking vacations further in advance. The company’s stock experienced a positive reaction, popping after the earnings announcement, which highlighted a record revenue quarter and strategic expansions including product expansion, AI integration, and enhanced payment flexibility.

The overall sentiment around Airbnb remains optimistic as the travel industry shows signs of recovery. Analysts and investors are particularly encouraged by Airbnb’s ability to adapt to changing market dynamics and leverage technology to enhance user experience and operational efficiency. This adaptability is likely to support Airbnb’s stock in the near term, especially as global travel continues to rebound.

The broader market context includes a surge in travel-related stocks, with competitors like Expedia also reporting positive earnings, further underscoring the sector’s recovery. However, Airbnb’s missed earnings highlight ongoing challenges, including potentially higher operational costs and competitive pressures, which could impact future profitability and stock performance.

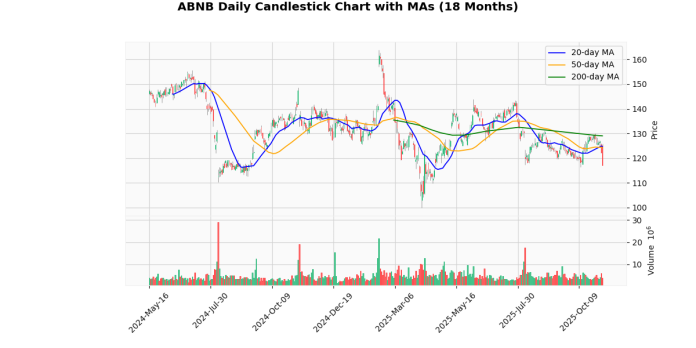

The current price of the asset at $117.19, which is down by 0.99% today, is situated near its week low of $117.19 and significantly below the week high of $127.32. This indicates a bearish trend in the short term. The asset has depreciated considerably from both its 52-week and year-to-date highs of $163.93, showing a sharp decline of -28.51% from these peaks. This substantial drop suggests a negative sentiment prevailing over the longer period.

The asset’s price is currently below all key moving averages (20-day, 50-day, 200-day), with respective declines of -6.04%, -5.61%, and -9.17%. This alignment below the moving averages further confirms a bearish trend across multiple time frames.

The Relative Strength Index (RSI) at 31.93 is nearing the oversold territory, which might indicate a potential for a price stabilization or reversal if other factors align. However, the Moving Average Convergence Divergence (MACD) at -0.08, being negative, supports the ongoing bearish momentum. Overall, the technical indicators suggest that the asset is currently facing significant downward pressure with potential for further declines unless there is a shift in market sentiment or external factors.

Airbnb’s Q3 2025 financial results, released on November 6, 2025, demonstrated robust growth and operational efficiency. The company reported a revenue increase of 10% year-over-year to $4.1 billion, maintaining this growth rate even after adjusting for foreign exchange influences. Net income stood strong at $1.4 billion, sustaining a net income margin of 34%. Adjusted EBITDA was particularly impressive, reaching $2.1 billion with a 50% margin, marking a 5% improvement from the previous year.

Free Cash Flow (FCF) grew by 33% year-over-year to $1.3 billion, resulting in a FCF margin of 33%. The Trailing Twelve Month (TTM) FCF was reported at $4.5 billion with a 38% margin. Gross Booking Value (GBV) rose to $22.9 billion, a 14% increase, while Nights and Seats Booked expanded by 9% to 133.6 million.

Strategic initiatives such as the “Reserve Now, Pay Later” feature and updated cancellation policies contributed to these positive trends. The company also focused on enhancing user experience with improved AI features and quality control measures, including the removal of over 550,000 listings.

For Q4 2025, Airbnb anticipates revenue between $2.66 billion and $2.72 billion, projecting a 7% to 10% year-over-year growth. The company expects continued growth in GBV and a mid-single-digit increase in Nights and Seats Booked. The full-year Adjusted EBITDA margin is projected to be around 35%. Additionally, Airbnb repurchased $857 million of its Class A common stock, emphasizing its commitment to shareholder value.

Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-11-06 | 2.31 | 2.21 | -4.33 |

| 1 | 2025-05-01 | 0.24 | 0.24 | 1.88 |

| 2 | 2025-02-13 | 0.58 | 0.73 | 26.77 |

| 3 | 2024-11-07 | 2.14 | 2.13 | -0.50 |

| 4 | 2024-08-06 | 0.92 | 0.86 | -6.16 |

| 5 | 2024-05-08 | 0.24 | 0.41 | 68.65 |

| 6 | 2024-02-13 | 0.62 | 0.76 | 22.32 |

| 7 | 2023-11-01 | 2.10 | 2.43 | 15.74 |

Analyzing the EPS trends over the last eight quarters reveals notable patterns and deviations. A cyclical trend is apparent, with significant EPS peaks typically occurring in the November quarters of each year (Q4). For instance, in November 2023, the reported EPS significantly exceeded estimates by 15.74%, and a similar, albeit less pronounced, trend is observed in November 2024 with a slight underperformance of -0.50%. However, November 2025 shows a decline with reported EPS underperforming estimates by -4.33%.

The first quarters of each year (Q1) also show a pattern of outperformance, with February 2024 and 2025 reporting EPS that exceeded estimates by 22.32% and 26.77%, respectively. This suggests a trend of earnings strength in the early part of the year.

Conversely, the mid-year and third-quarter results (Q2 and Q3) are more mixed, with May 2025 showing exact alignment with estimates, whereas May 2024 and August 2024 experienced significant positive and negative surprises, respectively.

Overall, the data indicates stronger performance in the first and last quarters of each fiscal year, with more variability and less predictability in the middle quarters. This pattern might suggest seasonal impacts on the company’s financial performance or could reflect differing analyst expectations throughout the fiscal year.

The most recent rating changes for Outer by various financial analysis firms demonstrate a mix of optimism and caution in their outlook towards the company’s stock.

- KeyBanc Capital Markets (2025-10-23): The firm resumed coverage on Outer, assigning a “Sector Weight” rating. This indicates a neutral stance, suggesting that KeyBanc views Outer’s performance as likely to be in line with the average returns of the sector. No specific target price was given, which typically implies an expectation of market performance without significant over or underperformance.

- Mizuho (2025-09-30): Initiated coverage with an “Outperform” rating and set a target price of $151. This represents a bullish outlook, indicating that Mizuho analysts believe Outer will outperform the average returns of its sector peers. The target price suggests a positive view on the company’s growth prospects or operational efficiency improvements.

- Truist (2025-05-30): Downgraded Outer from “Hold” to “Sell” and set a target price at $106. This significant shift to a more bearish stance reflects concerns about potential challenges or deteriorating fundamentals that could impact the company negatively. The target price of $106 suggests a cautious view on the company’s financial health or market position.

- Wedbush (2025-05-02): Downgraded their rating from “Outperform” to “Neutral” with a revised target price of $135. This change indicates a tempering of enthusiasm about the company’s future performance. The adjustment from a more aggressive growth expectation to a neutral stance could be due to revised earnings expectations, market conditions, or competitive dynamics that are less favorable than previously anticipated.

Overall, these rating changes reflect a diverse range of perspectives from the financial analysts, indicating varying degrees of confidence in Outer’s market position and future performance.

As of the latest available data, the current price of the stock is $117.19. This price is situated between the diverse target prices set by various analysts. Mizuho, with an “Outperform” rating, has the highest target price at $151, suggesting a potential upside of approximately 28.9%. Conversely, Truist has the lowest target at $106, indicating a potential downside of about 9.5%, having downgraded the stock from “Hold” to “Sell.” Wedbush offers a more neutral perspective with a target price of $135 after downgrading from “Outperform” to “Neutral,” reflecting a potential increase of 15.2%.

The range of target prices and ratings indicates varying degrees of confidence and expectations from analysts regarding the stock’s future performance. The average target price, considering the data from Mizuho and Wedbush (excluding KeyBanc Capital Markets due to the absence of a specific target price), is approximately $143, suggesting an average potential upside of about 22.1% from the current price. This variance in analyst expectations underscores the importance of monitoring ongoing financial performance and market conditions affecting the stock.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.