The first week of September 2024 is packed with significant economic data releases and events that will likely have substantial impacts on global financial markets. From PMI data in China to the all-important Nonfarm Payrolls in the United States, investors and analysts are keenly observing these indicators to gauge economic health and anticipate central bank actions. Let’s delve into the most critical events on the economic calendar for this week, providing insights into what these numbers mean for the global economy.

Monday, September 2: China’s Manufacturing PMI

The week kicks off with China’s Caixin Manufacturing PMI for August, released at 01:45 GMT. The PMI came in at 50.4, slightly above the consensus of 50 and higher than the previous month’s 49.8. The PMI (Purchasing Managers’ Index) is a critical indicator of economic health in the manufacturing sector, with a reading above 50 indicating expansion and below 50 indicating contraction. The fact that the PMI crossed the 50 threshold suggests a marginal improvement in China’s manufacturing activity, potentially signaling a stabilization in one of the world’s largest economies. This could provide a slight boost to global markets, particularly those heavily reliant on Chinese demand.

Tuesday, September 3: Swiss GDP and ISM Manufacturing PMI

On Tuesday, at 06:30 GMT, Switzerland will release its Consumer Price Index (CPI) for August, followed by the second-quarter GDP at 07:00 GMT. The Swiss CPI is a crucial measure of inflation, and while the exact figure isn’t provided, the consensus appears to be stable around 1.2% year-over-year, compared to 1.3% previously. Inflation trends in Switzerland are essential, not only for the Swiss economy but also for its influence on the Swiss Franc, a key currency in global financial markets.

At 14:00 GMT, the United States will release its ISM Manufacturing PMI for August. The consensus is set at 47.5, down from 46.8 in July. A PMI below 50 indicates a contraction in the manufacturing sector, and a further decline could raise concerns about the strength of the U.S. economy. Given that manufacturing is a leading indicator of economic activity, this report will be closely monitored for signs of whether the U.S. is edging closer to a potential recession.

Wednesday, September 4: Canadian GDP and BoC Interest Rate Decision

Wednesday’s focus shifts to Canada, with the release of its second-quarter GDP at 01:30 GMT, followed by the Caixin Services PMI for China at 01:45 GMT, and then the Bank of Canada’s (BoC) monetary policy decision at 13:45 GMT. The Canadian GDP is expected to show a quarter-on-quarter growth of 0.3%, slightly higher than the previous quarter’s 0.1%. This moderate growth could indicate a resilient Canadian economy amidst global uncertainties.

The BoC’s interest rate decision is another highlight. With inflationary pressures and economic growth in balance, the BoC’s stance will provide insights into how it plans to navigate the current economic landscape. The consensus is for a 25bp rates cut.

Thursday, September 5: Australian Trade Data and Retail Sales

Thursday begins with Australia’s trade balance for July at 01:30 GMT. The previous month’s trade balance was 5,589 million AUD, and the current consensus is for a slight decline to 5,150 million AUD. Trade balances are a key indicator of economic health, especially for an export-driven economy like Australia. A narrowing trade surplus could suggest weaker global demand or declining commodity prices, which are critical for Australia’s economic performance.

Following this, the Reserve Bank of Australia (RBA) Governor Bullock will deliver speeches at 02:00 GMT and 08:00 GMT. These speeches will be closely watched for any hints regarding future monetary policy actions, especially after the recent data on inflation and economic activity.

At 09:00 GMT, Eurozone Retail Sales for July will be released, with the consensus expecting a year-over-year change of -0.3%. Retail sales are a direct indicator of consumer spending, a primary driver of economic activity. Weak retail sales could heighten concerns about economic slowdown in the Eurozone, potentially influencing the European Central Bank’s (ECB) policy decisions.

At 12:15 GMT, the U.S. will release the ADP Employment Change for August, with the consensus forecast at 145,000 new jobs, down from 122,000 in July. The ADP report is seen as a precursor to Friday’s Nonfarm Payrolls and is often used to adjust expectations ahead of the official employment data. A strong ADP number could boost confidence in the U.S. labor market, while a weaker-than-expected figure might raise concerns about the health of the economy.

Finally, at 14:00 GMT, the U.S. ISM Services PMI for August will be published. The services sector accounts for a significant portion of U.S. economic activity, and a PMI reading of 51.1 is expected, slightly down from 51.4 in July. A decline in the services PMI could add to concerns about the overall strength of the U.S. economy.

Friday, September 6: The Big Day for the U.S. Economy

Friday is the most critical day of the week, with several significant data releases that will shape market sentiment. The Eurozone will start the day at 09:00 GMT with the release of its second-quarter GDP, both quarter-on-quarter and year-on-year. The expectations are for a stable growth of 0.3% QoQ and 0.6% YoY. This data will provide insights into the resilience of the Eurozone economy amid rising interest rates and geopolitical tensions.

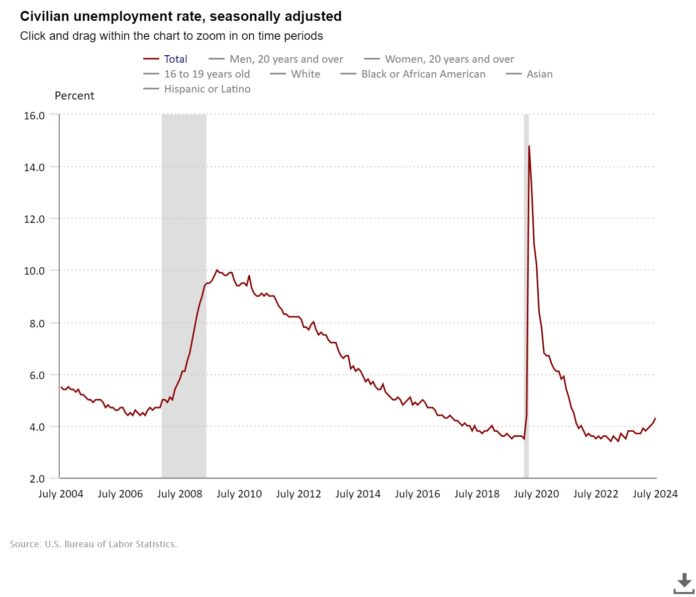

However, the main event is the U.S. Nonfarm Payrolls (NFP) report at 12:30 GMT. The consensus is for 165,000 new jobs in August, up from 114,000 in July. Additionally, the unemployment rate is expected to remain steady at 3.6%, while average hourly earnings are forecast to rise by 0.3% month-over-month, maintaining a year-over-year growth of 3.7%.

The NFP report is the most closely watched economic indicator globally, as it provides a comprehensive snapshot of the U.S. labor market. A strong report could reinforce expectations for further interest rate hikes by the Federal Reserve, while a weaker-than-expected report might prompt the Fed to adopt a more cautious approach. The report’s impact on financial markets, including equities, bonds, and the U.S. dollar, is likely to be significant.