GBP/USD is retracing by 0.43% to 1.2702, down for the third consecutive session while Inflation was 0.3% above forecasts. UK taxpayers concerned about cost of living and mortgage rates while the BoE is continuing with QE tightening and fighting a mix of both domestic and external shocks to price pressures.

The UK imports more than 50% of its food, mostly from the EU, and production costs increased in the old continent following Russian invasion of Ukraine, plus Brexit did not help. Wages pressure was due to a decrease in the participation rate, thus the labour force pool has decreased and this is not good for a neo classical theory of economic grow. Higher interest rates, despite remaining negative in real terms, are likely to push UK into recession.

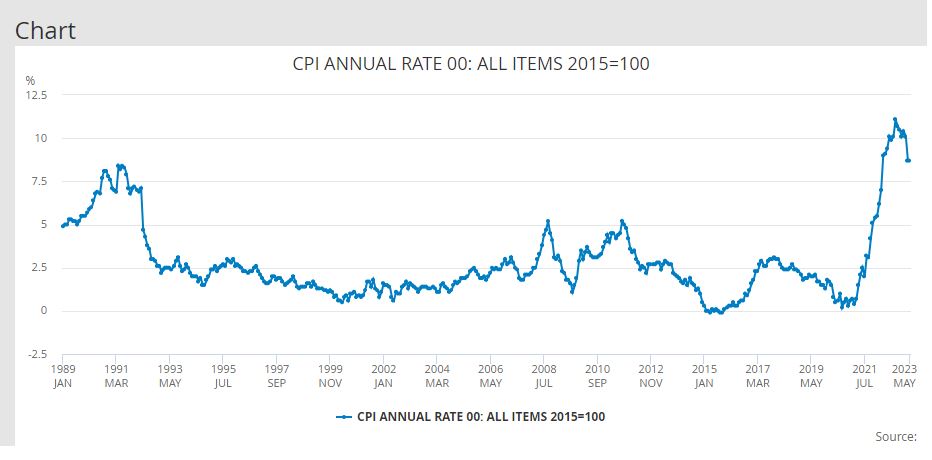

True that inflation is off its multiyear high reached on October 2022 at 11.1% but pressure on both the government and the Bank of England remain.

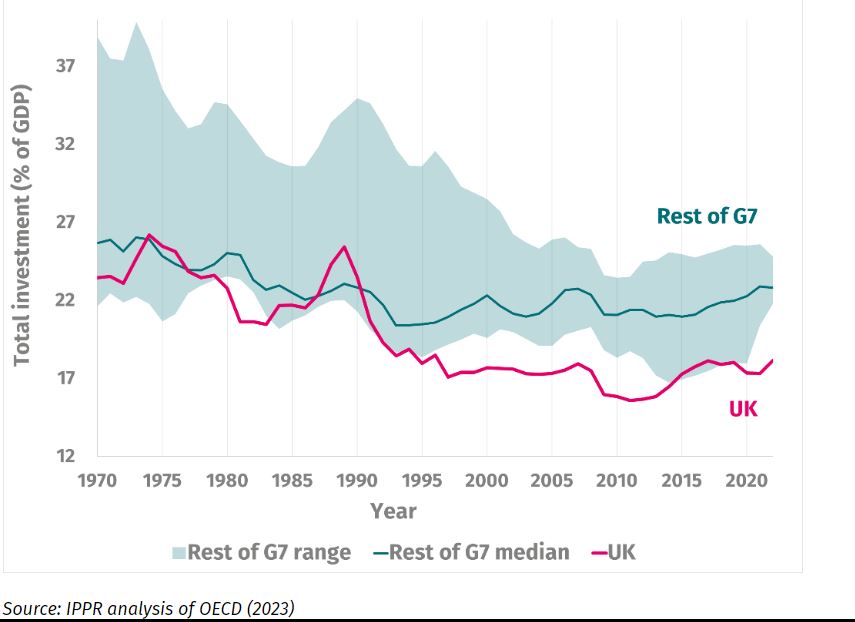

With public investment well below the G7 average the UK has suffered decades of under investment and yesterday report released by the IPPR, Institute for Public Policy Research lacked optimism on consumer spending, investments and business confidence.

Tomorrow the BoE is expected to hike rates by 25bps to 4.75%, and recent difficulties for the central bank with his inflationary projections could lead to more volatility for the Pound.

GBP/USD remain in a bullish channel started from its March 2023 low and below the static support 1.267 the pair should accelerate to test the lower side of the channel. A bearish framework would materialize below the lower side of this dynamic support. Short term buyers in control again in case GBP/USD would bounce on 1.2680 and win the 2023 high at 1.2847.