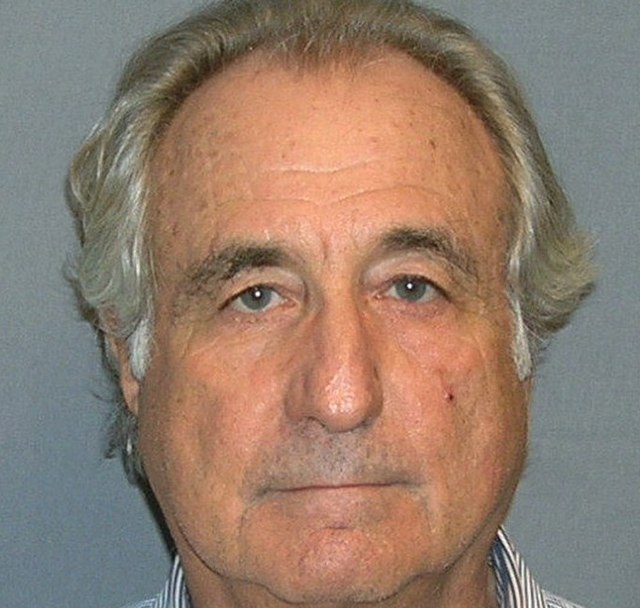

Photo from the U.S. Department of Justice, Bernard Madoff’s sign.

We have outlined in six points a method every potential investor and trader should review before opening accounts and depositing money.

- Check Licenses and Regulation

To protect yourself from financial fraud, ensure the platform is regulated by a recognized authority such the SEC , CFTC (USA). Regulatory bodies ensure platforms comply with financial laws and operate transparently. Unregistered platforms, like Binary Options, often operate illegally and are used to scam inexperienced investors. Use websites like the Consob list for investment firms or NFA BASIC (USA) to check a company’s registration status.

Example: Binary Options

Many investors have been defrauded by unregulated binary options platforms, which promised quick profits but often hid high risks and dishonest practices. Many countries have banned or heavily regulated these platforms due to numerous scams.

- Beware of Unrealistic Returns

Promises of guaranteed or excessively high returns are red flags for financial scams. No legitimate investment can promise consistent returns without risk. Fraudulent platforms use this tactic to lure investors. BitConnect, a cryptocurrency platform, promised its users daily returns of 1%, guaranteeing unrealistic profits that proved unsustainable.

Example: BitConnect

Launched in 2016, BitConnect attracted thousands of investors with the promise of astronomical returns. In 2018, it was declared a Ponzi scheme, with a collapse that caused millions of dollars in losses for investors.

- Trustworthy Cryptocurrency Exchanges

In the world of cryptocurrencies, using reliable exchanges is crucial to protecting your investments. Exchanges like Coinbase (listed on Wall Street and subject to quarterly reports), Gemini, and Crypto.com are regulated and have a long history of secure operations. However, cases like FTX have shown that even seemingly solid platforms can fail due to poor business practices. FTX collapsed in 2022, freezing billions of customer funds due to mismanagement.

Example: FTX

In 2022, FTX, one of the world’s largest exchanges, declared bankruptcy after it was revealed that it was misusing customer funds. This caused billions of dollars to be frozen and shook the entire cryptocurrency industry.

- Avoid Ponzi Schemes

Ponzi schemes are scams where investors’ profits are paid using new investors’ money, rather than generating real profits. These schemes collapse when there are no more new investments, leading to the system’s failure and the loss of funds for most investors.

Example: OneCoin

One of the most famous cases is OneCoin, which raised billions of dollars between 2014 and 2017 by promising high returns through a nonexistent cryptocurrency. In the end, it was revealed to be a global scam, affecting thousands of investors.

- Online Reviews and Verifications

Before trusting a platform or investment opportunity, seek impartial and thorough reviews on trusted sites. Scams often use fake reviews or aggressive advertising to appear more legitimate. Independent research can reveal if a platform has suspicious history or complaints from other users. Even in the case of companies audited by independent firms, risks remain, but regulated markets should generally be considered trustworthy.

Example: Wirecard

The case of Wirecard, a German financial services company, is emblematic. Until 2020, it seemed like a fintech giant, but an audit revealed that 1.9 billion euros were missing from its accounts, leading to the company’s collapse.

- Two-Factor Authentication (2FA)

Two-factor authentication (2FA) is a crucial security tool that adds an extra layer of protection to your trading or cryptocurrency accounts. With 2FA, in addition to a password, a temporary code sent to your phone or email is required, making it harder for fraudsters to access your accounts even if they know your password.

Example: Phishing Attacks

Many accounts on trading platforms have been hacked through phishing attacks, where users are tricked into providing their credentials. With 2FA active, even if the fraudster obtains the password, they cannot access the account without the temporary code, thus protecting your funds.

In conclusion, to avoid financial scams, it is essential to conduct thorough research and take preventive measures. Always verify that platforms are regulated and beware of promises of guaranteed and unrealistic returns. Only use reliable cryptocurrency exchanges and avoid Ponzi schemes like OneCoin. Look for impartial reviews on trusted platforms and protect your accounts with security tools like two-factor authentication. Awareness and caution are the keys to safeguarding your investments.