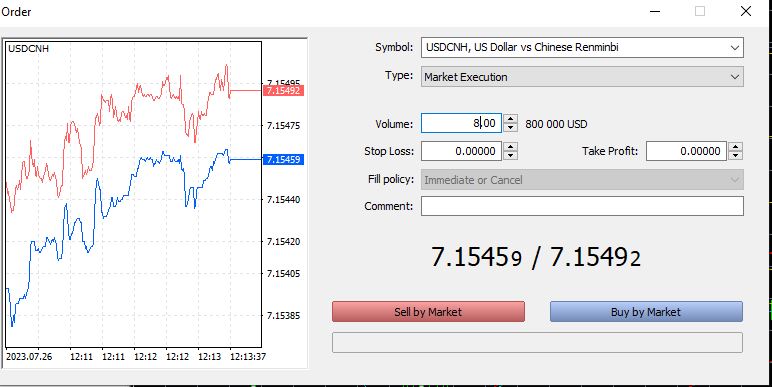

USD/CNH made a lower high from its 2023 top, while yesterday it tested its July low at 7.1265, developing a short term double bottom just above the 55 day EMA. The rate is trading now at 7.1541, down 0.12%

The 21 day SMA has already a negative slope, while the 55 day EMA and the 200 day SMA are almost flat. Besides risk appetite, the main catalyst for the next bearish or bullish leg would be the weights given to Federal Reserve monetary Policy on one side and People Bank of China on the other side to support their economies. If hiking cycle has almost reached its zenith for the FED and Chinese Authorities would implement more measures to support the second largest world economy, the net effect could be a stronger Yuan since FX rates are mainly driven by speculation in the short and medium term. A Yuan stronger would be reasonable in the long term if measures would produce the desired effect, boosting confidence on the ability to navigate both fiscal and monetary policy in challenging times.

From a technical perspective, USD/CNH has to make lower lows to confirm the developing of a correction, thus needs to trade below 7.1

Then possible test in area 7.06 , the 38.2% Fibonacci level and then 7. The most meaningful correction would be at 6.91, which is the 61.8% Fibonacci of the 2023 uptrend.

If the pair would resume its bullish trend, a breakout of the fresh generated supply line would be necessary and then the resistance in area 7.29 would have more chances to be won, providing space for a new 2023 high.