Workday, Inc., founded in 2005 by David A. Duffield and Aneel Bhusri, specializes in developing enterprise cloud applications for finance and human resources. The company offers robust solutions including financial management, human capital management, and analytics applications tailored for businesses, educational institutions, and government agencies. Headquartered in Pleasanton, CA, Workday is a pivotal player in the cloud-based software industry.

Recent developments around Workday (WDAY) suggest a mixed impact on its stock. Despite beating Q2 earnings estimates with solid revenue growth, Workday’s stock experienced a decline due to disappointing future revenue guidance, as highlighted by multiple sources including Investor’s Business Daily and Reuters. This resulted in a significant 4% drop in its stock price, although TD Cowen reiterated a “Buy” rating, indicating potential underlying strength or future recovery.

Moreover, the broader market sentiment, influenced by expectations of a September rate cut as indicated by Federal Reserve Chair Powell’s comments, could potentially bolster market stocks, including Workday. However, the company’s specific outlook miss and the subsequent stock reaction might overshadow broader market movements in the short term.

Additionally, Workday’s strategic moves, such as the acquisition of AI company Paradox, could either mitigate the negative impact of the disappointing revenue guidance by opening new business avenues or place further pressure on the stock if investors are skeptical about the integration and long-term benefits of this acquisition. Overall, the recent news presents a complex picture for Workday, suggesting potential volatility and investor caution.

The current price of the asset is $224.61, which reflects a 1.42% increase today. Despite today’s positive movement, the price shows a notable decline when compared to longer-term benchmarks. It is currently trading 23.6% below the 52-week high of $294 and 20.82% below the year-to-date high of $283.68. However, it has gained 9.39% from both the 52-week and year-to-date lows of $205.33, indicating some recovery.

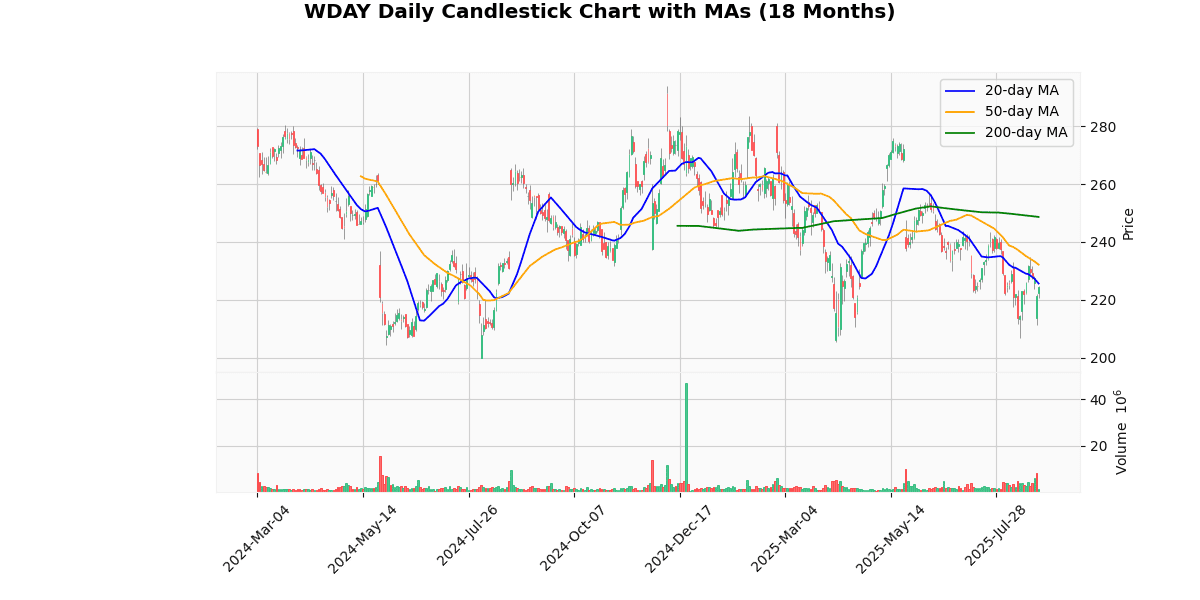

The asset is trading below all key moving averages: 0.46% below the 20-day MA, 3.26% below the 50-day MA, and significantly, 9.67% below the 200-day MA, suggesting a bearish trend over the medium to long term.

The Relative Strength Index (RSI) at 46.45 and the negative MACD value of -2.28 both reinforce a bearish sentiment, with the RSI indicating that the asset is neither oversold nor overbought, and the MACD suggesting ongoing downward momentum. The minimal difference between the current price and the week’s high (-0.12%) alongside a 1.82% increase from the week’s low also highlights short-term volatility within a generally negative trend.

## Price Chart

This section provides an overview of available data.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-08-21 | 2.11 | 2.21 | 4.74 |

| 1 | 2025-05-22 | 2.01 | 2.23 | 11.17 |

| 2 | 2025-02-25 | 1.78 | 1.92 | 8.02 |

| 3 | 2024-11-26 | 1.76 | 1.89 | 7.53 |

| 4 | 2024-08-22 | 1.65 | 1.75 | 6.19 |

| 5 | 2024-05-23 | 1.58 | 1.74 | 9.99 |

| 6 | 2024-02-26 | 1.47 | 1.57 | 6.83 |

| 7 | 2023-11-28 | 1.41 | 1.53 | 8.41 |

The earnings per share (EPS) data over the last eight quarters demonstrates a consistent trend of surpassing estimates, which suggests robust financial performance and effective management forecasting. Starting from November 2023, there has been a gradual increase in both estimated and reported EPS, indicating steady growth. The estimates rose from 1.41 in Q4 2023 to 2.11 in Q3 2025, while the actual reported EPS increased from 1.53 to 2.21 over the same period.

Notably, the surprise percentage, which measures the extent to which reported EPS exceeds estimates, has remained positive throughout, ranging from 4.74% to 11.17%. This consistent outperformance highlights the company’s ability to exceed analyst expectations and possibly indicates conservative guidance from the company.

The largest positive surprise occurred in Q2 2025, with a surprise percentage of 11.17%, where the reported EPS of 2.23 significantly exceeded the estimate of 2.01. This peak suggests a particularly strong quarter relative to expectations. Overall, the data points to a pattern of steady financial growth and reliable outperformance relative to analyst forecasts.

## Dividend Payments Table

| Date | Dividend |

|——–|————|

This section provides an overview of available data.

On August 22, 2025, both Oppenheimer and BMO Capital Markets reiterated their ratings on Outer, although each firm adjusted their target prices. Oppenheimer maintained an “Outperform” rating but reduced the target price from $300 to $270, reflecting a downward adjustment of $30. This change suggests that while Oppenheimer remains positive about Outer’s performance prospects, they have moderated their expectations possibly due to external market conditions or company-specific factors that may impact future growth or profitability.

Similarly, on the same day, BMO Capital Markets also reiterated an “Outperform” rating for Outer but decreased their target price from $314 to $285, a reduction of $29. This aligns with the trend observed with Oppenheimer, indicating a possibly shared sentiment among analysts about the company’s outlook albeit maintaining a favorable stance on the stock’s potential.

Earlier in the month, on August 14, 2025, Cantor Fitzgerald initiated coverage on Outer with an “Overweight” rating and a target price of $265. This initiation at a relatively optimistic rating suggests that Cantor Fitzgerald perceives a positive trajectory for Outer, potentially identifying untapped value or growth drivers that could benefit the company in the near future.

On July 10, 2025, Piper Sandler downgraded Outer from “Neutral” to “Underweight” and set a target price of $235. This move indicates a bearish outlook on the company, contrasting sharply with the views from other firms. The downgrade and relatively lower price target might reflect concerns over challenges that could impede Outer’s performance or market position, suggesting a more cautious approach to the stock relative to its peers.

These recent rating changes provide a mixed but predominantly positive outlook for Outer, with most firms showing a degree of confidence albeit with moderated expectations in terms of target prices.

The current price of the stock stands at $224.61. Recent ratings from financial analysts suggest a generally optimistic outlook, with target prices consistently above the current market price, signaling potential growth. Specifically, Oppenheimer has adjusted its target price from $300 to $270, while BMO Capital Markets has revised its target from $314 to $285. Both firms maintain an “Outperform” rating despite the reductions. Cantor Fitzgerald recently initiated coverage with an “Overweight” rating and a target price of $265. On a more cautious note, Piper Sandler downgraded its rating from “Neutral” to “Underweight” and set a target price of $235, which is slightly above the current price but lower than other forecasts.

This blend of viewpoints reflects a predominantly positive sentiment with a cautionary perspective from Piper Sandler. The reiterations and initiation of coverage with strong target prices indicate a belief in the stock’s potential to ascend, although the market should remain aware of the more conservative stance from Piper Sandler.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.