SentinelOne, Inc., founded in 2013 by Tomer Weingarten and Almog Cohen, is a cybersecurity firm based in Mountain View, CA. The company specializes in advanced endpoint security software that effectively detects, models, and predicts threat behaviors to prevent attacks across various computing devices. SentinelOne also offers services such as vigilance, support, and training to enhance security measures.

SentinelOne has recently been a focal point in the financial news, with several developments likely influencing its stock performance. On August 28, 2025, SentinelOne reported a significant beat on Q2 earnings and revenue estimates, leading to a raised annual revenue forecast due to strong cybersecurity demand. This positive financial performance, including surpassing the $1 billion ARR milestone as highlighted in their Q2 2026 earnings call, has sparked speculation of a potential takeover due to its strong outlook and AI differentiation.

Further bolstering investor confidence, Cantor Fitzgerald maintained an overweight rating on SentinelOne with a price target of $24, reflecting a positive outlook on the company’s growth trajectory and market position. These developments have led to a surge in the company’s stock, as evidenced by the stock trading up following these announcements.

Overall, the combination of exceeding earnings expectations, robust revenue forecasts, and strategic positioning in AI security paints a promising picture for SentinelOne’s future stock performance.

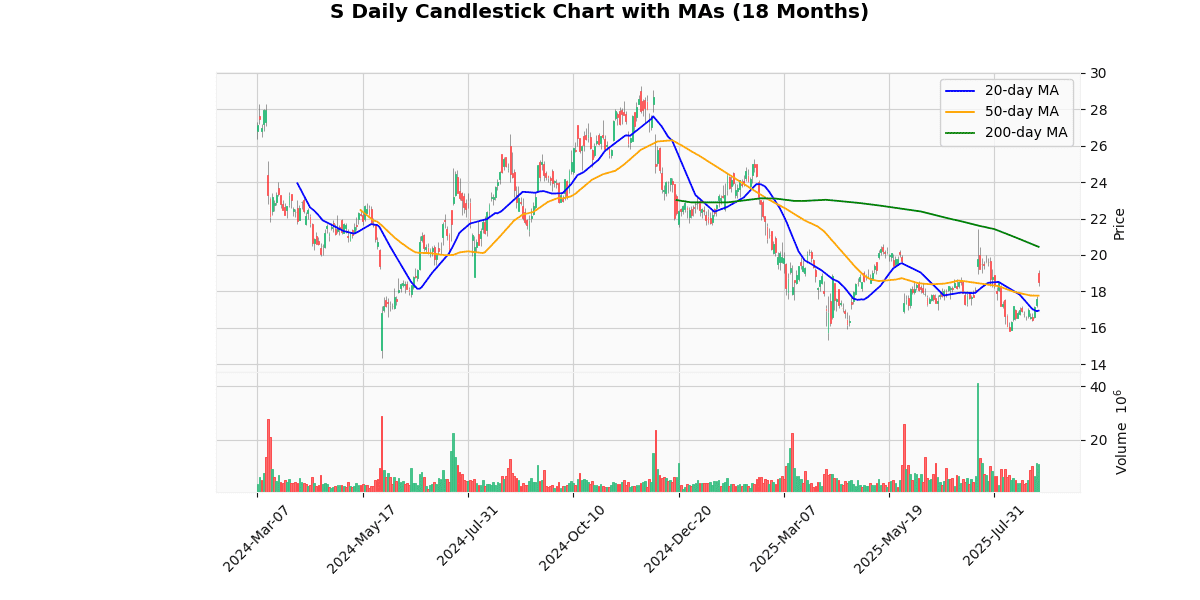

The current price of the asset is $18.51, showing a notable increase of 5.48% today, suggesting a bullish sentiment in the short term. The price has recovered from its 52-week and year-to-date lows ($15.36), indicating a 20.51% increase from these points, which could suggest a reversal or a positive correction in the longer trend.

The asset is trading above both the 20-day and 50-day moving averages by 9.23% and 4.17% respectively, highlighting recent bullish momentum. However, it remains below the 200-day moving average by 9.48%, indicating that the longer-term trend might still be bearish.

The RSI at 60.47 suggests the asset is approaching overbought territory but isn’t there yet, supporting the recent price increases. The MACD being slightly negative at -0.12 indicates that while the trend has improved, it might not be strongly bullish yet.

In summary, the asset has shown recovery from its lows with positive short-term indicators, yet caution is advised due to its performance relative to the 200-day moving average and a slight bearish hint from the MACD.

## Price Chart

SentinelOne, Inc. (NYSE: S) reported a 22% increase in total revenue for Q2 FY2026, reaching $242.2 million, up from $198.9 million in the previous year. The company’s annualized recurring revenue (ARR) also saw a significant rise, growing by 24% to surpass the $1 billion mark. The number of high-value customers, each contributing ARR of $100,000 or more, expanded by 23% to 1,513.

Despite steady GAAP gross margins at 75%, non-GAAP gross margins slightly declined to 79% from 80%. Operating margins showed improvement, with GAAP operating margin rising to (33%) from (40%) and non-GAAP operating margin turning positive at 2%, up from (3%). Net income margins also improved, with GAAP net loss margin reducing to (30%) from (35%) and non-GAAP net income margin increasing to 5% from 2%.

The company reported a net loss of $(72.0 million), maintaining a net loss per share of $(0.22). Operating expenses rose to $262.3 million from $227.6 million year-over-year. The firm ended the quarter with $1.2 billion in cash, cash equivalents, and investments.

Looking ahead, SentinelOne forecasts Q3 FY26 revenue at $256 million and anticipates full FY2026 revenue to be between $998 million and $1.002 billion. Non-GAAP gross margin guidance is expected to remain around 78.5%. The company also repurchased $52.7 million worth of common stock, though no dividends were declared during the period.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-08-28 | 0.03 | 0.04 | 33.33 |

| 1 | 2025-05-28 | 0.02 | 0.02 | 25.47 |

| 2 | 2025-03-12 | 0.01 | 0.04 | 180.31 |

| 3 | 2024-03-13 | -0.04 | -0.02 | 51.05 |

| 4 | 2023-12-05 | -0.08 | -0.03 | 63.28 |

| 5 | 2023-08-31 | -0.14 | -0.08 | 44.15 |

| 6 | 2023-06-01 | -0.17 | -0.15 | 9.86 |

| 7 | 2023-03-14 | -0.16 | -0.13 | 16.43 |

Over the past eight quarters, the company has demonstrated a notable improvement in its earnings per share (EPS), transitioning from negative to positive values. Initially, in Q1 2023, the company reported an EPS of -$0.13 against an estimate of -$0.16, surpassing expectations with a surprise percentage of 16.43%. This trend of outperforming EPS estimates continued, with each subsequent quarter showing either reduced losses or increased gains, alongside consistently positive surprise percentages.

By Q4 2023, the EPS had improved significantly to -$0.03, far better than the estimated -$0.08, and a surprise of 63.28%. This upward trajectory in performance culminated in Q3 2025, where the company not only met its positive EPS estimate of $0.02 but exceeded it in Q1 and Q3 of 2025, with the most substantial beat in Q1 2025 at a 180.31% surprise, reporting $0.04 against an estimate of $0.01.

The consistent outperformance against estimates, particularly the shift from negative to positive EPS, indicates effective management strategies and operational improvements. The company’s ability to surpass expectations might instill increased investor confidence, suggesting a robust outlook if the trend continues.

## Dividend Payments Table

| Date | Dividend |

|---|

This section provides an overview of available data.

On August 25, 2025, BTIG Research revised its stance on Outer from “Buy” to “Neutral,” indicating a shift in their outlook towards a more cautious perspective on the stock. This adjustment signifies a reevaluation of the stock’s potential, although no specific target price was provided alongside the downgrade.

Previously, on July 18, 2025, Rosenblatt initiated coverage on Outer with a “Buy” rating, setting a target price of $24. This initiation suggests a positive view on the stock’s future performance, implying that Rosenblatt sees a significant upside from its current levels.

Earlier in the year, on May 29, 2025, Wells Fargo downgraded Outer from “Overweight” to “Equal Weight” with a target price of $18. This change indicates a neutral stance, suggesting that Wells Fargo perceives the stock as fairly valued at its current price, with limited upside potential.

On the same day, JP Morgan also downgraded Outer from “Overweight” to “Neutral,” adjusting the target price from $22 to $19. This represents a decrease in their valuation assessment and a shift to a neutral outlook, reflecting decreased expectations for the stock’s performance relative to previous estimates.

These rating changes highlight a mix of optimism and caution among analysts, reflecting varying expectations about Outer’s financial health and market position.

The current price of the stock stands at $18.51. Analyzing the ratings from various research agencies shows a mixed sentiment with a downward trend in recent evaluations. BTIG Research recently downgraded the stock from Buy to Neutral, indicating a shift towards a more conservative outlook. Similarly, both Wells Fargo and JP Morgan have downgraded their ratings, moving from Overweight to Equal Weight and Overweight to Neutral, respectively, with JP Morgan also lowering their target price from $22 to $19.

On the other hand, Rosenblatt initiated coverage with a Buy rating, setting a target price at $24, which suggests a potential upside compared to the current market price. However, the consensus among these analysts, considering the most recent downgrades, points towards a cautious stance on the stock’s near-term performance.

The average target price from these analysts comes to approximately $20.33, which still represents a potential increase from the current price but reflects a conservative optimism compared to earlier expectations. The shift in ratings and target prices suggests that investors might expect limited growth or stability in earnings per share (EPS) and dividends, though specific trends in these areas are not detailed in the data provided.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.