C3.ai, Inc., founded in 2009 and headquartered in Redwood City, California, specializes in enterprise artificial intelligence (AI) software aimed at facilitating digital transformation. The company offers the C3 AI Suite, a platform for developing, deploying, and managing large-scale AI, predictive analytics, and Internet of Things applications. C3.ai serves a global market, including North America, Europe, the Middle East, Africa, and the Asia Pacific.

Failed to generate section: Too short (127 words). Partial content: C3.ai’s stock experienced a significant drop of 14…

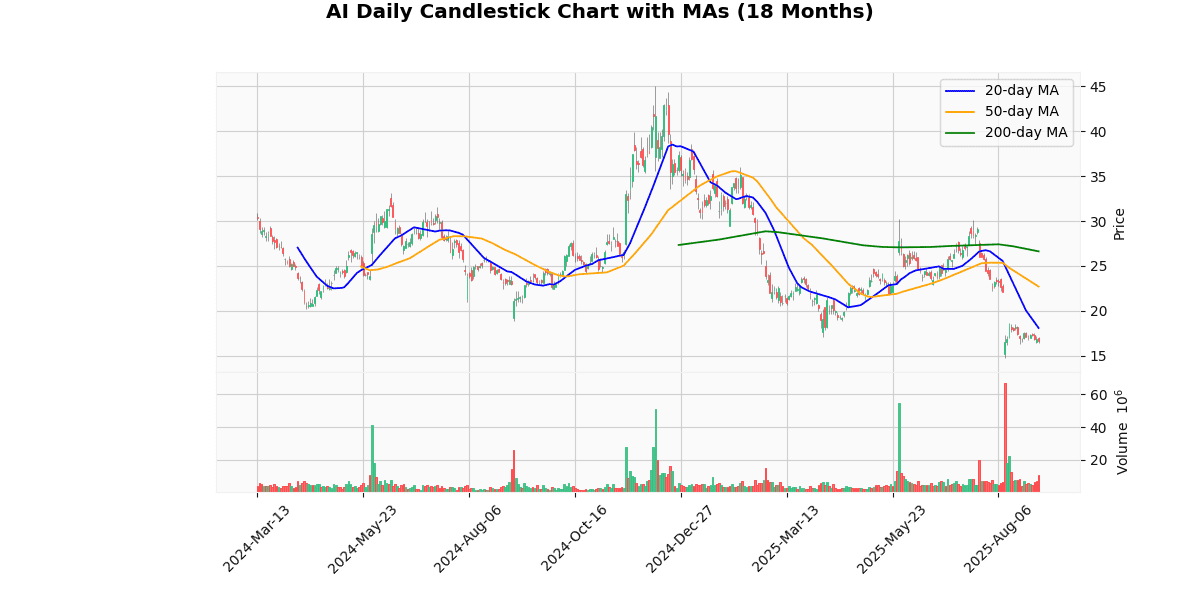

The price metrics indicate a significant bearish trend for the asset, with the current price of $16.68 reflecting a 0.83% decline today. The asset is trading well below its 20-day, 50-day, and 200-day moving averages, with respective percentage differences of -7.78%, -26.51%, and -37.34%. This suggests a strong downward momentum over both short and long-term periods.

The asset’s price is considerably lower than its 52-week high of $45.08 and year-to-date high of $38.58, showing declines of 63% and 56.77% respectively, which highlights a steep depreciation over the past year. However, it is slightly above the 52-week and year-to-date low of $14.7, with a 13.47% increase from these lows.

The technical indicators reinforce the bearish outlook: the RSI at 31.15 suggests the asset is approaching oversold territory, which might indicate a potential for stabilization or minor rebound. However, the MACD at -1.75 signals ongoing bearish momentum. The proximity to the week’s low price ($16.4) compared to the high ($17.14) further underscores limited upward movement in the short term. Overall, the asset is currently experiencing significant bearish pressure with potential for slight fluctuations near the oversold conditions.

## Price Chart

C3.ai, Inc. reported its fiscal Q1 2026 results with total revenue at $70.3 million, marking a 19% decrease from the previous year’s $87.2 million. The decline was reflected across key revenue streams, with subscription revenue down 18% to $60.3 million, making up 86% of the total revenue. The combined revenue from subscriptions and prioritized engineering services totaled $69.0 million, accounting for 98% of overall revenue. GAAP gross profit stood at $26.4 million with a 38% margin, significantly lower than the 60% margin seen in Q1 2025. Non-GAAP gross profit was $36.3 million, resulting in a 52% margin, down from 70%.

Net losses per share increased, with GAAP losses at $(0.86) compared to $(0.50) in the prior year, and Non-GAAP losses worsening to $(0.37) from $(0.05). The company’s cash position remains strong at $711.9 million.

Significant organizational changes include the appointment of Stephen Ehikian as CEO, succeeding founder Thomas M. Siebel. The company also restructured its sales and services organization and reported securing 46 new customer agreements, including expansions in government clientele.

Looking ahead, C3 AI projects Q2 revenue to be between $72.0 million and $80.0 million and anticipates a Non-GAAP loss from operations of $(49.5) to $(57.5) million. The company has withdrawn its full-year fiscal guidance following these management changes.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-09-03 | -0.38 | -0.37 | -2.63 |

| 1 | 2025-05-28 | -0.20 | -0.16 | 20.37 |

| 2 | 2025-02-26 | -0.25 | -0.12 | 52.01 |

| 3 | 2024-12-09 | -0.16 | -0.06 | 62.96 |

| 4 | 2024-09-04 | -0.13 | -0.05 | 62.60 |

| 5 | 2024-05-29 | -0.30 | -0.11 | 63.64 |

| 6 | 2024-02-28 | -0.28 | -0.13 | 53.28 |

| 7 | 2023-12-06 | -0.18 | -0.13 | 29.32 |

Over the last eight quarters, the company has consistently outperformed earnings per share (EPS) estimates, as evidenced by the positive surprise percentages in each period. This trend indicates a pattern of conservative forecasting or operational efficiencies that surpass expectations.

From December 2023 to September 2025, there is a noticeable improvement in the reported EPS, moving from -0.13 to -0.37. Although still negative, the magnitude of losses has decreased, particularly notable in the transition from a -0.13 EPS in December 2023 to a significantly lesser loss of -0.05 by September 2024. This suggests an operational improvement during this period.

The surprise percentage, which measures the extent to which actual EPS beats estimates, shows considerable variability but is notably high, especially from May 2024 to February 2025, where it ranged from 53.28% to 63.64%. This indicates that the actual financial performance was much better than what analysts had predicted, reflecting possible underestimation of the company’s earnings potential or unexpected positive developments within the company.

In summary, the EPS trends from the last eight quarters reveal a company progressively narrowing its losses more effectively than anticipated, which may reflect underlying operational improvements and potential underestimation of its financial resilience by analysts.

## Dividend Payments Table

| Date | Dividend |

|——–|————|

Failed to generate section: Too short (120 words). Partial content: It appears there is a lack of specific dividend da…

In the recent series of rating adjustments, four significant downgrades have been observed, reflecting a potentially cautious or bearish outlook from various financial analysis firms.

1. **Oppenheimer on August 13, 2025**: Oppenheimer revised its rating from “Outperform” to “Perform,” indicating a shift from an expectation of the stock outperforming the general market to performing in line with the market. This adjustment suggests a neutral stance, with no specific target price provided, reflecting possible concerns about the company’s future performance relative to market expectations.

2. **Northland Capital on August 12, 2025**: Northland Capital downgraded its rating from “Outperform” to “Market Perform” with a target price set at $17. This change points towards an expectation of the stock performing on par with the market, down from a previously more bullish outlook. The specified target price of $17 may suggest a limited upside potential from current levels.

3. **DA Davidson on August 11, 2025**: DA Davidson’s downgrade from “Neutral” to “Underperform” with a target price of $13 is particularly bearish. This indicates a negative outlook, suggesting that the stock is expected to perform worse than the overall market. The target price of $13 underscores concerns about significant downside risks.

4. **KeyBanc Capital Markets on December 19, 2024**: This firm downgraded its rating from “Sector Weight” to “Underweight” with a target price of $29. This suggests that KeyBanc expects the stock to underperform its sector. The target price of $29, while higher than the other mentioned target prices, still implies a cautious view relative to previous expectations.

These downgrades collectively suggest a growing skepticism about the company’s ability to outperform or even meet market expectations, potentially due to underlying challenges or market conditions affecting its sector.

The current price of the stock is $16.68, which is positioned between the recent target prices set by analysts. Northland Capital has a target of $17, closely aligning with the current price, suggesting a potential slight upside. However, DA Davidson sets a more pessimistic target at $13, indicating a potential downside from the current level. Previously, KeyBanc Capital Markets had a significantly higher target of $29, but this was before their downgrade from “Sector Weight” to “Underweight.”

The series of downgrades from various analysts, including a shift from “Outperform” to “Perform” by Oppenheimer, “Outperform” to “Market Perform” by Northland Capital, and “Neutral” to “Underperform” by DA Davidson, reflects a changing sentiment towards the stock. These adjustments suggest a reevaluation of the stock’s future performance, potentially due to evolving market conditions or internal challenges within the company. This trend in analyst ratings could influence investor confidence, impacting the stock’s market performance in the near term.