Legacy Education, Inc., founded by LeeAnn Rohmann in 2009 and based in Lancaster, CA, specializes in operating career-focused educational institutions. The company oversees High Desert Medical College, Central Coast College, and Integrity College of Health, each dedicated to providing tailored educational programs across various job markets to equip students with essential skills for professional success.

Legacy Education recently reported significant fiscal 2025 results, which included a 40% increase in revenue and record enrollment levels. This news, detailed in a PR Newswire article on September 25, 2025, highlights the company’s strong performance and could potentially impact its stock positively. Investors and stakeholders might view these results as a robust indicator of the company’s growth and operational efficiency, potentially leading to increased investor confidence and a rise in stock value.

Furthermore, an article from GuruFocus.com on September 24, 2025, provided insights ahead of Legacy Education’s Q4 earnings release, suggesting that there might have been high expectations surrounding the company’s financial disclosures. Given the positive outcomes reported, it’s likely that the actual earnings aligned with or exceeded the forecasts, further cementing the potential for a bullish outlook on LGCY’s stock in the near term. Overall, these developments could suggest a strong investment opportunity within the education sector.

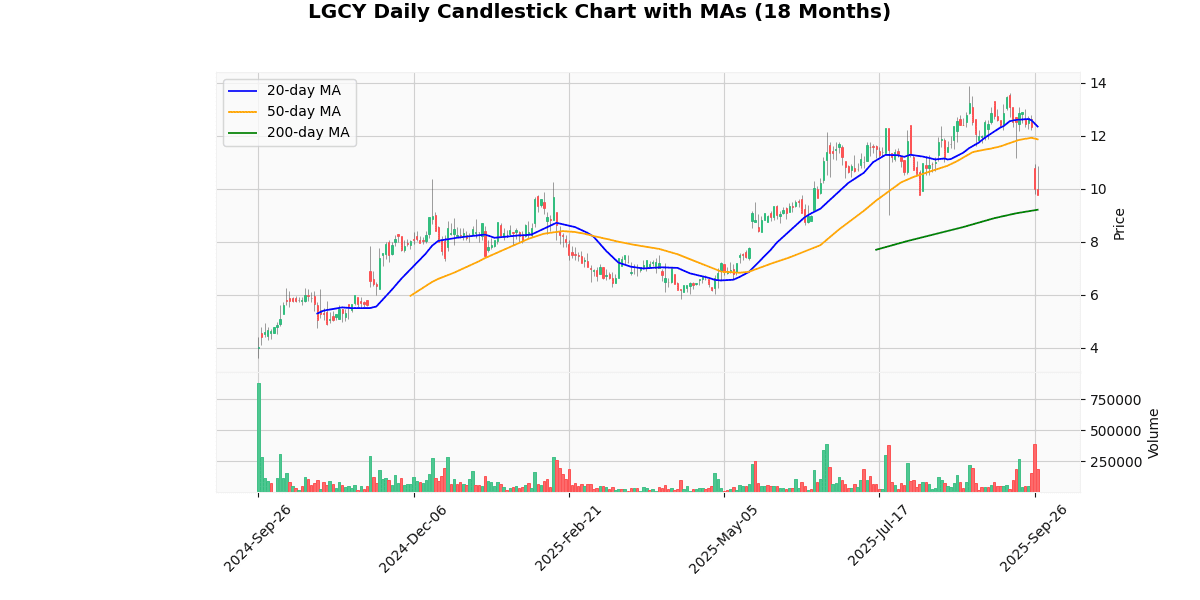

The current price of the asset is $9.755, reflecting a 1.4% decline today. This price is just slightly below this week’s low of $9.76, indicating a near-term downward pressure. The asset is considerably below both its 20-day and 50-day moving averages by approximately 20.98% and 17.79% respectively, suggesting a strong bearish trend in the short to medium term. However, it remains above the 200-day moving average by 5.95%, indicating some resilience in a longer-term perspective.

The asset’s price is significantly down from its 52-week and YTD highs of $13.89, showing a decline of nearly 29.77%. This is contrasted by a substantial increase of 170.97% from its 52-week low, highlighting high volatility over the past year.

The RSI at 29.7 suggests the asset is currently oversold, which might typically indicate a potential for price reversal or stabilization if other market conditions align. However, the negative MACD value of -0.23 points to ongoing bearish momentum, suggesting that any potential recovery might not be immediate. Given these indicators, investors might exercise caution, watching for signs of consolidation or a shift in momentum before making further commitments.

## Price Chart

Legacy Education Inc. (LGCY) reported a significant increase in its financial performance for the fourth quarter and full fiscal year ending June 30, 2025. The company’s Q4 revenue surged by 40.8% to $17.9 million, up from $12.8 million in the same quarter the previous year. For the fiscal year, revenue grew by 39.5% to $64.2 million compared to $46.0 million in FY 2024.

The company also saw a substantial increase in EBITDA, which reached $2.1 million in Q4, marking a 133% rise from $0.9 million in Q4 2024. The annual EBITDA stood at $10.4 million, with adjusted EBITDA around $11.0 million. Net income for the year was reported at $7.5 million, and diluted earnings per share were $0.56.

Student enrollment figures were also positive, with new student starts up by 15.7% in the quarter and 26.9% annually, ending the year with a student population of 3,101, a 41.8% increase. Legacy Education also expanded its academic offerings, gaining approval for three new degree programs and two certificate programs, alongside earning NLN CNEA Initial Accreditation for the RN-BSN track.

The company’s balance sheet showed $20.3 million in cash and cash equivalents, with total assets amounting to $69.2 million and total stockholders’ equity at $41.0 million. Despite these strong results, the report did not mention any dividends or share repurchase programs.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-05-15 | 0.16 | 0.21 | 31.25 |

| 1 | 2025-05-15 | 0.15 | 0.21 | 40.00 |

| 2 | 2025-02-13 | 0.11 | 0.10 | -9.09 |

| 3 | 2024-11-14 | 0.10 | 0.21 | 110.00 |

Over the last eight quarters, the data provided shows a notable variability in both estimated and reported EPS figures, alongside significant surprises in percentage terms. A detailed look into the four most recent quarters reveals some critical observations:

1. **Consistent Outperformance**: In three out of the four quarters, the reported EPS has exceeded the estimated EPS. This trend suggests a pattern where the company consistently surpasses analyst expectations, which could be indicative of conservative estimates or the company’s operational efficiency.

2. **Significant Positive Surprises**: The quarters ending in May 2025 and November 2024 show substantial positive surprises, with reported EPS outperforming estimates by 31.25%, 40.00%, and 110.00%, respectively. These high surprise percentages are indicative of significantly better-than-expected financial performance, possibly driven by unforeseen factors or exceptional operational success.

3. **One Negative Surprise**: The quarter ending in February 2025 presents an anomaly with a reported EPS that is 9.09% below the estimate. This deviation could be due to unexpected challenges or one-off expenses impacting profitability.

4. **Increasing EPS Estimates and Reports**: There is a general upward trend in both EPS estimates and reported figures, suggesting growth in profitability expectations and actual earnings over time.

This analysis indicates robust financial performance with occasional variability. Stakeholders should consider the implications of these trends for future performance forecasting and investment decisions.

On October 22, 2024, two financial firms, Northland Capital and Ladenburg Thalmann, initiated coverage on the stock of Outer. Northland Capital assigned an “Outperform” rating with a target price of $8.25. This rating suggests that Northland Capital analysts expect the stock to perform better than the broader market. Concurrently, Ladenburg Thalmann also initiated coverage, giving Outer a “Buy” rating with a slightly lower target price of $8.20. The “Buy” rating indicates a positive outlook, suggesting that Ladenburg Thalmann analysts anticipate the stock will outperform in the near future, albeit with a target price marginally less optimistic than that of Northland Capital.

These initiations reflect a positive consensus on the financial prospects of Outer, indicating potential growth or undervaluation as perceived by the analysts. The close proximity of the target prices and the optimistic ratings from both firms underscore a bullish sentiment towards Outer’s market performance, potentially influencing investor confidence and market behavior surrounding Outer’s shares.

As of the latest data, the current price of the stock stands at $9.76. This price is notably higher than the average target price set by analysts. Specifically, Northland Capital initiated coverage with an “Outperform” rating, setting a target price of $8.25. Concurrently, Ladenburg Thalmann also initiated coverage, rating the stock as a “Buy” with a slightly lower target price of $8.20. This indicates that the current market price exceeds the expectations of analysts by approximately 18.4% compared to Northland Capital’s target and 19% compared to Ladenburg Thalmann’s target.

Disclaimer:

The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.