# Adobe Inc. (ADBE) Post Earning Analysis

Adobe, Inc. is a leading global technology company specializing in digital marketing and media solutions. Founded in 1982 and headquartered in San Jose, California, Adobe operates through three main segments: Digital Media, Digital Experience, and Publishing and Advertising. The company provides a broad range of products and services that support the creation, publication, promotion, and monetization of content across various platforms.

Adobe Inc. (ADBE) has recently received a series of positive evaluations from major financial analysts following its Q3 FY 2025 earnings beat, signaling strong investor confidence. Stifel and DA Davidson maintained their “Buy” ratings, highlighting Adobe’s robust performance and growth prospects. Goldman Sachs reiterated a “Buy” rating with a price target of $570, emphasizing Adobe’s momentum in AI technology. Similarly, J.P. Morgan continued its “Buy” rating, reinforcing the optimistic outlook for Adobe’s stock.

Despite these endorsements, the broader market context shows some tech stocks, including Adobe, are still facing challenges as indicated by a Barrons.com article discussing the ongoing struggles of AI software companies. Additionally, Adobe’s stock has shown volatility with a recent drop as reported by Barrons.com, despite beating earnings estimates and showing revenue growth year-over-year.

Overall, the strong financial performance coupled with strategic advancements in AI appears to position Adobe positively in the market, although some investor caution remains due to sector-wide issues. This mixed sentiment could influence Adobe’s stock performance in the near term, balancing strong fundamentals against market-wide tech sector uncertainties.

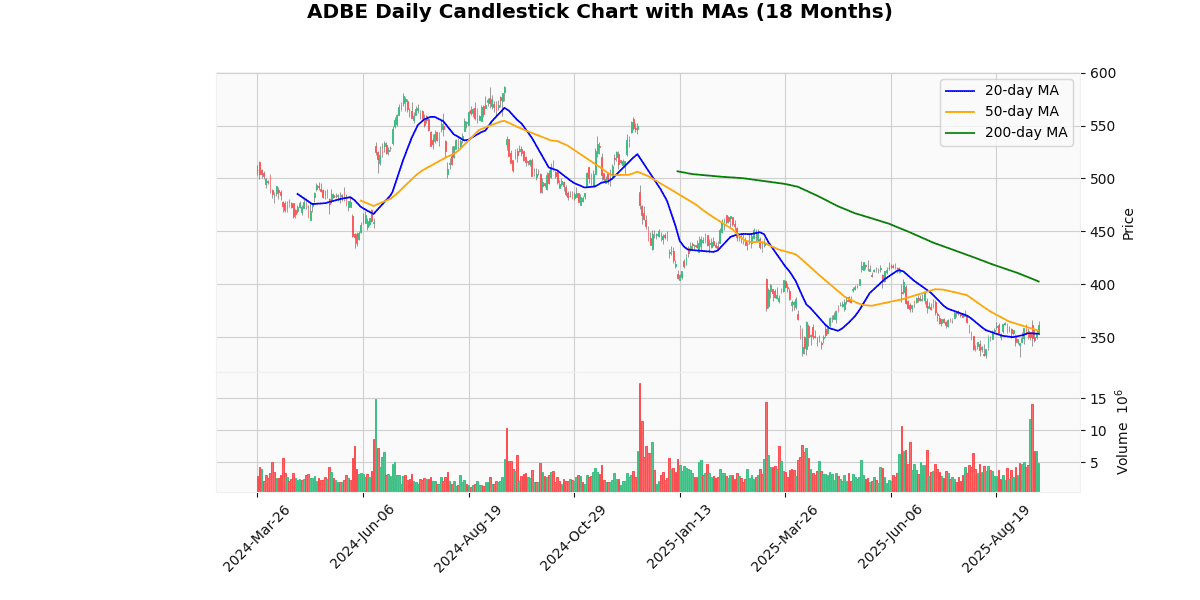

The current price of the asset is $361.875, marking a significant increase of 2.72% today. This recent uptick is close to the week’s high of $365.00 but still considerably lower than the 52-week high of $557.9, indicating a broader downtrend over the past year with a decline of 35.14%. This downtrend is also reflected in the year-to-date metrics, with the current price down 22.29% from the YTD high of $465.7.

The asset’s price is currently above both the 20-day and 50-day moving averages by 2.43% and 1.58% respectively, suggesting a short-term bullish sentiment. However, it remains 10.14% below the 200-day moving average, highlighting a longer-term bearish trend.

The Relative Strength Index (RSI) at 56.56 suggests the asset is neither overbought nor oversold, while the negative MACD (-0.92) indicates bearish momentum in the medium term. The proximity to the 52-week low (+9.65%) combined with these indicators suggests cautious optimism for recovery, but with significant resistance ahead.

## Price Chart

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-09-11 | 5.18 | 5.31 | 2.51 |

| 1 | 2025-06-12 | 4.96 | 5.06 | 1.93 |

| 2 | 2025-03-12 | 4.97 | 5.08 | 2.18 |

| 3 | 2024-12-11 | 4.66 | 4.81 | 3.17 |

| 4 | 2024-09-12 | 4.53 | 4.65 | 2.68 |

| 5 | 2024-06-13 | 4.39 | 4.48 | 2.06 |

| 6 | 2024-03-14 | 4.38 | 4.48 | 2.30 |

| 7 | 2023-12-13 | 4.14 | 4.27 | 3.21 |

The analysis of EPS trends over the last eight quarters reveals a consistent pattern of the company outperforming earnings estimates. The reported EPS has consistently surpassed the estimated EPS in each quarter, with a positive surprise percentage ranging from 1.93% to 3.21%. This indicates a robust financial performance and effective management forecasting.

Starting from December 2023, there has been a steady increase in both estimated and reported EPS, reflecting a growth trajectory in the company’s earnings. The estimated EPS rose from 4.14 in December 2023 to 5.18 by September 2025, while the reported EPS increased from 4.27 to 5.31 during the same period. This upward trend suggests not only improving operational efficiency but also an increasing ability to exceed analyst expectations.

The highest surprise percentage occurred in December 2023 and December 2024, at 3.21% and 3.17% respectively, indicating particularly strong quarters relative to expectations. The consistency in surpassing estimates could potentially build investor confidence and suggest a conservative estimation approach by analysts or an operational outperformance by the company.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2005-03-24 | 0.0065 |

| 2004-12-23 | 0.0065 |

| 2004-09-24 | 0.0065 |

| 2004-06-25 | 0.0065 |

| 2004-03-26 | 0.0065 |

| 2004-01-07 | 0.0065 |

| 2003-09-19 | 0.0065 |

| 2003-06-19 | 0.0065 |

The dividend data spanning from June 2003 to March 2005 reveals a consistent dividend payment of $0.0065 per share across all recorded dates. This uniformity in dividend distribution over the eight observed quarters suggests a stable dividend policy by the company during this period. The lack of variation in the dividend amount might indicate that the company maintained a steady financial performance, with sufficient earnings to support ongoing dividend payments at this rate. Additionally, the regularity of the payments, occurring quarterly, underscores a commitment to providing consistent returns to shareholders. This pattern might be viewed positively by investors seeking predictable income streams. However, the absence of any increase in the dividend amount over nearly two years could be a point of concern for those looking for growth in dividend returns, potentially reflecting limitations in the company’s ability to expand its profitability or redistribute larger portions of earnings to shareholders during this timeframe.

The most recent rating changes for the stock in question reflect a mix of reiterated positions and downgrades, with adjustments in target prices by notable financial firms.

1. **BMO Capital Markets on September 12, 2025**: BMO Capital Markets reiterated its ‘Outperform’ rating but reduced the target price from $450 to $405. This adjustment suggests that while BMO still views the stock favorably, they have moderated their expectations regarding its future performance, possibly due to emerging risks or a recalibration of the company’s growth prospects.

2. **Melius on August 11, 2025**: Melius downgraded the stock from ‘Hold’ to ‘Sell’ with a target price of $310. This significant shift indicates a bearish outlook from Melius, suggesting that they foresee deteriorating fundamentals or potential challenges that could negatively impact the stock’s value.

3. **Rothschild & Co Redburn on July 2, 2025**: Rothschild & Co Redburn also issued a downgrade, moving from ‘Neutral’ to ‘Sell’ with a target price set at $280. This downgrade, coupled with a relatively low target price, underscores concerns about the stock’s valuation and anticipated performance, possibly reflecting a pessimistic analysis of the company’s operational or market challenges.

4. **BMO Capital Markets on April 16, 2025**: Earlier in the year, BMO Capital Markets had reiterated an ‘Outperform’ rating but lowered the target price from $495 to $450. Similar to their later rating, this earlier adjustment indicates a continued positive outlook albeit with a tempered valuation expectation, possibly due to adjusted earnings forecasts or market conditions at the time.

These adjustments suggest a trend of cautious or negative sentiment from analysts regarding the stock’s future market performance, with a particular emphasis on revising target prices downward, reflecting revised expectations in the face of potential headwinds.

The current price of the stock is $361.88. This price reflects a varied perspective from analysts, with target prices ranging significantly. BMO Capital Markets recently reiterated an “Outperform” rating but adjusted their target price from $450 to $405, suggesting a potential upside of approximately 11.9%. Conversely, Melius and Rothschild & Co Redburn have downgraded their outlooks, with Melius moving from “Hold” to “Sell” and setting a target at $310, and Rothschild & Co Redburn also shifting to “Sell” with a more bearish target of $280.

This disparity in target prices indicates a mixed consensus among analysts about the stock’s future performance, reflecting different interpretations of market conditions, company performance, or sector impacts. The average of the given target prices ($331.67) is below the current stock price, suggesting that some analysts believe the stock might be overvalued at its current level.