Ambarella, Inc., founded in 2004 and based in Santa Clara, California, specializes in developing low-power system-on-a-chip (SoC) semiconductors and software for edge AI applications. The company’s products are used in various sectors including video security, advanced driver assistance systems (ADAS), autonomous driving, and robotics. Ambarella operates globally, with significant market segments in Taiwan, Asia Pacific, Europe, and North America.

Ambarella Inc. has recently seen a significant surge in its stock price following the release of its second quarter fiscal year 2026 earnings, which exceeded expectations. The company’s stock soared by 19% as detailed in multiple reports, including those from Zacks and Investor’s Business Daily. The positive momentum was primarily driven by strong Q2 earnings and revenue figures that surpassed analysts’ estimates. This performance boost is attributed to the growth in Edge AI technology, a sector where Ambarella is increasingly focusing.

The broader impact of these results has made Ambarella a trending ticker in financial news, as highlighted by Yahoo Finance and Barrons.com. Such a robust financial performance not only boosts investor confidence but could also potentially attract further investment into Ambarella, enhancing its market positioning against competitors. Additionally, the company’s success might influence stock market movements, particularly in the technology and AI sectors, given the growing interest in AI applications. This series of positive news could provide a sustained uplift to Ambarella’s stock in the near term.

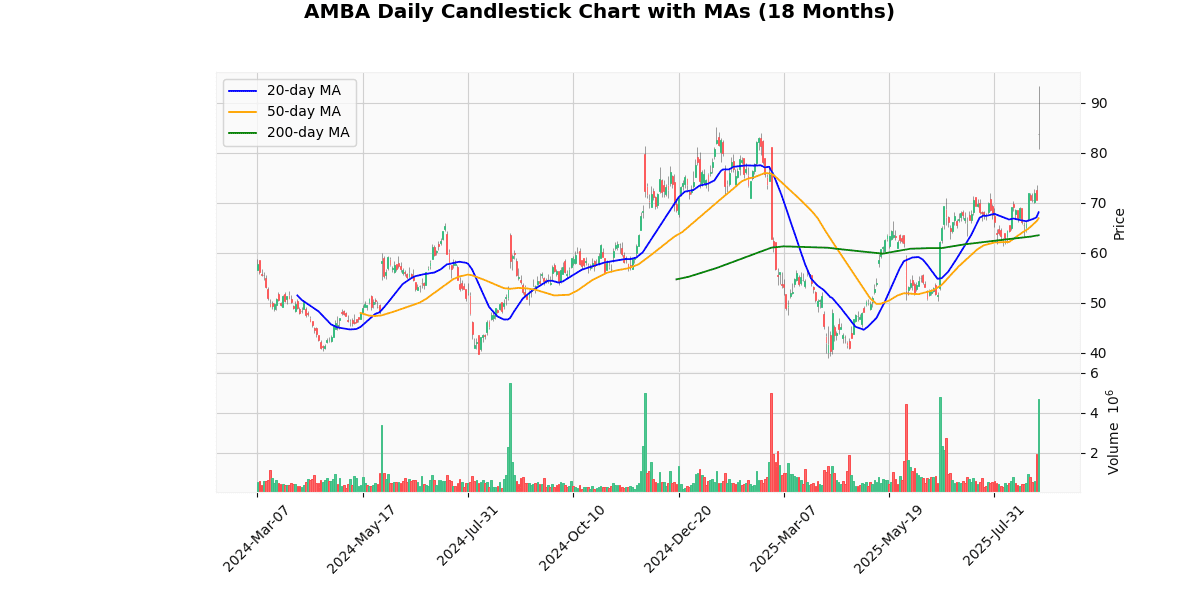

The current price of the asset at $83.84 shows a significant increase of 17.68% today, indicating a strong upward movement in the short term. This rise is supported by the asset’s performance relative to its moving averages, with current prices well above the 20-day (23.11%), 50-day (25.33%), and 200-day (32.03%) averages, suggesting a strong bullish trend.

The asset has had a remarkable rebound from its 52-week and YTD lows of $38.86, with a current price that represents a 115.75% increase, highlighting a significant recovery over the year. However, it is still trading 10.27% below the 52-week and YTD highs of $93.44, indicating some resistance near these levels.

The RSI at 74.94 suggests that the asset is potentially overbought, which could signal a forthcoming adjustment or pullback, especially considering its proximity to recent highs. The MACD value of 2.49 supports the current bullish momentum, but the high RSI could be cautionary for potential buyers looking for sustained growth beyond the recent highs.

Overall, the asset’s price trends show strong upward momentum with caution advised due to the high RSI, indicating possible overbought conditions.

## Price Chart

Ambarella, Inc. reported its financial results for the second quarter of 2026 on August 28, 2025, showcasing significant revenue growth and improvements in net profitability. The company achieved a revenue of $95.5 million, marking a substantial 49.9% increase from $63.7 million in Q2 2025. Over the six-month period ending July 31, 2025, revenue rose to $181.4 million, up 53.5% from the previous year’s $118.2 million.

Despite these gains, the company’s gross margin under GAAP saw a slight decline to 58.9% in Q2 2026 from 60.8% in Q2 2025. Similarly, non-GAAP gross margin decreased to 60.5% from 63.3% in the prior year. Net income also reflected a mixed picture; under GAAP, the net loss improved significantly to $20.0 million from a loss of $34.9 million in Q2 2025. Conversely, non-GAAP figures showed a net profit of $6.4 million, a reversal from a net loss of $5.5 million in the same quarter last year.

Looking ahead, Ambarella expects Q3 2026 revenue to be between $100.0 million and $108.0 million, with non-GAAP gross margins anticipated to range from 60.0% to 61.5%. Operating expenses are projected to be between $54.0 million and $57.0 million. The company reported an increase in cash and marketable securities to $261.2 million, up 18.8% from the previous year. No dividends or share repurchase plans were announced.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-08-28 | 0.06 | 0.15 | 150.00 |

| 1 | 2025-05-29 | 0.02 | 0.07 | 188.66 |

| 2 | 2025-02-26 | -0.02 | 0.11 | 776.92 |

| 3 | 2024-11-26 | 0.03 | 0.11 | 215.82 |

| 4 | 2024-08-27 | -0.19 | -0.13 | 32.34 |

| 5 | 2024-05-30 | -0.31 | -0.26 | 16.83 |

| 6 | 2024-02-27 | -0.33 | -0.24 | 26.73 |

| 7 | 2023-11-30 | -0.39 | -0.28 | 28.31 |

Over the last eight quarters, the company has demonstrated a significant improvement in its earnings per share (EPS) performance relative to estimates. Initially, the company reported negative EPS values, with the lowest being -0.39 in Q4 2023, which, while still below zero, outperformed estimates by 28.31%. This trend of surpassing negative EPS estimates continued through Q1 and Q2 of 2024, with surprise percentages of 26.73% and 16.83%, respectively, and a gradual decrease in the magnitude of negative EPS.

A notable shift occurred in Q3 2024, where the company not only continued to beat estimates but also reported a positive EPS of -0.13 against an estimate of -0.19, marking a significant turnaround. This positive trajectory was further solidified in subsequent quarters, with the company consistently outperforming EPS estimates by substantial margins. The reported EPS moved from 0.11 in Q4 2024 to 0.15 in Q2 2025, each time significantly exceeding expectations, highlighted by a striking 776.92% surprise in Q1 2025 when the actual EPS was 0.11 against an estimated -0.02.

This pattern suggests a robust recovery and a potential stabilization of the company’s financial health, reflecting improved operational efficiency or market conditions that favorably impacted earnings. The consistent and substantial outperformance against analyst estimates could also indicate conservative guidance by the company or underestimation of its earnings potential by analysts.

## Dividend Payments Table

| Date | Dividend |

|——–|————|

This section provides an overview of available data.

The most recent rating changes for Outer involve both upgrades and target price adjustments by notable firms.

1. On August 29, 2025, Summit Insights upgraded Outer from “Hold” to “Buy.” This change indicates a positive shift in the firm’s outlook on Outer’s potential market performance, though the specific target price was not provided in the summary.

2. Concurrently on August 29, 2025, Needham reiterated its “Buy” rating for Outer but increased the target price from $90 to $100. This adjustment suggests that Needham has a heightened confidence in Outer’s growth prospects and financial health, potentially due to recent company developments or market conditions.

3. Previously, on December 16, 2024, BofA Securities upgraded Outer from “Underperform” to “Neutral” with a target price set at $80. This upgrade reflects a moderated view from BofA Securities, possibly due to improvements in Outer’s operational or financial metrics that alleviate some previous concerns but still warrant a cautious stance.

4. Lastly, on November 27, 2024, Needham had also reiterated its “Buy” rating and adjusted the target price from $90 to $100. This earlier endorsement and price target increase by Needham align with their later reiteration, consistently signaling strong support for Outer’s stock and optimistic future performance expectations.

These rating changes collectively suggest a generally improving perception of Outer’s financial stability and growth potential among analysts, highlighted by both upgrades in status and increases in target prices.

The current price of the stock is $83.84, which is below the average target price suggested by recent analyst ratings. Notably, Needham has reiterated a “Buy” rating and increased their target price from $90 to $100, indicating a positive outlook on the stock’s potential. Additionally, Summit Insights upgraded their rating from “Hold” to “Buy,” although they did not specify a target price. BofA Securities also shifted their view from “Underperform” to “Neutral” with a target price of $80, which is slightly below the current market price but indicates a softening of their previous bearish stance.

This collection of ratings and target price adjustments suggests a generally optimistic sentiment among analysts regarding the stock’s future performance, with expectations leaning towards growth above the current market price. These upgrades and reiterated positive ratings could signal confidence in the company’s prospects, potentially influenced by factors like earnings performance, market position, or future growth opportunities.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.