A special purpose acquisition company (SPAC) is a shell company that raises money through an initial public offering (IPO) with the sole purpose of acquiring a private company. Once the SPAC has raised the necessary capital, it has two years to find a target company to acquire. If the SPAC is unable to find a target company within the two-year period, the SPAC will be dissolved and the investors will receive their money back.

SPACs offer a number of advantages over traditional IPOs, including:

Speed: SPACs can be taken public much more quickly than traditional IPOs. This is because the SPAC does not need to go through the same level of regulatory scrutiny as a traditional IPO.

Certainty: SPAC investors know exactly how much they will be investing, as the SPAC’s IPO price is set in advance. This is in contrast to traditional IPOs, where the price is set on the day of the IPO and can be volatile.

Access: SPACs give investors access to private companies that may not otherwise be available to them. This is because the SPAC’s target company is typically not publicly traded before the merger.

However, SPACs also have some risks, including:

Lack of transparency: SPACs do not have to disclose as much information about their target companies as traditional IPOs. This can make it difficult for investors to assess the risks of investing in a SPAC.

Valuation: The valuation of a SPAC’s target company can be difficult to determine. This is because the target company is not publicly traded before the merger.

Management: The management team of a SPAC is typically not as experienced as the management team of a traditional IPO. This can be a risk for investors, as the management team will be responsible for running the target company after the merger.

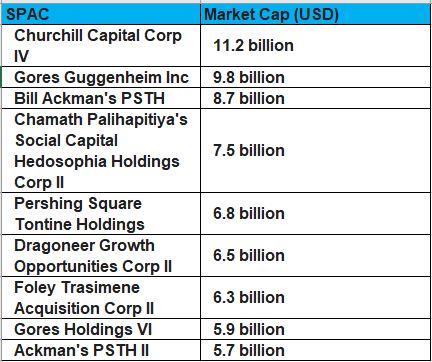

Here is a list of the 10 largest SPACs by market capitalization as of July 17, 2023:

It is important to note that the performance of SPACs can vary widely. Some SPACs have performed very well, while others have underperformed.

The average performance of SPACs 12 months after going public is negative. According to a study by Kiesel (2023), SPACs that completed their mergers in 2019 and 2020 had an average abnormal return of -14.1% 12 months after the merger announcement. This means that SPACs underperformed the market by 14.1% over this period.

The study also found that SPACs that had higher redemption rates (i.e., more investors who opted to redeem their shares after the merger announcement) underperformed the market even more. This suggests that SPACs that are seen as less attractive by investors tend to perform worse after the merger.

It is important to note that the performance of SPACs can vary widely. Some SPACs have performed very well, while others have underperformed.

Here are some of the factors that can affect the performance of a SPAC 12 months after going public:

The quality of the target company.

The valuation of the target company.

The management team of the SPAC.

The overall market conditions.

Investors should carefully consider all of these factors before investing in a SPAC.

And some examples of SPAC success and poor results:

Success

Churchill Capital Corp IV (CCIV) merged with Lucid Motors in February 2021. Lucid Motors is an electric vehicle company that is seen as a potential Tesla competitor. The merger has been very successful, with CCIV’s stock price more than quadrupling since the merger announcement.

Gores Guggenheim Inc (GGPI) merged with Polestar in June 2022. Polestar is an electric vehicle company that is backed by Volvo and Geely. The merger has been very successful, with GGPI’s stock price more than doubling since the merger announcement.

Poor results

Pershing Square Tontine Holdings (PSTH) was a SPAC that was led by billionaire investor Bill Ackman. PSTH was unable to find a target company to acquire and was dissolved in July 2022. PSTH’s stock price lost more than half of its value during its two-year lifespan.

Foley Trasimene Acquisition Corp II (FTAC) was a SPAC that was led by billionaire investor John Foley. FTAC merged with Carbon Health in June 2021. Carbon Health is a healthcare company that provides virtual and in-person care. However, FTAC’s stock price has fallen by more than 70% since the merger announcement.

SPACs have targeted a wide range of sectors in recent years, but some of the most popular sectors include:

- Technology: Technology has been a popular sector for SPACs, as there are many high-growth technology companies that are looking to go public. Some of the most notable technology SPACs include Churchill Capital Corp IV (Lucid Motors), Gores Guggenheim Inc (Polestar), and Bill Ackman’s PSTH II (still looking for a target).

- Healthcare: Healthcare is another popular sector for SPACs, as there are many innovative healthcare companies that are looking to go public. Some of the most notable healthcare SPACs include Foley Trasimene Acquisition Corp II (Carbon Health), Social Capital Hedosophia Holdings Corp II (CureVac), and Chamath Palihapitiya’s Social Capital Hedosophia Holdings Corp IV (Ginkgo Bioworks).

- Consumer: The consumer sector has also been a popular target for SPACs, as there are many consumer brands that are looking to go public. Some of the most notable consumer SPACs include Dragoneer Growth Opportunities Corp II (Oatly), Chamath Palihapitiya’s Social Capital Hedosophia Holdings Corp V (Virgin Galactic), and Bill Ackman’s PSTH (still looking for a target).

- Industrials: The industrials sector has also been a popular target for SPACs, as there are many industrial companies that are looking to go public. Some of the most notable industrial SPACs include Churchill Capital Corp II (Bilibili), Gores Guggenheim Inc (QuantumScape), and Bill Ackman’s PSTH (still looking for a target).

These are just a few of the sectors that have been targeted by SPACs in recent years. SPACs have also targeted a wide range of other sectors, including energy, financial services, and real estate.

It is important to note that the popularity of SPACs in a particular sector can vary over time. For example, the technology sector was very popular for SPACs in 2020 and 2021, but it has become less popular in 2022.

As you can see, the performance of SPACs can vary widely. Some SPACs have been very successful, while others have underperformed.

SPACs are considered alternative investments. Alternative investments are investments that are not traded on traditional exchanges, such as the New York Stock Exchange or the Nasdaq. SPACs are considered alternative investments because they are not traditional IPOs.

There are a few reasons why SPACs are considered alternative investments. First, SPACs are not subject to the same level of regulatory scrutiny as traditional IPOs. This means that there is less information available about SPACs, which can make them more risky for investors. Second, SPACs are often used to acquire private companies, which can be more risky than investing in public companies.

However, there are also some advantages to investing in SPACs. SPACs can be a good way to get exposure to private companies that may not otherwise be available to investors. Additionally, SPACs can offer investors the opportunity to participate in the growth of a company at an early stage.

Overall, SPACs are considered alternative investments because they are not traditional IPOs and they can be more risky than investing in public companies. However, there are also some advantages to investing in SPACs, such as the opportunity to get exposure to private companies.