Arista Networks Inc (ANET) Slides Post Earning Release: Analysis

Arista Networks, Inc., founded in 2004 by Andreas Bechtolsheim, David Cheriton, and Kenneth Duda, specializes in cloud networking solutions. Headquartered in Santa Clara, CA, the company offers a range of products including EOS network applications and Gigabit Ethernet switching and routing platforms. Its portfolio spans Core, Cognitive Adjacencies, and Network Software and Services, catering to advanced networking demands.

Arista Networks Inc. (ANET) recently reported its Q3 2025 earnings, which have been a focal point for investors and analysts. Despite achieving record revenue growth, largely driven by demand in AI technologies, the company’s stock experienced a decline due to what was perceived as underwhelming future guidance and only a small beat on third-quarter expectations. This mixed financial performance led to notable stock price volatility on the day the earnings were announced. Various reports highlighted that while Arista’s revenue and earnings surpassed estimates, the future outlook provided by the company did not meet some investors’ more optimistic expectations, causing a drop in stock value. This reaction underscores the market’s sensitivity to not just current earnings but also future prospects, especially in the high-stakes tech sector where Arista operates. The overall sentiment from the earnings call and subsequent stock movement suggests that while Arista is growing, there are concerns about its ability to sustain this momentum in the upcoming quarters.

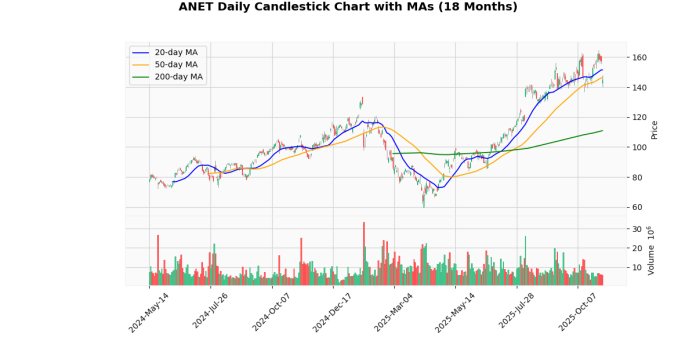

The current price of $145.0 represents a significant decrease of 5.69% today, indicating a bearish movement in the short term. This price is notably lower than both the 52-week and year-to-date highs of $164.94, showing a 12.09% drop from these peaks. The price is, however, substantially higher than the 52-week and year-to-date lows of $59.43, suggesting a strong overall gain within the year.

The price is currently below the 20-day moving average by 4.24% and slightly below the 50-day moving average by 0.94%, which could signal a short-term downward trend. However, it remains well above the 200-day moving average by 30.76%, indicating a robust long-term upward trend.

The Relative Strength Index (RSI) at 44.45 suggests the stock is neither overbought nor oversold, offering no strong momentum cues. The positive MACD of 2.72 indicates underlying bullish momentum in the longer term despite recent price drops.

Overall, while there is short-term bearish pressure, the long-term trend appears positive, supported by the significant distance above the year’s low and a positive MACD. Investors might view recent dips as potential buying opportunities if they believe in the stock’s fundamental strength.

Arista Networks, Inc. (NYSE: ANET) reported a strong financial performance for the third quarter of 2025, ending September 30, with revenues of $2.308 billion, marking a 4.7% increase from the previous quarter and a significant 27.5% rise from Q3 2024. The company’s GAAP net income for the quarter was $853.0 million, translating to $0.67 per diluted share, an improvement from $747.9 million or $0.58 per diluted share in the same period last year. Non-GAAP net income also saw a robust increase to $962.3 million, or $0.75 per diluted share, compared to $769.0 million or $0.60 per diluted share in Q3 2024.

The gross margin on a GAAP basis slightly declined to 64.6% from 65.2% in Q2 2025 but showed a year-over-year improvement from 64.2%. Non-GAAP gross margin also experienced a slight decrease from the previous quarter to 65.2% but was higher than the 64.6% reported in Q3 2024.

Looking ahead, Arista forecasts revenues between $2.3 billion and $2.4 billion for the upcoming quarter, with non-GAAP gross margins expected to range between 62% and 63%. The company also highlighted significant leadership appointments and strategic collaborations aimed at enhancing its technological capabilities in AI and cloud networking.

Overall, Arista’s robust revenue growth and profitability underscore its strong market position and operational efficiency, despite a competitive and dynamic technological landscape.

Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-11-04 | 0.72 | 0.75 | 4.75 |

| 1 | 2025-05-06 | 0.59 | 0.65 | 10.95 |

| 2 | 2025-02-18 | 0.57 | 0.65 | 14.31 |

| 3 | 2024-11-07 | 2.08 | 2.40 | 15.17 |

| 4 | 2024-07-30 | 1.95 | 2.10 | 7.87 |

| 5 | 2024-05-07 | 1.74 | 1.99 | 14.29 |

| 6 | 2024-02-12 | 1.70 | 2.08 | 22.14 |

| 7 | 2023-10-30 | 1.58 | 1.83 | 15.77 |

Over the last eight quarters, the data illustrates a consistent trend of the company surpassing its estimated EPS, indicating robust financial performance and effective management forecasting. The reported EPS consistently exceeded estimates, with the surprise percentage ranging from a modest 4.75% to a significant 22.14%.

A closer look at the data reveals a seasonal pattern in the EPS figures. The company tends to report significantly higher EPS in the later quarters of each year (Q3 and Q4), with peak performances typically in the fourth quarter, as evidenced by the 2.40 reported EPS in Q4 2024 and a 1.83 in Q4 2023, both substantially above their respective estimates.

The first and second quarters of each year, while also showing positive surprises, report lower EPS compared to the latter half of the year. This could be indicative of cyclical business operations where revenue and earnings peak during the end of the year.

Overall, the consistent outperformance against estimates could suggest conservative forecasting by the company or an operational strategy that maximizes year-end results. This trend of exceeding EPS estimates could potentially build investor confidence, reflecting positively on the company’s stock performance in the long term.

The most recent activity in analyst ratings for the covered entity includes two upgrades, a reiterated rating, and a new initiation, each reflecting varied expectations from different financial institutions.

- BNP Paribas Exane on September 25, 2025: The firm upgraded its rating from ‘Neutral’ to ‘Outperform’, setting a target price of $172. This adjustment suggests a positive shift in the firm’s outlook, potentially due to improved company fundamentals or market conditions that favor the entity’s business model.

- Erste Group on July 23, 2025: This firm upgraded its recommendation from ‘Hold’ to ‘Buy’. Although no specific target price was provided, the upgrade indicates a bullish view on the stock, implying that Erste Group expects the stock’s market performance to be strong going forward.

- Citigroup on July 11, 2025: Citigroup reiterated its ‘Buy’ rating but adjusted the target price from $112 to $123. This increase in target price reflects an optimistic reassessment of the stock’s value, suggesting that Citigroup analysts see more upside potential than previously estimated.

- Wolfe Research on July 8, 2025: Wolfe Research initiated coverage with an ‘Outperform’ rating, though without a specified target price. The initiation at such a positive rating level indicates that Wolfe Research perceives substantial growth prospects or competitive strengths in the entity that are likely to drive its market performance above the average sector movement.

These recent rating changes highlight a generally positive sentiment among analysts regarding the entity’s future market performance, with expectations of outperformance and strong buy recommendations dominating the latest analyses.

The current price of the stock stands at $145.00. Recent analyst ratings indicate a generally positive outlook, with notable upgrades and target adjustments suggesting potential growth. BNP Paribas Exane upgraded the stock from Neutral to Outperform, setting a target price of $172, which is significantly higher than the current price. Similarly, Erste Group upgraded their rating from Hold to Buy, although they did not specify a target price. Citigroup reiterated a Buy rating and increased their target from $112 to $123, though this remains below the current market price. Wolfe Research initiated coverage with an Outperform rating but did not provide a specific target price.

These upgrades and positive ratings suggest an optimistic view on the stock’s future performance, with BNP Paribas Exane’s target of $172 highlighting a particularly strong growth expectation. This suggests that analysts see potential in the stock that may not yet be fully reflected in its current market price.

Disclaimer:

The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.