Asana, Inc. (NYSE: ASAN) recently reported its fiscal second quarter 2026 results, surpassing both earnings and revenue estimates, which has positively impacted its stock. On September 3, 2025, Asana announced better-than-expected sales for Q2, leading to a significant rise in its stock price. This news was widely covered, with reports highlighting the company’s strong performance despite a challenging economic environment. Additionally, Asana’s proactive engagement with the investment community is evident from its announcement on September 2 about presenting at upcoming investor events. This series of positive reports comes after speculative previews and expectations set by financial news outlets, which speculated on the potential outcomes of Asana’s earnings report. The overall sentiment around Asana is currently positive, reflecting investor confidence boosted by the company’s latest financial outcomes and forward-looking initiatives. This could potentially lead to sustained interest and investment in Asana’s stock in the near term.

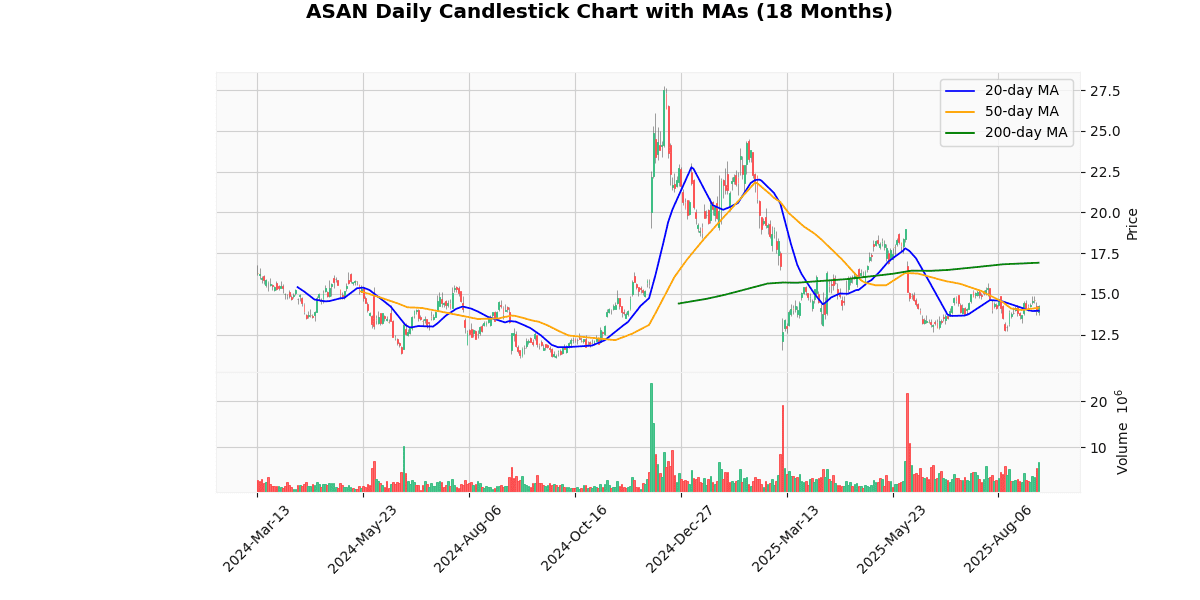

The current price of the asset is $14.23, showing a significant increase of 2.23% today, indicating a positive short-term momentum. However, the price is notably below the 52-week high of $27.77, down by approximately 48.76%, and also below the year-to-date (YTD) high of $24.5, reflecting a decline of 41.92%. This suggests a bearish trend over the longer term.

The asset’s price is relatively stable compared to the week’s fluctuations, with a current price close to the week’s high of $14.48 and well above the week’s low of $13.68. This stability is supported by the Relative Strength Index (RSI) at 50.67, indicating neither overbought nor oversold conditions, and a MACD of -0.0, suggesting no strong momentum in either direction.

The moving averages indicate mixed signals; the price is above the 20-day and 50-day moving averages by 1.91% and 0.57% respectively, suggesting some short-term bullishness. However, it remains significantly below the 200-day moving average by 15.85%, highlighting a longer-term bearish trend.

Overall, while there’s some short-term recovery, the asset’s performance over the past year and YTD suggests a cautious approach for long-term investors.

## Price Chart

Asana, Inc. (ASAN) reported its Q2 2026 financial results on September 3, 2025, showcasing a robust performance with total revenues of $196.9 million, marking a 10% year-over-year increase. The company significantly improved its operational efficiency, reducing its GAAP operating loss to $49.5 million, or 25% of revenues, from $76.8 million in the previous year. Non-GAAP figures were also strong, with operating income reaching $14.0 million, a turnaround from a non-GAAP operating loss of $15.7 million in Q2 2025.

Net income metrics followed a similar positive trend. The GAAP net loss narrowed to $48.4 million from $72.2 million year over year, with a per-share loss improving to $0.20 from $0.31. Non-GAAP net income reached $15.1 million, recovering from a net loss of $11.1 million in the prior year, with earnings per share at $0.06.

Operational cash flow was robust at $39.8 million, and adjusted free cash flow increased to $35.4 million. Customer growth was evident with Core customers increasing by 9% to 25,006 and high-value customers growing by 19% to 770.

Looking ahead to Q3 Fiscal 2026, Asana expects revenues between $197.5 million and $199.5 million and non-GAAP operating income between $12.0 million and $14.0 million. For the full fiscal year, the company anticipates revenues between $780.0 million and $790.0 million and non-GAAP operating income between $46.0 million and $50.0 million. Additionally, Asana engaged in share repurchases totaling $28.9 million during the quarter, up from $19.0 million in the previous year.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-09-03 | 0.05 | 0.06 | 20.00 |

| 1 | 2025-06-03 | 0.02 | 0.05 | 159.47 |

| 2 | 2024-12-05 | -0.07 | -0.02 | 70.43 |

| 3 | 2024-09-03 | -0.08 | -0.05 | 38.60 |

| 4 | 2024-05-30 | -0.08 | -0.06 | 27.25 |

| 5 | 2024-03-11 | -0.10 | -0.04 | 58.50 |

| 6 | 2023-12-05 | -0.11 | -0.04 | 62.62 |

| 7 | 2023-09-05 | -0.11 | -0.04 | 65.17 |

The EPS trends over the last eight quarters show a significant improvement, transitioning from negative to positive values. Initially, the company reported EPS below zero, with estimates ranging from -0.11 to -0.08 between Q3 2023 and Q2 2024. Despite these negative estimates, the actual reported EPS consistently outperformed expectations, with surprises ranging from 27.25% to 65.17%, indicating a less severe loss than anticipated.

A notable shift occurred by Q3 2024, where the negative trend in EPS began to lessen, moving from -0.08 estimated to -0.05 reported, and continued improving in subsequent quarters. By Q2 2025, the company not only reversed the negative EPS trend but also reported a substantial positive surprise of 159.47%, far exceeding the modest positive estimate.

By Q3 2025, the company solidified its positive earnings trajectory with an EPS of 0.06 against an estimate of 0.05, reflecting a 20.00% surprise. This progression from negative to positive EPS, coupled with consistently exceeding analyst expectations, suggests effective management strategies and potentially improving operational efficiency. This trend is crucial for investors as it indicates a recovery and potential for sustained profitability.

## Dividend Payments Table

| Date | Dividend |

|——–|————|

The most recent rating changes for the company in question reflect a mix of investor sentiment and market positioning by various financial institutions.

1. **HSBC Securities – June 4, 2025**: HSBC Securities downgraded their rating from “Hold” to “Reduce,” concurrently lowering the target price from $13 to $10. This adjustment suggests a bearish outlook from HSBC, indicating a potential decline in the company’s stock value or a reevaluation of its future growth prospects. The significant reduction in target price points to concerns over operational performance or market conditions impacting the company adversely.

2. **Morgan Stanley – May 20, 2025**: Morgan Stanley shifted their stance from “Equal-Weight” to “Underweight” without a specified target price adjustment from the previous $14. This downgrade implies that Morgan Stanley forecasts the company’s performance to lag relative to the broader market or its sector peers, advising investors to decrease their exposure to mitigate potential risks.

3. **KeyBanc Capital Markets – December 6, 2024**: KeyBanc Capital Markets upgraded the company from “Underweight” to “Sector Weight.” This change indicates a neutral view on the stock, suggesting that earlier concerns may have been addressed or that the company’s market performance is expected to align more closely with sector averages. The absence of a new target price could imply a wait-and-see approach, pending further clarity on the company’s strategic direction and market conditions.

4. **Scotiabank – November 19, 2024**: Scotiabank initiated coverage with a “Sector Perform” rating and a target price of $15. This initiation at a neutral stance suggests that Scotiabank views the company as adequately valued at its current price, with expected performance in line with the sector average. The target price of $15 indicates a baseline valuation given the prevailing market conditions at the time of initiation.

These ratings and adjustments provide crucial insights into the financial community’s perception of the company’s value and potential, guiding investors in their decision-making processes.

As of the latest data, the current stock price stands at $14.23. This price is closely aligned with the recent analyst ratings and target prices. Notably, Scotiabank initiated coverage with a “Sector Perform” rating and a target price of $15, suggesting a slight potential upside. However, subsequent ratings indicate a bearish outlook, with Morgan Stanley downgrading the stock from “Equal-Weight” to “Underweight” without specifying a new target price, and HSBC Securities lowering their rating from “Hold” to “Reduce” and adjusting their target price significantly downward from $13 to $10.

This series of downgrades, particularly the sharp target price reduction by HSBC, suggests that analysts are anticipating weaker future performance, which could be reflective of underlying challenges in earnings potential or market conditions impacting the stock. The absence of specific earnings per share (EPS) and dividend trends in the provided data limits a detailed analysis of financial health and shareholder returns, but the prevailing analyst sentiment appears cautious, with a lean towards a bearish outlook on the stock’s value.