Asian Markets Steady as S&P/NZX 50 Gains on Positive Economic Outlook

Note: This analysis covers the Asian trading session close for October 30, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3986.90 | -0.73 |

| Nikkei 225 | 51325.61 | +0.04 |

| Hang Seng Index | 26282.69 | -0.24 |

| Shenzhen Component | 13532.13 | -1.16 |

| KOSPI | 4086.89 | +0.14 |

| S&P/ASX 200 | 8885.50 | -0.46 |

| NIFTY 50 | 25877.85 | -0.68 |

| Straits Times Index | 4437.44 | -0.06 |

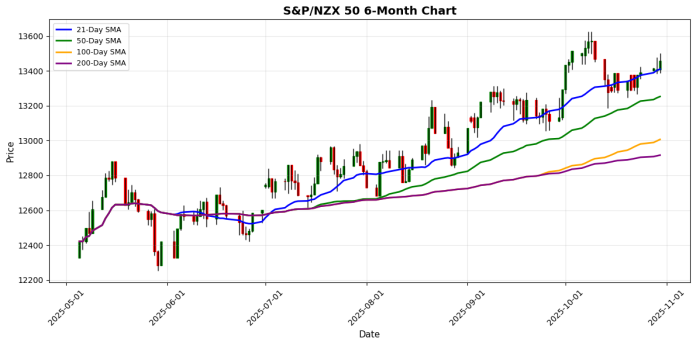

| S&P/NZX 50 | 13459.29 | +0.37 |

| Thailand SET Index | 1314.65 | -0.08 |

| FTSE Bursa Malaysia KLCI | 1614.20 | +0.17 |

| TAIEX | 28287.53 | -0.03 |

📰 Market Commentary

On October 30, 2025, Asian markets exhibited mixed performance amid various regional developments and external influences. The Bank of Japan (BOJ) Governor Kazuo Ueda expressed increased optimism regarding the Japanese economy and inflation, suggesting that the likelihood of achieving the BOJ’s economic outlook has improved. This sentiment contributed to a slight uptick in the Nikkei 225, which closed up by 0.04%. However, the broader Asian market faced headwinds from geopolitical concerns and economic data.

In China, the Shanghai Composite fell by 0.73%, while the Shenzhen Component experienced a more significant decline of 1.16%. The negative sentiment was partly driven by a police crackdown on a syndicate selling counterfeit semiconductor chips, highlighting ongoing vulnerabilities in the technology supply chain amid U.S. export controls. This incident underscores the challenges faced by Chinese manufacturers, further exacerbating concerns about the country’s economic slowdown.

Market sentiment was also influenced by external factors, including comments from U.S. President Donald Trump regarding the potential resumption of nuclear testing, which could heighten geopolitical tensions and impact investor confidence in the region. In South Korea, the KOSPI managed a modest gain of 0.14%, buoyed by a strong performance from Hybe Corporation, which saw its market value increase by $644 million following a favorable court ruling related to a contract for its popular K-pop group, NewJeans.

In the financial sector, Standard Chartered reported a 10% rise in pre-tax profits for the third quarter, prompting an upgrade in its return on tangible equity (RoTE) targets. This positive news contributed to a generally favorable outlook for banks operating in emerging markets, despite the broader market’s mixed performance.

Additionally, a report highlighted that nearly half of senior roles in Hong Kong’s financial sector are now held by women, reflecting significant progress toward gender parity in leadership positions. This development is indicative of a more inclusive corporate environment, which could enhance the region’s attractiveness to global investors.

Overall, while some indices showed resilience, the prevailing market sentiment remains cautious due to geopolitical uncertainties and economic challenges, particularly in China. As investors navigate these complexities, the focus will likely remain on regional economic indicators and external geopolitical developments.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-29 | 02:30 | 🇯🇵 | Medium | BoJ Press Conference | ||

| 2025-10-29 | 19:30 | 🇯🇵 | Medium | Tokyo Core CPI (YoY) (Oct) | 2.6% | |

| 2025-10-29 | 19:50 | 🇯🇵 | Medium | Industrial Production (MoM) (Sep) | 1.5% | |

| 2025-10-29 | 21:30 | 🇨🇳 | Medium | Chinese Composite PMI (Oct) | ||

| 2025-10-29 | 21:30 | 🇨🇳 | High | Manufacturing PMI (Oct) | 49.6 | |

| 2025-10-29 | 21:30 | 🇨🇳 | Medium | Non-Manufacturing PMI (Oct) | 50.1 | |

| 2025-10-29 | 22:30 | 🇯🇵 | Medium | BoJ Monetary Policy Statement | ||

| 2025-10-29 | 23:00 | 🇯🇵 | Medium | BoJ Outlook Report (YoY) | ||

| 2025-10-29 | 23:00 | 🇯🇵 | High | BoJ Interest Rate Decision | 0.50% | 0.50% |

On October 30, 2025, several high-impact economic events from Asia were released, particularly from Japan and China, which are crucial for traders to monitor.

The Bank of Japan (BoJ) maintained its interest rate at 0.50%, aligning with forecasts, indicating a steady approach amidst ongoing economic challenges. However, the Tokyo Core CPI for October, with a forecast of 2.6%, remains unreported, leaving inflation expectations uncertain. Additionally, the Industrial Production for September, expected to rise by 1.5%, also lacks reported data, which could impact market sentiment regarding Japan’s economic recovery.

In China, the Manufacturing PMI for October is reported at 49.6, slightly below the forecast, indicating continued contraction in the manufacturing sector. Conversely, the Non-Manufacturing PMI is projected at 50.1, suggesting slight expansion in services. The divergence between these PMIs reflects mixed economic signals, which may lead to volatility in Chinese equities.

Overall, the consistency in Japan’s interest rate and the mixed PMI data from China suggest a cautious outlook for Asian indices. Traders should prepare for potential fluctuations, especially in Japanese and Chinese markets, as investors digest these economic indicators.

💱 FX, Commodities & Crypto

In recent trading sessions, the foreign exchange market showed notable movements, with the USD/JPY rising by 1.00% to 154.1750, driven by expectations of continued interest rate hikes by the Federal Reserve. The USD/CNY and USD/SGD also experienced slight gains, while the AUD/USD and NZD/USD declined, reflecting concerns over economic growth in Australia and New Zealand. The USD/INR increased by 0.34%, influenced by domestic inflation pressures in India.

In commodities, gold prices edged down by 0.23% to $3,991.10, while crude oil fell by 0.51% to $60.17, impacted by ongoing supply concerns and fluctuating demand forecasts amid global economic uncertainties.

In the cryptocurrency sector, Bitcoin and Ethereum both saw declines of 0.65% and 0.84%, respectively, as market sentiment remains cautious amid regulatory scrutiny and macroeconomic pressures.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 154.18 | +1.00 |

| USD/CNY | 7.11 | +0.19 |

| USD/SGD | 1.30 | +0.24 |

| AUD/USD | 0.66 | -0.29 |

| NZD/USD | 0.58 | -0.19 |

| USD/INR | 88.66 | +0.34 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 3991.10 | -0.23 |

| Crude Oil | 60.17 | -0.51 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 109346.00 | -0.65 |

| Ethereum | 3870.94 | -0.84 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.