Asian Markets Steady with Straits Times Index Leading Modest Gains

Note: This analysis covers the Asian trading session close for October 28, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

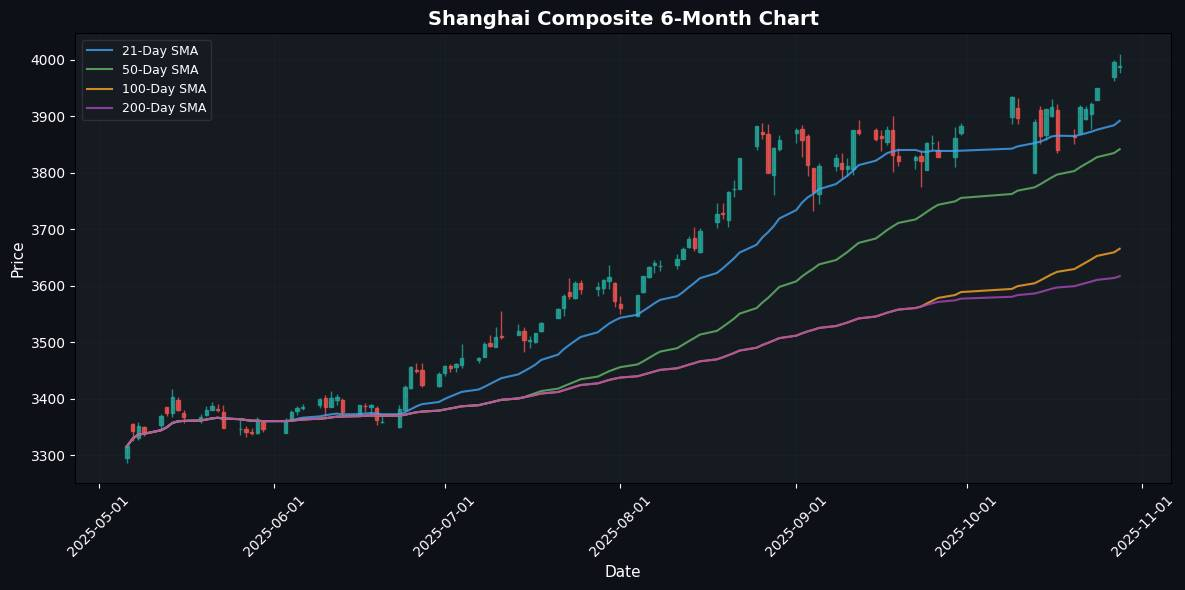

| Shanghai Composite | 3988.22 | -0.22 |

| Nikkei 225 | 50219.18 | -0.58 |

| Hang Seng Index | 26346.14 | -0.33 |

| Shenzhen Component | 13430.10 | -0.44 |

| KOSPI | 4010.41 | -0.80 |

| S&P/ASX 200 | 9012.50 | -0.48 |

| NIFTY 50 | 25936.20 | -0.11 |

| Straits Times Index | 4450.36 | +0.23 |

| S&P/NZX 50 | 13402.66 | +0.08 |

| Thailand SET Index | 1314.28 | -0.70 |

| FTSE Bursa Malaysia KLCI | 1613.56 | -0.30 |

| TAIEX | 27949.11 | -0.16 |

📰 Market Commentary

On October 28, 2025, Asian markets experienced a generally negative performance, influenced by a combination of geopolitical developments and economic indicators. A key driver was the anticipated bilateral talks between Japan’s Prime Minister Takaichi and South Korean officials at the upcoming APEC summit. While these discussions are expected to bolster regional cooperation, concerns over lavish spending plans under Takaichi’s leadership have raised questions about Japan’s economic recovery trajectory.

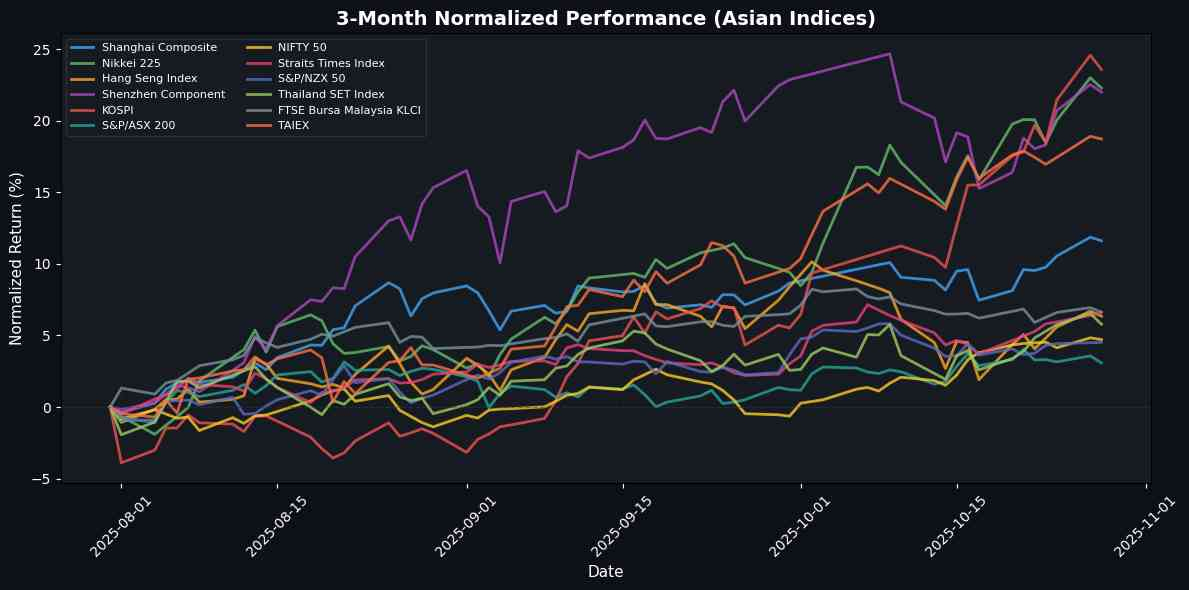

Market indices reflected this uncertainty, with the Nikkei 225 declining by 0.58% and the KOSPI falling by 0.80%. The Hang Seng Index and Shanghai Composite also recorded losses, down 0.33% and 0.22%, respectively. Notably, rare earth stocks continued to struggle as the U.S. anticipated delays in China’s export controls, further dampening investor sentiment across the region.

South Korea’s economic landscape, however, showcased resilience, with the third-quarter GDP growth marking the fastest increase in over a year, driven by robust exports and manufacturing. This positive development contrasts with the broader market trends, highlighting a divergence in regional economic performance.

In Hong Kong, Finance Secretary Paul Chan emphasized the importance of public-private partnerships to maintain the city’s competitiveness, particularly in light of its ranking as the second most resilient economy in Asia against U.S. tariff shocks. Meanwhile, the Straits Times Index in Singapore managed a slight gain of 0.23%, signaling some localized strength amidst the overarching market decline.

Overall, the Asian markets on October 28, 2025, reflect a complex interplay of economic growth in specific areas, overshadowed by geopolitical tensions and investor caution.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

No significant economic events during Asian session.

📈 Main Index Charts

Nikkei 225

Hang Seng Index

Shanghai Composite

Shenzhen Component

KOSPI

S&P/ASX 200

NIFTY 50

Straits Times Index

💱 FX, Commodities & Crypto

In the foreign exchange market, the USD/JPY pair saw a notable decline of 0.48%, influenced by market sentiment surrounding U.S. monetary policy and Japan’s economic outlook. The USD/CNY also dipped slightly by 0.13%, reflecting ongoing trade tensions and China’s economic performance. Conversely, AUD/USD gained 0.15%, buoyed by strong commodity prices and Australian economic resilience.

In commodities, gold prices fell by 1.57% to $3,955.80, driven by a stronger U.S. dollar and rising interest rates, while crude oil prices decreased by 1.09% to $60.66 amid concerns over global demand.

In the cryptocurrency market, Bitcoin rose by 1.18% to $115,466.27, supported by increased institutional interest, while Ethereum increased by 0.65% to $4,147.34, reflecting broader market optimism and technological advancements within the blockchain space.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 152.11 | -0.48 |

| USD/CNY | 7.10 | -0.13 |

| USD/SGD | 1.29 | -0.12 |

| AUD/USD | 0.66 | +0.15 |

| NZD/USD | 0.58 | -0.02 |

| USD/INR | 88.26 | +0.10 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 3955.80 | -1.57 |

| Crude Oil | 60.66 | -1.09 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 115466.27 | +1.18 |

| Ethereum | 4147.34 | +0.65 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.