Top 10 Performers

Broadcom Inc (AVGO) (9.49%)

Recent News (Last 24 Hours)

Broadcom Inc. (AVGO) has experienced a significant surge in its stock price, following the announcement of a multi-year partnership with OpenAI to develop up to 10 gigawatts of custom chips. This collaboration, highlighted across multiple financial news sources including CNBC, Yahoo Finance, and Bloomberg, positions Broadcom at the forefront of AI technology infrastructure, potentially reshaping its market standing and investor appeal.

Bernstein has reaffirmed a bullish outlook on Broadcom, citing robust demand in AI and compute solutions, which is likely to bolster investor confidence further. The strategic importance of this partnership is underscored by the immediate market reaction, with Broadcom’s stock jumping over 7% as reported by Yahoo Finance and other outlets.

This deal not only enhances Broadcom’s product offerings but also solidifies its competitive position against other major players in the semiconductor industry. The focus on co-packaged optics technology, another area where Broadcom has hit key milestones, complements its expansion into AI chip production, potentially driving long-term growth in its stock value.

Overall, the partnership with OpenAI could be a transformative development for Broadcom, promising substantial impacts on its market performance and investor perceptions.

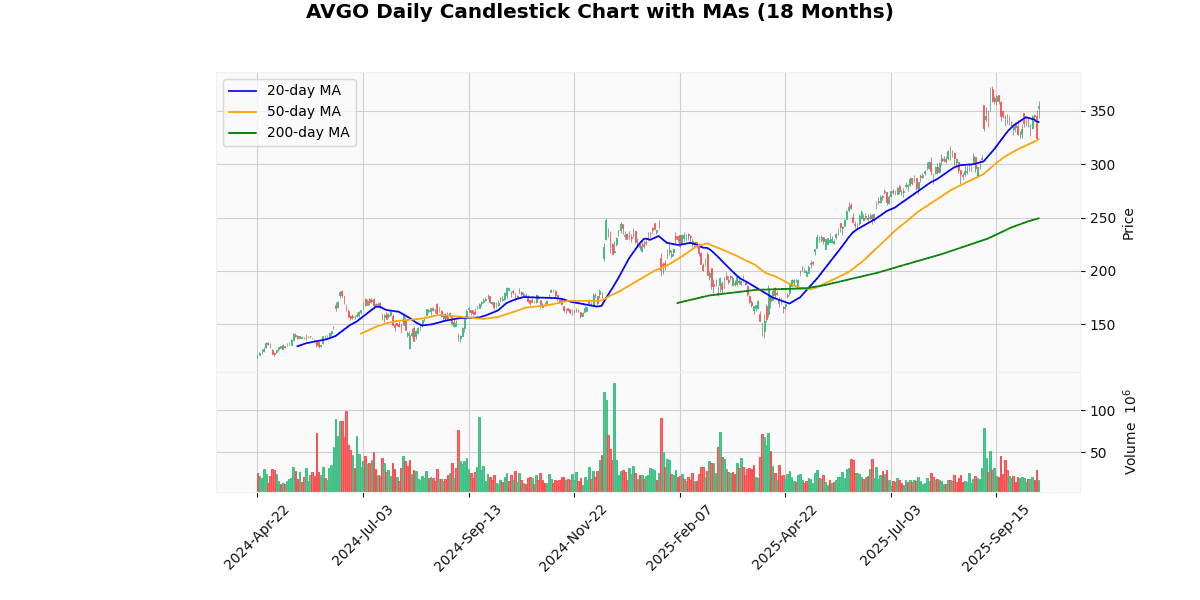

Technical Analysis

The current price of the asset at $353.4 indicates a strong upward trend when analyzed against its moving averages (MAs). The 20-day MA at $339.5 and the 50-day MA at $323.39 both sit significantly below the current price, suggesting a bullish short-term momentum. This is further underscored by the 200-day MA at $249.34, which highlights a robust long-term uptrend. The considerable gap between the current price and the 200-day MA may also suggest that the price has accelerated faster than its longer-term average, potentially indicating overextension in the market. Investors might view this as a strong positive signal, but should also be wary of potential volatility or corrections, as the market may need to consolidate gains. Overall, the asset appears well-positioned for further growth, albeit with caution advised due to the steep ascent in recent periods.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-09-15 00:00:00 | Initiated | Macquarie | Outperform | $420 |

| 2025-09-05 00:00:00 | Reiterated | TD Cowen | Buy | $355 → $370 |

| 2025-08-28 00:00:00 | Reiterated | Oppenheimer | Outperform | $305 → $325 |

| 2025-07-10 00:00:00 | Initiated | Goldman | Buy | $315 |

Monolithic Power System Inc (MPWR) (8.73%)

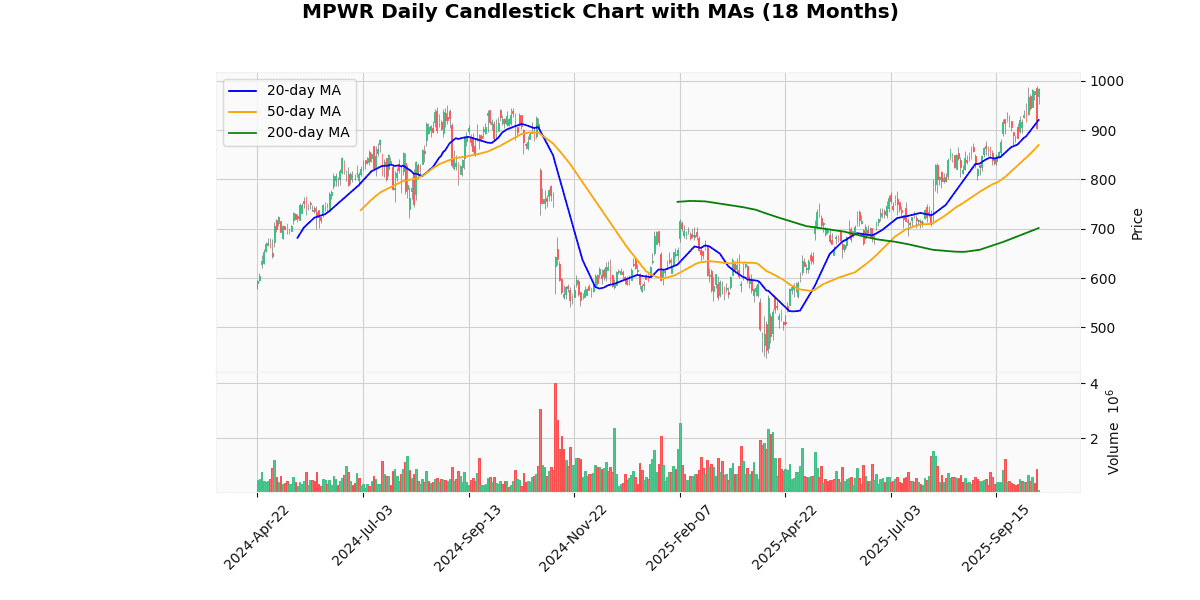

Technical Analysis

The current price of the asset at 972.2 indicates a robust upward trend when analyzed against its moving averages (MAs). The 20-day MA at 920.02, 50-day MA at 869.49, and 200-day MA at 701.27 all suggest a strong bullish momentum, as the current price is significantly above all three averages. This positioning above the short-term (20-day), medium-term (50-day), and long-term (200-day) MAs typically signals strong buyer confidence and potential continuation of the uptrend. The substantial gap between the current price and the 200-day MA highlights the accelerated price appreciation over the longer term. Investors might view this as a positive market sentiment, potentially attracting more buyers, although caution about overvaluation becomes pertinent if prices continue to stretch far above the long-term averages.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-03 00:00:00 | Reiterated | Citigroup | Buy | $825 → $1100 |

| 2025-05-02 00:00:00 | Reiterated | TD Cowen | Buy | $600 → $675 |

| 2024-12-11 00:00:00 | Initiated | Citigroup | Buy | $700 |

| 2024-11-22 00:00:00 | Initiated | Wells Fargo | Equal Weight | $610 |

Best Buy Co. Inc (BBY) (7.02%)

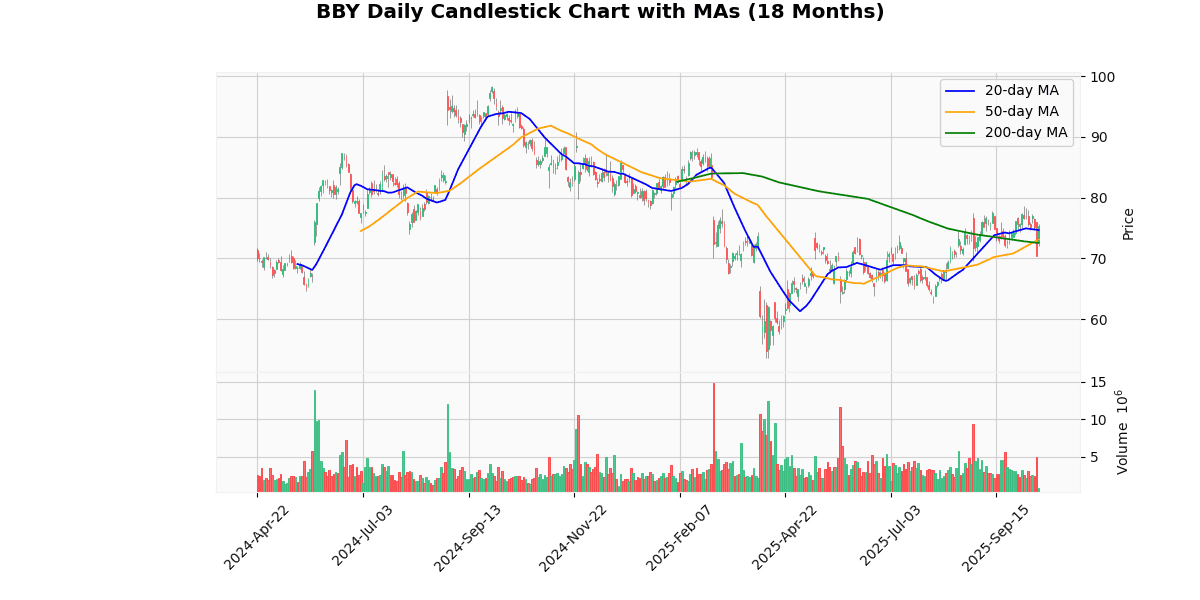

Technical Analysis

Failed to generate section: Too short (116 words). Partial content: The current price of the asset at $74.94 exhibits …

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-07-14 00:00:00 | Downgrade | Piper Sandler | Overweight → Neutral | $75 |

| 2025-05-23 00:00:00 | Reiterated | Telsey Advisory Group | Outperform | $100 → $90 |

| 2025-04-03 00:00:00 | Downgrade | Citigroup | Buy → Neutral | $70 |

| 2025-03-05 00:00:00 | Reiterated | Telsey Advisory Group | Outperform | $110 → $100 |

Albemarle Corp (ALB) (6.82%)

Recent News (Last 24 Hours)

Recent financial news highlights significant movements in the stock market, particularly in sectors deemed ‘critical’ by political and financial leaders. According to a MarketWatch report dated October 13, 2025, stocks in these critical industries are experiencing a surge following JPMorgan’s decision to emulate former President Trump’s investment strategy. This move by JPMorgan could signal a broader financial endorsement of these sectors, potentially leading to increased investor confidence and capital inflow, which might bolster stock prices further.

Additionally, Barrons.com reported on the same day that stocks like MP Materials are rallying due to geopolitical tensions and policies related to rare earth materials involving the U.S. and China. This situation underscores the impact of international relations on commodity-based stocks, suggesting that companies involved in these materials could see continued volatility based on geopolitical developments.

Investors should monitor these trends closely, as shifts in investment strategies by major banks like JPMorgan and international political dynamics could have significant implications for portfolio adjustments and long-term investment strategies in the affected sectors.

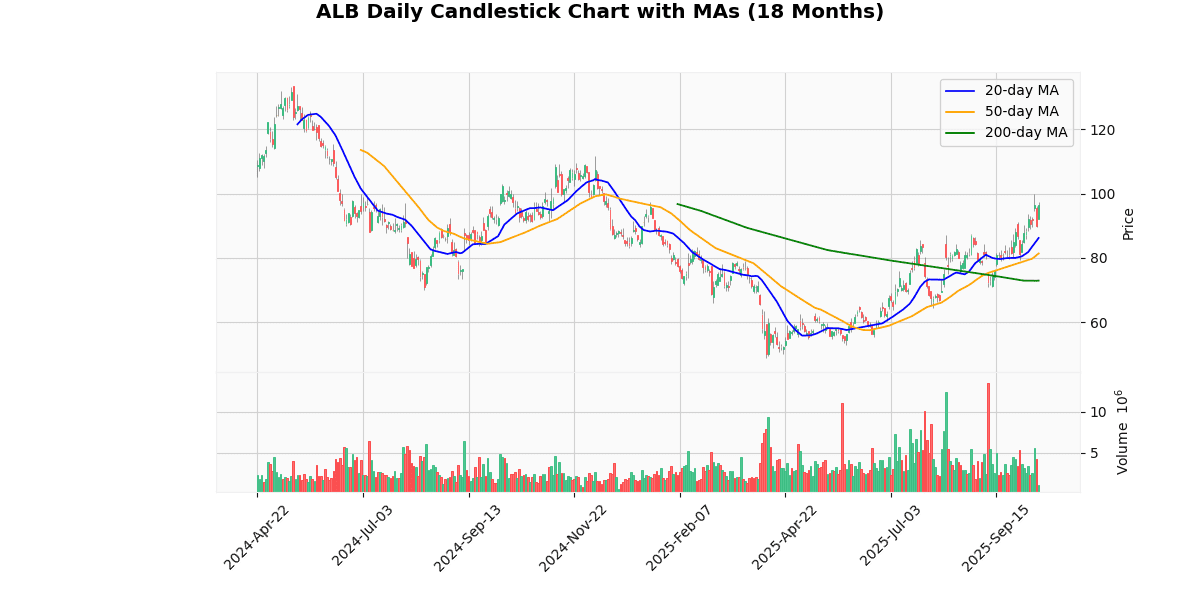

Technical Analysis

The current price of the asset at $96.36 shows a significant upward trend when compared to its moving averages (MA) over different time frames: 20-day MA at $86.21, 50-day MA at $81.37, and 200-day MA at $72.97. This indicates a strong bullish momentum in the short to medium term, as the current price is well above all listed moving averages. The consistent increase in moving averages from the 200-day to the 20-day suggests that the price has been on a steady incline over a longer period, reinforcing the bullish outlook. Investors might view these metrics as a signal of robust market positioning and potentially growing investor confidence. However, such a steep incline could also prompt considerations of overvaluation, warranting a cautious approach for potential corrections or pullbacks.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-08-26 00:00:00 | Upgrade | UBS | Sell → Neutral | $89 |

| 2025-07-30 00:00:00 | Downgrade | KeyBanc Capital Markets | Overweight → Sector Weight | |

| 2025-07-29 00:00:00 | Downgrade | Robert W. Baird | Neutral → Underperform | $60 |

| 2025-07-11 00:00:00 | Downgrade | UBS | Neutral → Sell | $57 |

Estee Lauder Cos. Inc (EL) (6.62%)

Recent News (Last 24 Hours)

In recent financial news, Estee Lauder has seen a positive shift with Goldman Sachs upgrading its rating due to an anticipated rebound in China and recovery in travel retail sectors. This upgrade could signal a bullish outlook for Estee Lauder’s stock, potentially increasing investor confidence and driving up its share price. The upgrade is particularly noteworthy as it reflects broader market recovery trends and Estee Lauder’s strategic positioning to capitalize on these opportunities.

In other news, the semiconductor industry is experiencing shifts in analyst sentiments. Intel has been downgraded while Micron has received an upgrade. This realignment could influence the stock performance of both companies, with potential negative impacts on Intel’s stock price and positive implications for Micron. Investors in the tech sector should monitor these developments closely, as they could affect sector dynamics and individual investment decisions.

Additionally, Estee Lauder’s inclusion in Michael Burry’s stock portfolio as highlighted by Insider Monkey suggests a strong vote of confidence from a renowned investor, possibly influencing other investors to follow suit and bolstering Estee Lauder’s market position further.

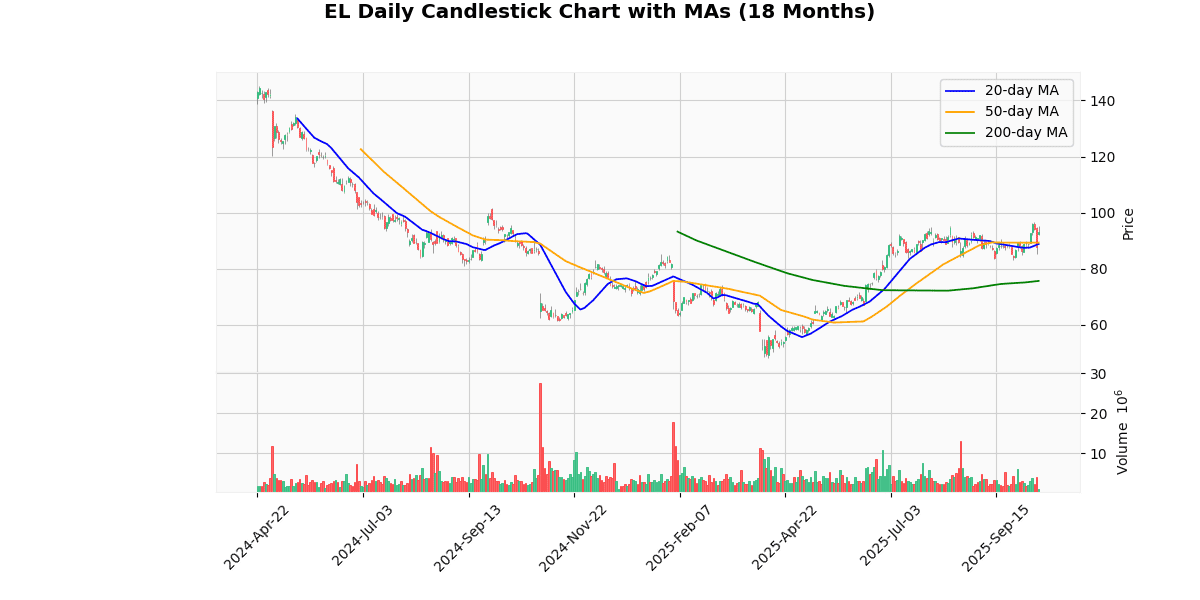

Technical Analysis

The current price of the asset at $92.43 indicates a robust upward trend when analyzed against its moving averages (MAs). The 20-day MA at $88.74 and the 50-day MA at $89.26, both below the current price, suggest a strong short-term bullish sentiment. This is further reinforced by the price being significantly above the 200-day MA of $75.58, indicating a solid long-term upward momentum. The consistent increase in MAs and the current price surpassing these averages highlight a potential bullish market positioning. Investors might view these indicators as a confirmation of continuing strength in the asset’s price, possibly driven by underlying positive market factors or investor confidence. Caution should be advised as such trends could also invite price corrections if rapid gains are perceived as overextensions.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-13 | Upgrade | Goldman | Neutral → Buy | $115 |

| 2025-08-14 00:00:00 | Reiterated | Telsey Advisory Group | Market Perform | $66 → $99 |

| 2025-07-25 00:00:00 | Upgrade | JP Morgan | Neutral → Overweight | $101 |

| 2025-07-10 00:00:00 | Resumed | BofA Securities | Buy | $110 |

ON Semiconductor Corp (ON) (6.12%)

Recent News (Last 24 Hours)

MP Materials Corp. (MP) experienced a notable increase in its stock price as reported on October 13, 2025, amid escalating U.S.-China trade tensions. This movement reflects the market’s sensitivity to geopolitical events, particularly those affecting sectors reliant on international trade and supply chains. As a producer of rare earth materials, MP Materials is strategically positioned within the trade dynamics between the U.S. and China, two major global players in the rare earths market essential for various high-tech and defense applications.

The rise in MP Materials’ shares suggests investor confidence in the company’s ability to leverage these tensions to its advantage, possibly due to anticipated protective measures or incentives from the U.S. government aimed at bolstering domestic production capabilities against foreign dependency. This scenario could lead to enhanced profitability and market share growth for MP Materials if trade barriers increase the costs or restrict the availability of imported rare earths. Investors should monitor ongoing trade negotiations and regulatory changes, as these factors could significantly impact MP Materials’ operational landscape and stock performance.

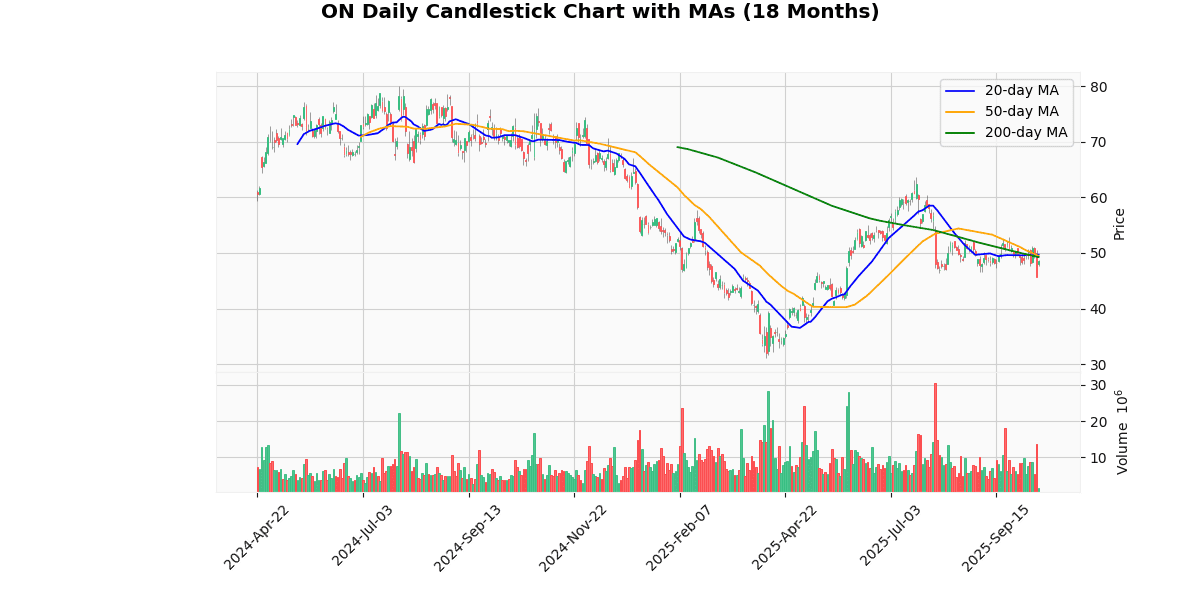

Technical Analysis

The current price of $48.24 is positioned below all key moving averages: the 20-day MA at $49.69, the 50-day MA at $49.44, and the 200-day MA at $49.25. This configuration indicates a bearish trend in the short to medium term, as the price is trading below these critical benchmarks, which often act as resistance levels. The fact that the current price is below the 20-day MA suggests recent weakness, while being under the 50-day and 200-day MAs points to a potentially more entrenched downtrend. Investors might view these levels as potential resistance points for any upward price movements. If the price fails to break above these averages soon, the bearish sentiment could strengthen, leading to further declines. Conversely, a move above these averages could signal a shift in market sentiment, potentially leading to a bullish reversal.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-08-05 00:00:00 | Reiterated | TD Cowen | Buy | $68 → $55 |

| 2025-08-05 00:00:00 | Downgrade | BofA Securities | Buy → Neutral | $56 |

| 2025-07-10 00:00:00 | Initiated | Goldman | Neutral | $60 |

| 2025-06-18 00:00:00 | Initiated | Cantor Fitzgerald | Neutral | $55 |

Dollar Tree Inc (DLTR) (5.95%)

Recent News (Last 24 Hours)

In a recent article published by StockStory on October 13, 2025, titled “3 Profitable Stocks We Keep Off Our Radar,” the focus shifted to a trio of companies that, despite demonstrating profitability, are not currently recommended for inclusion in investment portfolios. The article did not specify the reasons these stocks are being overlooked, which could range from overvaluation, lack of growth potential, market saturation, or underlying financial or operational issues that might not be apparent from profitability alone.

For investors, this analysis suggests a need for caution. Stocks often overlooked by market analysts or investment firms might carry hidden risks not immediately evident through a superficial examination of their financial statements. The potential impact on the stock market could be significant, particularly if these companies are large enough to influence market indices or sectors. Investors should consider deeper due diligence or await further analysis that clarifies the reasons behind the exclusion of these profitable stocks from recommended portfolios.

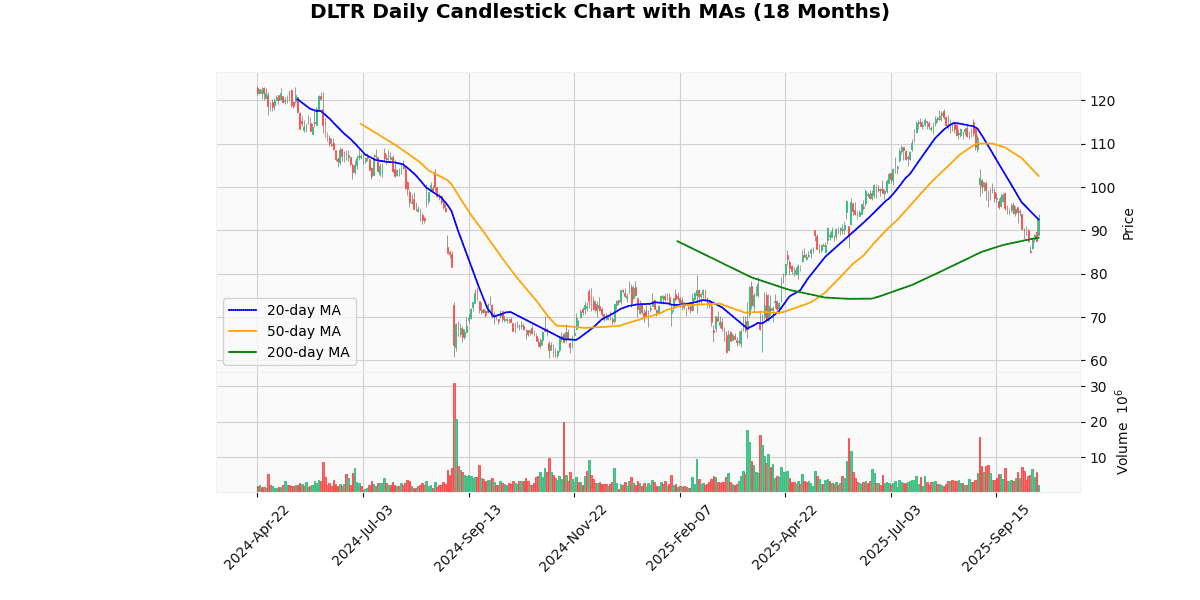

Technical Analysis

The current price of the asset at $92.49 is closely aligned with the 20-day moving average (MA20) of $92.48, suggesting a short-term stabilization in price movement. However, the asset is trading below the 50-day moving average (MA50) of $102.56, indicating a bearish trend over the medium term. This discrepancy between the MA20 and MA50 could signal potential volatility or a downward pressure on the price. On a more positive note, the current price is above the 200-day moving average (MA200) of $88.33, which could suggest a longer-term upward trend. Investors might view this as a sign of overall bullish sentiment in the longer term, despite recent pullbacks. Market participants should monitor these moving averages closely as they could provide key resistance or support levels.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-07 00:00:00 | Downgrade | Jefferies | Hold → Underperform | $70 |

| 2025-09-18 00:00:00 | Resumed | Wolfe Research | Peer Perform | |

| 2025-09-03 00:00:00 | Downgrade | Gordon Haskett | Hold → Reduce | $95 |

| 2025-08-29 00:00:00 | Upgrade | Telsey Advisory Group | Market Perform → Outperform | $100 → $130 |

Warner Bros. Discovery Inc (WBD) (5.06%)

Recent News (Last 24 Hours)

Recent financial news highlights several key developments that could influence stock market dynamics. Notably, MP Materials’ shares have risen amid easing U.S.-China trade tensions, a factor that could potentially bolster investor confidence in sectors sensitive to geopolitical shifts (MarketWatch). This development is particularly significant given the current global economic climate, where trade relations play a crucial role in market movements.

Furthermore, Warner Bros. Discovery’s rejection of a takeover bid from Paramount Skydance, as reported by CNBC TV, introduces potential volatility in the media sector. Such corporate actions often lead to speculative trading, impacting not only the stocks involved but also broader market sentiment.

Additionally, Zacks has spotlighted two consumer discretionary stocks, suggesting a strategic opportunity for investors. Consumer discretionary stocks are typically sensitive to market sentiment and economic indicators, implying that positive analyst coverage could lead to increased investor interest in this sector.

Overall, these developments suggest a cautiously optimistic outlook for the stock market, with specific opportunities in consumer discretionary and media stocks, alongside potential stability from sectors benefiting from eased trade tensions. Investors should monitor these trends closely, as they could significantly impact portfolio performance.

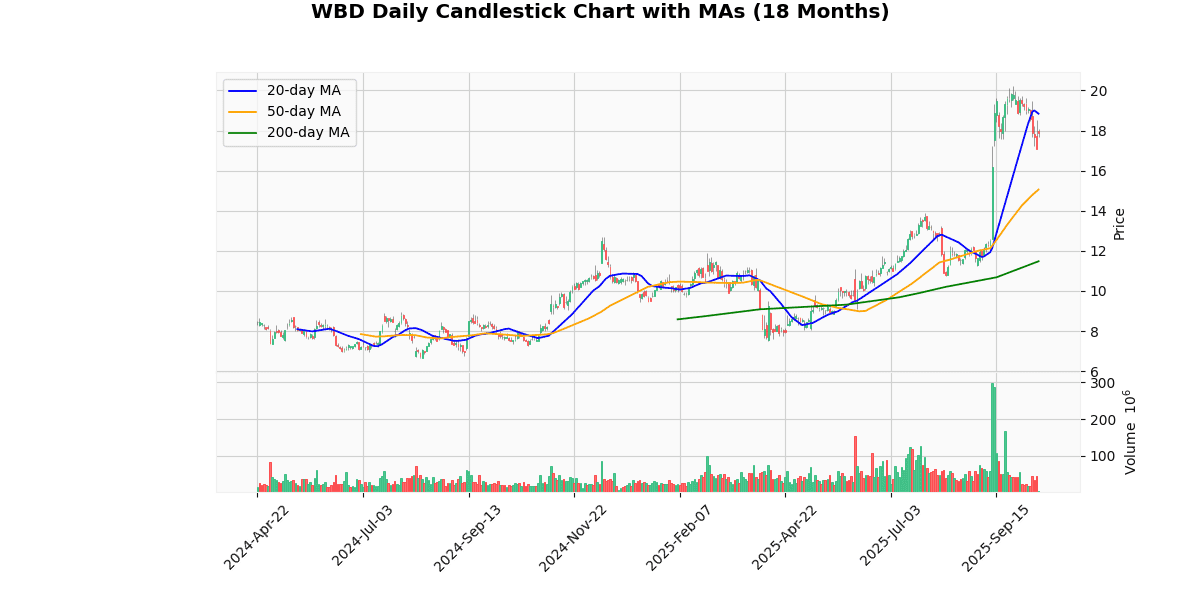

Technical Analysis

The current price of the asset at $17.91 indicates a recent downtrend as it is positioned below the 20-day moving average (MA20) of $18.84, suggesting short-term bearish sentiment. However, the price is well above both the 50-day and 200-day moving averages, at $15.06 and $11.48 respectively, indicating a strong bullish trend in the medium to long term. The significant gap between the MA200 and the current price highlights substantial gains over a longer period, reflecting sustained investor confidence and a potentially strong foundational support level. The recent dip below the MA20 could represent a corrective phase within a broader upward trajectory or a potential pivot point for traders. Investors might consider monitoring upcoming trading sessions for signs of stabilization or continuation of the current pullback before making further commitments.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-09-26 00:00:00 | Downgrade | KeyBanc Capital Markets | Overweight → Sector Weight | |

| 2025-09-16 00:00:00 | Downgrade | TD Cowen | Buy → Hold | $14 |

| 2025-01-21 00:00:00 | Upgrade | MoffettNathanson | Neutral → Buy | $9 → $13 |

| 2024-11-11 00:00:00 | Upgrade | Wolfe Research | Underperform → Peer Perform |

Applied Materials Inc (AMAT) (4.94%)

Recent News (Last 24 Hours)

In recent financial news, Cantor Fitzgerald has reaffirmed its Overweight rating on Applied Materials (AMAT) with a price target of $225. This endorsement, as reported by Insider Monkey, could potentially bolster investor confidence in AMAT, possibly leading to an uptick in its stock price as market perceptions align with Cantor Fitzgerald’s positive outlook.

Simultaneously, investors are keenly observing ASML Holding as it approaches its Q3 earnings release. Zacks has provided insights on how investors might strategize around ASML’s stock during this period. The anticipation surrounding these earnings and the strategies suggested could influence trading behaviors, potentially impacting ASML’s stock performance in the short term.

Both pieces of news are crucial for stakeholders in the semiconductor equipment sector, suggesting a period of significant activity and potential volatility based on these firms’ financial outlooks and market expectations. Investors should consider these factors when making portfolio decisions related to Applied Materials and ASML Holding.

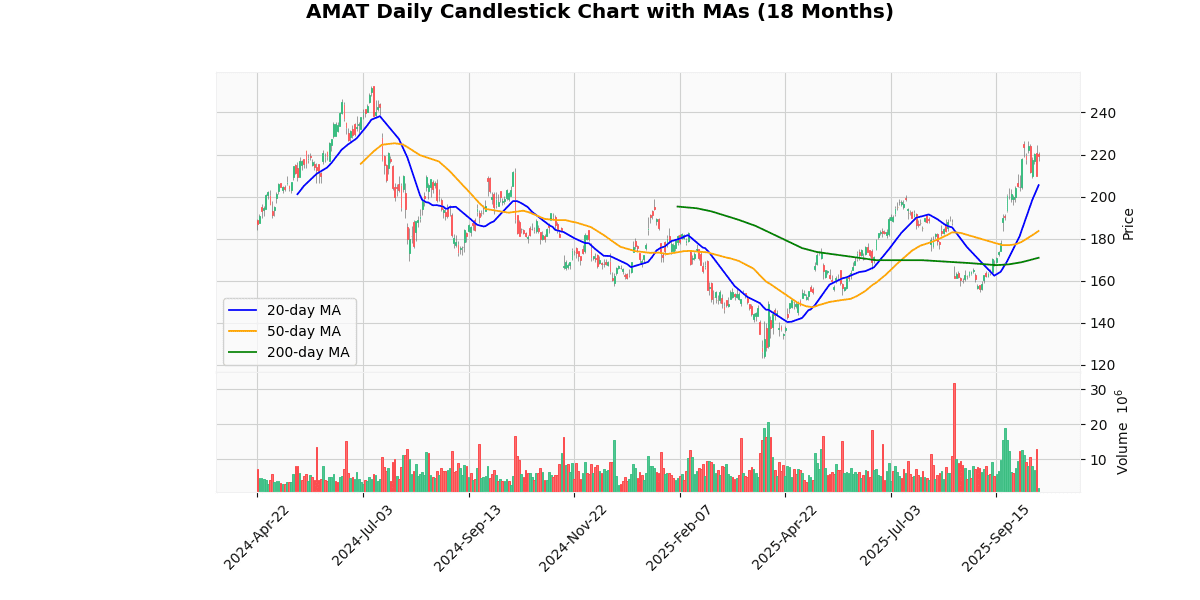

Technical Analysis

The current price of the asset at $218.87 indicates a robust upward trend, as it stands significantly above all key moving averages: 20-day MA at $205.43, 50-day MA at $183.63, and 200-day MA at $170.88. This positioning above all major moving averages suggests strong bullish momentum in the short, medium, and long term. The gap between the current price and these averages is particularly notable with the 200-day MA, highlighting a sustained positive trajectory over a longer period. Investors might view these metrics as a sign of potential continued upward movement, given the asset’s consistent performance above these trend indicators. However, the steep rise relative to the 200-day MA could also signal overextension, warranting caution for potential reversion or consolidation phases.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-13 | Upgrade | BofA Securities | Neutral → Buy | $250 |

| 2025-09-22 00:00:00 | Upgrade | Morgan Stanley | Equal-Weight → Overweight | $209 |

| 2025-09-12 00:00:00 | Downgrade | Mizuho | Outperform → Neutral | $175 |

| 2025-08-20 00:00:00 | Downgrade | Daiwa Securities | Outperform → Neutral | $170 |

Ross Stores Inc (ROST) (4.86%)

Recent News (Last 24 Hours)

Ross Stores has recently expanded its retail footprint by opening 40 new locations, as reported on October 13, 2025, by PR Newswire. This significant expansion could potentially enhance the company’s market presence and revenue streams, indicating a bullish outlook for the stock. Investors might view this expansion as a positive signal of Ross Stores’ growth strategy and operational confidence, particularly in a retail environment that has been challenging for many players.

Additionally, a recent analysis by StockStory, also dated October 13, 2025, highlighted Ross Stores as a “safe-and-steady” stock worth investigating. This designation suggests a perception of Ross Stores as a stable investment, likely due to its consistent performance and strategic expansion efforts. Such a reputation can attract more conservative investors looking for reliable returns in volatile markets.

Together, these developments could positively influence investor sentiment and potentially boost Ross Stores’ stock performance in the near term as the company capitalizes on its expanded operational base and solid market reputation.

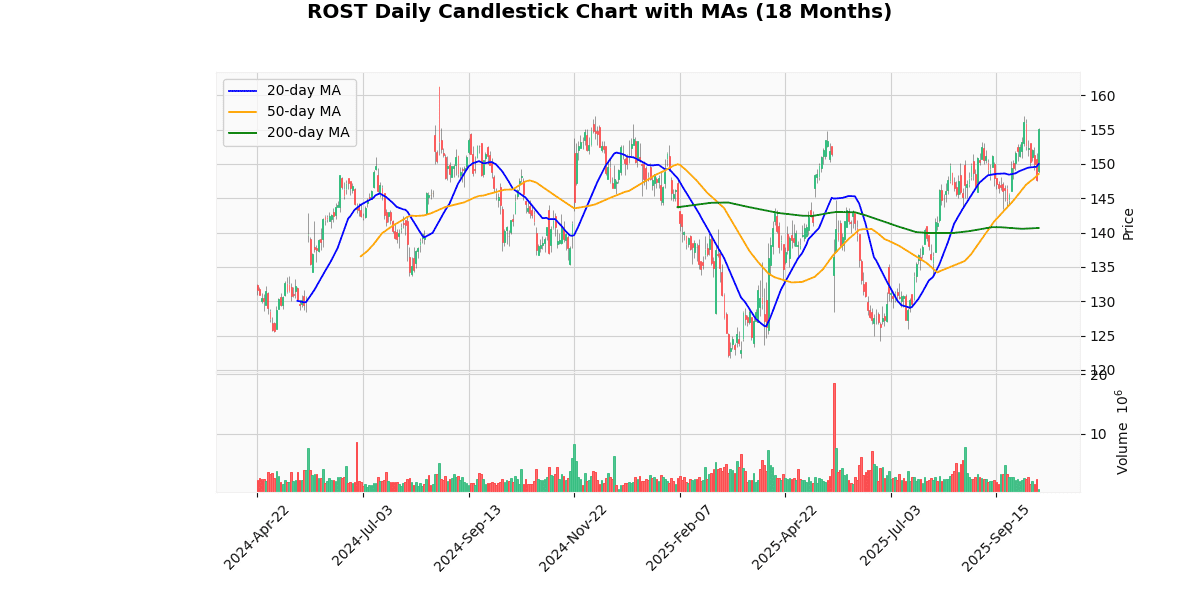

Technical Analysis

The current price of the asset at $154.46 shows a notable uptrend when analyzed against its moving averages (MAs). It is trading above the 20-day MA of $149.96, the 50-day MA of $148.52, and significantly higher than the 200-day MA of $140.67. This positioning indicates a strong bullish momentum in the short to medium term, as the price is consistently higher than all key MAs, suggesting sustained buying interest.

The gap between the current price and the 200-day MA is particularly indicative of a robust upward trend over a longer period. Investors might view the current levels above all three MAs as a confirmation of a stable upward trajectory, potentially attracting more buyers into the market. However, vigilance is advised as such trends could also prompt profit-taking, leading to increased volatility.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-08-22 00:00:00 | Reiterated | Telsey Advisory Group | Market Perform | $150 → $160 |

| 2025-07-02 00:00:00 | Upgrade | Jefferies | Hold → Buy | $150 |

| 2025-04-08 00:00:00 | Upgrade | Wells Fargo | Equal Weight → Overweight | $150 |

| 2025-04-03 00:00:00 | Upgrade | Citigroup | Neutral → Buy | $146 |

Worst 10 Performers

Las Vegas Sands Corp (LVS) (-5.62%)

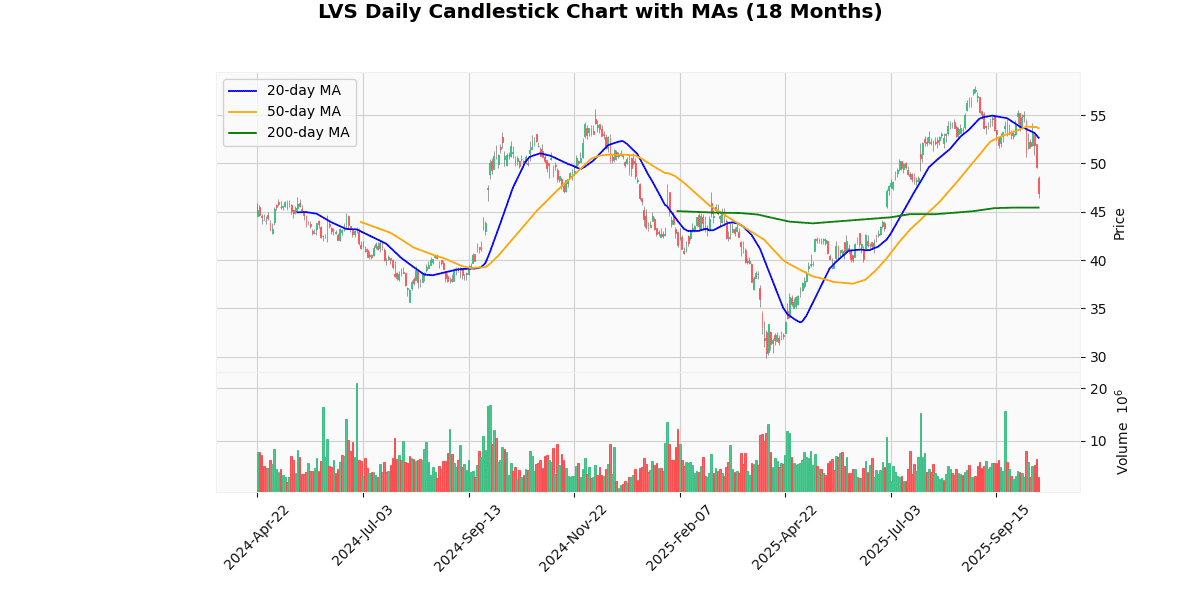

Technical Analysis

The current price of the asset at $46.97 indicates a notable deviation from its short-term moving averages (MAs), specifically the 20-day MA at $52.66 and the 50-day MA at $53.66, suggesting a bearish trend in the recent weeks. This downward movement could be reflective of short-term selling pressure or a market correction after a period of higher prices. However, the asset’s price remains above the 200-day MA of $45.44, which could indicate that the longer-term trend is still bullish. This positioning above the 200-day MA might suggest underlying strength in the asset, potentially attracting long-term investors. Investors should monitor if the price will stabilize or revert closer to the short-term MAs to assess the possibility of a trend reversal or continuation of the current bearish sentiment.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-07-28 00:00:00 | Upgrade | Argus | Hold → Buy | $60 |

| 2025-07-07 00:00:00 | Initiated | Goldman | Neutral | $52 |

| 2025-06-23 00:00:00 | Initiated | JP Morgan | Neutral | $47 |

| 2025-01-14 00:00:00 | Downgrade | Morgan Stanley | Overweight → Equal-Weight | $54 → $51 |

Fastenal Co (FAST) (-4.13%)

Recent News (Last 24 Hours)

Fastenal (NASDAQ: FAST) experienced a notable decline in its stock price following the release of its Q3 earnings, which failed to meet profit expectations. Despite achieving revenue figures that aligned with forecasts, the company’s earnings miss has led to a negative reaction in the market, as evidenced by the gap lower in stock price reported by Schaeffer’s Research. This performance could potentially signal broader implications for the industrial sector, particularly given Fastenal’s role as a bellwether within the S&P 500 industrials, as highlighted by Investor’s Business Daily.

The earnings snapshot, detailed by multiple sources including Zacks and the Associated Press Finance, indicates that while revenue has increased, it was not sufficient to offset concerns over profitability. This situation places Fastenal among other stocks that have shown significant movement in the market today, as noted by Barrons.com. Investors and analysts will likely continue to scrutinize Fastenal’s financial health and its impact on sector sentiment, especially in light of the broader economic indicators and industry performance trends. This could influence future investment decisions and market strategies concerning Fastenal and similar industrial entities.

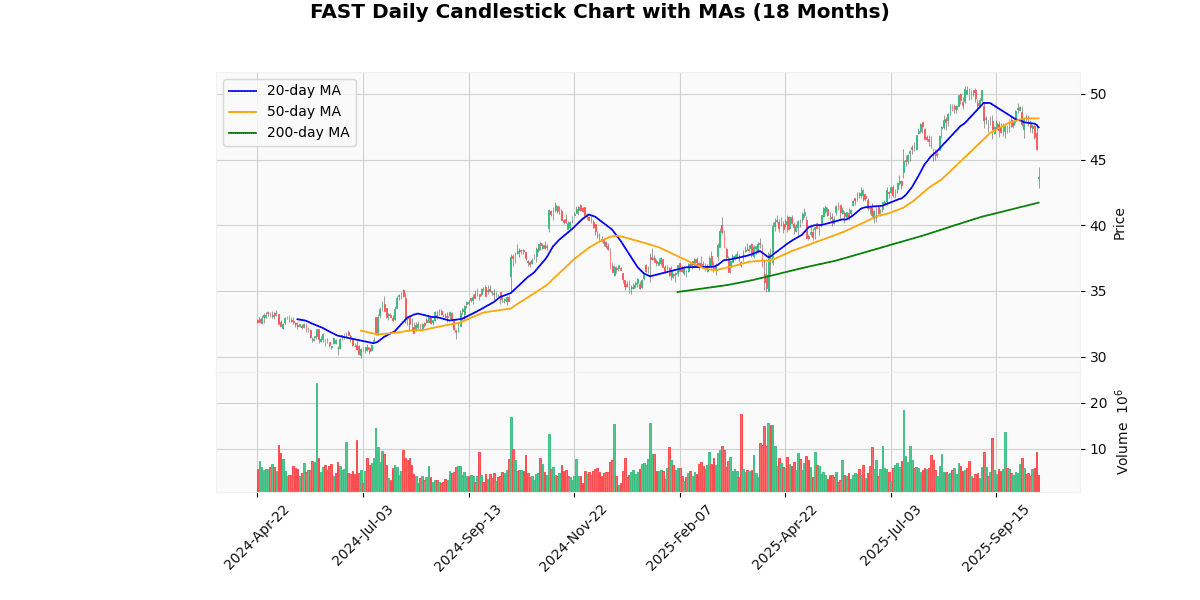

Technical Analysis

The current price of the asset at $43.43 reflects a downward trend when compared to the shorter-term moving averages (MA20 at $47.44 and MA50 at $48.14), indicating recent bearish momentum in the market. This suggests that the asset has been underperforming in the recent weeks relative to the past one to two months. However, the price is positioned above the longer-term MA200, which is $41.72, suggesting that despite recent declines, the overall longer-term trend remains bullish. This positioning above the MA200 could indicate potential support around this level, but the discrepancy between the short-term and long-term averages may also signal volatility or a possible trend reversal. Investors should monitor if the current price can stabilize or if it will align more closely with either the shorter or longer-term averages to gauge future movements.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-08 00:00:00 | Initiated | Barclays | Equal Weight | $49 |

| 2025-08-21 00:00:00 | Initiated | Northcoast | Neutral | |

| 2025-08-07 00:00:00 | Upgrade | Robert W. Baird | Neutral → Outperform | $55 |

| 2025-04-03 00:00:00 | Upgrade | Wolfe Research | Underperform → Peer Perform |

Wynn Resorts Ltd (WYNN) (-3.39%)

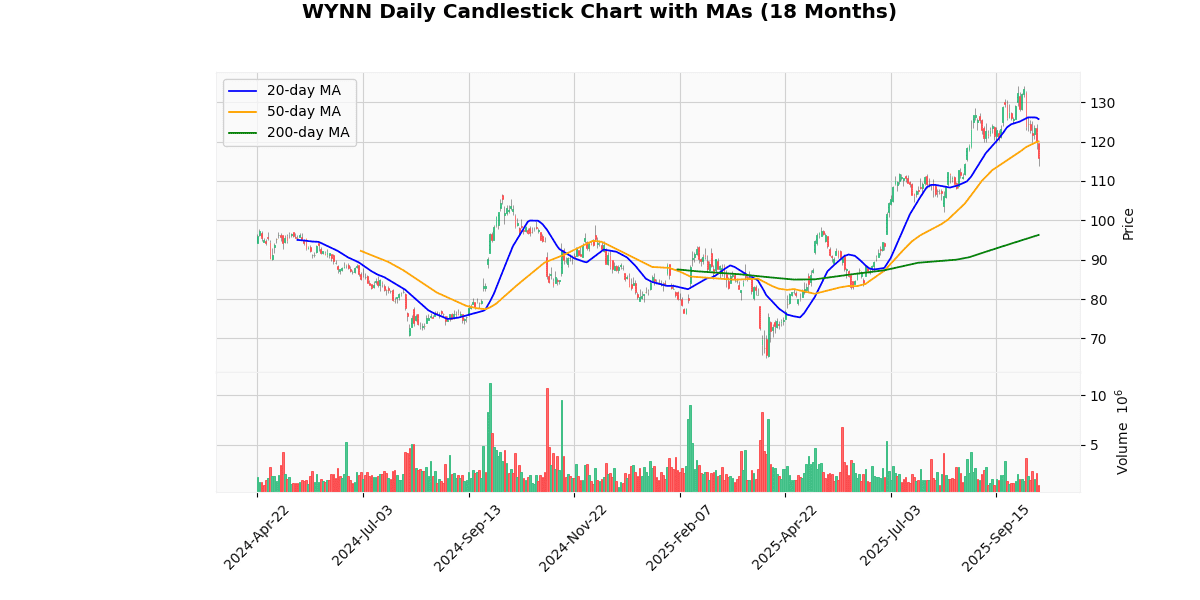

Technical Analysis

The current price of the asset at $115.82 indicates a recent downtrend when compared to the 20-day moving average (MA20) of $125.73 and the 50-day moving average (MA50) of $120.06, suggesting a short-term bearish sentiment in the market. However, the price remains well above the 200-day moving average (MA200) of $96.30, highlighting a longer-term bullish trend. This discrepancy between the short-term and long-term trends may indicate a potential consolidation phase or a correction period following earlier gains. Investors should monitor if the price will stabilize or revert closer to the shorter-term moving averages, which could signal a continuation of the upward trend or further confirm a bearish reversal if the decline persists. Overall, the market positioning seems cautiously optimistic but warrants close observation for signs of sustained directional movement.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-09-03 00:00:00 | Upgrade | Argus | Hold → Buy | $145 |

| 2025-08-28 00:00:00 | Upgrade | UBS | Neutral → Buy | $147 |

| 2025-07-09 00:00:00 | Downgrade | Citigroup | Buy → Neutral | $114 |

| 2025-07-07 00:00:00 | Initiated | Goldman | Buy | $122 |

Conagra Brands Inc (CAG) (-2.50%)

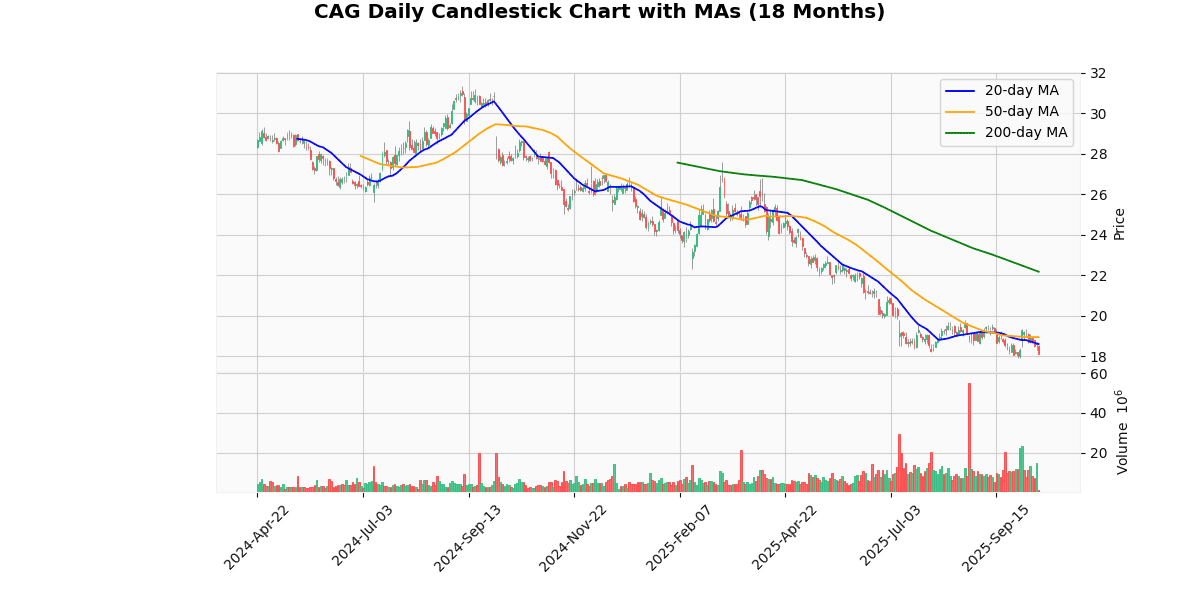

Technical Analysis

The current price of the asset at $18.00 is positioned below all key moving averages: the 20-day ($18.59), 50-day ($18.94), and significantly below the 200-day moving average ($22.17). This positioning suggests a bearish trend in the short to medium term. The downward trajectory between the moving averages, with the 200-day MA being the highest, indicates a longer-term decline in price. The fact that the current price is below the 20-day and 50-day MAs further reinforces the immediate bearish sentiment, suggesting that sellers are currently dominating the market. Investors might view the substantial gap between the current price and the 200-day MA as a potential indicator of an oversold condition, which could lead to a price correction if other market factors align favorably. However, caution is advised as the prevailing trend is downward.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-08-20 00:00:00 | Resumed | JP Morgan | Neutral | $20 |

| 2025-06-16 00:00:00 | Initiated | UBS | Neutral | $22 |

| 2025-06-12 00:00:00 | Downgrade | BofA Securities | Neutral → Underperform | $20 |

| 2025-06-09 00:00:00 | Downgrade | Goldman | Neutral → Sell | $21 |

Regeneron Pharmaceuticals Inc (REGN) (-2.34%)

Recent News (Last 24 Hours)

Regeneron Pharmaceuticals, Inc. (NASDAQ: REGN) is set to record an $83 million charge, as reported by Insider Monkey. This financial adjustment is significant as it may influence Regeneron’s upcoming quarterly financial results, potentially impacting its earnings per share and overall financial health. Investors should monitor how this charge could affect Regeneron’s profitability and operational efficiency.

In broader market news, the Dow experienced a substantial increase, surging 400 points following comments on tariffs by President Trump. This rally was supported by significant gains in major tech and automotive stocks, including Broadcom, Nvidia, and Tesla, as detailed in a live coverage report by Investor’s Business Daily. The positive movement in these influential sectors could signal a robust market sentiment, possibly leading to increased investor confidence and market liquidity, which might benefit a wide array of stocks, including those in the biopharmaceutical sector like Regeneron.

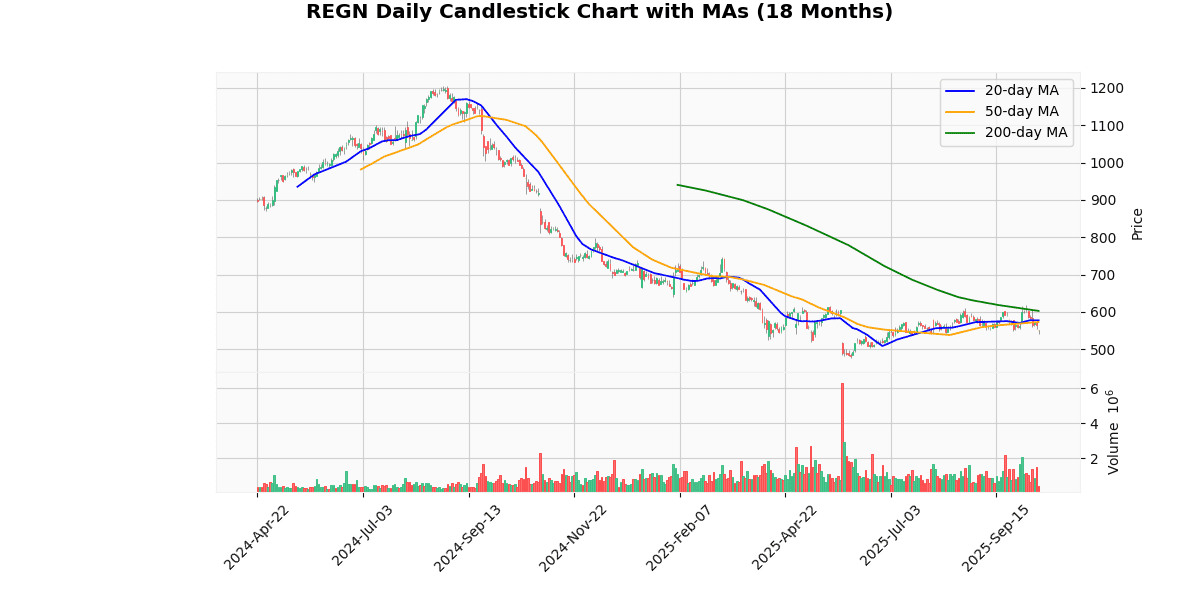

Technical Analysis

The analysis of the given price metrics indicates a bearish trend for the asset in question. The current price of $552.00 is positioned below all key moving averages: the 20-day moving average (MA20) at $577.66, the 50-day moving average (MA50) at $573.20, and significantly below the 200-day moving average (MA200) at $602.81. This positioning suggests a sustained downward momentum over both short and longer-term periods. The fact that the current price is trailing behind the shorter-term MAs (MA20 and MA50) further underscores immediate bearish sentiment in the market. Additionally, the substantial gap between the current price and the MA200 highlights a longer-term depreciation in value, which might concern long-term investors. Market participants might view these indicators as a signal for potential continued weakness, warranting a cautious approach in the near term.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-08-14 00:00:00 | Initiated | Rothschild & Co Redburn | Buy | $890 |

| 2025-06-30 00:00:00 | Downgrade | Argus | Buy → Hold | |

| 2025-05-30 00:00:00 | Downgrade | Wells Fargo | Overweight → Equal Weight | $580 |

| 2025-05-30 00:00:00 | Downgrade | RBC Capital Mkts | Outperform → Sector Perform | $662 |

Kroger Co (KR) (-2.32%)

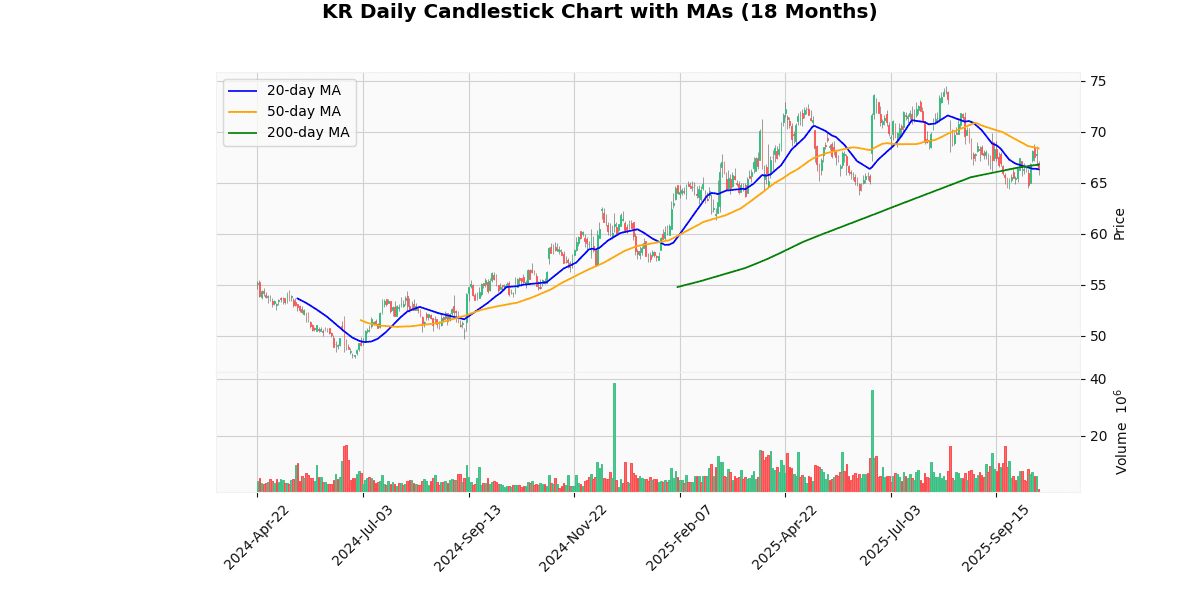

Technical Analysis

The current price of the asset at $66.04 shows a slight deviation below the 20-day moving average (MA20) of $66.29, indicating a potential short-term bearish sentiment. This is further supported by the price positioning below both the 50-day moving average (MA50) at $68.37 and the 200-day moving average (MA200) at $66.78, suggesting a broader negative trend over the medium to long term. The proximity of the current price to the MA200, however, hints at a possible area of support or resistance, which could be pivotal for future price movements. Overall, the asset appears to be in a consolidation phase, with a bearish bias, as indicated by its positioning relative to these key moving averages. Investors should monitor these levels closely for signs of either a trend reversal or further decline.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-09-17 00:00:00 | Upgrade | Roth Capital | Neutral → Buy | $75 |

| 2025-08-20 00:00:00 | Downgrade | JP Morgan | Overweight → Neutral | $75 |

| 2025-07-21 00:00:00 | Initiated | Barclays | Equal Weight | $75 |

| 2025-06-23 00:00:00 | Reiterated | Telsey Advisory Group | Outperform | $73 → $82 |

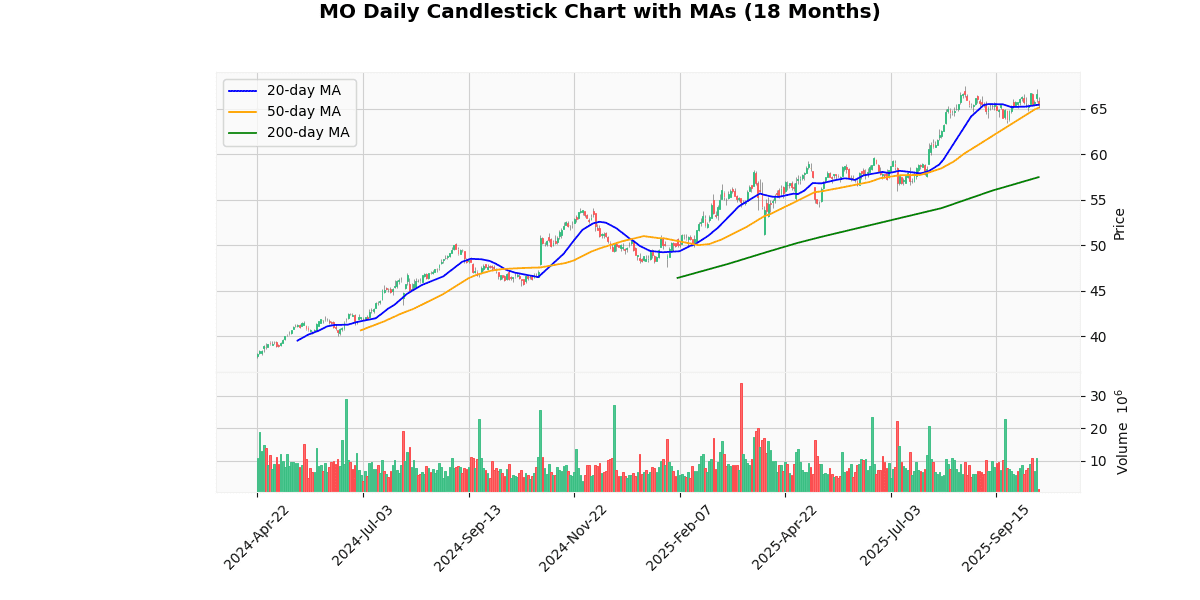

Altria Group Inc (MO) (-2.24%)

Recent News (Last 24 Hours)

In a recent article published by Motley Fool on October 13, 2025, titled “Got $1,000? 3 Stocks to Buy Now While They’re on Sale,” investors are presented with an opportunity to consider purchasing stocks that are currently perceived as undervalued. The article highlights three specific stocks that are recommended for acquisition, suggesting that their current market prices are lower than their intrinsic values, thus presenting a favorable buying opportunity.

The potential impact of this publication on the stock market, particularly on the stocks mentioned, could be significant. Such recommendations can lead to increased buying activity as investors seek to capitalize on what they perceive as advantageous pricing. This can result in a short-term uplift in the stock prices due to heightened demand. However, investors should conduct their own research or consult with financial advisors to validate these claims and assess the long-term viability of these investments based on their individual financial goals and risk tolerance.

Technical Analysis

The current price of the asset at $65.24 is positioned closely between its 20-day moving average (MA20) of $65.41 and its 50-day moving average (MA50) of $65.08, indicating a relatively stable short-term price trend. The proximity of the current price to the MA20 suggests minor resistance near this level, with potential for slight fluctuations. The asset’s price is significantly above the 200-day moving average (MA200) at $57.47, highlighting a strong upward trend over the longer term. This considerable gap between the MA200 and both the current price and shorter MAs suggests robust bullish sentiment in the market over recent months. Investors might view this as a confirmation of sustained positive momentum, although vigilance is advised as the market assesses whether current levels can be maintained or further growth is feasible.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-07-09 00:00:00 | Resumed | Jefferies | Underperform | $50 |

| 2025-07-02 00:00:00 | Upgrade | UBS | Sell → Neutral | $59 |

| 2025-04-01 00:00:00 | Downgrade | Deutsche Bank | Buy → Hold | |

| 2025-01-16 00:00:00 | Initiated | Morgan Stanley | Equal-Weight | $54 |

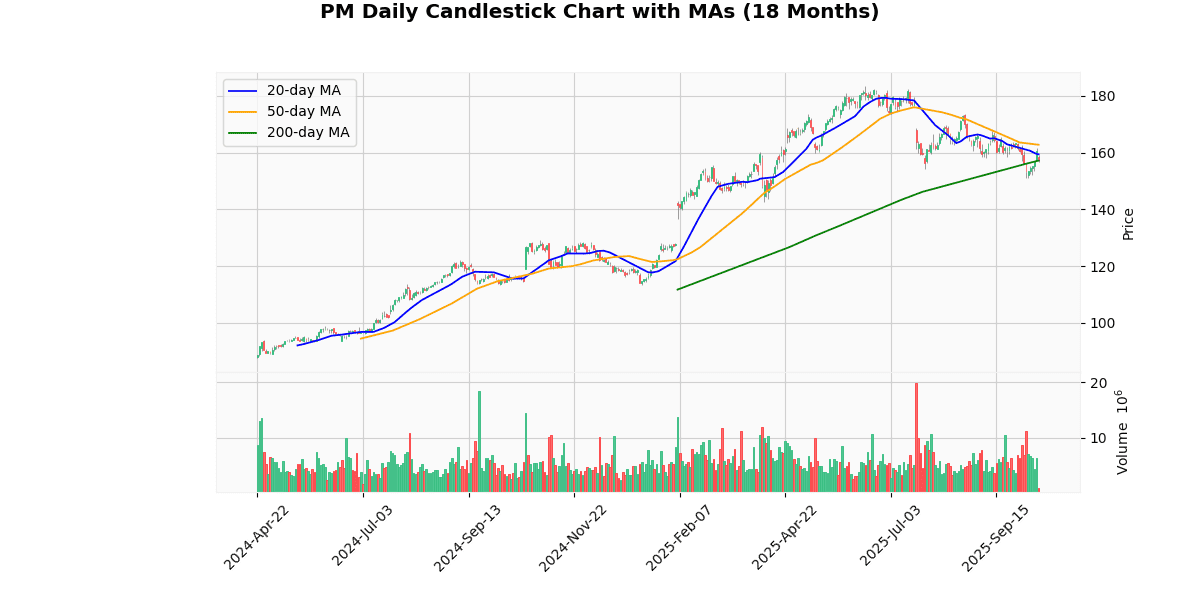

Philip Morris International Inc (PM) (-2.15%)

Technical Analysis

The current price of the asset at $157.48 is positioned below both the 20-day and 50-day moving averages, at $159.37 and $162.74 respectively, indicating a short-term bearish trend. This suggests that the asset has been experiencing a downward pressure in the more recent trading sessions. However, it is noteworthy that the current price is marginally above the 200-day moving average of $157.15, which could signal underlying long-term support for the asset at this level. The proximity of the current price to the 200-day moving average also suggests a potential pivotal point; a sustained move above this level might attract buying interest, potentially reversing the recent bearish trend. Conversely, failure to maintain this level could see further declines as bearish sentiment persists. Investors should monitor these key moving averages closely for signs of directional change.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-07-09 00:00:00 | Resumed | Jefferies | Buy | $220 |

| 2025-05-22 00:00:00 | Initiated | Needham | Buy | $195 |

| 2025-04-25 00:00:00 | Upgrade | UBS | Sell → Neutral | $170 |

| 2025-03-14 00:00:00 | Upgrade | Argus | Hold → Buy |

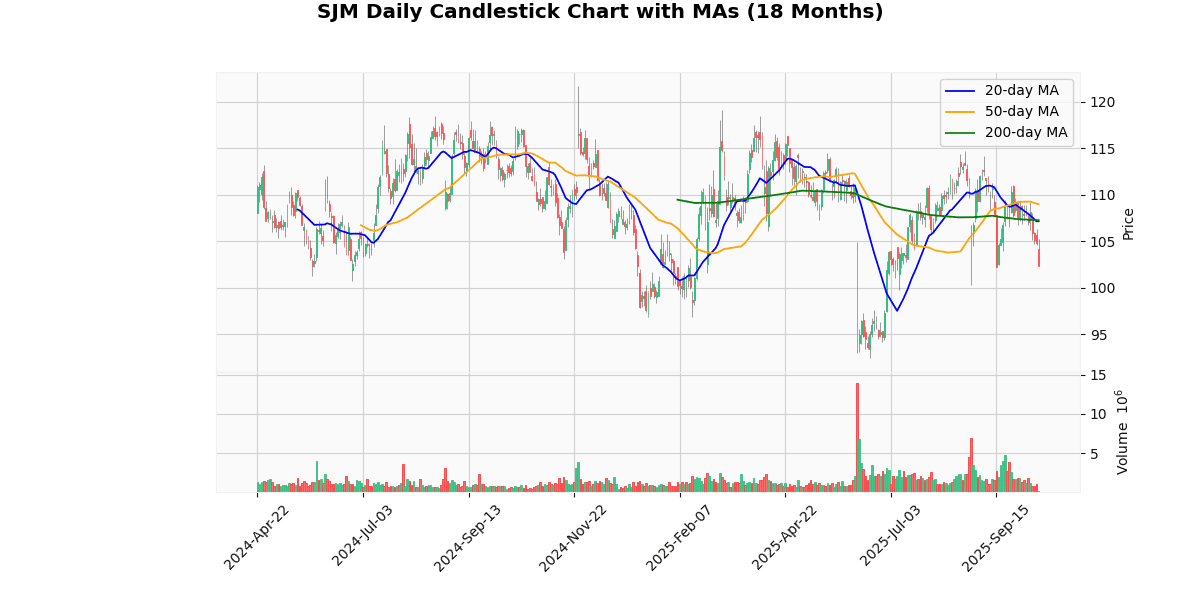

J.M. Smucker Co (SJM) (-2.01%)

Technical Analysis

The current price of the asset at $101.97 is positioned below all key moving averages: the 20-day MA at $107.11, the 50-day MA at $108.95, and the 200-day MA at $107.24. This positioning indicates a bearish trend in the short to medium term, as the price is trading below both shorter and longer-term averages. The fact that the 20-day MA is also below the 50-day MA further confirms a downward momentum in the near term. Investors might view this as a potential signal for a continued bearish outlook, suggesting that the asset could face further declines unless there is a significant market catalyst to reverse the trend. This setup could be of interest to short sellers or might prompt current holders to consider defensive strategies to protect against further downside risks.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-09-12 00:00:00 | Downgrade | Argus | Buy → Hold | |

| 2025-08-20 00:00:00 | Upgrade | JP Morgan | Neutral → Overweight | $129 |

| 2025-07-09 00:00:00 | Upgrade | BNP Paribas Exane | Underperform → Outperform | $120 |

| 2025-07-07 00:00:00 | Initiated | RBC Capital Mkts | Outperform | $130 |

Hershey Company (HSY) (-1.97%)

Recent News (Last 24 Hours)

In a recent article published by Motley Fool on October 13, 2025, titled “2 Dividend Stocks to Buy for a Lifetime of Passive Income,” investors are provided with insights into two dividend-yielding stocks considered robust for long-term investment. The recommendation focuses on the stability and consistent dividend payouts of these stocks, which are seen as attractive for those looking to generate passive income over an extended period.

The identification of these stocks as viable options for sustained income could lead to increased investor interest, potentially boosting stock prices due to heightened demand. For current shareholders, the reaffirmation of these stocks’ value might encourage holding onto shares, contributing to price stability and possibly attracting conservative investors who prioritize security over high-risk returns. This news is particularly relevant in the context of a volatile market environment where reliable dividends are highly prized.

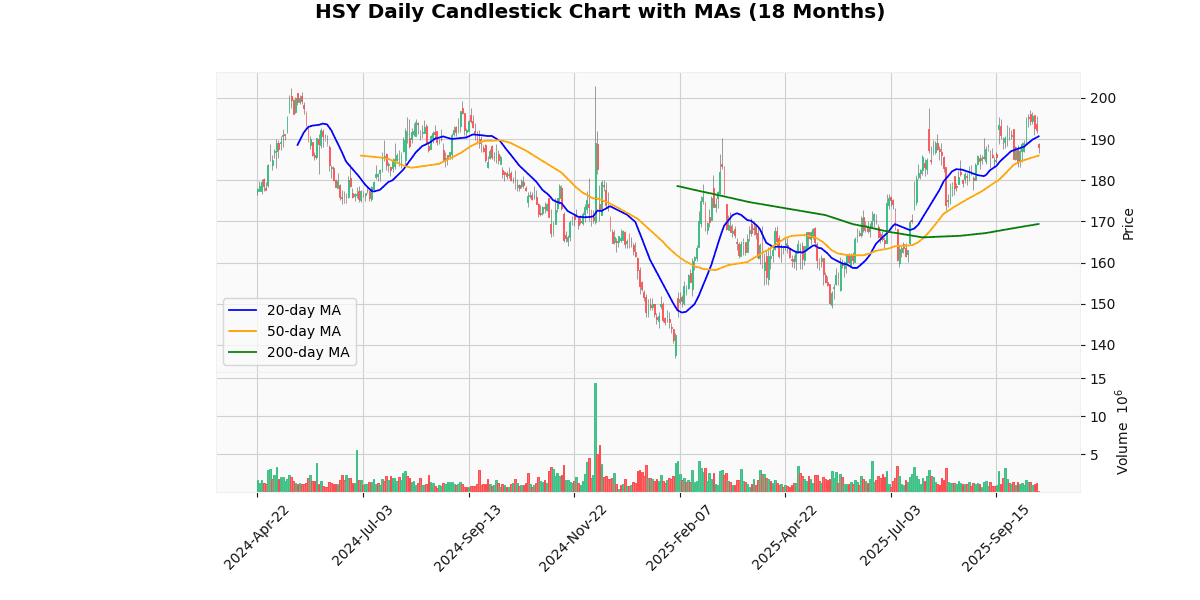

Technical Analysis

The current price of the asset at $186.79 reflects a nuanced position relative to its moving averages, indicating mixed signals in market trends. It is trading below the 20-day moving average (MA20) of $190.6, suggesting a short-term downward trend or a potential resistance level that could impede upward movement in the near future. Conversely, the price is slightly above the 50-day moving average (MA50) of $185.97, which could indicate some resilience or a tentative bullish sentiment in the medium term. Significantly, the price stands well above the 200-day moving average (MA200) of $169.36, underscoring a strong bullish trend over a longer period. This positioning above the MA200 but below the MA20 may suggest a consolidation phase or a possible reevaluation of the asset’s value by the market before establishing a clearer direction.

Recent Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-09-16 00:00:00 | Upgrade | Goldman | Sell → Buy | $222 |

| 2025-09-15 00:00:00 | Upgrade | BNP Paribas Exane | Neutral → Outperform | |

| 2025-08-20 00:00:00 | Resumed | JP Morgan | Neutral | $187 |

| 2025-07-31 00:00:00 | Reiterated | Morgan Stanley | Equal-Weight | $173 → $189 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.