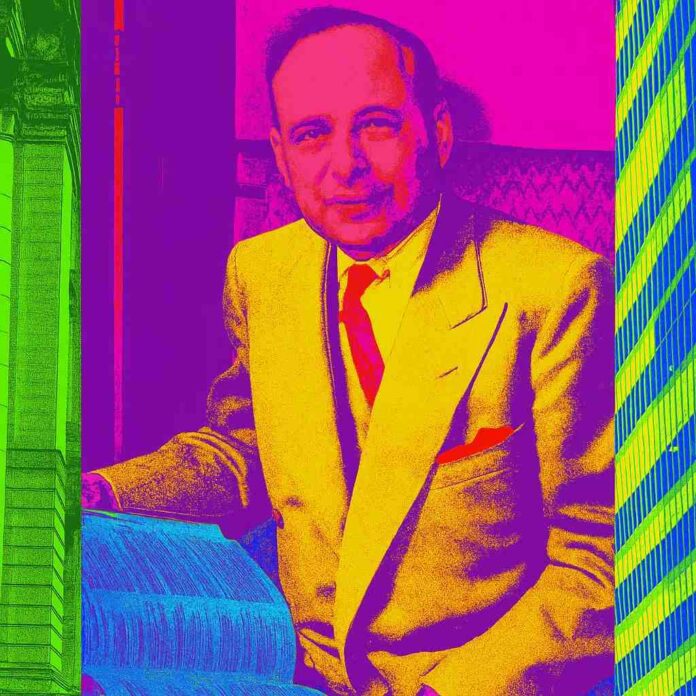

Few names carry as much weight in the world of finance as Benjamin Graham. Revered as the father of value investing, Graham’s principles and teachings have shaped the thinking of countless investors, from retail traders to Wall Street titans. Most notably, Warren Buffett — arguably the most successful investor of all time — credits Graham as his greatest teacher and intellectual mentor. But Graham’s legacy extends far beyond a single student. His philosophy of investing with discipline, patience, and a margin of safety continues to serve as the backbone of sound portfolio management today.

This article explores the life, ideas, and enduring influence of Benjamin Graham, weaving together his biography, investment philosophy, and the lessons that remain relevant in modern markets.

Early Life and Education

Benjamin Graham was born as Benjamin Grossbaum in London in 1894. His family immigrated to the United States when he was just a year old, settling in New York City. The Grahams enjoyed a comfortable life until financial misfortune struck after the death of his father. The family slipped into poverty, and these early experiences left a deep impression on young Benjamin.

He excelled academically and won a scholarship to Columbia University, where he graduated in 1914 at the top of his class. Remarkably, Graham was offered teaching positions in mathematics, philosophy, and English upon graduation. Instead, he chose Wall Street, where his analytical brilliance soon set him apart.

Career on Wall Street

Graham began his career at Newburger, Henderson & Loeb, a Wall Street firm where he quickly earned a reputation for keen financial insight. By the age of 25, he was making a salary of $600,000 in today’s dollars, a staggering sum for such a young man. However, the stock market crash of 1929 and the ensuing Great Depression wiped out much of his wealth, an experience that profoundly shaped his cautious and disciplined approach to investing.

It was during the 1930s that Graham partnered with Jerome Newman to form the Graham-Newman Partnership, an investment firm that applied rigorous analysis to identify undervalued securities. This partnership generated strong returns and established Graham as a thought leader in finance.

The Birth of Value Investing

Benjamin Graham’s greatest contribution to the world of finance was his philosophy of value investing. He argued that investors should treat stock purchases not as speculative bets on short-term price movements but as ownership stakes in real businesses. To him, the stock market was not a casino but a weighing machine, eventually reflecting the true value of a company.

In his groundbreaking books — Security Analysis (1934, co-authored with David Dodd) and The Intelligent Investor (1949) — Graham codified his investment philosophy. These works remain essential reading for investors today.

Key Principles of Graham’s Philosophy:

- Intrinsic Value

Every company has an underlying intrinsic value determined by its assets, earnings, and future potential. Investors should calculate this value and only buy stocks trading significantly below it. - Margin of Safety

Graham emphasized the importance of building a “margin of safety” into every investment. By purchasing securities well below their intrinsic value, investors create a buffer against errors in judgment or unforeseen market shocks. - Mr. Market Analogy

In The Intelligent Investor, Graham introduced the famous parable of Mr. Market. He described the stock market as a moody partner who offers to buy or sell shares at fluctuating prices each day. The wise investor does not get carried away by Mr. Market’s emotions but takes advantage of his irrationality. - Defensive vs. Enterprising Investors

Graham distinguished between two types of investors:- Defensive investors, who prioritize safety and prefer a passive strategy, often through diversified portfolios.

- Enterprising investors, who are willing to put in more time and effort to uncover hidden opportunities.

- Focus on Fundamentals

Instead of chasing trends or listening to speculation, Graham urged investors to focus on tangible metrics like earnings, dividends, and balance sheet strength.

The Teacher and Mentor

Benjamin Graham’s influence extended far beyond his own investment practice. He returned to Columbia University as a professor and inspired a generation of students who would go on to become legends in their own right. Among them was Warren Buffett, who described Graham’s The Intelligent Investor as “by far the best book on investing ever written.”

Buffett studied under Graham at Columbia and later worked for him at the Graham-Newman Partnership. He has repeatedly credited Graham’s teachings with shaping his investment philosophy, particularly the emphasis on intrinsic value and margin of safety. Other prominent disciples include Irving Kahn, Walter Schloss, and William J. Ruane, all of whom applied Graham’s ideas to great success.

Beyond Investing: Ethical Capitalism

Graham’s philosophy was not merely about making money. He believed strongly in the ethical dimension of investing. Having experienced the ruin of the Great Depression, he understood the dangers of speculation and the importance of responsibility in financial markets.

He advocated for clear disclosures, conservative accounting practices, and transparency from corporations — principles that later influenced U.S. securities laws and the formation of the Securities and Exchange Commission (SEC). In many ways, Graham was as much a reformer as he was an investor.

Criticism and Limitations

While Graham’s ideas have stood the test of time, critics argue that markets today are more efficient than in his era, making it harder to find “cigar butt” stocks — companies trading so cheaply that they offer one last puff of value. With the rise of technology, globalization, and sophisticated quantitative strategies, some believe Graham’s methods are less effective in the 21st century.

Yet others counter that his principles — focusing on fundamentals, avoiding speculation, and demanding a margin of safety — are timeless. Even if the exact tactics evolve, the underlying philosophy continues to guide prudent investors.

Lasting Legacy

Benjamin Graham retired from active investing in the 1950s and spent his later years teaching and writing. He passed away in 1976, but his legacy has only grown stronger. His books are still in print, studied not just by finance professionals but by anyone seeking to understand the psychology and discipline of markets.

Graham’s insistence on rationality, skepticism, and ethical conduct offers a stark contrast to the excesses of speculation that periodically grip Wall Street. His teachings remind us that investing is not about chasing quick profits but about building wealth steadily, responsibly, and with respect for risk.

Lessons for Today’s Investors

What can today’s investors learn from Benjamin Graham?

- Patience Pays – Avoid the urge to trade frequently. Instead, wait for clear opportunities when the price is well below intrinsic value.

- Embrace Skepticism – Question market fads, overhyped IPOs, and speculative bubbles.

- Diversify Wisely – Even the best analysis can go wrong; diversification provides a safety net.

- Prioritize Discipline Over Emotion – Do not let fear or greed dictate your decisions.

- Think Long-Term – The stock market is unpredictable in the short run but rational over the long run.

Conclusion

Benjamin Graham was more than just a successful investor. He was a philosopher of finance, a teacher of discipline, and a champion of rational, ethical investing. His life story — from poverty in childhood to the heights of Wall Street — is a testament to resilience and intellectual rigor.

In a world where financial markets are often dominated by noise, speculation, and hype, Graham’s principles offer a steady compass. His teachings remind us that investing is not about beating the market every day but about making thoughtful, informed decisions that compound over a lifetime.

As Warren Buffett once put it, “I am one-third Benjamin Graham, one-third Phil Fisher, and one-third Charlie Munger.” For Buffett — and countless others — that one-third of Graham may very well be the most important.