Warren Buffett, often referred to as the “Oracle of Omaha,” is widely regarded as one of the most successful investors of all time. His investment philosophy, which is grounded in value investing, long-term thinking, and disciplined risk management, has made him a legendary figure in the financial world. The centerpiece of Buffett’s empire is Berkshire Hathaway, a conglomerate that has grown from a struggling textile company into one of the largest and most diversified corporations in the world.

Yesterday Berkshire Hathaway closed above $ 1 trillion market capitalization for the first time yesterday, and joined a club where is the only one non-tech member.

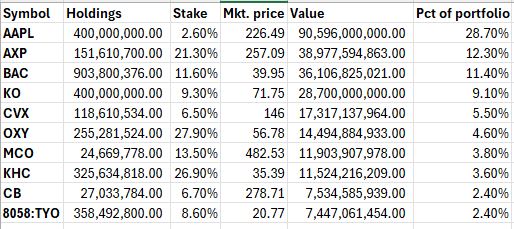

If we take a look at Berkshire Hathaway portfolio, based on the most recent EDGAR filings 13F uploaded on the SEC portal, we can see that one third circa of its holdings are concentrated on Apple Inc..

The second largest holding is American Express Company, which is not a traditional brick and mortar or main street type of business.

It is a concentrated portfolio, where the Top 10 holdings have a 80% weight of the total portfolio. Buffett began buying Apple in the first quarter of 2016, when shares consolidated and for same investors could have been considered a buy under the value approach instead of growth approach.

Buffett’s investment strategy is famously simple yet profoundly effective. He focuses on acquiring companies with strong fundamentals, excellent management, and durable competitive advantages—what he calls “economic moats.” He prefers to buy these companies at prices below their intrinsic value, allowing for significant long-term appreciation.

Berkshire Hathaway’s portfolio includes wholly owned subsidiaries like GEICO, BNSF Railway, and Dairy Queen, as well as significant minority stakes in companies such as Apple, Coca-Cola, and American Express. Buffett’s preference for holding investments indefinitely, a strategy encapsulated in his famous quote, “Our favorite holding period is forever,” has enabled Berkshire Hathaway to compound wealth over decades.

Beyond the numbers, Buffett’s legacy is one of integrity, patience, and humility. He is known for his frugality despite his immense wealth, still residing in the modest Omaha home he bought in 1958. His annual letters to shareholders are widely read, offering insights not only into the performance of Berkshire Hathaway but also into his views on business, economics, and life.

Buffett has also pledged to give away the vast majority of his wealth through the Giving Pledge, which he co-founded with Bill and Melinda Gates. This commitment underscores his belief in using wealth for the greater good, a principle that has endeared him to millions around the world.

Warren Buffett’s empire, built on the foundation of Berkshire Hathaway, stands as a testament to the power of disciplined investing and long-term thinking. As the company continues to evolve, it remains a beacon of financial strength and ethical business practices, reflecting the values that have guided Buffett throughout his illustrious career.