Blackstone, Inc., founded by Stephen Allen Schwarzman in 1985 and headquartered in New York, NY, is a premier global investment and fund management firm. The company operates through four main segments: Real Estate, Private Equity, Credit and Insurance, and Hedge Fund Solutions. Blackstone’s Real Estate segment manages a diverse array of real estate funds, ranging from opportunistic and Core+ funds to high-yield and liquid real estate debt funds. Its Private Equity division oversees a variety of investment vehicles including flagship funds, sector-specific, and geographically focused funds, as well as platforms dedicated to life sciences, growth equity, and infrastructure. The Credit and Insurance segment, known as Blackstone Credit, offers strategies in both private and liquid credit and includes an expansive insurer-focused platform. Lastly, the Hedge Fund Solutions segment, operating under Blackstone Alternative Asset Management, provides comprehensive hedge fund of funds solutions and innovative alternative investment products.

Blackstone Inc. (BX) has recently demonstrated significant financial performance and strategic growth, positively impacting its stock potential. On July 24, 2025, Blackstone reported a substantial profit surge of $1.57 billion, significantly exceeding Wall Street expectations. This financial uplift was complemented by their announcement of reaching a record $1.2 trillion in assets under management (AUM), setting an industry benchmark. These achievements were highlighted in their Q2 earnings report, where Blackstone not only beat earnings and revenue estimates but also showcased the most fund appreciation in nearly four years. Additionally, Blackstone’s leadership indicated a renewed vigor in deal-making activities, suggesting a positive outlook for future growth. This series of robust financial and operational performances is likely to bolster investor confidence and could lead to an uptrend in Blackstone’s stock value.

The current price of $179.37 is positioned robustly within its recent range, showing significant recovery from both the 52-week and YTD lows of $114.85, marking an increase of over 56%. This upward trend is underscored by its proximity to the week’s high of $181.32 and a moderate retreat from the YTD high of $185.94. The price is currently underperforming relative to the 52-week high by approximately 9.35%, suggesting some room for potential growth or retesting of this peak.

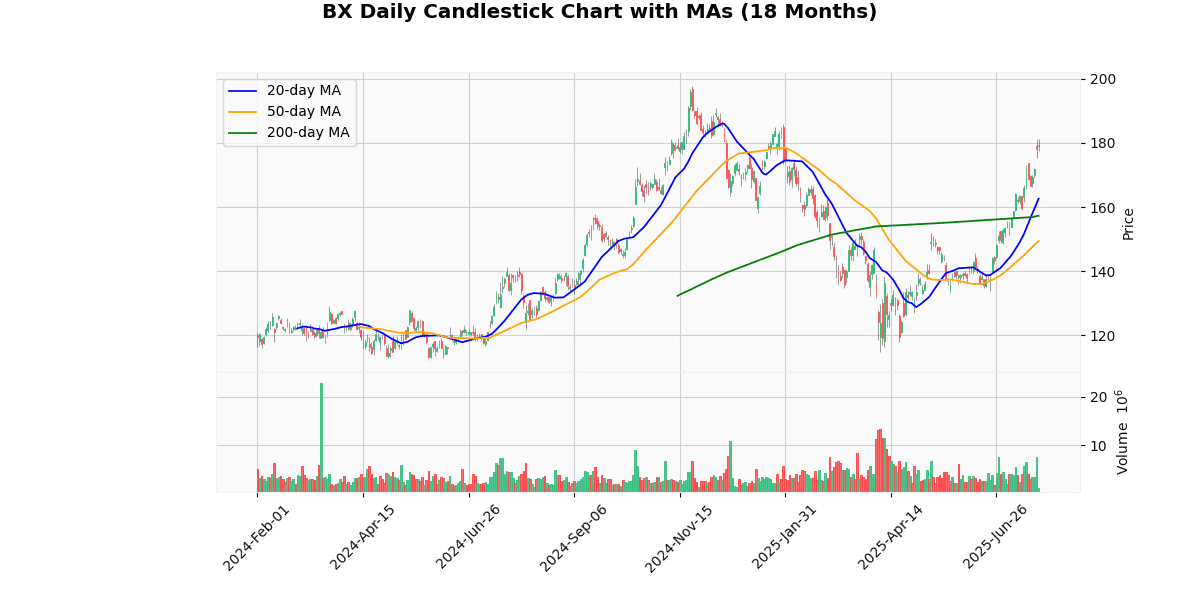

## Price Chart

The moving averages indicate strong bullish momentum, with the current price exceeding the 20-day, 50-day, and 200-day moving averages by 10.31%, 20.08%, and 14.04%, respectively. This is further supported by a high RSI of 74.7, which, while indicating overbought conditions, also reflects strong buying pressure in recent times. The MACD value of 8.07 confirms this bullish sentiment, suggesting that the upward trend might continue, albeit with potential for volatility due to the high RSI level.

Overall, the price metrics suggest a strong bullish trend with caution advised due to possible overbought conditions that could lead to a short-term pullback.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-07-24 | 1.10 | 1.21 | 10.00 |

| 1 | 2025-04-17 | 1.05 | 1.09 | 3.67 |

| 2 | 2025-01-30 | 1.46 | 1.69 | 15.81 |

| 3 | 2024-10-17 | 0.92 | 1.01 | 9.71 |

| 4 | 2024-07-18 | 0.99 | 0.96 | -2.54 |

| 5 | 2024-04-18 | 0.96 | 0.98 | 1.67 |

| 6 | 2024-01-25 | 0.95 | 1.11 | 16.82 |

| 7 | 2023-10-19 | 1.01 | 0.94 | -7.38 |

Blackstone (NYSE: BX) reported robust financial results for Q2 2025 on July 24, 2025. The company’s total revenue surged by 33% to $3.7 billion compared to $2.8 billion in Q2 2024, driven by significant increases in management and advisory fees, and performance fees which saw a 75% jump to $1.1 billion. Distributable earnings per share rose by 31% to $1.21. Total assets under management (AUM) grew by 13% year-over-year to $1.2 trillion, with fee-earning AUM up by 10% and perpetual capital AUM increasing by 16%.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-04-28 | 0.93 |

| 2025-02-10 | 1.44 |

| 2024-10-28 | 0.86 |

| 2024-07-29 | 0.82 |

| 2024-04-26 | 0.83 |

| 2024-02-02 | 0.94 |

| 2023-10-27 | 0.8 |

| 2023-07-28 | 0.79 |

For the first half of 2025, Blackstone’s net income reached $2.8 billion, with revenues totaling $7.0 billion, marking an 8% increase from the previous year. The firm declared a quarterly dividend of $1.03 per share and repurchased 0.2 million common shares during the quarter. Blackstone’s performance across various strategies showed mixed results, with private equity and credit & insurance sectors experiencing growth, while real estate faced a challenging environment.