Caterpillar Inc. Shares surges 13.3% After Earnings Report

Current Price: $594.08

+13.27%

on October 29, 2025

Caterpillar, Inc., founded in 1925 and headquartered in Irving, TX, is a leading manufacturer of construction and mining equipment, as well as diesel engines and locomotives. The company operates through various segments, including Construction Industries, Resource Industries, Energy and Transportation, and Financial Products, providing innovative machinery and financing solutions to support infrastructure, mining, and energy sectors worldwide.

📰 Recent Developments

Caterpillar Inc. reported third-quarter 2024 financial results, with sales and revenues totaling $16.1 billion, a decrease of 4% from the prior year, primarily due to lower volumes in resource industries and energy & transportation segments. Profit per share reached $5.17, reflecting a 7% decline amid higher operating costs and currency impacts. The company maintained its full-year sales and revenues outlook while projecting adjusted operating profit margins between 20% and 22%.

In operational expansions, Caterpillar announced plans to invest $150 million in a new manufacturing facility in Mexico to enhance production capacity for electric and autonomous mining equipment. This move supports the company’s strategy to meet growing demand for sustainable machinery solutions.

Additionally, Caterpillar formed a strategic partnership with a leading battery technology firm to accelerate development of next-generation hybrid propulsion systems for construction equipment, aiming for commercialization by 2026. No significant management changes or regulatory developments were noted during the period.

📊 Earnings Report Summary

Caterpillar Inc. (NYSE: CAT) reported its Q3 2025 financial results, showcasing a 10% increase in sales and revenues to $17.6 billion compared to $16.1 billion in Q3 2024. However, profit per share decreased by 3.6% to $4.88, and adjusted profit per share fell 4.3% to $4.95. Operating profit declined 3% to $3.052 billion, with an operating profit margin of 17.3%, down from 19.5% a year earlier. The Energy & Transportation segment was a standout, with a 17% sales increase to $8.397 billion and a corresponding rise in segment profit. Caterpillar allocated $1.1 billion towards dividends and share repurchases. The effective tax rate rose to 26.7%, impacting net profits. Despite challenges from rising costs and tariffs, the company maintained a robust cash position of $7.5 billion, indicating strong operational health.

📈 Technical Analysis

Daily Price Change: +13.27%

Technical Indicators

| Metric | Value |

|---|---|

| Current Price | $594.57 |

| Daily Change | 13.37% |

| MA20 | $517.01 |

| MA50 | $471.21 |

| MA200 | $385.93 |

| 52W High | $596.21 |

| 52W Low | $264.29 |

| % from 52W High | -0.28% |

| % from 52W Low | 124.97% |

| YTD % | 67.76% |

| BB Position | 130.40% |

| RSI | 79.46 |

| MACD | 21.81 |

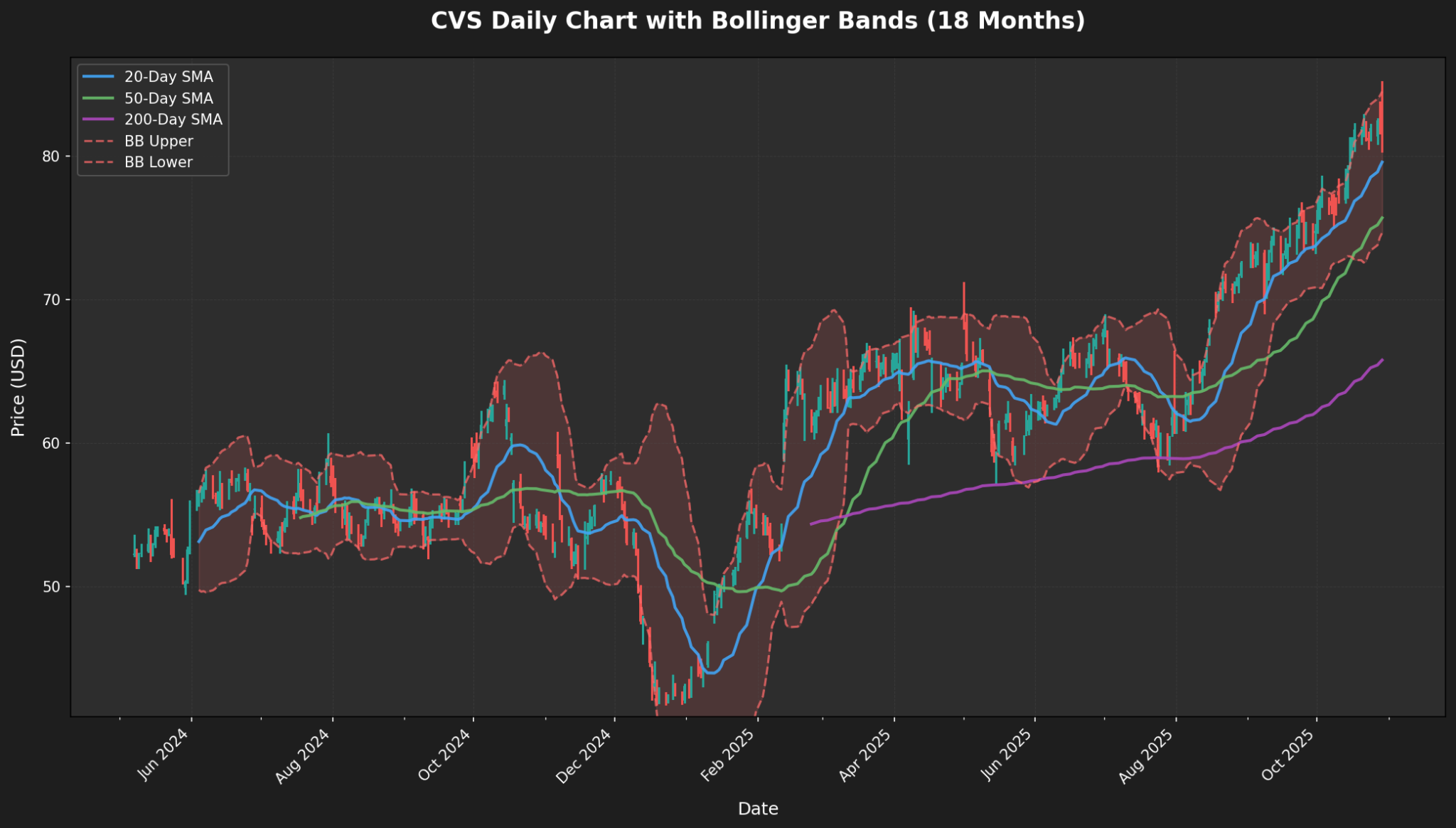

The current price of $594.57 reflects a daily increase of $13.37, indicating strong upward momentum. The stock is nearing its 52-week high of $596.21, just 0.28% away, and significantly above its 52-week low of $264.29, marking a 125% gain from that point. Short-term moving averages show bullish sentiment, with the 20-day MA at $517.01 and the 50-day MA at $471.21, both well below the current price.

The Bollinger Bands indicate volatility, with the upper band at $565.25, suggesting the stock is trading above this range, reinforcing the bullish trend. The RSI at 79.46 indicates overbought conditions, which may signal a potential pullback. Additionally, the MACD of 21.81 supports the upward trend, but caution is warranted given the high RSI levels. Overall, the stock appears strong but may face short-term corrections.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-30 | 4.35 | 4.25 | -2.22 | Earnings |

| 2025-01-30 | 5.02 | 5.14 | 2.41 | Earnings |

| 2024-10-30 | 5.34 | 5.17 | -3.12 | Earnings |

| 2024-08-06 | 5.54 | 5.99 | 8.14 | Earnings |

| 2024-04-25 | 5.14 | 5.6 | 9.04 | Earnings |

| 2024-02-05 | 4.75 | 5.23 | 10.01 | Earnings |

| 2023-10-31 | 4.79 | 5.52 | 15.17 | Earnings |

| 2023-08-01 | 4.58 | 5.55 | 21.09 | Earnings |

Analyzing the EPS trends from the provided earnings data reveals a generally positive trajectory in the company’s earnings performance. Over the last six reported quarters, the company has consistently exceeded EPS estimates, showcasing a notable ability to outperform market expectations. The most significant surprise occurred in October 2023, where the reported EPS of 5.52 surpassed the estimate of 4.79 by an impressive 15.17%.

Following this trend, subsequent quarters showed a mix of surprises, with the company maintaining strong performance in early 2024, as seen in February (5.23 vs. 4.75) and April (5.60 vs. 5.14). However, there was a slight decline in reported EPS in October 2024 (5.17 vs. 5.34), indicating potential challenges in sustaining growth. The most recent report in April 2025 saw a slight miss, with a reported EPS of 4.25 against an estimate of 4.35, suggesting a need for cautious monitoring of future performance. Overall, the data reflects a solid earnings trajectory, albeit with emerging volatility.

💵 Dividend History

| Date | Dividend |

|---|---|

| 2025-10-20 | 1.51 |

| 2025-07-21 | 1.51 |

| 2025-04-21 | 1.41 |

| 2025-01-21 | 1.41 |

| 2024-10-21 | 1.41 |

| 2024-07-22 | 1.41 |

| 2024-04-19 | 1.3 |

| 2024-01-19 | 1.3 |

The dividend data reveals a notable trend in the company’s dividend payouts over recent quarters. Starting from early 2024, dividends have shown a steady increase, moving from $1.30 in January to $1.41 by mid-year. This consistent rise reflects a positive outlook on the company’s financial health and profitability, suggesting that management is confident in sustaining and potentially increasing shareholder returns.

By the latter half of 2025, dividends further increased to $1.51, indicating a robust growth trajectory. This trend may attract income-focused investors, especially in a market characterized by volatility and uncertainty. The decision to raise dividends could also signal the company’s commitment to returning value to shareholders, which is often viewed favorably in the investment community.

Overall, the upward trajectory in dividend payouts is a positive indicator, suggesting strong operational performance and a strategic focus on shareholder value. Investors should closely monitor these trends for potential future opportunities.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-22 00:00:00 | Initiated | RBC Capital Mkts | Sector Perform | $560 |

| 2025-10-03 00:00:00 | Upgrade | Erste Group | Hold → Buy | |

| 2025-08-19 00:00:00 | Upgrade | Evercore ISI | In-line → Outperform | $476 |

| 2025-08-07 00:00:00 | Downgrade | Morgan Stanley | Equal-Weight → Underweight | $350 |

Recent rating changes reflect a dynamic landscape in market sentiment and analyst expectations. RBC Capital Markets initiated coverage with a “Sector Perform” rating, suggesting a cautious outlook on the stock, indicating potential for moderate performance relative to the market. In contrast, Erste Group’s upgrade from “Hold” to “Buy” signifies increased confidence in the stock’s prospects, likely driven by positive developments or improved fundamentals. Similarly, Evercore ISI’s upgrade from “In-line” to “Outperform” further emphasizes a bullish outlook, with a target price of $476, suggesting analysts see significant upside potential.

Conversely, Morgan Stanley’s downgrade from “Equal-Weight” to “Underweight” indicates a shift towards a more pessimistic view, possibly due to concerns over valuation or market conditions, with a target price of $350. Overall, these rating changes illustrate the varied perspectives analysts hold, influenced by recent performance metrics, market trends, and broader economic factors, highlighting the importance of ongoing analysis in investment decision-making.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.