Closing Bell: Asian Markets Mixed as KOSPI Hits New Highs

Note: This analysis covers the Asian trading session close for October 22, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3913.76 | -0.07 |

| Nikkei 225 | 49307.79 | -0.02 |

| Hang Seng Index | 25781.77 | -0.94 |

| Shenzhen Component | 12996.61 | -0.62 |

| KOSPI | 3883.68 | +1.56 |

| S&P/ASX 200 | 9030.00 | -0.71 |

| NIFTY 50 | 25868.60 | +0.10 |

| Straits Times Index | 4393.92 | +0.29 |

| S&P/NZX 50 | 13306.44 | +0.11 |

| Thailand SET Index | 1302.35 | +0.90 |

| FTSE Bursa Malaysia KLCI | 1602.69 | -0.87 |

| TAIEX | 27648.91 | -0.37 |

📰 Market Commentary

On October 22, 2025, Asian markets exhibited mixed performance amid various regional developments and economic indicators. The KOSPI in South Korea stood out with a notable increase of 1.56%, continuing its upward trajectory as investor sentiment remained buoyed by strong corporate earnings and positive economic data. Conversely, the Hang Seng Index in Hong Kong declined by 0.94%, reflecting ongoing concerns over regulatory scrutiny and geopolitical tensions.

Key events impacting the indices included China’s strategic investments in infrastructure, particularly the dual-purpose railway linking Kunming and Vientiane, which is seen as a vital asset in the ongoing trade dynamics between China and its neighbors. This infrastructure development aims to secure critical resources like potassium, potentially influencing commodity markets and trade flows in the region. Meanwhile, the Shanghai Composite experienced a slight dip of 0.07%, reflecting investor caution amid these geopolitical developments.

In India, reports emerged indicating a potential reduction in Russian oil imports as the country seeks to recalibrate its trade relationships with the U.S. This comes in the wake of stalled trade talks earlier this year, which could impact market sentiment as investors watch for further developments in U.S.-India relations. The NIFTY 50 index showed marginal growth of 0.10%, suggesting a mixed response from investors.

Economic developments also featured prominently, with Allianz opening a new office in Vietnam to capitalize on the country’s growing role in global trade. This move highlights Vietnam’s positive economic outlook, projected to grow by 6.7% in 2025, despite the looming threat of high tariffs. The Straits Times Index in Singapore rose by 0.29%, reflecting optimism in the local economy amid these regional developments.

In the wealth management sector, Endowus, a digital platform based in Singapore, surpassed $10 billion in assets under management, indicating robust growth in the financial technology space. This trend aligns with the increasing demand for innovative financial solutions across Asia.

Overall, market sentiment remains cautious yet optimistic, with investors closely monitoring geopolitical tensions, trade negotiations, and economic indicators that could influence future market trajectories across the region.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Adjusted Trade Balance | -0.31T | -0.11T |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Exports (YoY) (Sep) | 4.2% | 4.6% |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Trade Balance (Sep) | -234.6B | 22.0B |

On October 22, 2025, key economic data from Japan revealed a significant deterioration in trade figures, impacting market sentiment. The Adjusted Trade Balance for September showed a deficit of -0.31 trillion JPY, sharply worse than the forecasted -0.11 trillion JPY. This unexpected shortfall indicates a growing trade imbalance that could raise concerns about Japan’s economic health.

Additionally, exports year-over-year for September reported a growth of 4.2%, falling short of the anticipated 4.6%. This underperformance in export growth suggests weakening external demand, which could further strain Japan’s economic recovery.

The Trade Balance for September also reported a substantial deficit of -234.6 billion JPY, contrasting sharply with the forecasted surplus of 22.0 billion JPY. This significant deviation underscores the challenges facing Japan’s economy, particularly in the context of global trade dynamics.

Overall, these disappointing figures may lead to increased volatility in Japanese equities and could weigh on the Nikkei 225 index. Traders should brace for potential downward adjustments in market expectations as investors reassess the outlook for Japan’s economic resilience amid these adverse trade conditions.

📈 Individual Index Charts

Shanghai Composite

Nikkei 225

Hang Seng Index

Shenzhen Component

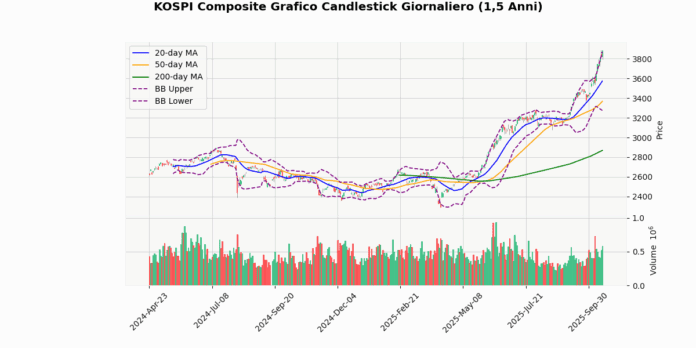

KOSPI

S&P/ASX 200

NIFTY 50

Straits Times Index

S&P/NZX 50

Thailand SET Index

FTSE Bursa Malaysia KLCI

TAIEX

💱 FX, Commodities & Crypto

In the FX market, the USD/JPY pair saw a slight decline of 0.046%, while the USD/CNY and USD/SGD pairs experienced modest gains of 0.038% and 0.131%, respectively. The AUD/USD and NZD/USD pairs also posted minor increases, reflecting a mixed sentiment influenced by economic data releases and interest rate expectations. The USD/INR declined by 0.272%, driven by shifts in investor sentiment towards emerging markets.

In commodities, gold prices fell by 0.63% amid a stronger dollar and rising yields, while crude oil prices increased by 1.29%, supported by supply concerns and geopolitical tensions.

In the cryptocurrency market, Bitcoin and Ethereum experienced slight declines of 0.224% and 0.644%, respectively, as regulatory concerns and market volatility continued to weigh on investor confidence. Overall, market dynamics were shaped by macroeconomic factors and geopolitical developments.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 151.80 | -0.05 |

| USD/CNY | 7.12 | +0.04 |

| USD/SGD | 1.30 | +0.13 |

| AUD/USD | 0.65 | +0.06 |

| NZD/USD | 0.57 | +0.07 |

| USD/INR | 87.74 | -0.27 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 4082.20 | -0.63 |

| Crude Oil | 57.98 | +1.29 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 108137.52 | -0.22 |

| Ethereum | 3849.66 | -0.64 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.