CME Group, the global leader in derivatives trading, announced that its metals complex reached an all-time daily volume record of 2,829,666 contracts on October 17, 2025. This milestone surpassed the previous record of 2,148,990 contracts set just eight days earlier on October 9, 2025.

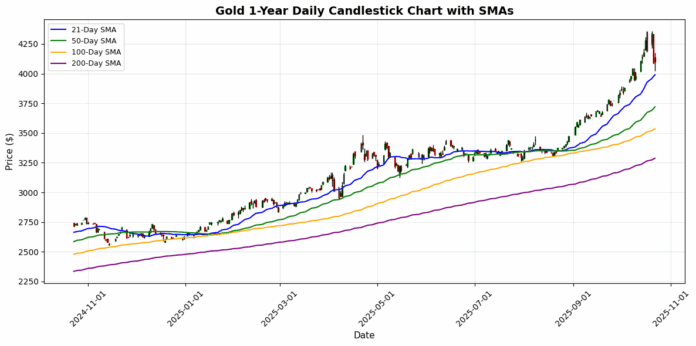

Jin Hennig, Managing Director and Global Head of Metals at CME Group, attributed the surge to heightened demand for safe-haven assets amid ongoing economic uncertainty. “Clients across the globe continue to turn to our Gold futures and options to hedge their risk and pursue opportunities in this complex environment,” Hennig said. The record activity reflects participation from both large institutions and retail traders, driving unprecedented trading volumes across CME Group’s metals product suite.

The metals complex, listed on and subject to the rules of COMEX, includes a diverse range of benchmark products covering precious and industrial metals. On October 17, several products within the complex also set single-day volume records, including:

- Metals futures: 2,599,935 contracts

- Micro Gold futures: 1,267,436 contracts

- 1-Ounce Gold futures: 199,928 contracts, with a record open interest of 20,326 contracts

- E-mini Gold futures: 12,818 contracts

CME Group’s metals offerings enable market participants to manage risk and capitalize on opportunities in volatile markets. The company’s comprehensive portfolio spans futures and options across asset classes, including interest rates, equity indexes, foreign exchange, cryptocurrencies, energy, agricultural products, and metals. Trading is facilitated through the CME Globex platform, with additional services like fixed income trading via BrokerTec, foreign exchange trading on the EBS platform, and clearing through CME Clearing, one of the world’s leading central counterparty clearing providers.

As the world’s foremost derivatives marketplace, CME Group continues to empower global market participants with tools to navigate economic challenges and seize opportunities.

References

- CME Group Press Release: CME Group Metals Complex Reaches All-Time Daily Volume Record

- CME Group Metals Products

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.