# Fiserv, Inc. (FI) Post Earning Analysis

# Fiserv, Inc.: Navigating Financial Services Technology

## Introduction

Fiserv, Inc. is a leading player in the financial services technology sector, offering a range of products and services to enable commerce and financial transactions for businesses of all sizes. The company operates through two main segments: Merchant and Financial, catering to a diverse client base. Founded in 1984, Fiserv has established itself as a key player in the industry, providing essential solutions for digital payments, fraud protection, and more.

## Recent News

In the last five days, Fiserv has been in the spotlight for various reasons. The company’s stock tumbled as its outlook softened despite striking a deal with TD. Fiserv trimmed its annual revenue forecast due to a slowdown in Clover growth, leading to a slide in shares. However, the company managed to surpass Q2 earnings estimates and refine its 2025 outlook. Fiserv also announced strategic relationships with TD to enhance its merchant solutions offering in Canada. Despite challenges, Fiserv continues to make strategic moves to strengthen its position in the market.

## Price Trend

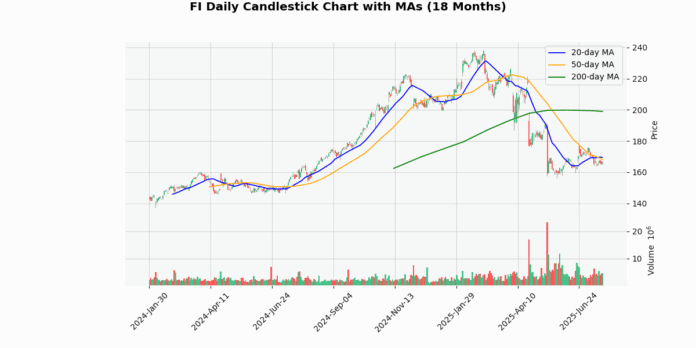

Fiserv’s current price stands at $165.98, showing a -21.63% change. The stock is trading below its moving averages, with -2.12% below the 20-day, -1.31% below the 50-day, and -16.58% below the 200-day moving average. The 52-week high is $238.59, representing a -30.43% difference, while the 52-week low is $154.17, showing a 7.66% variance. The RSI stands at 44.43, indicating a neutral position, and the MACD is -1.23, signaling a bearish trend. The week high and low are $167.39 and $164.61, respectively, with minimal fluctuations.

## Q10 Summary

In the Q2 2025 financial results, Fiserv reported positive growth across various metrics. GAAP revenue increased by 8% to $5.52 billion, with segment performance showing growth in both Merchant and Financial segments. The company’s EPS saw a significant rise of 22% to $1.86 compared to the previous year. Fiserv also achieved organic revenue growth of 8% and improved adjusted financial metrics. The company repurchased shares worth $2.2 billion and provided a refined guidance for 2025, expecting organic revenue growth of around 10% and an adjusted EPS outlook of $10.15 to $10.30.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % |

|---|---|---|---|

| 2025-07-23 | 2.43 | 2.47 | 1.65 |

| 2025-04-24 | 2.08 | 2.14 | 3.10 |

| 2025-02-05 | 2.48 | 2.51 | 1.24 |

| 2024-10-22 | 2.26 | 2.30 | 1.75 |

| 2024-07-24 | 2.10 | 2.13 | 1.44 |

| 2024-04-23 | 1.79 | 1.88 | 5.24 |

| 2024-02-06 | 2.15 | 2.19 | 1.77 |

| 2023-10-24 | 1.93 | 1.96 | 1.52 |

## Earnings Trend

Fiserv has shown consistency in its earnings performance over the last eight quarters. With a 22% increase in GAAP EPS in Q2 2025, the company has been able to maintain a positive earnings trend. The average surprise percentage and variability in earnings have been relatively stable, indicating a steady financial performance. Investors can find confidence in Fiserv’s ability to deliver consistent earnings results.

## Ratings

Recent rating changes for Fiserv include an upgrade from Monness Crespi & Hardt, shifting from Sell to Neutral. Deutsche Bank resumed coverage with a Buy rating, showing positive sentiment. Truist initiated coverage with a Buy rating and a target price of $181. Redburn Atlantic downgraded Fiserv from Neutral to Sell, setting a target price of $150. These rating changes reflect the varying perspectives on Fiserv’s performance and potential in the market.