# Constellation Brands, Inc. (STZ) Research Update

# Constellation Brands, Inc.: A Comprehensive Analysis

## Introduction:

Constellation Brands, Inc. is a renowned company engaged in the production, marketing, and distribution of beer, wine, and spirits. With a diverse portfolio spanning various alcoholic beverage categories, the company operates through segments like Beer, Wine and Spirits, Corporate Operations and Other, and Canopy. Constellation Brands has a rich history dating back to 1945 and is headquartered in Rochester, NY.

## Recent News:

In recent news, Constellation Brands has been making headlines in the financial world. Jefferies upgraded the company, citing signs of easing headwinds. Analysts believe that despite tariffs affecting the stock, it remains a buy. The company’s Q2 earnings call raised important questions among analysts, indicating a keen interest in its performance. Additionally, Wall Street analysts have identified Constellation Brands as a potential dividend stock with significant growth prospects.

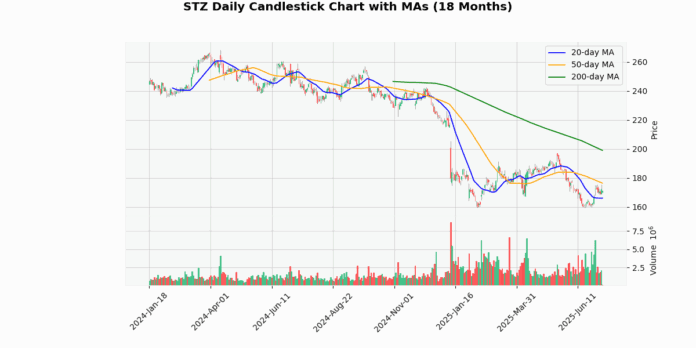

## Price Trend:

The current price of Constellation Brands stands at $171.18, showing a slight decrease. The stock is trading below its 20-day moving average by 3.09% but above the 50-day moving average by 2.95%. However, it is notably below the 200-day moving average by 13.97%. The 52-week high is at $259.25, representing a 33.97% difference, while the low is at $159.35, showing a 7.42% variance. The Relative Strength Index (RSI) is at 51.98, indicating a neutral position. The Moving Average Convergence Divergence (MACD) is -0.89, suggesting a bearish signal.

## Q10 Summary:

The Q1 FY 2026 earnings report for Constellation Brands highlighted various aspects of the company’s performance. Despite challenges in consumer demand impacting net sales, the company reported EPS of $2.90 and comparable EPS of $3.22. It declared a quarterly dividend of $1.02 per share and repurchased $381 million in shares. The company provided updated guidance for fiscal 2026, maintaining its outlook for comparable EPS and cash flow targets.

## Earnings Trend Table

| Earnings Date | Estimate | Reported EPS | Surprise% | Event Type |

|---|---|---|---|---|

| 2025-07-01 | 3.31 | 3.22 | -2.6 | Earnings |

| 2025-04-09 | 2.28 | 2.63 | 15.45 | Earnings |

| 2025-01-10 | 3.31 | 3.25 | -1.95 | Earnings |

| 2024-10-03 | 4.08 | 4.32 | 5.84 | Earnings |

| 2024-07-03 | 3.46 | 3.57 | 3.15 | Earnings |

| 2024-04-11 | 2.08 | 2.26 | 8.47 | Earnings |

| 2024-01-05 | 3 | 3.19 | 6.29 | Earnings |

| 2023-10-05 | 3.36 | 3.7 | 10.07 | Earnings |

## Earnings Trend:

Over the last eight quarters, Constellation Brands has shown consistency in its earnings performance. The company has managed to deliver positive surprises, with a focus on maintaining EPS levels. Despite fluctuations in net income attributable to CBI and adjusted EPS, Constellation Brands has demonstrated resilience in its earnings trends.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-04-29 | 1.02 |

| 2025-02-07 | 1.01 |

| 2024-11-05 | 1.01 |

| 2024-08-14 | 1.01 |

| 2024-05-02 | 1.01 |

| 2024-02-07 | 0.89 |

| 2023-11-02 | 0.89 |

| 2023-08-09 | 0.89 |

## Dividend Summary:

Constellation Brands has been consistent in its dividend payments, with a quarterly dividend of $1.02 per share declared in the latest report. The company’s commitment to returning value to shareholders through dividends is evident in its track record of dividend payments over the past eight samples.

## Ratings:

The most recent rating changes for Constellation Brands reflect positive sentiment from analysts. Jefferies upgraded the stock from Hold to Buy, setting a target price of $205. Needham reiterated a Buy rating with a target price adjustment from $215 to $195. Truist also upgraded the stock from Hold to Buy, setting a target price of $215. These rating changes indicate a bullish outlook on Constellation Brands’ future performance.