Cracker Barrel Old Country Store, Inc., founded by Dan W. Evins in 1969 and headquartered in Lebanon, Tennessee, operates a chain of combined restaurant and retail outlets. Known for its distinctive old country-store design, Cracker Barrel offers a menu of home-style country food, capturing the essence of traditional Southern hospitality in each of its locations.

Recent news has highlighted significant movements and decisions in the stock market, particularly focusing on Cracker Barrel and Nvidia. Cracker Barrel has decided to revert to its old logo following a backlash over a new design, which initially caused a slump in its stock. This decision led to a recovery in its stock price as reported on August 27, 2025. The controversy surrounding the logo change and its impact on Cracker Barrel’s market value has been a focal point, with the stock experiencing fluctuations due to public and investor reactions.

Overall, these developments indicate potential volatility and investor sensitivity to corporate decisions and financial reports. The outcomes could affect not only the involved companies’ stock prices but also broader market sentiment.

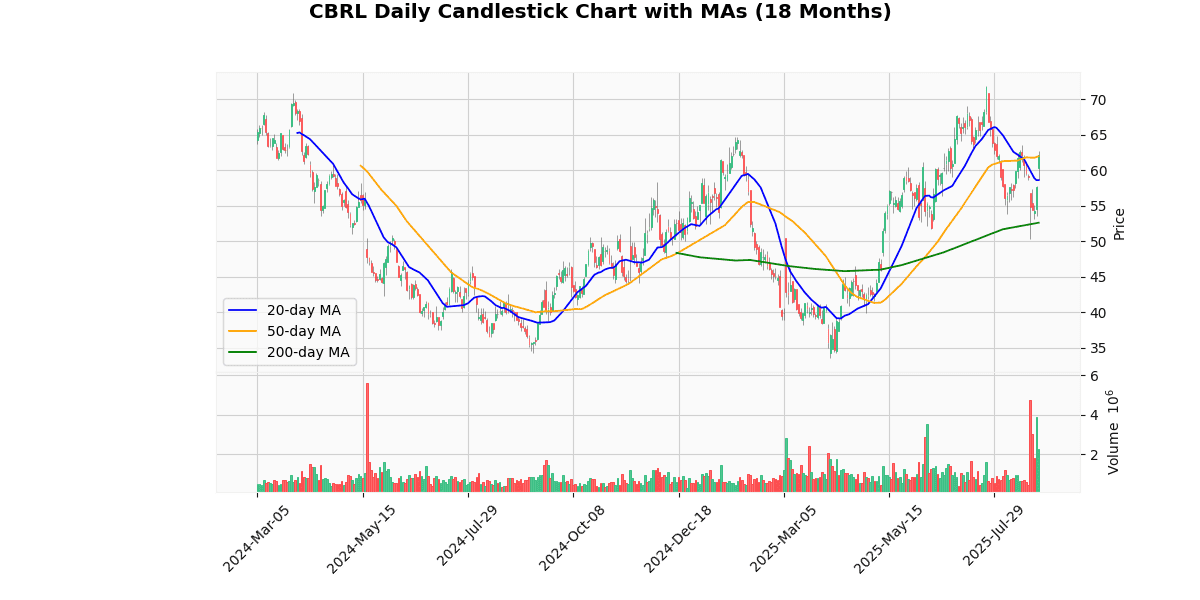

The current price of the asset is $62.15, showing a significant increase of 7.17% today, indicating a strong upward movement in the short term. This surge places the price just below the week’s high of $62.69, suggesting a potential resistance near this level.

Analyzing the moving averages, the asset is performing well above the 20-day (MA20) and 200-day (MA200) moving averages by 6.02% and 18.11%, respectively, highlighting a robust bullish trend in both the short and long term. However, the proximity to the 50-day moving average (MA50) with a slight 0.24% difference indicates some consolidation in the medium term.

The Relative Strength Index (RSI) at 55.58 is moderately bullish, suggesting that the asset is neither overbought nor oversold, supporting a stable upward momentum. However, the negative MACD value of -1.1 indicates a recent bearish crossover, which could signal caution for potential pullbacks or consolidation.

Year-to-date, the asset has shown tremendous growth, rebounding from a low of $33.51 to a high of $71.93, though it currently trades 13.6% below the year’s peak. This significant recovery from the yearly low, coupled with the current price trends and technical indicators, suggests a generally bullish outlook but advises vigilance due to potential volatility or corrective phases indicated by the MACD.

## Price Chart

Cracker Barrel Old Country Store, Inc. reported its financial results for the third quarter of fiscal 2025 on June 5, 2025. The company saw a modest revenue increase to $821.1 million, up 0.5% from $817.1 million in the same quarter the previous year. This growth was driven by a 1.0% rise in comparable store restaurant sales, despite a 3.8% decline in comparable store retail sales.

The company achieved a significant turnaround in profitability, reporting a GAAP net income of $12.6 million, or $0.56 per diluted share, compared to a net loss of $9.2 million, or ($0.41) per share, in Q3 2024. Adjusted earnings per diluted share were $0.58, down from $0.88 a year earlier.

Adjusted EBITDA slightly increased to $48.1 million, representing 5.9% of total revenue. The company managed to reduce labor and related expenses to $304.8 million and reported a slight increase in the cost of goods sold to $247.3 million.

For the full fiscal year, Cracker Barrel expects total revenue between $3.45 billion and $3.50 billion, with adjusted EBITDA projected to be between $215 million and $225 million. The company anticipates commodity and hourly wage inflation in the mid-2% range and plans capital expenditures of $160 million to $170 million. Additionally, Cracker Barrel plans to open one new store and has already opened four new Maple Street Biscuit Company units.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-06-05 | 0.17 | 0.58 | 241.18 |

| 1 | 2025-06-05 | 0.30 | 0.58 | 95.19 |

| 2 | 2025-03-06 | 1.09 | 1.38 | 27.19 |

| 3 | 2024-11-14 | 0.34 | 0.45 | 31.84 |

| 4 | 2024-09-19 | 1.10 | 0.98 | -10.99 |

| 5 | 2024-05-30 | 0.66 | 0.88 | 33.33 |

| 6 | 2024-02-27 | 1.36 | 1.37 | 0.73 |

| 7 | 2023-11-30 | 0.74 | 0.51 | -31.49 |

Over the last eight quarters, the company’s earnings per share (EPS) have shown significant variability in both performance against estimates and overall trends. A detailed analysis reveals a pattern of fluctuating EPS that occasionally exceeds expectations but also falls short in certain quarters.

Starting from the most recent quarter (Q2 2025), there was a substantial positive surprise, with the reported EPS of $0.58 significantly surpassing the estimate of $0.17 by 241.18%. This was mirrored in the same quarter by another calculation showing a 95.19% positive surprise on the same EPS figure against a higher estimate of $0.30, indicating possible recalculations or adjustments in estimated EPS figures.

In Q1 2025 and Q4 2024, the company also outperformed EPS estimates with surprises of 27.19% and 31.84%, respectively. However, there was a notable underperformance in Q3 2024, where the reported EPS of $0.98 fell short of the estimate by 10.99%.

The trend from 2024 shows a recovery from an earlier dip in Q4 2023, where the reported EPS of $0.51 was significantly below the estimate by 31.49%. This was followed by better-than-expected performances in Q1 and Q2 2024, with surprises of 0.73% and 33.33%, respectively.

Overall, the EPS trend over these eight quarters highlights a company experiencing significant volatility in its earnings outcomes, with a mix of substantial overperformances and notable underperformances relative to analyst expectations. This pattern suggests a degree of unpredictability in financial outcomes, which could be indicative of variable business conditions or changes in the company’s operational efficiency.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-07-18 | 0.25 |

| 2025-04-11 | 0.25 |

| 2025-01-17 | 0.25 |

| 2024-10-18 | 0.25 |

| 2024-07-19 | 0.25 |

| 2024-04-11 | 1.3 |

| 2024-01-18 | 1.3 |

| 2023-10-19 | 1.3 |

The dividend data over the last eight quarters shows a distinct shift in the dividend payout pattern. Initially, from October 2023 to April 2024, the company maintained a consistent dividend of $1.30. This higher dividend rate suggests a period of stronger financial performance or a strategic decision to distribute more earnings back to shareholders.

However, starting from July 2024, there is a notable reduction in the dividend to $0.25, which has been maintained through to the most recent data point in July 2025. This significant decrease could indicate a strategic shift by the company, possibly due to a need to conserve cash for internal investments or due to decreased earnings. The consistency of the lower dividend rate over the subsequent quarters suggests that this new level may be the new norm, reflecting a recalibration of payout policies in response to changing company dynamics or broader economic conditions. This trend warrants close monitoring to understand the underlying factors driving these decisions, as they could have implications for investor confidence and future company stability.

The most recent rating changes for Outer include two upgrades, one reiterated rating, and one downgrade, reflecting varied analyst perspectives on the company’s financial outlook.

1. **Truist – Upgrade (2025-03-10):** Truist Financial upgraded Outer from ‘Hold’ to ‘Buy’ and increased the target price from $51 to $55. This adjustment suggests a positive shift in Truist’s valuation of Outer, possibly due to improved company performance or market conditions that favor Outer’s business model.

2. **Piper Sandler – Reiterated (2024-12-05):** Piper Sandler maintained a ‘Neutral’ rating on Outer but raised the target price significantly from $46 to $58. This substantial increase in target price, despite the neutral stance, indicates that Piper Sandler acknowledges growth potentials or recovery in Outer’s operations that were not fully reflected in the previous target.

3. **Argus – Upgrade (2024-11-18):** Argus upgraded Outer from ‘Hold’ to ‘Buy’ with a set target price of $52. This upgrade, occurring shortly after a downgrade by the same firm, suggests a reassessment of Outer’s prospects or a response to new developments that could positively impact the company’s future earnings and market position.

4. **Argus – Downgrade (2024-08-06):** Earlier in the year, Argus downgraded Outer from ‘Buy’ to ‘Hold’. This downgrade reflects a more cautious stance from Argus, possibly due to emerging challenges or disappointing performance indicators that could hinder Outer’s growth or profitability.

Overall, these rating changes reflect a dynamic view on Outer’s financial health and market potential, with recent upgrades indicating a possible recovery or positive adjustment in the company’s strategy and performance outlook.

The current price of the stock is $62.15, which is above the average target price provided by recent analyst ratings. The most recent upgrade by Truist on March 10, 2025, raised the target price from $51 to $55 and upgraded the stock from Hold to Buy. Similarly, Piper Sandler reiterated a Neutral rating on December 5, 2024, but increased their target price from $46 to $58. Earlier, on November 18, 2024, Argus upgraded the stock from Hold to Buy with a target price of $52. However, Argus had previously downgraded the stock from Buy to Hold on August 6, 2024, without specifying a new target price.

These analyst adjustments suggest a generally positive outlook on the stock, despite the current price exceeding the latest target prices. This could indicate that the stock is performing better than analysts had anticipated. The trend in ratings and target prices points to an improving sentiment among analysts over the recent months.