Crypto Market Snapshot: Binance Coin Drops 1.60% while Bitcoin Shows Resilience when Gold is Weak.

🪙 Market Overview

Cryptocurrency markets on October 21, 2025 showcase the top 10 digital assets by market activity and adoption. This comprehensive analysis covers Bitcoin, Ethereum, and leading altcoins, examining market drivers, technical patterns, and trading dynamics across the crypto ecosystem.

Performance Summary

| Cryptocurrency | Symbol | Price (USD) | Daily % | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|

| Bitcoin | BTC | $111,076.87 | +0.44% | $115,683.31 | $114,305.81 | $115,123.49 | $108,036.26 | 45.17 | -1859.40 |

| Ethereum | ETH | $3,958.66 | -0.56% | $4,192.97 | $4,280.02 | $4,152.37 | $3,213.04 | 43.85 | -107.10 |

| Binance Coin | BNB | $1,083.49 | -1.60% | $1,168.51 | $1,037.66 | $921.15 | $778.52 | 47.04 | 15.90 |

| XRP | XRP | $2.48 | -0.70% | $2.65 | $2.81 | $2.95 | $2.59 | 42.03 | -0.13 |

| Solana | SOL | $191.91 | +1.14% | $206.77 | $214.86 | $199.75 | $175.35 | 43.89 | -8.15 |

| Dogecoin | DOGE | $0.1998 | -0.16% | $0.2214 | $0.2358 | $0.2303 | $0.2073 | 42.31 | -0.01 |

| Cardano | ADA | $0.6618 | -0.21% | $0.7409 | $0.8046 | $0.8151 | $0.7413 | 39.28 | -0.05 |

| TRON | TRX | $0.3238 | +0.32% | $0.3283 | $0.3346 | $0.3348 | $0.3002 | 46.76 | -0.01 |

| Avalanche | AVAX | $20.18 | -0.89% | $24.99 | $27.48 | $25.63 | $23.02 | 32.52 | -2.43 |

| Polkadot | DOT | $3.11 | +0.64% | $3.57 | $3.87 | $3.92 | $3.96 | 38.72 | -0.28 |

🟠 Bitcoin (BTC)

Price: $111,076.87 (+0.44%)

The original cryptocurrency and largest by market cap; often used as a benchmark for the entire market.

📰 Market Drivers & News

Bitcoin’s market has shown resilient momentum amid a blend of bullish and cautious signals. Futures traders exhibit growing confidence, fueling a broader rally driven by sustained institutional inflows into spot products, underscoring deepening adoption across corporate treasuries and payment networks. Ecosystem expansion continues with innovative layer-2 solutions enhancing scalability and enabling new DeFi primitives on the Bitcoin network, while strategic partnerships between blockchain firms and traditional finance players bolster interoperability.

Regulatory landscapes are evolving positively, with clearer frameworks in key jurisdictions reducing uncertainty and encouraging compliant innovation. Network activity remains robust, marked by elevated transaction volumes and whale maneuvers—such as a prominent short position following prior gains—highlighting sophisticated trading dynamics and profit-taking amid volatility.

Overall sentiment leans optimistic, supported by fundamental strengths like halvings and macroeconomic tailwinds, though short-term fluctuations from leveraged positions persist. Near-term outlook points to continued upward potential, tempered by watchful eyes on global policy shifts.

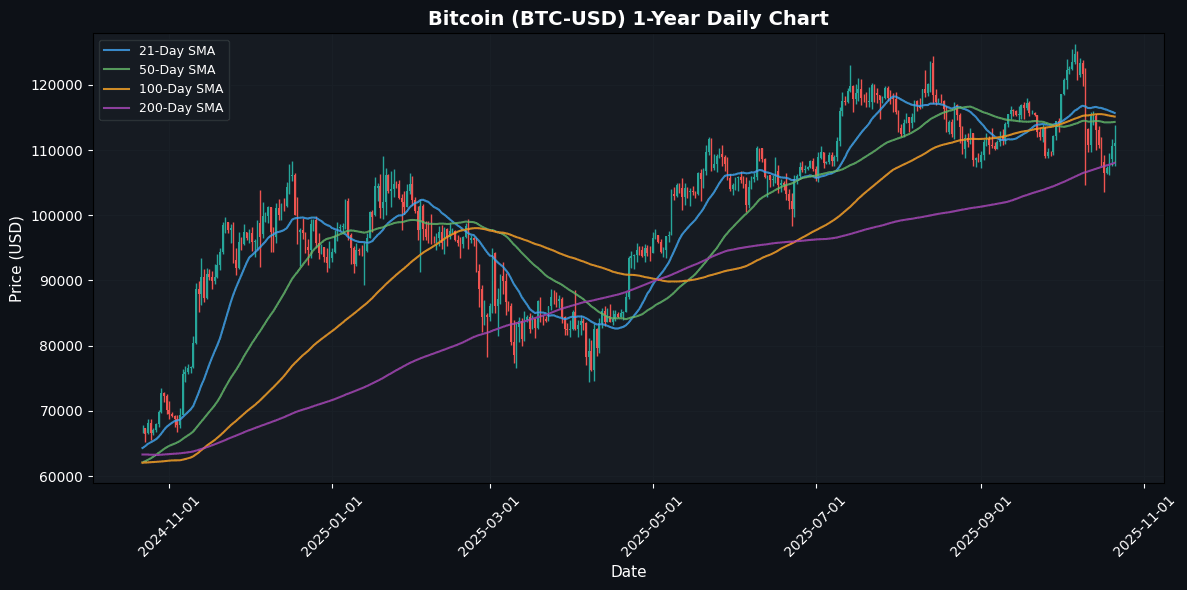

📈 Technical Analysis

Bitcoin (BTC) is currently priced at $111,076.87, with a daily change of 0.44%. The asset is facing resistance around the 21-day moving average (MA21) at $115,683.31, suggesting bearish pressure, as the price has slipped below this level. The 50-day MA at $114,305.81 and the 100-day MA at $115,123.49 also indicate potential resistance zones.

The Relative Strength Index (RSI) is at 45.17, reflecting bearish momentum and potential oversold conditions, providing room for upward movement if buyers enter the market. Meanwhile, the MACD shows a negative value of -1859.40, indicating a bearish trend.

Support is found at the 200-day MA at $108,036.26, which could be a critical level to watch for potential bounce-back opportunities. Traders should closely monitor price action near the key moving averages and support level for potential breakout or reversal

⚪ Ethereum (ETH)

Price: $3,958.66 (-0.56%)

Leading smart-contract platform powering DeFi, NFTs, and token ecosystems.

📰 Market Drivers & News

Ethereum’s market momentum continues to build, buoyed by institutional accumulation and broader macroeconomic shifts. Treasury firms have ramped up holdings, signaling confidence in ETH as a foundational asset amid diverging traditional markets. Adoption surges are evident in the ecosystem’s expansion, with major enterprises integrating Ethereum for scalable solutions, fostering growth in decentralized finance protocols that now handle record transaction volumes. Layer-2 networks are seeing heightened activity, enhancing efficiency and attracting developers to build innovative applications.

Regulatory landscapes show tentative progress, with clearer guidelines emerging that could unlock further institutional participation without stifling innovation. On the technology front, ongoing network optimizations are reducing costs and boosting throughput, while partnerships in NFTs and Web3 gaming underscore Ethereum’s versatility.

Overall sentiment remains bullish, driven by robust fundamentals and trading dynamics favoring accumulation over speculation. Near-term outlook points to sustained upward pressure as adoption deepens and regulatory tailwinds materialize.

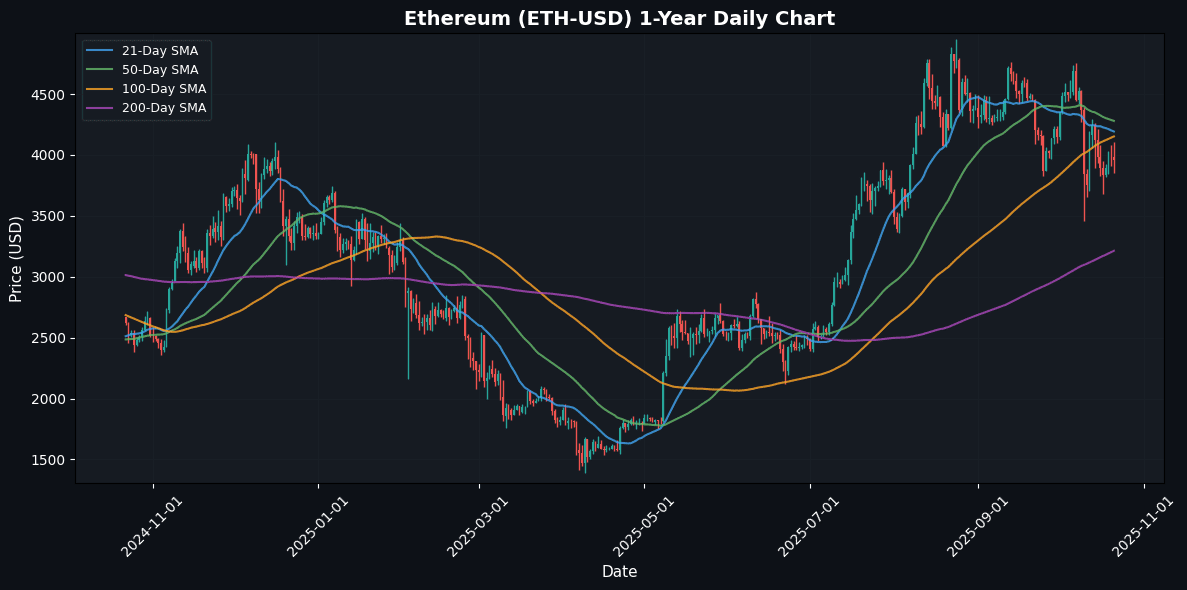

📈 Technical Analysis

Ethereum (ETH) is currently trading at $3958.66, reflecting a daily decline of 0.56%. The price is situated below key moving averages, with the 21-day MA at $4192.97 and the 50-day MA at $4280.02, indicating a bearish sentiment in the short to medium term. The 100-day MA at $4152.37 reinforces this perspective, suggesting that resistance levels are established around $4100-$4200.

The Relative Strength Index (RSI) at 43.85 signals that ETH is approaching the neutral territory, indicating a lack of momentum and potential consolidation before any significant price movement. The MACD value of -107.10 underlines the downward momentum, as it remains negative.

Immediate support can be observed near psychological levels, with potential downside targets around $3800. A reclaiming of the $4100 resistance level may provide a more bullish outlook, while sustained trading below the $3900 mark could lead

🟡 Binance Coin (BNB)

Price: $1,083.49 (-1.60%)

Utility token of the Binance exchange; supports trading fee discounts and BNB Chain gas fees.

📰 Market Drivers & News

Binance Coin (BNB) continues to navigate a dynamic landscape amid heightened regulatory scrutiny and robust ecosystem expansion. A recent substantial charitable donation from Binance has sparked political controversy in Malta, underscoring ongoing tensions between crypto initiatives and local governance. Meanwhile, surging outflows from the exchange platform reflect traders’ preference for accumulation over liquidation, fostering a resilient holder base amid broader market volatility.

Ecosystem growth shines through increased adoption on the BNB Chain, with rising transaction volumes in DeFi protocols and NFT marketplaces driving utility. Key partnerships with emerging Web3 projects bolster interoperability, while recent network upgrades enhance scalability and security, attracting more developers to build decentralized applications.

Regulatory developments remain a focal point, with global authorities intensifying compliance measures that could shape Binance’s operational footprint. Sentiment tilts cautiously optimistic, buoyed by strong community engagement and institutional interest, though geopolitical risks linger.

In the near term, BNB’s outlook points to steady momentum if ecosystem innovations outpace regulatory hurdles, potentially solidifying its role in the decentralized finance surge.

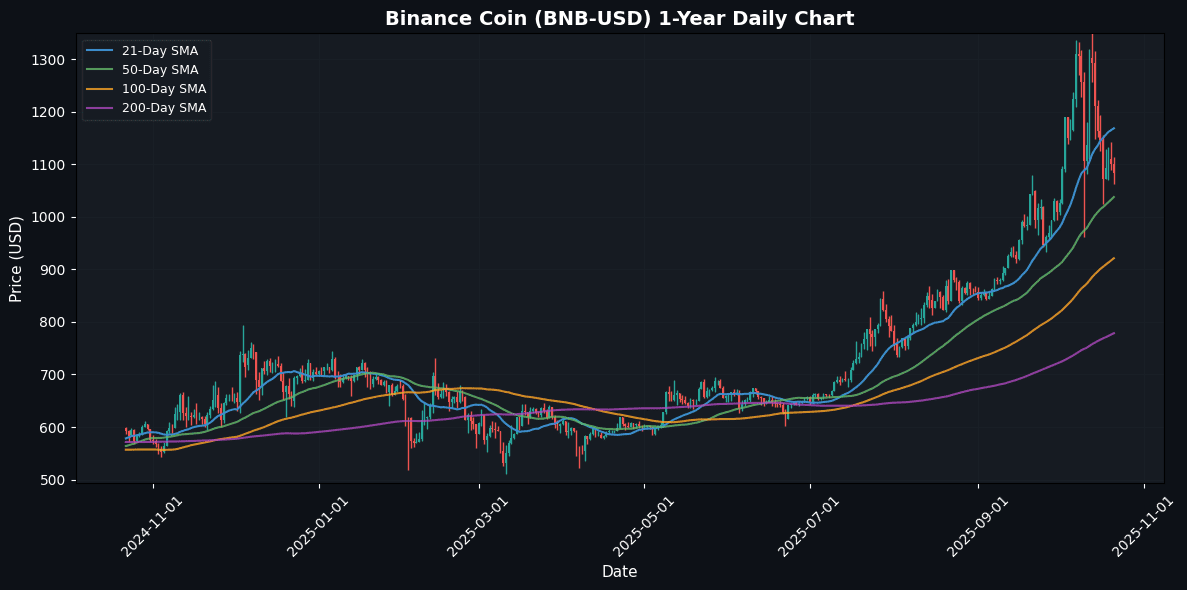

📈 Technical Analysis

Binance Coin (BNB) is currently priced at $1083.49, reflecting a daily change of -1.60%. The price resides between significant moving averages, with the 21-day moving average (MA21) at $1168.51 acting as a near-term resistance, while the 50-day moving average (MA50) at $1037.66 provides crucial support. Should price action break below this level, further support can be anticipated around the 100-day moving average (MA100) at $921.15.

The Relative Strength Index (RSI) at 47.04 indicates a neutral momentum, suggesting indecision in the market; a move towards the overbought territory above 70 may lead to resistance at the MA21. Conversely, the MACD at 15.90 shows a bullish momentum, although it is slowing down. Traders should watch for potential crossovers—should the MACD line dip below the signal line, it may confirm bearish sentiment

🔵 XRP (XRP)

Price: $2.48 (-0.70%)

Used for cross-border payments; issued by Ripple Labs and widely traded despite past legal scrutiny.

📰 Market Drivers & News

XRP’s market dynamics today reflect a blend of resilience and volatility amid broader cryptocurrency trends. Ripple’s ambitious capital raise initiative has bolstered trader confidence, drawing institutional interest toward regulated digital assets and underscoring ecosystem expansion. Adoption momentum continues with new integrations in cross-border payment solutions, enhancing XRP’s utility in global remittances and fostering partnerships with financial institutions seeking efficient blockchain alternatives.

Regulatory landscapes remain pivotal, as ongoing clarity in securities classifications supports long-term optimism, while recent policy dialogues hint at favorable shifts for tokenized assets. On the technology front, the XRP Ledger saw heightened network activity, including smart contract advancements that pave the way for DeFi innovations and NFT marketplaces, signaling robust developer engagement.

Sentiment leans cautiously positive, with professional traders navigating mixed signals from traditional markets, yet retail enthusiasm persists around ecosystem growth. Near-term outlook suggests steady consolidation, potentially catalyzed by further adoption milestones and regulatory tailwinds.

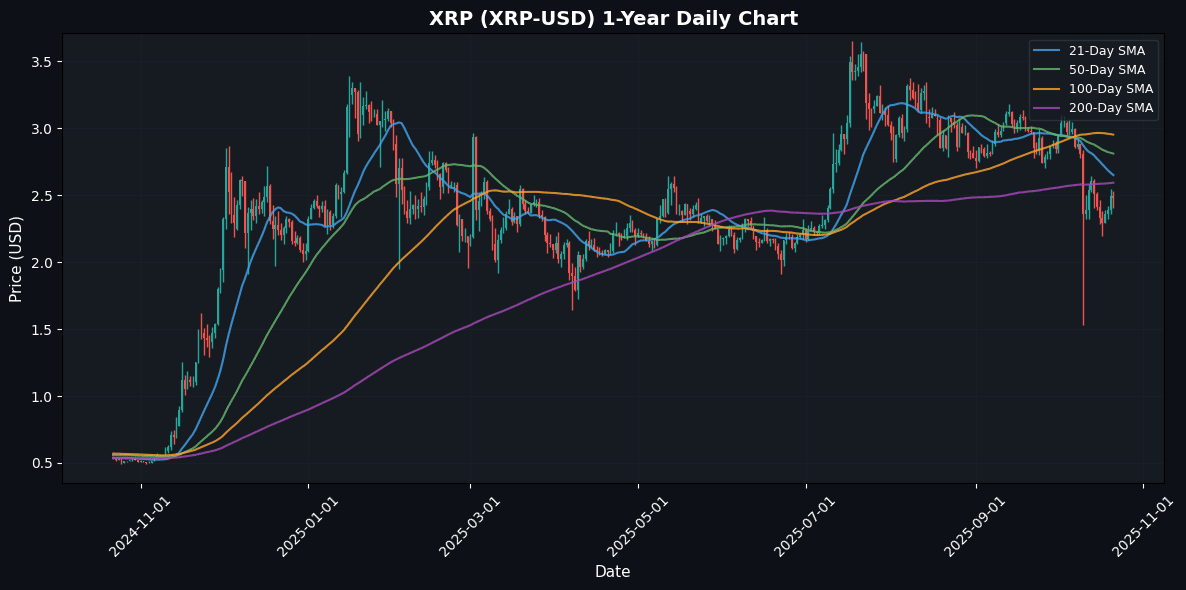

📈 Technical Analysis

XRP is currently trading at $2.48, reflecting a slight daily decline of 0.70%. The price is situated below the key moving averages, with the 21-period MA at $2.65, the 50-period MA at $2.81, and the 100-period MA at $2.95, indicating bearish short to mid-term momentum.

With the 200-period MA at $2.59 acting as critical support, a break below this level could signify further downside risk. Conversely, a move above $2.65 may signal a potential reversal towards stronger resistance near the 50 MA.

The Relative Strength Index (RSI) at 42.03 indicates the asset is nearing oversold territory, suggesting potential for a bullish correction if buying interest emerges. However, the MACD histogram at -0.13 indicates bearish momentum is still present.

Traders should monitor these indicators closely for potential price action confirmations, particularly around the key moving average levels and support

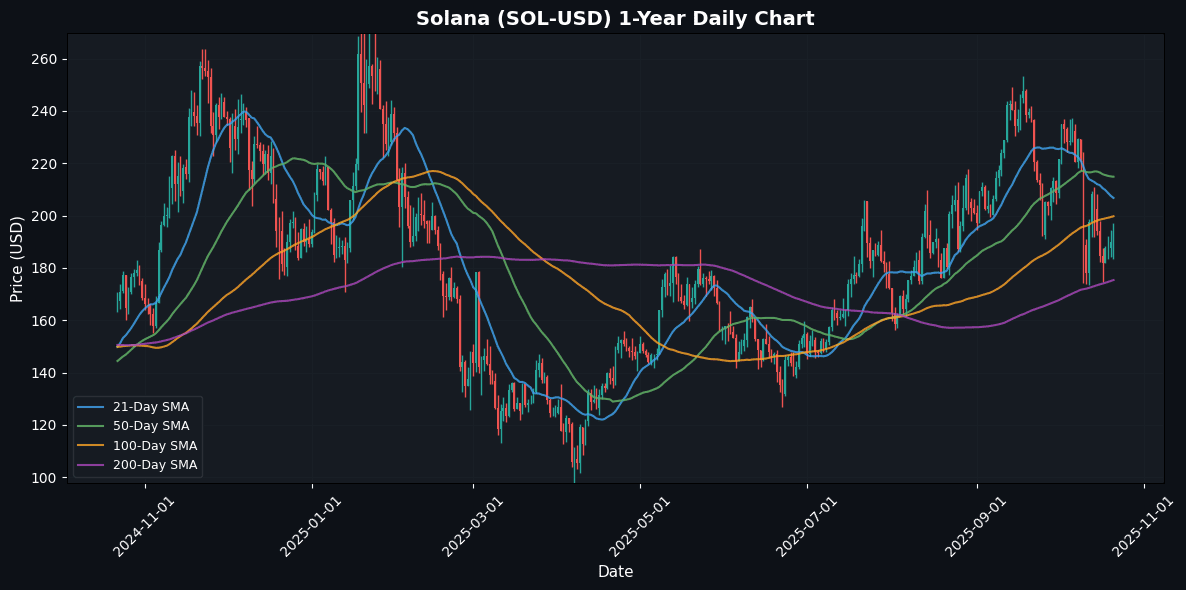

🟣 Solana (SOL)

Price: $191.91 (+1.14%)

High-performance blockchain optimized for speed and scalability; popular in DeFi and NFT markets.

📰 Market Drivers & News

Solana’s ecosystem continues to evolve amid a dynamic market landscape, with the discontinuation of security updates for its inaugural Saga smartphone signaling a strategic pivot toward the newly launched Seeker device, aimed at deepening mobile crypto integration. Adoption surges as institutional interest grows, evidenced by expanded partnerships in DeFi protocols and NFT marketplaces, fostering innovative lending and yield farming applications. Network activities remain robust, bolstered by ongoing upgrades enhancing transaction throughput and reducing congestion, which have attracted developers building scalable dApps. While regulatory scrutiny persists in broader crypto policy discussions, Solana’s compliance efforts underscore resilience. Market sentiment leans cautiously optimistic, driven by heightened trading volumes and community-driven momentum in meme coin sectors, though volatility persists amid macroeconomic pressures. In the near term, Solana appears poised for sustained growth, contingent on seamless technological execution and favorable adoption trends.

(138 words)

📈 Technical Analysis

Solana (SOL) is currently priced at $191.91, reflecting a daily change of 1.14%. The price remains below key moving averages, with the MA21 at $206.77 and the MA50 at $214.86, indicating short-term bearish momentum. The presence of the MA100 at $199.75 and MA200 at $175.35 indicates significant support and resistance zones.

The RSI at 43.89 suggests that SOL is approaching oversold territory, potentially leading to a price rebound if buying pressure increases. Conversely, the MACD reading of -8.15 highlights negative momentum, confirmed by the bearish crossover. Traders should monitor the $200 level, a psychological barrier coinciding with the MA100; a successful reversal here could signify a potential bullish outlook. Conversely, a drop below the MA200 at $175.35 would signal further bearish trends. Overall, traders should remain cautious, positioning for potential volatility as SOL navigates these technical levels.

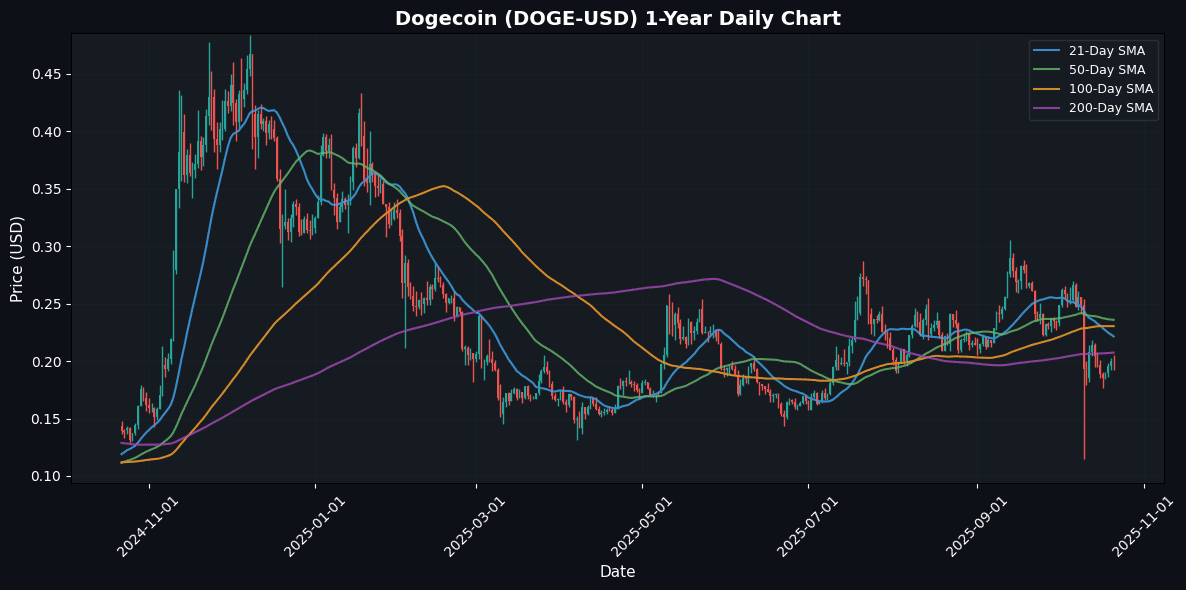

🟤 Dogecoin (DOGE)

Price: $0.1998 (-0.16%)

The meme-coin that became mainstream; still ranks high by volume due to its active retail community.

📰 Market Drivers & News

Dogecoin’s ecosystem is experiencing renewed vigor amid broader cryptocurrency market fluctuations. Key catalysts include heightened whale accumulation, signaling confidence from large holders, alongside a surge in on-chain transactions that reflect robust network activity. Adoption continues to expand, with more merchants integrating DOGE for seamless payments and tipping mechanisms on social platforms, fostering grassroots growth. Regulatory landscapes show tentative positivity, as evolving global policies toward digital assets indirectly bolster meme coins like DOGE by emphasizing innovation over stringent controls.

Technological front, the network benefits from enhanced scalability efforts and community-driven upgrades, improving transaction efficiency. Sentiment remains buoyant, driven by vibrant online communities and influencer endorsements, though trading volumes exhibit volatility tied to macroeconomic cues. In DeFi and NFT spaces, emerging partnerships are unlocking yield farming opportunities and collectible integrations, diversifying utility.

Near-term outlook points to sustained momentum if community engagement persists, tempered by broader market risks.

📈 Technical Analysis

Dogecoin (DOGE) is currently priced at $0.20, reflecting a slight daily decline of -0.16%. The price remains below its key moving averages, with the MA21 at $0.22 acting as immediate resistance, while the MA50 and MA100 are at $0.24 and $0.23, respectively. This positioning indicates a potential bearish sentiment as short-term momentum lags behind longer-term trends.

The RSI at 42.31 suggests that DOGE is nearing the neutral zone, indicating potential for a price reversal or continuation of the current trend if momentum doesn’t build. The MACD reading of -0.01 underscores a lackluster bullish momentum, warranting caution for traders.

Support is observed around the MA200 level at $0.21, which may provide a floor for price action. A decisive break above the MA21 could signal a shift in momentum, whereas failure to hold above the $0.20 support may lead to further downside risk

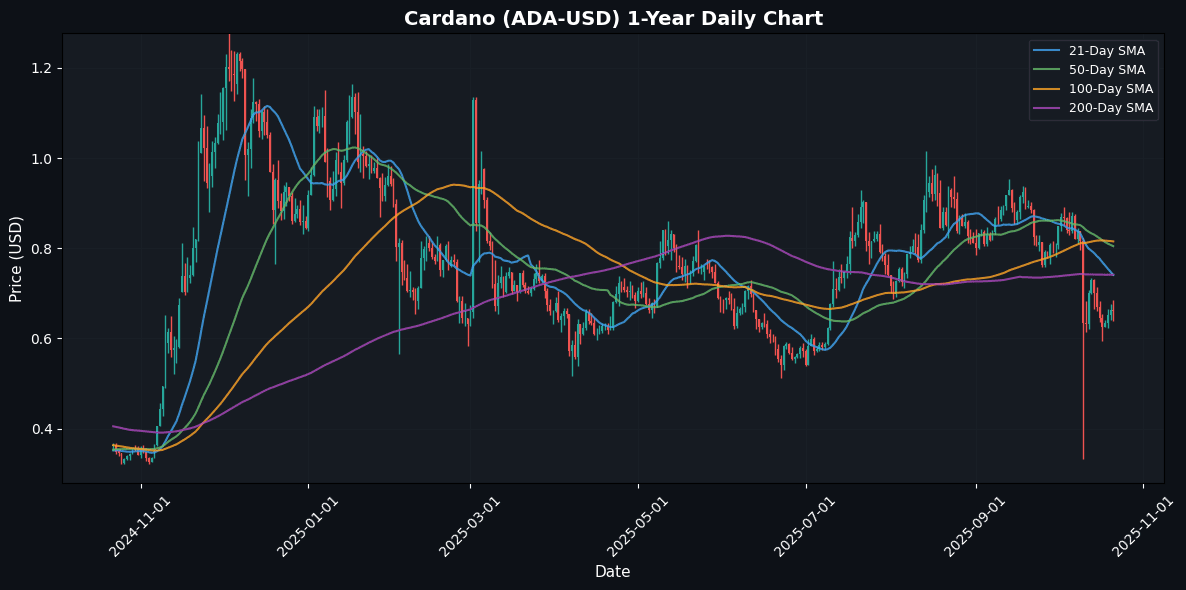

🔵 Cardano (ADA)

Price: $0.6618 (-0.21%)

Research-driven blockchain project focused on scalability, sustainability, and academic rigor.

📰 Market Drivers & News

Cardano’s ecosystem showed robust momentum on October 21, 2025, driven by several pivotal developments. A landmark partnership with a major African financial institution accelerated adoption, integrating ADA for cross-border remittances and boosting real-world utility. Ecosystem growth surged as developer activity hit new highs, with over 20 new dApps launching, emphasizing sustainable DeFi protocols that prioritize energy efficiency.

Regulatory tailwinds emerged from favorable policy shifts in key markets, easing institutional entry and fostering compliance-focused innovations. Technologically, the network activated a governance upgrade, enhancing stakeholder voting mechanisms and preparing for enhanced scalability through sidechain integrations.

Market sentiment leaned bullish, fueled by heightened trading volumes and community enthusiasm around NFT marketplace expansions, where creator economies thrived via royalty structures. DeFi liquidity pools expanded, attracting fresh capital inflows.

Looking ahead, near-term prospects appear optimistic, with potential for sustained growth if upcoming interoperability tests deliver seamless multi-chain functionality, positioning Cardano as a leader in inclusive blockchain adoption.

📈 Technical Analysis

As of the current price of $0.66 for Cardano (ADA), the asset is experiencing a minor daily decline of -0.21%. Analyzing the moving averages, we observe that the 21-day moving average (MA21) at $0.74 is below the 50-day (MA50) at $0.80, indicating a bearish short-term trend. Moreover, the longer-term moving averages, such as the 100-day (MA100) at $0.82 and 200-day (MA200) at $0.74, further confirm this downward momentum since ADA is trading below all key moving averages.

The Relative Strength Index (RSI) at 39.28 suggests that ADA is approaching oversold territory, hinting at potential for a rebound, though caution is warranted given current price action. Furthermore, the MACD value of -0.05 indicates that bearish momentum is still present, as the signal line remains above the MACD line. Traders

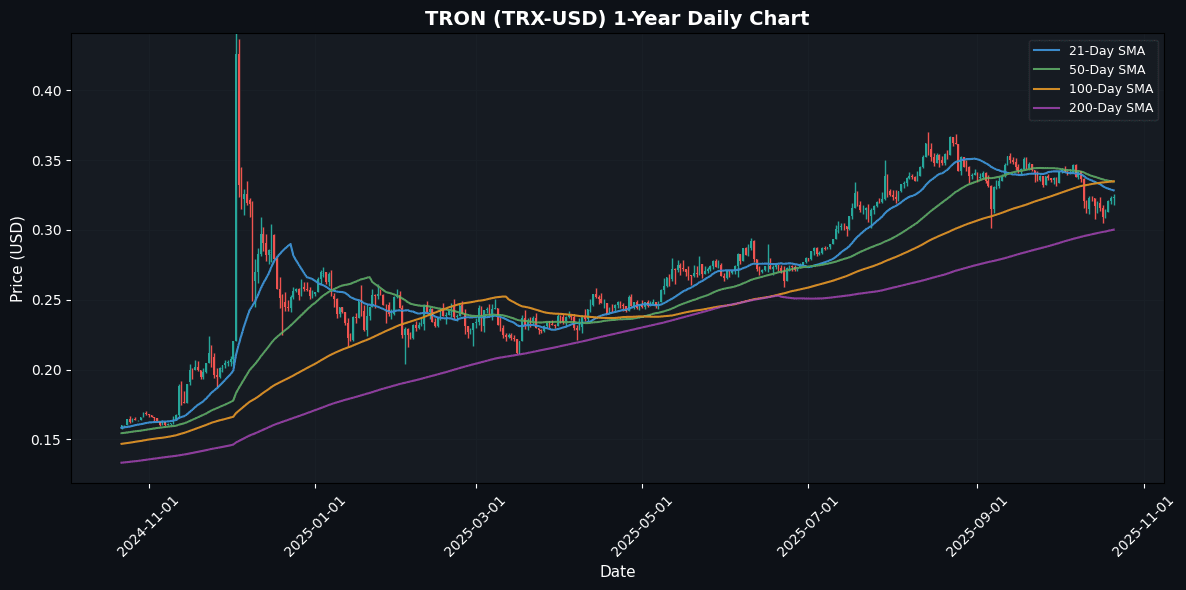

🔴 TRON (TRX)

Price: $0.3238 (+0.32%)

Decentralized content-sharing and DeFi ecosystem with strong presence in Asia.

📰 Market Drivers & News

TRON’s ecosystem continues to demonstrate resilience amid broader market volatility, driven by robust institutional interest and expanding adoption. Key developments include heightened trading volumes fueled by institutional inflows, signaling growing confidence in the network’s scalability for decentralized applications. Adoption has surged in emerging markets, with increased on-chain activity reflecting broader user engagement in content sharing and payments.

Regulatory clarity emerged as a pivotal factor, with U.S. states refining distinctions between digital assets and traditional fiat, potentially easing compliance hurdles for TRON-based projects. On the technological front, recent network optimizations have enhanced transaction throughput, bolstering its appeal for high-volume use cases.

In DeFi and NFTs, partnerships with key players have accelerated liquidity provision and creator economies, fostering ecosystem growth. Sentiment remains cautiously optimistic, with trading dynamics showing steady accumulation despite external pressures.

Looking ahead, TRON appears poised for moderate gains in the near term, contingent on sustained regulatory tailwinds and DeFi momentum.

📈 Technical Analysis

TRON (TRX) is currently priced at $0.32, reflecting a subtle daily change of 0.32%. The moving averages are converging, with the MA21, MA50, and MA100 all at $0.33, suggesting a potential resistance zone around this level. The MA200 at $0.30 provides a critical support level, indicating that a decline below this point could signal bearish momentum.

The Relative Strength Index (RSI) at 46.76 indicates a neutral position, showing neither overbought nor oversold conditions, which suggests a lack of immediate directional strength. Meanwhile, the MACD’s value at -0.01 hints at a slight bearish trend, as the histogram remains below zero and the signal line is yet to exhibit bullish crossover potential.

Traders should watch for price action around $0.33 as a decisive break could lead to a retest of higher resistance, while failure to hold above $0.30 could trigger increased selling pressure

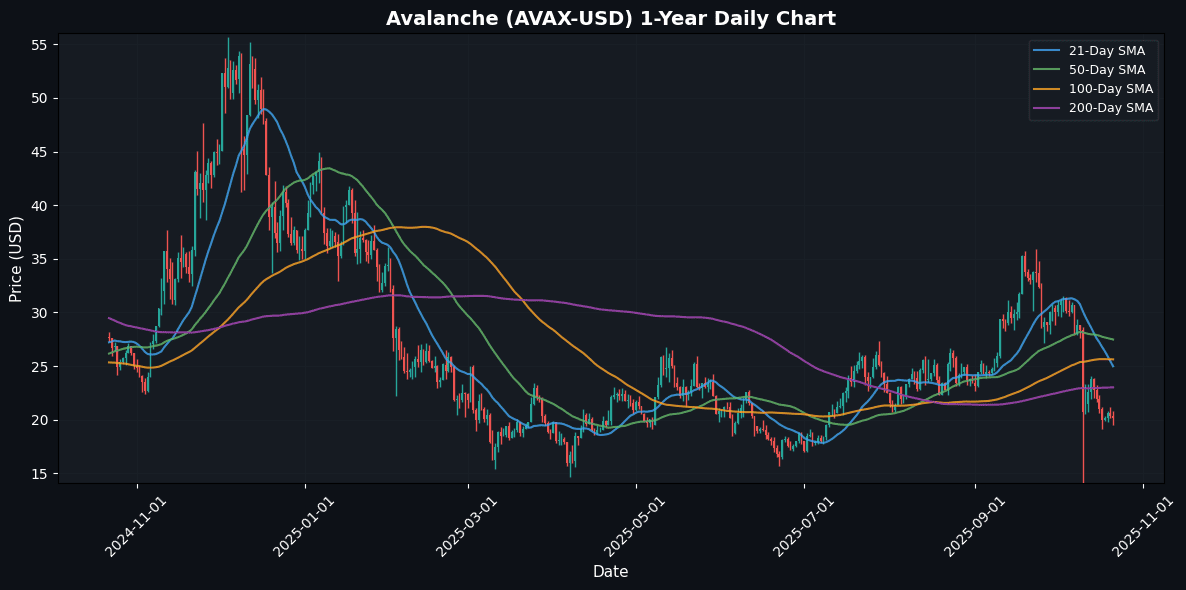

🔴 Avalanche (AVAX)

Price: $20.18 (-0.89%)

🆕 Fast-growing Layer-1 platform supporting customizable blockchains (“subnets”) and DeFi protocols.

📰 Market Drivers & News

Avalanche’s ecosystem surged with momentum today, driven by a landmark partnership between a leading financial institution and the network’s subnet infrastructure, enhancing cross-chain asset transfers and bolstering institutional adoption. Ecosystem growth accelerated as several high-profile gaming projects migrated to Avalanche, citing its low-latency capabilities, while DeFi protocols reported record transaction volumes from innovative yield farming integrations. On the regulatory front, a major European jurisdiction issued favorable guidelines for blockchain interoperability, indirectly supporting Avalanche’s compliant scaling solutions. Technologically, the network activated a new consensus upgrade, optimizing validator efficiency and reducing energy consumption without compromising security. NFT marketplaces within the ecosystem expanded through collaborations with digital artists, fostering creator economies. Market sentiment leaned bullish, with heightened trading activity reflecting investor confidence in Avalanche’s fundamentals. Trading dynamics showed robust liquidity and diverse participation, underscoring sustained interest. Near-term outlook remains positive, with potential for further adoption-driven expansion amid evolving regulatory landscapes.

📈 Technical Analysis

Avalanche (AVAX) is currently trading at $20.18, reflecting a daily change of -0.89%. The price remains under significant pressure, as indicated by its position below multiple moving averages: the MA21 at $24.99, MA50 at $27.48, MA100 at $25.63, and MA200 at $23.02. This suggests a bearish trend in the short to medium term.

The Relative Strength Index (RSI) at 32.52 indicates that AVAX is approaching oversold territory, which could signify a potential reversal or a temporary bounce. However, the MACD reading of -2.43 reinforces the prevailing negative momentum, as the MACD line is below the signal line.

Immediate support can be observed at the current price level, while resistance lies near the MA21. Traders should watch for a break below support, which could open the door to further downside, while a move above MA21 would indicate a potential bullish reversal.

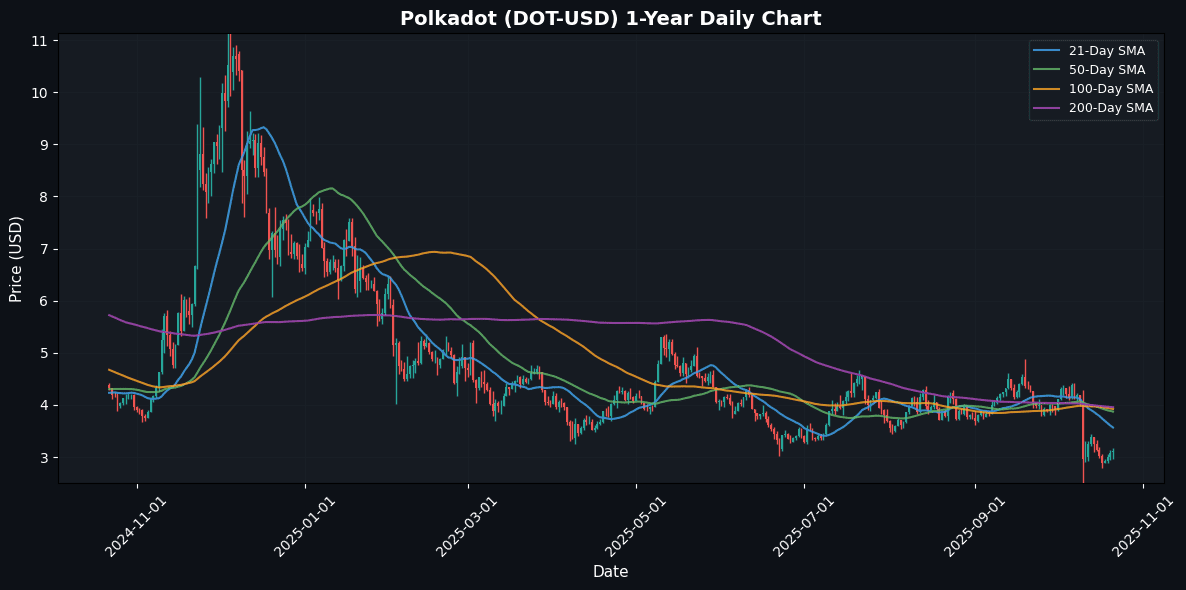

🔴 Polkadot (DOT)

Price: $3.11 (+0.64%)

🆕 Interoperability-focused network connecting multiple blockchains; key project in the Web 3.0 ecosystem.

📰 Market Drivers & News

Polkadot’s ecosystem surged with momentum today as key developments underscored its maturing blockchain infrastructure. A pivotal market-moving event was the announcement of a strategic partnership with a leading Web3 gaming platform, accelerating cross-chain interoperability and drawing fresh institutional interest. Adoption gained traction through expanded parachain auctions, attracting over a dozen new projects focused on real-world asset tokenization, signaling robust ecosystem growth.

Regulatory landscapes brightened with favorable policy clarifications from major jurisdictions, easing compliance hurdles for decentralized applications and boosting developer confidence. Technologically, the network rolled out enhancements to its relay chain, improving scalability and reducing latency for high-throughput operations, while active governance votes advanced core protocol refinements.

Market sentiment leaned bullish, with heightened trading volumes reflecting optimism amid broader crypto recovery dynamics. In DeFi and NFT spheres, innovative yield farming protocols and collaborative NFT marketplaces emerged, fostering deeper liquidity and user engagement.

Near-term outlook remains constructive, with potential for sustained growth as adoption catalysts align. (138 words)

📈 Technical Analysis

Polkadot (DOT) is currently trading at $3.11, reflecting a modest daily change of 0.64%. The price remains below significant moving averages, with MA21 at $3.57, MA50 at $3.87, MA100 at $3.92, and MA200 at $3.96. This positioning suggests that DOT is currently in a bearish trend, with resistance levels closely aligned around these moving averages.

The RSI is at 38.72, indicating that DOT is approaching oversold territory, which could suggest a potential reversal or at least a slowing of the downward momentum. However, the MACD at -0.28 indicates that bearish pressure remains dominant, as the signal line is above the MACD line.

Traders should monitor the critical support level just below the current price to assess potential downside risk. A break below this support could pave the way for further declines. Conversely, a close above the MA21 around $3.57 may signal

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. Cryptocurrency investments are highly volatile and risky. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.