💎 Crypto Update: Chainlink Advances 3.07% – Market Analysis

📊 Market Overview

Report Date: October 31, 2025

| Cryptocurrency | Symbol | Price (USD) | Daily Change (%) | MA50 | MA200 | RSI |

|---|---|---|---|---|---|---|

| Bitcoin | BTC | $110299.34 | +1.84% | $114091.54 | $109494.74 | 46.15 |

| Ethereum | ETH | $3877.81 | +1.93% | $4198.57 | $3329.47 | 44.20 |

| Binance Coin | BNB | $1087.34 | +0.81% | $1084.76 | $804.95 | 47.15 |

| XRP | XRP | $2.51 | +2.96% | $2.74 | $2.62 | 46.46 |

| Solana | SOL | $188.65 | +2.18% | $210.80 | $179.01 | 44.33 |

| Dogecoin | DOGE | $0.19 | +2.19% | $0.23 | $0.21 | 40.19 |

| Cardano | ADA | $0.62 | +2.54% | $0.76 | $0.74 | 38.25 |

| Avalanche | AVAX | $18.50 | +2.02% | $26.21 | $23.07 | 33.95 |

| Polkadot | DOT | $2.91 | +1.24% | $3.68 | $3.93 | 37.75 |

| Chainlink | LINK | $17.32 | +3.07% | $20.51 | $17.89 | 42.31 |

🟠 Bitcoin

📈 Technical Analysis

As of the current price of $110,299.34, Bitcoin (BTC) reflects a daily change of 1.84%. The price is situated close to its 200-day moving average (MA200) at $109,494.74, which may act as a strong support level. However, it remains below the short-term MA21 ($110,732.25), suggesting a potential resistance zone just above the current price. The longer-term MAs (50 and 100 days) further indicate selling pressure, with resistance at $114,091.54 and $114,353.02, respectively.

The Relative Strength Index (RSI) at 46.15 signifies neutrality, suggesting there is no immediate overbought or oversold condition, while the negative MACD (-1035.84) indicates bearish momentum which could lead to further downward pressure if not corrected soon. Traders should monitor the $109,494.74 support closely. A breakout above $110,732.

⚪ Ethereum

📈 Technical Analysis

Ethereum (ETH) is currently trading at $3,877.81, reflecting a daily increase of 1.93%. Technical indicators reveal bearish momentum as the price remains below key moving averages: MA21 at $3,958.63, MA50 at $4,198.57, and MA100 at $4,195.06, suggesting resistance levels around these averages. The MA200 at $3,329.47 presents a longer-term support level, indicating potential downside consolidation.

The Relative Strength Index (RSI) at 44.20 indicates neutral momentum, signaling that ETH is neither overbought nor oversold, but caution is warranted as the MACD at -77.92 suggests negative momentum may persist. Traders should closely monitor resistance at the MA21 and the psychological level of $4,000. A confirmed breakout above $3,958.63 would signal a potential bullish reversal, while a drop below the MA200 could signal further bearish pressure. Overall, a

🟡 Binance Coin

📈 Technical Analysis

As of the latest price of $1087.34, Binance Coin (BNB) has experienced a modest daily change of 0.81%, indicating a relatively stable market. The moving averages reveal key levels: the 21-day MA at $1131.70 suggests initial resistance, while the 50-day MA at $1084.76 serves as immediate support. Beneath that, the 100-day MA at $958.09 and the 200-day MA at $804.95 signify longer-term support levels.

The RSI at 47.15 indicates that BNB is approaching neutral territory, suggesting potential for upward momentum but not yet overbought. The negative MACD value of -1.67 reinforces the bearish sentiment in the short term; however, a crossover could result in bullish momentum if bullish signals arise.

Traders should watch for price action around the 50-day MA for potential bounce or breakdown, while targeting resistance at the 21-day MA for possible selling opportunities.

🔵 XRP

📈 Technical Analysis

XRP is currently priced at $2.51, reflecting a daily gain of 2.96%. The asset is trading just above its 21-day moving average (MA21) of $2.48, suggesting a short-term bullish trend. However, it remains below the 50-day (MA50) and 100-day (MA100) averages, indicating potential resistance levels at $2.74 and $2.87, respectively.

The Relative Strength Index (RSI) stands at 46.46, which indicates XRP is neither overbought nor oversold but lacks strong bullish momentum. The MACD reading of -0.05 suggests a weakening bearish momentum but has not yet crossed into bullish territory.

Traders should watch for a potential breakout above the MA50 at $2.74 to confirm a more sustained upward trend. Conversely, key support levels to monitor include the MA21 at $2.48 and psychological support around $2.50, with trading strategies possibly

🟣 Solana

📈 Technical Analysis

Solana (SOL) is currently priced at $188.65, experiencing a daily increase of 2.18%. Technical indicators suggest mixed momentum, as the Relative Strength Index (RSI) sits at 44.33, indicating that SOL is nearing neutral territory, which could imply potential for upward movement. However, the MACD at -4.69 signals bearish momentum as it remains below zero, presenting caution for bullish traders.

Moving averages reveal significant resistance levels, with the 21-day MA at $191.34 and the 50-day MA at $210.80. A breach above the MA21 could imply a bullish trend if supported by volume, while the MA200 at $179.01 serves as potential support. In the short term, traders should monitor these key levels closely; sustained trading above $191.34 could signify a reversal, whereas a drop below $179.01 may trigger selling pressure. Overall, a cautious approach is recommended as market sentiment remains mixed.

🟤 Dogecoin

📈 Technical Analysis

As of the latest session, Dogecoin (DOGE) trades at $0.19, reflecting a daily increase of 2.19%. An analysis of moving averages shows DOGE is currently below its MA21 ($0.20), MA50 ($0.23), and MA100 ($0.23), indicating a bearish sentiment in the short to medium term. The MA200 ($0.21) provides a potential support level, while resistance can be anticipated around the MA50 at $0.23.

The RSI at 40.19 suggests that DOGE is nearing oversold territory, which may indicate an upcoming reversal or stabilization in price, yet the MACD at -0.01 reveals weak momentum, indicating the market lacks bullish strength. Overall, traders should closely monitor DOGE’s ability to break above key moving averages. A confirmed move past $0.20 could signal a more bullish outlook, while failure to hold above support levels may lead to further declines. Caution is advised

🔵 Cardano

📈 Technical Analysis

As of the latest data, Cardano (ADA) is priced at $0.62, reflecting a daily increase of 2.54%. However, the technical indicators suggest potential bearish sentiment, with the RSI at 38.25 indicating a position close to the oversold territory. The close proximity of the current price to the 21-day moving average (MA21) at $0.65 suggests immediate resistance; a breakout above this level could trigger stronger buying interest towards the MA50 at $0.76.

The downward sloping MA100 ($0.80) and MA200 ($0.74) reinforce the resistance levels, making it critical for traders to watch for signs of consolidation around the MA21. The MACD at -0.04 confirms a slight bearish momentum but is approaching a potential crossover, which could signal a change in trend if momentum shifts. Traders should consider these levels for both entry and exit points, while closely monitoring volume and broader market conditions for potential shifts in sentiment

🔴 Avalanche

📈 Technical Analysis

Avalanche (AVAX) is currently priced at $18.50, reflecting a daily increase of 2.02%. The cryptocurrency is trading below its moving averages, with the 21-day MA at $20.41 acting as a near-term resistance level, and the longer-term MAs (50-day at $26.21, 100-day at $25.18, and 200-day at $23.07) indicating a bearish sentiment as they lie above the current price. The RSI stands at 33.95, suggesting that AVAX is nearly in oversold territory, which may indicate potential for a price rebound, albeit with caution. Meanwhile, the MACD reading of -1.94 suggests ongoing bearish momentum, confirming that the selling pressure remains. Traders should monitor the price action around the MA21 for potential reversals, while the area around $18.00 may serve as key support. A confirmation above $20.41 could trigger bullish sentiment, while sustained moves below

🟣 Polkadot

📈 Technical Analysis

Polkadot (DOT) is currently priced at $2.91, reflecting a daily increase of 1.24%. Analyzing key moving averages, DOT is trading below the 21-day MA at $3.06, suggesting immediate resistance. The convergence of MA50 ($3.68), MA100 ($3.80), and MA200 ($3.93) further establishes a multi-layered resistance zone that will be critical to overcome for bullish momentum.

The Relative Strength Index (RSI) at 37.75 indicates that DOT is approaching oversold conditions, which may suggest potential for upward price correction in the near term. However, the MACD reading of -0.19 confirms bearish momentum, signaling the need for consolidation before a definitive trend reversal.

For traders, monitoring the resistance levels at $3.06 and the impact of broader market sentiment will be crucial. A break above these levels could signify a shift towards bullish sentiment, while sustained bearish momentum could lead DOT to test

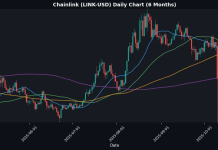

🔵 Chainlink

📈 Technical Analysis

As of the current price of $17.32, Chainlink (LINK) exhibits a daily gain of 3.07%. The price is currently trading below key moving averages, namely the MA21 at $17.86, MA50 at $20.51, and MA100 at $21.11, indicating potential resistance levels that could challenge upward momentum. Notably, the MA200 at $17.89 serves as a crucial support level, suggesting that sustained movement below this threshold could signal further downside risk.

The Relative Strength Index (RSI) at 42.31 indicates that LINK is approaching neutral territory, leaning slightly towards the bearish zone, while the MACD of -0.81 suggests a current negative momentum. Traders should closely monitor the price action around the MA21 and MA200 for potential trading opportunities, with a breakout above $17.86 possibly signaling a shift in momentum. Conversely, falling below the MA200 could evoke caution and lead to further declines.

⚠️ Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. Cryptocurrency markets are highly volatile, and all investments involve significant risks. Past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.