💎 Crypto Update: Polkadot Plunges 14.84% – Market Analysis

📊 Market Overview

Report Date: November 03, 2025

| Cryptocurrency | Symbol | Price (USD) | Daily Change (%) | MA50 | MA200 | RSI |

|---|---|---|---|---|---|---|

| Bitcoin | BTC | $106222.70 | -3.99% | $113666.01 | $109862.66 | 38.80 |

| Ethereum | ETH | $3582.30 | -8.41% | $4145.45 | $3362.41 | 35.73 |

| Binance Coin | BNB | $990.56 | -8.65% | $1092.46 | $812.04 | 37.02 |

| XRP | XRP | $2.29 | -9.44% | $2.70 | $2.62 | 36.75 |

| Solana | SOL | $165.40 | -11.94% | $207.05 | $179.74 | 32.83 |

| Dogecoin | DOGE | $0.17 | -10.96% | $0.22 | $0.21 | 32.11 |

| Cardano | ADA | $0.55 | -10.23% | $0.74 | $0.74 | 29.81 |

| Avalanche | AVAX | $16.59 | -12.04% | $25.52 | $23.06 | 29.25 |

| Polkadot | DOT | $2.54 | -14.84% | $3.59 | $3.92 | 30.64 |

| Chainlink | LINK | $15.18 | -13.76% | $20.03 | $17.96 | 34.21 |

🟠 Bitcoin

📈 Technical Analysis

As of the latest data, Bitcoin (BTC) is priced at $106,222.70, reflecting a daily decline of 3.99%. The current price is below key moving averages (MA21 at $110,014.84, MA50 at $113,666.01, MA100 at $114,075.34), indicating a bearish trend and potential resistance levels. The MA200 at $109,862.66 offers a slight support benchmark but suggests increased selling pressure below these averages.

The Relative Strength Index (RSI) at 38.80 indicates that Bitcoin is approaching the oversold territory, suggesting limited downside risk, while still reflecting bearish momentum. The MACD at -1295.50 confirms this trend, signaling continued downward movement with a lack of bullish crossover.

Traders should exercise caution and consider waiting for a potential reversal signal before entering long positions, particularly if Bitcoin can reclaim levels above MA21 and test resistance at the MA50. Monitoring volume and broader market

⚪ Ethereum

📈 Technical Analysis

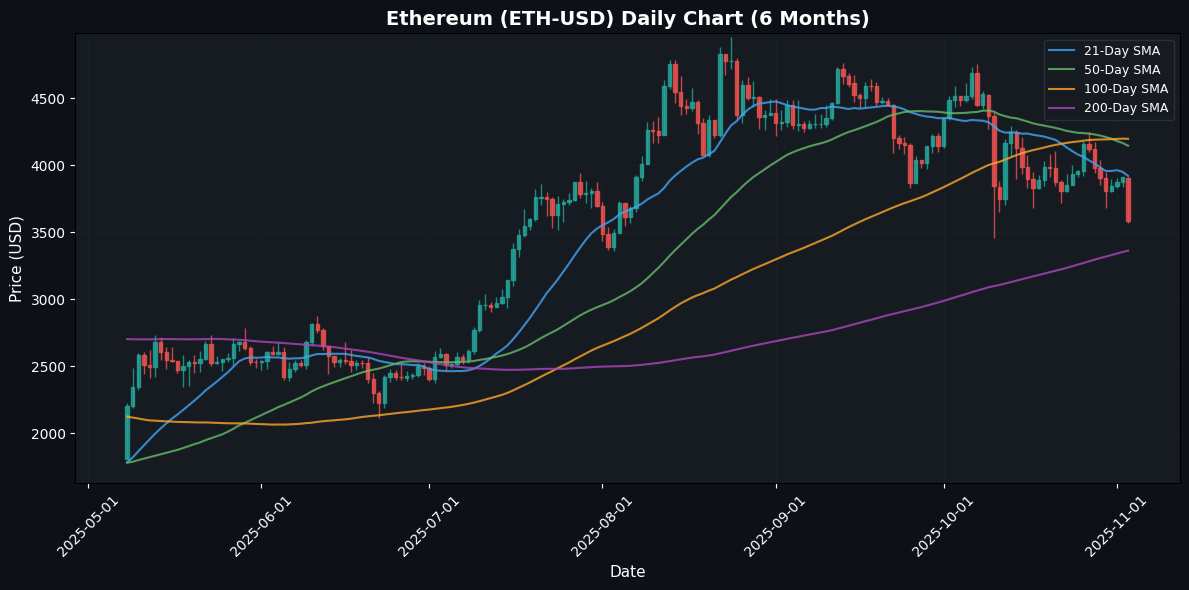

Ethereum (ETH) is currently priced at $3582.30, reflecting a daily decline of 8.41%. The cryptocurrency’s short-term moving average (MA21) at $3919.41 suggests that ETH is trading below its recent average, indicating a bearish trend. Both the 50-day (MA50) and 100-day (MA100) averages are above the current price, reinforcing downward pressure. However, the long-term moving average (MA200) at $3362.41 provides a critical support level, hinting at potential buying interest should the price approach this threshold.

The RSI at 35.73 indicates oversold conditions, suggesting a possible rebound, while the MACD at -97.77 signifies bearish momentum. Traders should watch for price action near the MA200 for potential support, while resistance remains at the MA21 and MA50 levels. Short-term strategies might focus on reversal opportunities, but caution is advised amid ongoing downward momentum. Overall, a patient approach is

🟡 Binance Coin

📈 Technical Analysis

Binance Coin (BNB) is currently trading at $990.56, reflecting a daily loss of 8.65%. The asset is showing bearish momentum, confirmed by its Relative Strength Index (RSI) at 37.02, suggesting it is approaching oversold territory. The Moving Average Convergence Divergence (MACD) is also negative at -12.91, indicating that downward price pressure may persist in the short term.

Key support resides around the 100-day moving average at $966.30, which may provide a critical floor if bearish sentiment continues. Resistance levels appear to be at the 21-day moving average of $1104.91 and 50-day moving average of $1092.46.

Traders should remain cautious and potentially look for buying opportunities near the $966 support level, while being mindful of selling pressure in the near term. A strategic approach incorporating stops just below this support could mitigate risks as the market stabilizes.

🔵 XRP

📈 Technical Analysis

XRP is currently trading at $2.29, reflecting a significant daily decline of 9.44%. The price remains below key moving averages, with the 21-day moving average (MA21) at $2.47, suggesting resistance ahead. The 50-day (MA50) and 100-day (MA100) averages at $2.70 and $2.85 indicate stronger resistance levels, while the 200-day average (MA200) at $2.62 serves as a critical support zone.

The Relative Strength Index (RSI) at 36.75 indicates that XRP is nearing oversold conditions, suggesting potential for a rebound if buying interest emerges. However, the MACD value of -0.06 signals bearish momentum, which could keep prices under pressure in the short term.

Traders should watch for a confirmation of support around the $2.20 level, as a break below could trigger further selling. Conversely, a recovery above the MA21 would signal a

🟣 Solana

📈 Technical Analysis

Solana (SOL) is currently trading at $165.40, reflecting a significant daily decrease of 11.94%. The price is below key moving averages, with the 21-day MA at $189.16, the 50-day at $207.05, the 100-day at $200.70, and the 200-day at $179.74, indicating bearish sentiment and potential resistance levels above. The Relative Strength Index (RSI) at 32.83 suggests oversold conditions, signaling that a price rebound may be possible; however, continued downward momentum is indicated by the MACD at -6.45. Traders should monitor the $165 support level closely, as a breakdown could lead to further declines. Conversely, if the price climbs back above the 21-day MA, it may instigate a short-term recovery. Caution is advised due to current trends, emphasizing the importance of risk management strategies in a volatile market.

🟤 Dogecoin

📈 Technical Analysis

Dogecoin (DOGE) is currently trading at $0.17, reflecting a significant daily decline of 10.96%. The price is below key moving averages, with MA21 at $0.19, MA50 and MA100 both at $0.22, and MA200 at $0.21, indicating a bearish trend in the short to medium term. The Relative Strength Index (RSI) is at 32.11, suggesting that DOGE is approaching oversold territory, which may signal a potential reversal if buying interest returns. Meanwhile, the MACD at -0.01 indicates a weakening bearish momentum, but still shows potential for further declines. Traders should monitor the critical support level around $0.15 for potential bounce-back opportunities, while resistance is observed at $0.19. A clear breach of either level will help establish the next directional move. Caution is advised, as the current volatility presents both risks and opportunities.

🔵 Cardano

📈 Technical Analysis

Cardano (ADA) is currently trading at $0.55, having experienced a significant daily decline of 10.23%. The short-term trend is bearish, evidenced by the price trading below key moving averages—MA21 ($0.64), MA50 ($0.74), MA100 ($0.79), and MA200 ($0.74). This suggests a resistance zone around $0.64 and further major resistance at $0.74.

The Relative Strength Index (RSI) is at 29.81, indicating that ADA is in oversold territory, which may signal a potential reversal or at least a near-term bounce, though this remains speculative. The MACD (-0.04) also reflects bearish momentum but is approaching a critical inflection point, indicating possible consolidation ahead.

Traders should monitor support at the psychological level of $0.50, as a breach below this could lead to further losses. Caution is advised, with potential recovery scenarios hinging on

🔴 Avalanche

📈 Technical Analysis

Avalanche (AVAX) is currently priced at $16.59, reflecting a significant daily decline of 12.04%. The asset is below its short-term moving averages, with the 21-day MA at $19.74, indicating bearish sentiment. The 50-day ($25.52), 100-day ($24.99), and 200-day ($23.06) moving averages further establish a downward trend, suggesting that AVAX is facing substantial resistance near these levels.

The Relative Strength Index (RSI) of 29.25 indicates that the asset is in the oversold territory, which could imply a potential reversal or a short-term bounce. However, the MACD reading of -1.92 further underscores bearish momentum in the market.

Traders should monitor for potential support levels around $15 and resistance at the MA21. A sustained move below $15 may trigger further selling pressure, while a recovery above the MA21 could indicate a bullish correction. Caution is advised

🟣 Polkadot

📈 Technical Analysis

Polkadot (DOT) is currently trading at $2.54, reflecting a significant daily decline of 14.84%. The price is notably below key moving averages, with the 21-day MA at $3.01, the 50-day MA at $3.59, the 100-day MA at $3.76, and the 200-day MA at $3.92. This positioning suggests bearish momentum, as the current price is moving further away from these averages.

The Relative Strength Index (RSI) stands at 30.64, indicating DOT is nearing oversold territory, which may suggest a potential reversal, albeit accompanied by heightened volatility. Meanwhile, the MACD reading of -0.20 confirms bearish momentum, showing a bearish crossover. Traders should look for immediate support around $2.50, while resistance is seen at $3.00. A confirmed break above this level could signal a trend reversal, but caution is advised as current market dynamics lean bearish.

🔵 Chainlink

📈 Technical Analysis

Chainlink (LINK) is currently priced at $15.18, marking a significant daily decline of 13.76%. The bearish momentum is underscored by its Relative Strength Index (RSI) at 34.21, indicating oversold conditions and potential for a corrective bounce if buying interest emerges.

Moving averages reveal a bearish trend, with the 21-day MA at $17.56 significantly above the current price, suggesting resistance at this level. The 50-day MA ($20.03) and 100-day MA ($21.06) further reinforce this bearish outlook, while the 200-day MA ($17.96) offers potential support.

The MACD at -0.90 indicates increasing bearish momentum. Traders should monitor the $15 and $14 support levels, as a breakdown could accelerate selling pressure. Conversely, a reclaiming of $17.56 could signal a potential reversal. Caution is advised given the prevailing downtrend, with strategic entry points essential in this

⚠️ Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. Cryptocurrency markets are highly volatile, and all investments involve significant risks. Past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.