Energy Market Snapshot: WTI Crude, Brent Soar Keeping Momentum

⚡ Market Overview

Energy markets on October 23, 2025 reflect dynamic trading across crude oil, Brent, and natural gas December 2025 futures contracts. The analysis below covers market drivers, technical indicators, and trading outlook for each energy commodity.

📋 Contract Specifications

December 2025 Futures Contracts:

• CLZ25: NYMEX WTI Crude Oil (CL = Crude Light, Z = December, 25 = 2025)

• BZZ25: ICE Brent Crude (BZ = Brent, Z = December, 25 = 2025)

• NGZ25: NYMEX Natural Gas (NG = Natural Gas, Z = December, 25 = 2025)

Performance Summary

| Commodity | Contract | Price | Unit | Daily % | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|

| Crude Oil (WTI) | CLZ25 | $60.44 | $/barrel | +3.32% | $60.16 | $61.59 | $62.59 | $63.25 | 51.56 | -1.13 |

| Brent Oil | BZZ25 | $64.56 | $/barrel | +3.15% | $64.26 | $65.62 | $66.31 | $66.94 | 51.68 | -1.11 |

| Natural Gas | NGZ25 | $4.08 | $/MMBtu | +0.54% | $3.91 | $3.87 | $4.17 | $4.48 | 59.51 | 0.02 |

⚫ Crude Oil (WTI)

Contract: CLZ25 | Price: $60.44 $/barrel (+3.32%)

📰 Market Drivers & News

Crude oil markets opened with renewed vigor, propelled by a confluence of supportive fundamentals. Key developments included a surprise drawdown in U.S. inventories, signaling tighter supply amid steady refinery runs and anticipated summer demand surges. On the supply side, ongoing OPEC+ production cuts held firm, countering potential increases from non-OPEC producers, while disruptions from Middle Eastern geopolitical tensions—particularly shipping route vulnerabilities—added a risk premium to global flows.

Demand dynamics remain robust, bolstered by recovering economic indicators from major consumers, though lingering concerns over Chinese growth tempered enthusiasm. Production-wise, voluntary curtailments by key exporters underscored a cautious approach to balancing output against volatile consumption patterns.

Trader sentiment has shifted bullish, with increased long positioning reflecting optimism over sustained deficits. However, watchful eyes on upcoming policy announcements could introduce volatility. Near-term, the market outlook points to modest upside potential, contingent on avoiding escalatory geopolitical flares.

📈 Technical Analysis

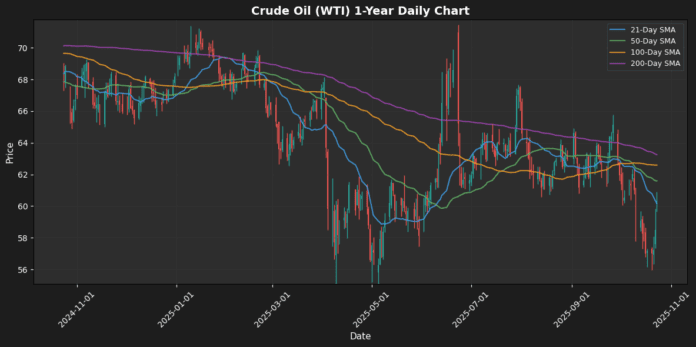

Crude Oil (WTI) is currently trading at $60.44, showing a daily gain of 3.32%. The price is positioned slightly above the 21-day moving average (MA21) of $60.16, suggesting a short-term bullish sentiment. However, it remains below the 50-day MA at $61.59, indicating potential resistance in the near term.

The Relative Strength Index (RSI) at 51.56 indicates that the market is neither overbought nor oversold, reflecting neutral momentum. The MACD value of -1.13 suggests that the momentum is currently favoring bearishness, with the potential for a crossover should prices continue to rise.

Key resistance levels are situated at $61.59 (MA50) and $62.59 (MA100), while immediate support can be assessed around the MA21. Traders should monitor price action closely around these levels for potential breakout or reversal opportunities.

🟤 Brent Oil

Contract: BZZ25 | Price: $64.56 $/barrel (+3.15%)

📰 Market Drivers & News

In the Brent oil market, early European trading reflects a blend of cautious optimism amid evolving global dynamics. Key developments include ongoing OPEC+ deliberations on production quotas, with signals of potential extensions to voluntary cuts to balance supply amid softening demand from major economies like China, where economic recovery appears uneven. US inventory data revealed modest builds in crude stocks, tempering bullish pressures, while refined product draws highlighted persistent refining margins.

Geopolitical tensions in the Middle East continue to disrupt shipping routes, adding a risk premium to supply chains, though no major escalations have materialized. Non-OPEC producers, particularly in North America, maintain robust output levels, countering efforts to tighten the market.

Trader sentiment leans constructive, with increased long positioning driven by expectations of tighter balances later in the year, though recession fears cap enthusiasm. Near-term, the outlook points to steady consolidation, contingent on upcoming policy signals and economic indicators that could sway demand trajectories.

📈 Technical Analysis

Brent Oil is currently priced at $64.56, reflecting a daily change of 3.15%. The price is trading above the 21-day moving average (MA21) of $64.26, indicating short-term bullish momentum. However, it remains below the longer-term moving averages (MA50 of $65.62, MA100 of $66.31, and MA200 of $66.94), suggesting a bearish trend in broader contexts.

The Relative Strength Index (RSI) at 51.68 indicates neutral momentum, suggesting neither overbought nor oversold conditions, potentially allowing for further price fluctuations. The MACD at -1.11, still below zero, signals a bearish sentiment with a lack of strong upward momentum.

Key resistance is observed around the MA50 level at $65.62, while support is likely near the recent low near $64.00. Traders should monitor for potential crossover signals as the price approaches these significant moving averages, with careful attention

🔵 Natural Gas

Contract: NGZ25 | Price: $4.08 $/MMBtu (+0.54%)

📰 Market Drivers & News

In the natural gas market, robust global demand continues to drive momentum, as evidenced by strong quarterly results from major pipeline operators highlighting historic consumption growth in key regions. Supply dynamics remain tight, with inventory levels drawing down faster than anticipated amid seasonal heating needs and surging liquefied natural gas exports to Europe and Asia. Geopolitical tensions escalate risks, as new sanctions targeting Russian energy producers disrupt export flows, prompting accelerated diversification efforts by importers and heightening supply vulnerabilities.

On the production front, North American operators are ramping up output from shale plays to meet escalating needs, though infrastructure constraints limit immediate gains. Trader sentiment leans bullish, with increased long positioning reflecting confidence in sustained demand amid weather-driven volatility.

Looking ahead, the near-term outlook points to upward pressure, supported by persistent supply tightness and geopolitical uncertainties, though any mild weather shifts could temper gains.

📈 Technical Analysis

Natural gas is currently trading at $4.08, reflecting a daily increase of 0.54%. This upward momentum is supported by the Relative Strength Index (RSI), which stands at 59.51, indicating strength without entering overbought territory. The Moving Averages (MAs) show a mixed signal, with the MA21 ($3.91) and MA50 ($3.87) acting as initial support levels, suggesting short-term bullish sentiment. However, the MA100 at $4.17 presents a potential resistance point, while the longer-term MA200 at $4.48 highlights a significant resistance threshold for a more bullish trend.

The MACD at 0.02 indicates a cautious bullish momentum, with the closing price above the short-term averages reinforcing this outlook. Traders should monitor the $4.17 level closely for potential breakout opportunities. A failure to hold above $4.00 may see natural gas testing lower support around the MAs. Overall, the market maintains

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.