Energy Update: Crude Oil (WTI) Declines 1.67%

📊 Market Overview

Report Date: November 06, 2025

| Commodity | Price | Daily Change (%) | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|

| Crude Oil (WTI) | $59.55 | -1.67% | $59.60 | $61.34 | $62.41 | $62.83 | 45.34 | -0.15 |

| Brent Oil | $65.07 | +0.11% | $63.88 | $65.59 | $66.34 | $66.69 | 52.47 | -0.15 |

| Natural Gas | $4.30 | -1.04% | $3.96 | $3.92 | $4.11 | $4.46 | 64.24 | 0.09 |

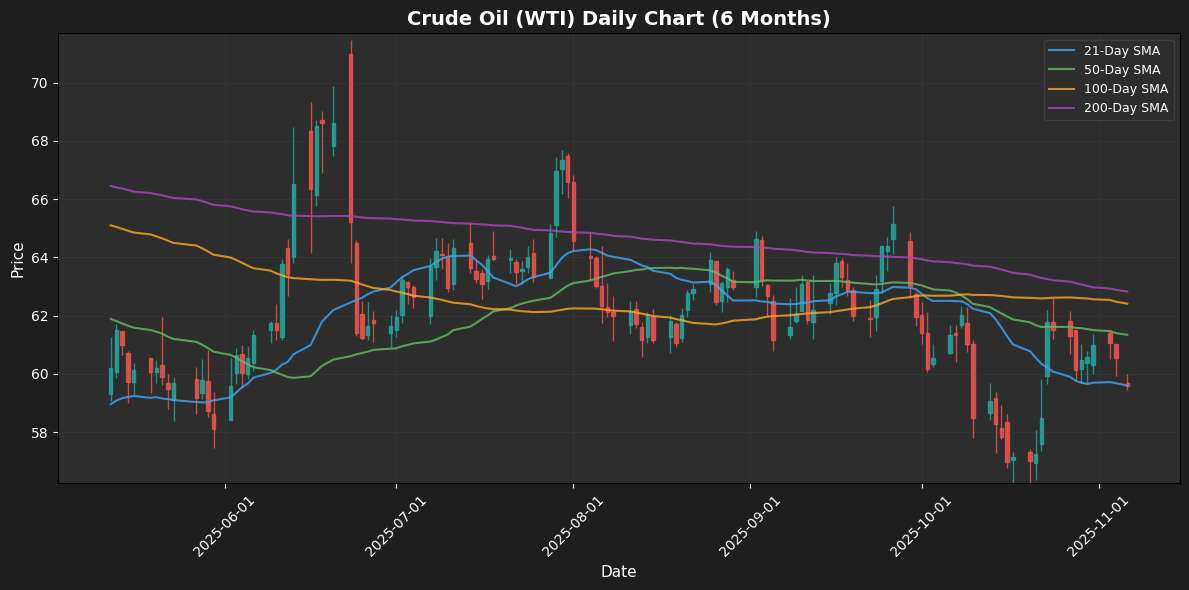

⚡ Crude Oil (WTI)

Technical Analysis

As of the latest trading session, WTI crude oil is priced at $59.55, reflecting a daily decline of 1.67%. The price is hovering just below its 21-day moving average (MA21) of $59.60, indicating potential short-term weakness. Additional pressure can be seen with the 50-day MA at $61.34 and the 100-day MA at $62.41, highlighting a bearish trend as the price remains below these key resistance levels.

The Relative Strength Index (RSI) at 45.34 suggests that crude oil is approaching neutral territory, indicating limited buying momentum, while the MACD at -0.15 confirms a bearish outlook as momentum remains negative. Immediate support can be anticipated around the $59.00 mark, while resistance remains significant at the $61.00 level. Overall, unless prices reclaim the 50-day MA, the outlook appears bearish, with potential for further declines in the near term.

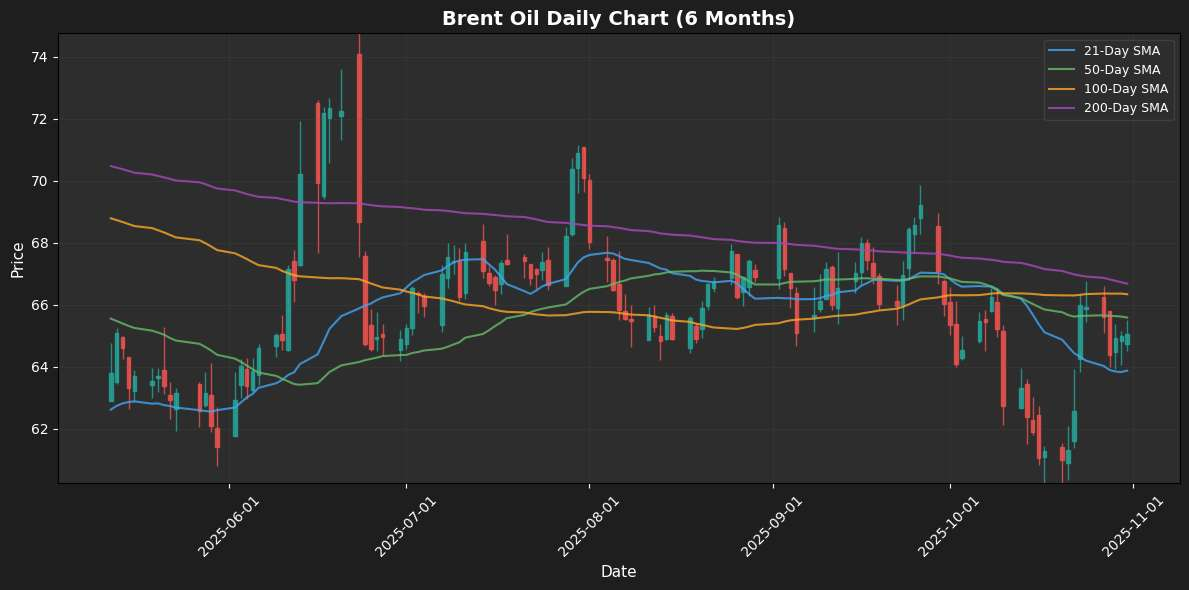

⚡ Brent Oil

Technical Analysis

Brent Oil is currently trading at $65.07, reflecting a modest daily increase of 0.11%. The price is situated near its 50-day moving average of $65.59, indicating potential short-term resistance, while the 21-day MA at $63.88 serves as immediate support. The 100-day and 200-day MAs at $66.34 and $66.69, respectively, represent further resistance levels that may hinder upward momentum.

The Relative Strength Index (RSI) at 52.47 suggests the asset is approaching neutral territory, indicating a balanced market without significant overbought or oversold conditions. Meanwhile, the MACD value of -0.15, while slightly negative, reinforces the presence of bearish momentum but does not signal a strong downtrend.

Overall, Brent Oil appears to be consolidating within a range as it navigates significant resistance levels. A sustained break above $66 could trigger bullish sentiment, while slipping below $63.88 may

⚡ Natural Gas

Technical Analysis

Natural Gas is currently priced at $4.30, reflecting a daily decline of 1.04%. The key moving averages indicate a mixed outlook; the short-term MA21 at $3.96 suggests immediate support, while the longer-term MA200 at $4.46 acts as a formidable resistance level. The MA50 and MA100, both below the current price, reinforce bullish sentiments if support holds. The RSI of 64.24 signals that the market is approaching overbought conditions, indicating potential consolidation or pullback ahead. The MACD at 0.09 implies slight bullish momentum, though this is waning. A break below the MA21 could lead to a revisit of support around $3.96, while a sustained move above $4.46 could open the door to higher targets. Investors should monitor these critical levels closely for signs of trend direction. Overall, a cautious but optimistic outlook prevails depending on price action around support and resistance levels.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.