Energy Update: Brent Oil Advances 1.32% – RSI at 53

📊 Market Overview

Report Date: October 29, 2025

| Commodity | Price | Daily Change (%) | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|

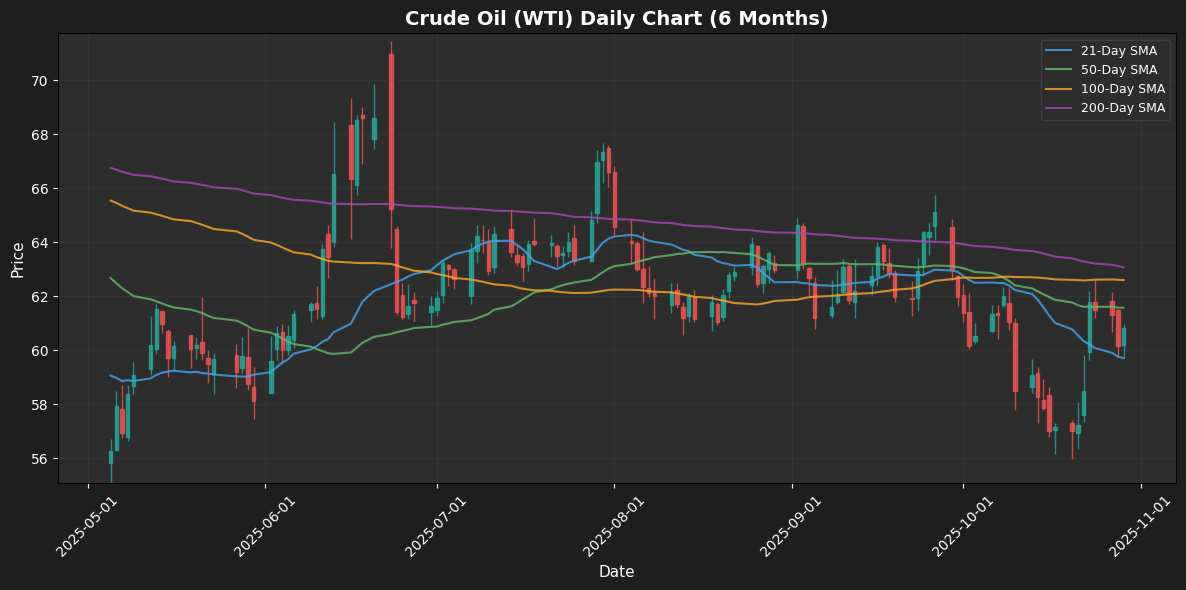

| Crude Oil (WTI) | $60.92 | +1.28% | $59.72 | $61.58 | $62.60 | $63.07 | 52.39 | -0.36 |

| Brent Oil | $65.25 | +1.32% | $63.87 | $65.65 | $66.37 | $66.78 | 53.08 | -0.29 |

| Natural Gas | $3.85 | -0.57% | $3.93 | $3.88 | $4.14 | $4.47 | 46.03 | 0.01 |

⚡ Crude Oil (WTI)

Market News

No significant recent developments.

Technical Analysis

Crude Oil (WTI) is currently trading at $60.92, reflecting a daily increase of 1.28%. The recent price action indicates a tentative recovery as the price hovers near the 21-day moving average (MA21) of $59.72. However, the failure to sustain momentum above the 50-day (MA50) at $61.58 presents a resistance challenge, with further resistance found at the MA100 of $62.60 and the MA200 at $63.07.

The Relative Strength Index (RSI) at 52.39 suggests a neutral momentum, indicating potential for further upside or downside. Meanwhile, the MACD of -0.36 signals bearish momentum, suggesting caution.

Key support can be identified around the MA21 at $59.72. If the price consolidates above this level, a bullish outlook may emerge towards the resistance levels. Conversely, a breach below the MA21 could lead to increased selling pressure, with the next

⚡ Brent Oil

Technical Analysis

Brent Oil is currently trading at $65.25, marking a 1.32% increase for the day. The price is situated near its 50-day moving average of $65.65, suggesting a potential resistance level. The MA21 at $63.87 indicates immediate support, reinforcing a bullish sentiment if the price stays above this threshold.

Momentum indicators show a neutral RSI at 53.08, signaling no immediate overbought or oversold conditions. However, the MACD at -0.29 indicates bearish momentum, as the signal line remains above the MACD line, suggesting caution among buyers.

In summary, while Brent Oil shows potential for bullish movements, traders should watch for price action near key moving averages and be alert for any signs of momentum shift. A sustained break above $66.37 (MA100) would strengthen the bullish outlook, while a fall below $63.87 could open the door for further downside risks.

⚡ Natural Gas

Technical Analysis

Natural gas is currently trading at $3.85, reflecting a daily decrease of 0.57%. The price is below the short-term moving average (MA21) of $3.93 and the medium-term MA50 of $3.88, suggesting bearish sentiment in the near term. The longer-term moving averages—MA100 at $4.14 and MA200 at $4.47—indicate that the market remains in a downtrend overall, with significant resistance levels above the current price.

The Relative Strength Index (RSI) at 46.03 indicates neutral momentum, suggesting neither overbought nor oversold conditions. The MACD at 0.01 is close to the zero line, signaling weakness in bullish momentum.

Key support levels are seen around $3.80, while resistance is evident at $3.93 and $4.00. A sustained break above $4.00 might signal a potential reversal, but current indicators lean towards continued consolidation or further

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.