🌍 Equity Markets Dwindle, USD Gains

European markets approaching close (still trading) • US markets actively trading • Analysis based on last 8 hours

📊 Market Overview

As European markets approach their close, the FTSE 100 is down approximately 0.38%, reflecting a broader theme of weakness in risk-sensitive assets. The primary driver of this decline is the ongoing softness in the Pound Sterling (GBP), which has weakened 0.6% against the US Dollar (USD) ahead of the Bank of England’s policy meeting on Thursday. The EUR/GBP is trading around 0.8800, buoyed by GBP’s underperformance and the Euro’s own struggles, which has hit fresh local lows around 1.15 against the USD. This dynamic underscores the increasing risk aversion among investors, which has been a recurring theme today.

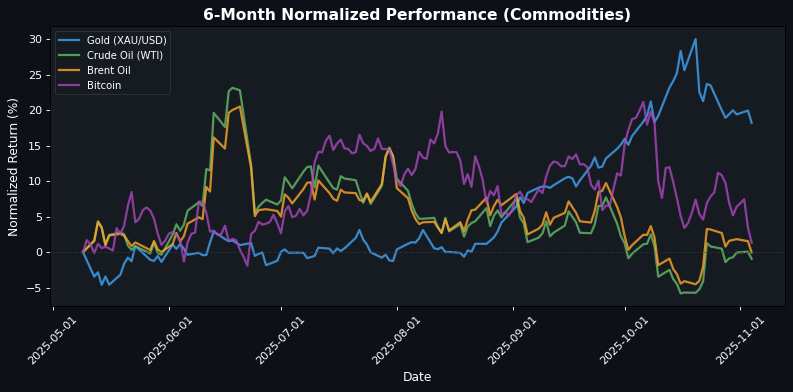

Across the Atlantic, US markets are currently experiencing a similar downturn, with the Dow Jones down 0.44%. The strength of the USD, which is testing the 100 level on the Dollar Index, is exerting downward pressure on US equities, particularly in the technology sector. Concerns about frothy valuations in tech stocks are weighing on market sentiment, contributing to a cautious outlook amongst investors. Furthermore, commodities are feeling the impact of these currency fluctuations; gold prices have fallen below the $3,950 mark, influenced by the USD’s resilience and a cautious Federal Reserve outlook.

Sector trends reveal a divergence, with defensive sectors outperforming as investors seek safety amidst rising risk aversion. The bearish bias in crude oil prices, driven by OPEC+ decisions and oversupply concerns, continues to cap upside potential for energy stocks. Overall, market sentiment remains cautious, with ongoing geopolitical tensions and economic uncertainties further complicating the landscape for investors. As both European and US markets navigate these challenges, the correlation between currency strength and asset performance appears increasingly pronounced, influencing trading strategies across the board.

🇪🇺 European Markets (Approaching Close)

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5635.23 | -0.78% |

| DAX | 23844.91 | -1.19% |

| FTSE 100 | 9665.01 | -0.38% |

| CAC 40 | 8031.81 | -0.96% |

🇺🇸 US Markets (Currently Active)

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6804.62 | -0.69% |

| Dow Jones | 47126.09 | -0.44% |

| Nasdaq 100 | 25728.12 | -0.94% |

🌏 Asian Markets

| Name | Price | Daily (%) |

|---|---|---|

| Nikkei 225 | 51497.20 | -1.74% |

| Shanghai Composite | 3960.19 | -0.41% |

| Hang Seng | 25952.40 | -0.79% |

💱 FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | -0.34% |

| GBP/USD | 1.30 | -0.74% |

| USD/JPY | 153.43 | -0.49% |

| Gold (XAU/USD) | 3942.80 | -1.44% |

| Crude Oil (WTI) | 60.44 | -1.00% |

| Brent Oil | 63.87 | -1.57% |

| Bitcoin | 104334.88 | -2.08% |

🌍 Geopolitics and Market Drivers

Current geopolitical and macroeconomic factors are significantly impacting global markets. The Bank of England’s upcoming decisions are causing the British Pound to weaken, particularly as warnings about increased UK borrowing costs surface. Concurrently, the U.S. Dollar is strengthening amid a cautious Federal Reserve outlook, leading to declines in commodities like gold and silver. The risk-off sentiment is palpable, with the Canadian Dollar and Euro also underperforming, reflecting a broader aversion to riskier assets.

Central bank policies are pivotal, as the Reserve Bank of Australia holds interest rates steady, further pressuring the Australian Dollar. Meanwhile, the U.S. Dollar’s resilience is pushing USD/CHF to a two-month high, accentuating the divergence in monetary policy expectations. Geopolitical tensions and fears surrounding frothy tech stocks are exacerbating market volatility, contributing to bearish trends in oil prices, as WTI struggles below key moving averages. As investors navigate these dynamics, market sentiment remains cautious, with a focus on upcoming economic data releases and political developments that could further influence central bank actions.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.