European Indices Decline Following Risk Appetite Reversal in US, ASIA

European Trading Session Report | October 31, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: 31 October 2025

European equities opened the trading session under modest pressure, extending losses from a subdued overnight performance in US and Asian markets. The S&P 500 closed down 0.99%, with the Nasdaq 100 shedding 1.47% amid tech sector volatility, while Dow Jones limited losses to 0.23%. In Asia, selective gains in Hong Kong—driven by robust insurance sector demand from mainland Chinese investors seeking yield—provided a minor counterbalance, but broader risk-off sentiment prevailed as regional indices consolidated. This backdrop contributed to a cautious European open, with investors digesting mixed Eurozone credit conditions from the latest securities financing survey, which highlighted tighter terms in euro-denominated markets amid ongoing liquidity concerns.

Key European indices trended lower, reflecting broader economic headwinds. The Euro Stoxx 50 dipped 0.30%, weighed by declines in financials and industrials, as corporate job cuts accelerated in a tightening economy fueled by AI-driven efficiencies. Germany’s DAX fell 0.40%, pressured by export-sensitive autos amid softening global demand signals. France’s CAC 40 edged down 0.26%, with consumer staples offering relative resilience, while the FTSE 100 underperformed at -0.56%, hit by UK political uncertainties. Expectations of fiscal restraint in the upcoming Budget—no full lift on the two-child benefit cap and potential tax hikes—dampened sentiment in consumer discretionary and real estate sectors, exacerbating rental market frictions and private equity strains, as seen in recent UK fund challenges.

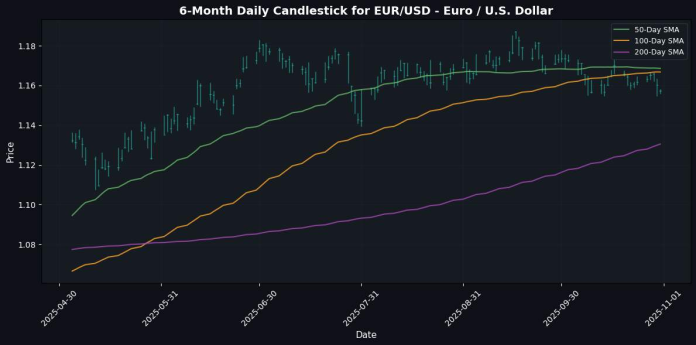

On the currency front, the euro held steady against the dollar, with EUR/USD slipping just 0.01%, supported by ECB rhetoric signaling no immediate policy pivot despite subdued Eurozone data. Sterling weakened more sharply, GBP/USD down 0.22%, as Budget jitters eroded confidence in UK growth prospects. The Swiss franc gained modestly, USD/CHF up 0.09%, bolstering its safe-haven appeal amid global volatility. EUR/GBP rose 0.20%, underscoring relative euro strength.

Overall market sentiment remains guarded, with investors positioned defensively in bonds and gold as hedges against political risks and US election spillovers. Eurozone PMI revisions and ECB minutes later this week will be pivotal; positioning suggests limited upside without clearer fiscal clarity from London and Frankfurt.

(Word count: 342)

🇪🇺 European Indices Performance

Performance: (Today Last – Yesterday Close) / Yesterday Close × 100

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5682.09 | -0.30 |

| DAX | 24021.50 | -0.40 |

| CAC 40 | 8136.23 | -0.26 |

| FTSE 100 | 9705.56 | -0.56 |

🇺🇸 US Markets (Previous Close)

Performance: (Yesterday – 2 Days Ago) / 2 Days Ago × 100

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6822.34 | -0.99 |

| Dow Jones | 47522.12 | -0.23 |

| Nasdaq 100 | 25734.81 | -1.47 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | -0.01 |

| GBP/USD | 1.31 | -0.22 |

| USD/JPY | 154.12 | +0.14 |

| EUR/GBP | 0.88 | +0.20 |

| USD/CHF | 0.80 | +0.09 |

| AUD/USD | 0.65 | -0.27 |

| USD/CAD | 1.40 | +0.22 |

🛢️ Commodities Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Commodity | Price | Daily (%) |

|---|---|---|

| Gold | 4018.40 | +0.43 |

| Silver | 48.44 | +0.02 |

| Crude Oil (WTI) | 60.32 | -0.41 |

| Brent Oil | 64.64 | -0.55 |

₿ Cryptocurrency Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Crypto | Price | Daily (%) |

|---|---|---|

| Bitcoin | 109841.80 | +1.42 |

| Ethereum | 3840.07 | +0.94 |

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-31 | 03:00 | 🇬🇧 | Medium | Nationwide HPI (MoM) (Oct) | 0.3% | 0.0% |

| 2025-10-31 | 03:00 | 🇬🇧 | Medium | Nationwide HPI (YoY) (Oct) | 2.4% | 2.3% |

| 2025-10-31 | 03:00 | 🇪🇺 | Medium | German Retail Sales (MoM) (Sep) | 0.2% | 0.2% |

| 2025-10-31 | 03:45 | 🇪🇺 | Medium | French CPI (MoM) (Oct) | 0.1% | 0.1% |

| 2025-10-31 | 03:45 | 🇪🇺 | Medium | French HICP (MoM) (Oct) | 0.1% | 0.1% |

| 2025-10-31 | 06:00 | 🇪🇺 | Medium | Core CPI (YoY) (Oct) | 2.4% | 2.3% |

| 2025-10-31 | 06:00 | 🇪🇺 | Medium | CPI (MoM) (Oct) | 0.2% | |

| 2025-10-31 | 06:00 | 🇪🇺 | High | CPI (YoY) (Oct) | 2.1% | 2.1% |

| 2025-10-31 | 07:30 | 🇧🇷 | Medium | Gross Debt-to-GDP ratio (MoM) (Sep) | ||

| 2025-10-31 | 08:00 | 🇧🇷 | Medium | Unemployment Rate (Sep) | 5.6% | |

| 2025-10-31 | 08:30 | 🇨🇦 | Medium | GDP (MoM) (Aug) | 0.0% | |

| 2025-10-31 | 08:31 | 🇨🇦 | Medium | GDP (MoM) (Sep) | ||

| 2025-10-31 | 09:45 | 🇺🇸 | High | Chicago PMI (Oct) | 42.3 | |

| 2025-10-31 | 12:00 | 🇺🇸 | Medium | FOMC Member Bostic Speaks | ||

| 2025-10-31 | 12:00 | 🇷🇺 | Medium | GDP Monthly (YoY) (Sep) | ||

| 2025-10-31 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | ||

| 2025-10-31 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.